267,305.

267,305.

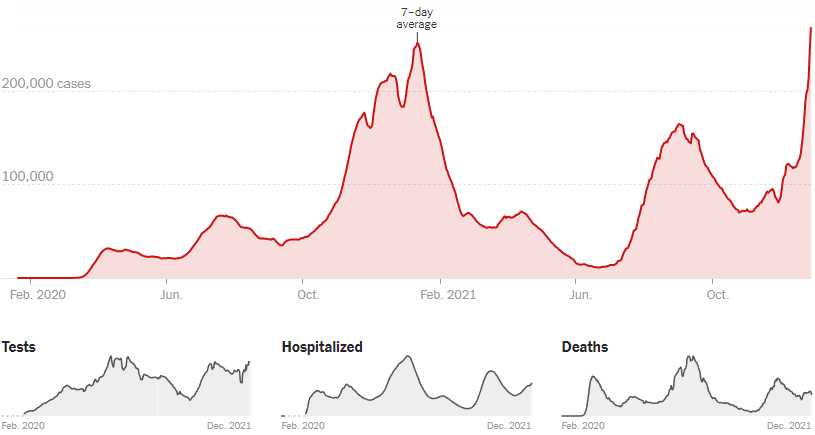

That is our new 7-day average of infections, beating the old high of 250,512 set back on January 12th. On Monday, there were 543,415 infections and 380,751 yesterday and the trend is not our friend as the rate of infection has been doubling every two weeks since we were at 70,000 per day in early November.

For perspective, the entire World shut down in the Spring of 2020, when we peaked out at just over 30,000 cases per day in the US – that is 1/18th as many cases as we had on Monday alone. Does it make sense to you that the "messaging" you are getting from the Government and the Corporate Media is now to just grin and bear is as the virus spreads completely out of control. As we suspected would happen on Monday, already the Government is "solving" the problem by officially telling people they only need 5 days of isolation instead of 10 days – because they want everyone to get back to work.

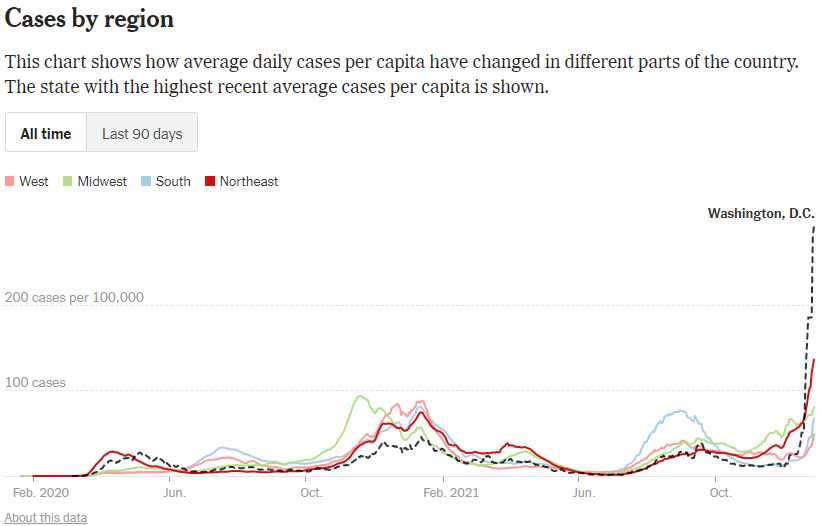

And, of couse, in Washington, DC, home of the anti-vaxxers and their staffs, things are completely out of control with 7 TIMES more infections per day than they had at their peak last fall and the entire Northeastern US is running more than double the rate they were at last January.

And, of couse, in Washington, DC, home of the anti-vaxxers and their staffs, things are completely out of control with 7 TIMES more infections per day than they had at their peak last fall and the entire Northeastern US is running more than double the rate they were at last January.

Can the markets keep ignoring this surge in cases? Certainly not if we're talking 1M cases per day next week. Even if Omicron were as mild as the flu – having 7M people per week get sick would be damaging to the economy. At the moment, "THEY" keep pointing out that hospitalizations and deaths are not maching the record highs – but that's because those are LAGGING indicators that FOLLOW the infections. Yes, that's very obvious but, unfortunately, you have to actually say these things out loud to cut through the BS that's pumped out by the Corporate Media.

I think I'm going to get a bit more hedged into the weekend, while the shorts are cheap. We just did our Short-Term Portfolio Review (STP) on Dec 14th and determined we had $580,000 worth of downside protection against a 20% drop but our Long-Term Portfolio has popped up to $2,197,044 – up over $100,000 in the past two weeks – so we should be taking about 1/3 of those ill-gotten gains to lock in the other 2/3 with some more hedges. When you are up $100,000 on paper – isn't is smart to guarantee you'll be able to pull out $66,000 when you need to? That's what hedging is all about.

- One investment we can make is to buy 100 more SQQQ 2023 $5 calls for $2.11, as that's $21,100 for calls that are $7,500 in the money and a 20% drop on the 3x ETF would send it up 60% to $9.20, and we'd be $4.20 in the money at $42,000, so we are buying $21,000 worth of protection and, eventually, we will sell covers to lower our cost but, for now, we're going to buy back the 100 short March $12 calls for 0.18 ($1,800) as they've already lost 83% of their value – we will do better selling new short calls on the next bounce.

| SQQQ Long Call | 2023 20-JAN 5.00 CALL [SQQQ @ $5.75 $0.00] | 200 | 8/2/2021 | (387) | $83,000 | $4.15 | $-2.05 | $4.38 | $2.11 | $0.00 | $-40,900 | -49.3% | $42,100 | ||

| SQQQ Short Call | 2023 20-JAN 15.00 CALL [SQQQ @ $5.75 $0.00] | -100 | 7/30/2021 | (387) | $-21,000 | $2.10 | $-1.10 | $1.00 | $0.00 | $11,000 | 52.4% | $-10,000 | |||

| SQQQ Short Call | 2022 18-MAR 12.00 CALL [SQQQ @ $5.75 $0.00] | -100 | 10/12/2021 | (79) | $-10,500 | $1.05 | $-0.87 | $0.18 | $0.00 | $8,700 | 82.9% | $-1,800 | |||

| SQQQ Short Put | 2023 20-JAN 10.00 PUT [SQQQ @ $5.75 $0.00] | -40 | 10/12/2021 | (387) | $-17,200 | $4.30 | $1.28 | $5.58 | $0.00 | $-5,100 | -29.7% | $-22,300 |

- Another short that's exhausted itself is the 20 short TQQQ Jan $130 puts, now at $1.33 ($2,660). We'll buy those back because TQQQ is another 3x ETF and $130 is only about 25% below the current price so an 8% drop in the Nasdaq would put us there. Our 2023 $200/150 put spread is half in the money and this is an income play – we will sell more short puts when we get another dip.

Our other major hedge is TZA and we have the following spread in the STP:

| TZA Long Call | 2023 20-JAN 20.00 CALL [TZA @ $26.95 $0.00] | 200 | 11/16/2021 | (387) | $160,000 | $8.00 | $2.40 | $14.29 | $10.40 | $0.00 | $48,000 | 30.0% | $208,000 | ||

| TZA Short Call | 2023 20-JAN 50.00 CALL [TZA @ $26.95 $0.00] | -100 | 5/7/2021 | (387) | $-77,000 | $7.70 | $-2.43 | $5.28 | $0.00 | $24,250 | 31.5% | $-52,750 | |||

| TZA Short Call | 2024 19-JAN 40.00 CALL [TZA @ $26.95 $0.00] | -100 | 11/16/2021 | (751) | $-84,000 | $8.40 | $1.38 | $9.78 | $0.00 | $-13,750 | -16.4% | $-97,750 | |||

| TZA Short Call | 2023 20-JAN 50.00 CALL [TZA @ $26.95 $0.00] | -100 | 12/3/2021 | (387) | $-90,000 | $9.00 | $-3.73 | $5.28 | $0.00 | $37,250 | 41.4% | $-52,750 |

- Another 3x ETF at $27 so, if the Russell falls 20%, this ETF gains 60% to $43. The spread is currently net $4,750 and would pay $400,000 at $40, so it's the bulk of our protection but, over $40 and we run into the short 2024 calls, so that's our limit and then we'd be worried about the short calls so, even though we don't think we'll hit $50 in the near-term, let's just buy back 50 of the 2023 $50 calls at $5.28 ($26,400), just to tilt the position slightly more bearish.

We don't have to do anything drastic since we already had $580,000 of downside protection and now I think we're up around $650,000. That locks in the gains we made in the LTP quite nicely and we'll see how that holds up into next week.

As I mentioned above, I'm going to use 4,780 as the shorting line for the S&P Futures (/ES) and I think 2 to start there and 1 more at 4,790 and 1 more at 4,800 if it goes any higher and that would make a nice hold over the weekend with an average of 4,787.5 on 4 shorts. Again, BECAUSE we have gained $100,000 in two weeks on our LTP longs, we can afford to gamble on the short side since we know that, if we lose these bets – we'll very likely make up the losses in the LTP anyway.

As I mentioned above, I'm going to use 4,780 as the shorting line for the S&P Futures (/ES) and I think 2 to start there and 1 more at 4,790 and 1 more at 4,800 if it goes any higher and that would make a nice hold over the weekend with an average of 4,787.5 on 4 shorts. Again, BECAUSE we have gained $100,000 in two weeks on our LTP longs, we can afford to gamble on the short side since we know that, if we lose these bets – we'll very likely make up the losses in the LTP anyway.

Please be careful out there!