So far, so bad on our S&P 500 (/ES) Futures shorts.

So far, so bad on our S&P 500 (/ES) Futures shorts.

We're down about $1,200 with only 3 of our 4 shorts filled (we never made 4,800 – our goal to fill the final short) but we were up about $1,400 during yesterday's Live Trading Webinar (replay available here), so the potential is clearly there. This position is a hedge not a trade, so we didn't take the money and run – as we would have on a trade.

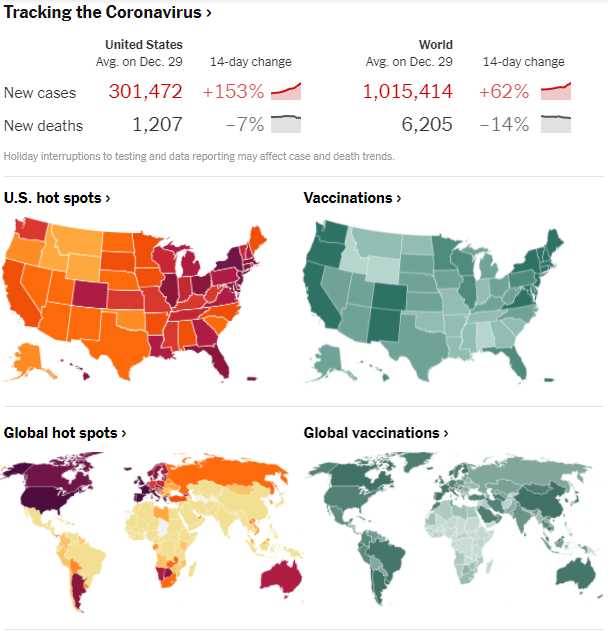

This isn't a bet on where the S&P will be now, during a meaningless, low-volume rally – but where it will be once the traders come back from their holidays – as the virus numbers begin to skyrocket. Today we are averaging 301,472 cases per day (14-day average), the most since the start of Covid and that's up from and average of 267,305 new cases per day, YESTERDAY. How does the 14-day average change so fast? Because we're dropping off the oldest day, two weeks ago, when there were few cases and adding yesterday, which was another record. This trend is accelerating so far, not slowing down.

I did not know there was a color code wose than red but, apparently, the color of dried blood means your area is worse than red… I guess this makes sense to coronors. They say this strain is mild and my daughter feels better after having tested positive Christmas Eve (day 6) and got a negative rapid test so today she seeks to confirm that with a proper test but good luck finding one as the testing centers are overwhelmed.

"With more countries cutting isolation times and testing requirements, the World Health Organization has warned governments that they are engaging in a trade-off between slowing Covid-19 transmission rates and keeping economies and essential services running."

The WHO is beginning to question policies of choosing profits over populations. “We must remember that hospitalizations and deaths are lagging indicators,” Fauci said. “However, the pattern and disparity between cases and hospitalization strongly suggest that there will be a lower hospitalization-to-case ratio when the situation becomes clear.” The CDC this week advised that infected people who are asymptomatic can leave isolation after five days and should wear masks when around other people for another five days; those who are vaccinated and exposed to someone with Covid-19 should wear a mask for 10 days and try to get tested five days after exposure.

We bumped up our hedges yesterday so now we switch back to bargain-hunting mode and I don't want to do anything before the holiday but here's a few stocks worth looking at:

- Bidu (BIDU) is 60% off it's highs at $136, which is a market cap of $85Bn although the company makes a fairly consistent $3Bn a year so less than 30x for the high-growth company is very nice. People are worried Chinese stocks will be delisted but that doesn't mean you can't own them on foreign exchanges. That's what the rest of the World does with US Stocks – so don't be afraid of it.

- JD.Com (JD) is 40% off it's highs and $65 is just $103Bn for a company that is on track to make $13Bn this year and expects to make $20Bn in 2022. JD is a logistics company that mainly does business in China and again, it's stupidly low because of fear – nothing that's acutally wrong with the business.

- Generac (GNRC) is a generator company we always like when they are down and $347 is 33% off the highs at $22Bn and these guys made $351M in 2020 and are making $604M this year and project $756M for 2022. Every time there's a natural disaster – their phones ring and, the way this World is warming – business will be booming for years to come.

- Alaska Air (ALK) is my favorite airline. They are 30% off the highs at $52, which is $6.5Bn and they used to make almost $1Bn per year but they lost $1.3Bn in 2020 and this year is about break-even and maybe next year will be too but, one day – they will make money again. The nice thing about options is we don't have to buy them for $52, we can PROMISE to buy 500 shares at net $35 (another 33% off) by selling 5 2024 $40 puts for $5 ($2,500). That puts $2,500 cash in our pockets while we wait and see how Omicron plays out in Q1 – let's do that in our Long-Term Portfolio (LTP).

- Activision (ATVI) is a huge gaming company that is down 36%, mostly because they are involved in a sexual discrimination case in California because, who would have guessed, gamers and coders apparently don't know how to behave properly around women. Does this affect their gamer audience? My oldest daughter is a radical feminist and she hasn't closed her Warcraft account so I think they'll be OK. ATVI makes $3.90 per $52 share you buy, which is a p/e of 13.33 and they haven't even had a big release recently but the Metaverse will open up a whole new frontier for gaming companies and who has all the top coders?

- Medtronic (MDT) is another old favorite and $104 is 23% off the high and a $140Bn market cap for a company that makes about $4Bn/year and is growing nicely. As with ALK, I'd be happy to promise to buy them if they get cheaper.

- Boeing (BA) is only $119Bn at $203 and they generally made $5-10Bn a year before their problems. They still have a 7-year backlog of orders to fill and there's nobody breathing down their necks to compete (though we do have stock in ERJ). This will be a slow turnaround so we don't expect a big jump but you really don't want to miss the comeback on them. We already sold 5 of the 2024 $200 puts in our LTP for $30 back in November and now they are even better at $38, netting you in at $162.

- Phillips 66 (PSX) is 22% off the highs at $73 and that's $32Bn and, pre-covid, these guys made $5Bn a year. They lost $4Bn in 2020 but that's why you can buy them so cheap. This year making about $1.7Bn, next year they expect to be back over $3Bn so now's the time to get in.

- Disney (DIS) is 24% off the highs at $155 and that's $281Bn in market cap and they are good for $10Bn in a good year so not really a bargain and Omicron makes them too risky but worth keeping an eye on in case we're shut down again and they get closer to $120 – where I would find them irresistable.

- Corning (GLW) is another old favorite of ours that's 20% off the highs, which is $32Bn at $37.50 and they are good for about $1.8Bn so paying 20x for a steady-growing industry leader is very fair, in my opinion.

So there's 10 stocks for a Holiday Watch List we can keep our eye on. If we survive the weekend, we'll probably add a few more to our portfolios and, if we don't – then these are the fresh horses we'll want to ride into the next recovery.