Wheeee, what a ride!

Wheeee, what a ride!

"THEY" have taken full advantage of the low-volume, holiday markets to bring the S&P up to new highs at just under 4,800 and we have Dow 36,272, Nasdaq 16,654 and only the Russell, at 2,264 is not at the all-time high – which was 2,460 back in November – so we're 8% below that level still.

Does that mean we should bet the Russell to catch up and make all-time highs? Not necessarily. There's no way to know that these low-volume rallies can stick once the participants return and start selling so we're just in a "watch and wait" sort of mode at the moment – we did all our bargain-hunting during the dip – now we are reaping the rewards on our bullish bets.

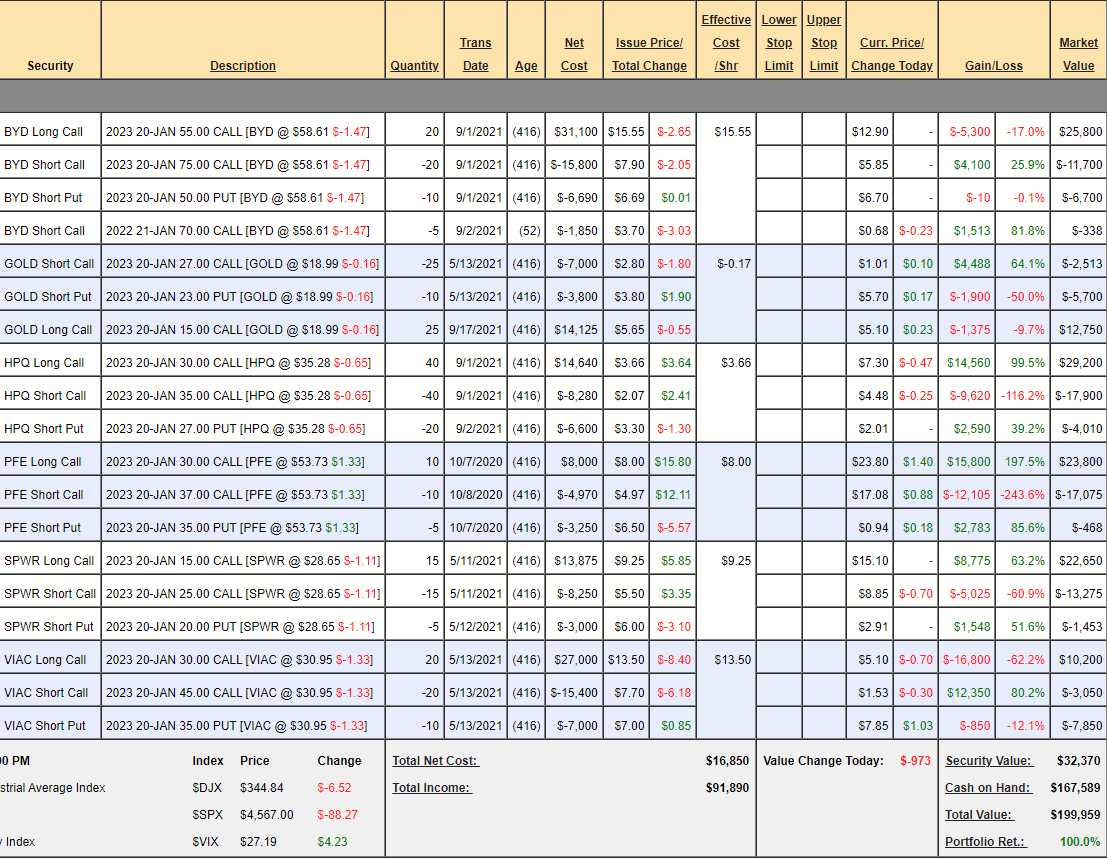

For example, on December 1st, I was on BNN's "Money Talk" and we announced our 2022 Trade of the Year play (IBM) along with 3 of our top runners up, with trade ideas for each one that were featured in that morning's PSW Report. The runner-up trades were for Intel (INTC), Altria (MO) and Walgreens (WBA) and, prior to adding these trades, on December 1st, our Money Talk Portfolio looked like this:

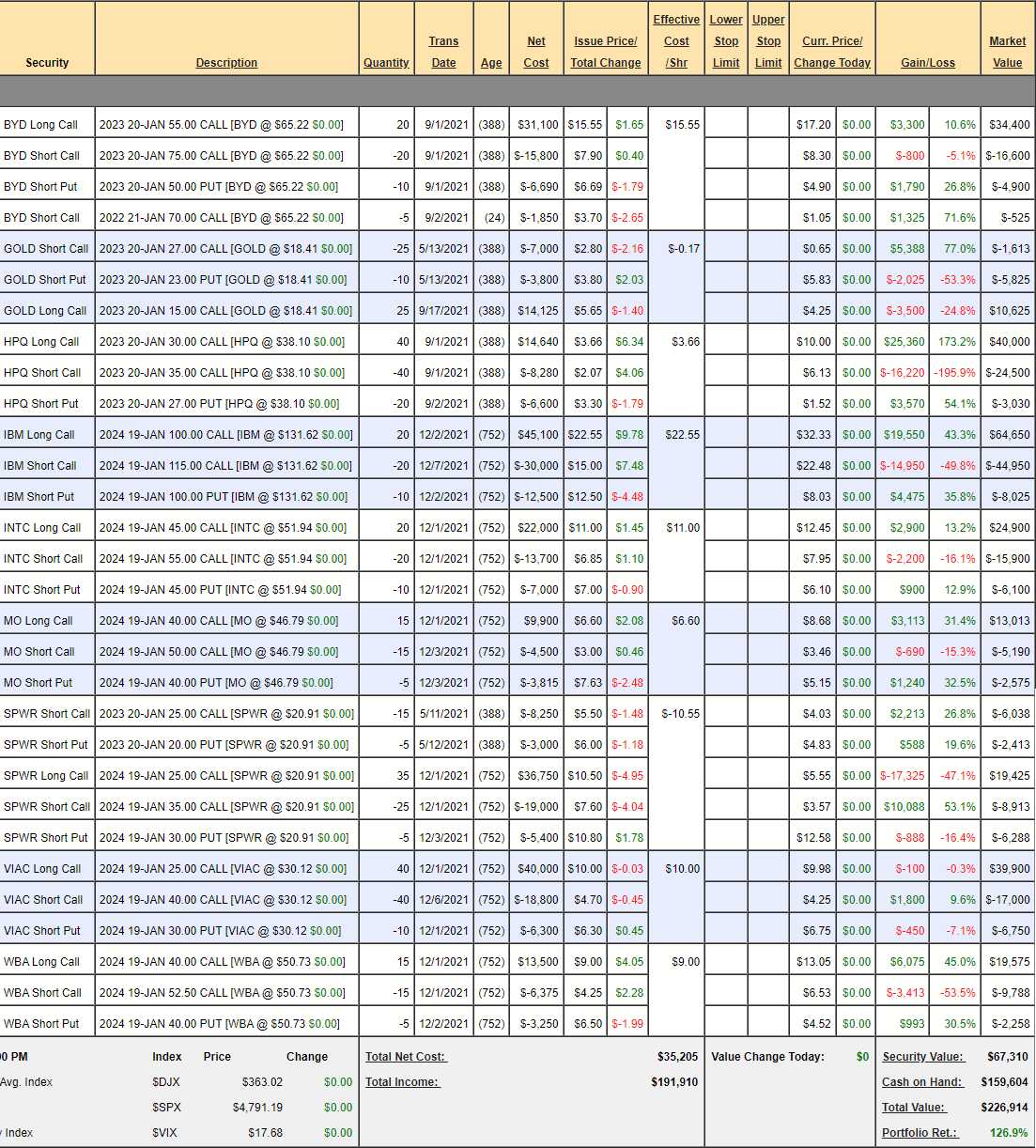

We begain the portfolio with $100,000 back on Nov 13th, 2019, so it's just over 2 years old and up 100% at the time is 50% a year – that's about what we shoot for and, by our calculations (all laid out in the 12/1 Report), the portfolio had another $235,336 left to gain – including our 4 new trade ideas.

Here we are, not even a month later, and our Money Talk Portfolio closed yesterday at $226,914, up $26,914 (26.9%) in less than a month. Now, we're SUPPOSED to make about $12,000 in a normal month – that's how we get to $235,000 so that's how far ahead of plan we are at the moment. Knowing how much money you expect to make on each trade and knowing whether or not each trade is on track is the key to strong portfolio management. We only adjust the Money Talk Portfolio when we're on the show (once per quarter) – so it's very important to make those adjustments count.

And, by the way, the really cool thing about this portfolio is we're only using $67,310 of our CASH!!!, keeping $159,604 on the sidelines – so plenty of room for adjustments and new trades but these positions are going to make another 100% in two more years – so no need to do more than nudge them along if necessary.

We did a full review last month so let's just check on the new trades, though I'll note the ones that are great for new trades:

- GOLD – Net $3,185 on a $20,000 spread means there's $16,815 (527%) of upside potential if GOLD goes up 50% over the next year. It's a great inflation hedge and the worst-case is owning 1,000 shares at net $18.185, which is the current price – and that's only if you grossly mismanage the trade.

- IBM – Our Trade of the Year got off to a flying start and I am not a fan of chasing so sorry if you missed it (subscribing here would fix that in the future!). Did our making the call on IBM cause the rally or did we call a perfect bottom? Hard to tell….

- INTC – This was our 2021 Trade of the Year but we cashed it in early precisely so we could buy it again if it went back down, which it did. Also ran up fast but not out of reach at net $2,900 on the $20,000 spread so still $17,100 (589%) of upside potential at $55 and, oh look, Intel is already at $52 so we have 2 years to make $3 and 589% – aren't options fun?

- MO – Also took off fast but net $5,248 out of a potential $15,000 still leaves us up to $9,752 (185%) of upside if MO can get to $50 by Jan, 2024. If marijuana is legalized nationally, that target will be left in the dust.

- SPWR is priced like there will never be an infrastructure bill and solar energy is just a fad – great for a new trade! This is a net $4,227 CREDIT on the $35,000 spread that needs SPWR to get back to $35 over the next two years but pays well on anything over $25.

- VIAC – I forgot, we threw out the old trade and now we have this so it was sort of pick number 5 last month. I call VIAC tragically undervalued at $30 and, if I had $20Bn, I'd buy them myself! I'm pretty sure someone else will so get in while you can at net $16,150 on the $60,000 spread. That's $43,850 (271%) of upside potential at $40 and we're $20,000 in the money now!

- WBA – Where do you get your shots? Where do you get your tests? Can this trade have been any more obvious? This one went up so fast it's hardly worth playing anymore at net $7,529 vs our net $3,875 entry but it is an $18,750 spread so $11,221 (149%) of upside potential remains – even if you missed our entry last month. It certainly looks a lot less risky now than it did then but not to us – we're value investors – charts don't scare us, they just point to opportunities.

Keep in mind the reason we're able to make 26.9% in a month (and much more than that on our cash deployment) is because we waited PATIENTLY for the opportunity to add stocks at good prices. We also took advantage of stocks that were too far ahead of our plan and cashed them out early – so we had money on the sidelines to take advantage of fresh opportunities.

That's what proper trading is all about!