By Jacob Wolinsky. Originally published at ValueWalk.

Stanphyl Capital’s commentary for the month ended December 2021, discussing the U.S. economic situation, and their long positions in NuScale Power, Volkswagen AG (OTCMKTS:VWAPY), and General Motors Company (NYSE:GM).

Q3 2021 hedge fund letters, conferences and more

Friends and Fellow Investors:

Stanphyl Capital’s Performance

For December 2021 the fund was up approximately 15.3% net of all fees and expenses. By way of comparison, the S&P 500 was up 4.5% while the Russell 2000 was up 2.2%. For 2021 the fund was up 25.9% net while the S&P 500 was up 28.7% and the Russell 2000 was up 14.8%. Since inception on June 1, 2011 the fund is up 71.3% net while the S&P 500 is up 338.1% and the Russell 2000 is up 205.4%. Since inception the fund has compounded at 5.2% net annually vs 15.0% for the S&P 500 and 11.1% for the Russell 2000. (The S&P and Russell performances are based on their “Total Returns” indices which include reinvested dividends. The fund’s performance results are approximate; investors will receive exact figures from the outside administrator within a week or two. Please note that individual partners’ returns will vary in accordance with their high-water marks.)

In November & December the market’s sanitation department finally arrived to pick up some trash, and high on its list of non-recyclables (i.e., suitable for landfill only) was the ARKK ETF, a giant collection of bubble-stocks which we’ve been short for much of 2021 (and remain short in somewhat reduced—although still significant—size). Thank you, Crazy Crooked Cathie, for helping to give us a halfway-decent year.

Also contributing a bit to this month’s gains was our short position in Tesla, which finally appears to be “losing the narrative” as an onslaught of great new EVs gains both market share and investor mindshare, while another Tesla headwind was the killing (for now, at least) of the anticipated extension of the U.S. EV tax credit, thanks to Manchin’s opposition to Biden’s spending boondoggle. (Please see my Twitter thread about why all EV credits are a massive waste of money relative to their immeasurably tiny effect on “climate change.”)

On the long side, new to the fund this month is a position in NuScale Energy, a designer of safe, small modular nuclear reactors that’s going public via a SPAC with the ticker SV; more on that later in this letter.

We’re Entering A Stagflationary Repeat Of The 1970s

Meanwhile, I continue to believe we’re entering a stagflationary repeat of the 1970s, which is why we own gold and several deep-value stocks and remain short high-PE bubble-stocks such as Tesla and ARKK. Even if the failure (for now, anyway) of the “BBB Bill” removes some near-term inflationary pressure, this may be offset by Biden’s possible cancellation of $1 trillion in student debt and increasing demands for cost-of-living increase clauses from workers. (I suspect that the new Omicron COVID variant won’t change this outlook, as patients appear to get much less sick than they’d be under previous versions of the disease.)

The Fed’s new slightly less dovish stance (i.e., printing tens of billions of dollars per month through March instead of June while predicting three tiny 2022 rate increases totaling less than 1%) is laughable relative to the rate of inflation, even if that inflation were to ease significantly in 2022 to the 4% range from the 6%+ we see now.

Even at today’s absurdly low rates the interest on the nearly $30 trillion in federal debt costs around $400 billion a year. Does anyone seriously think this Fed has the stomach to face the political firestorm of Congress having to slash Medicare, the defense budget, etc. in order to pay the higher interest cost created by significantly raising those rates to a level commensurate with 4%+ inflation? Powell doesn’t have the guts for that, nor does anyone else in Washington; thus this Fed will be behind the inflation curve for at least a decade.

Meanwhile the broad-based increases in the CPI, PPI and even the Fed’s nonsensical core PCE continue to indicate that this inflation is not “transitory.” (Nor is it restricted to the U.S; at 4.9%, the Euro Area recently reported its highest inflation rate since its inception, and German inflation is the highest since 1992.)

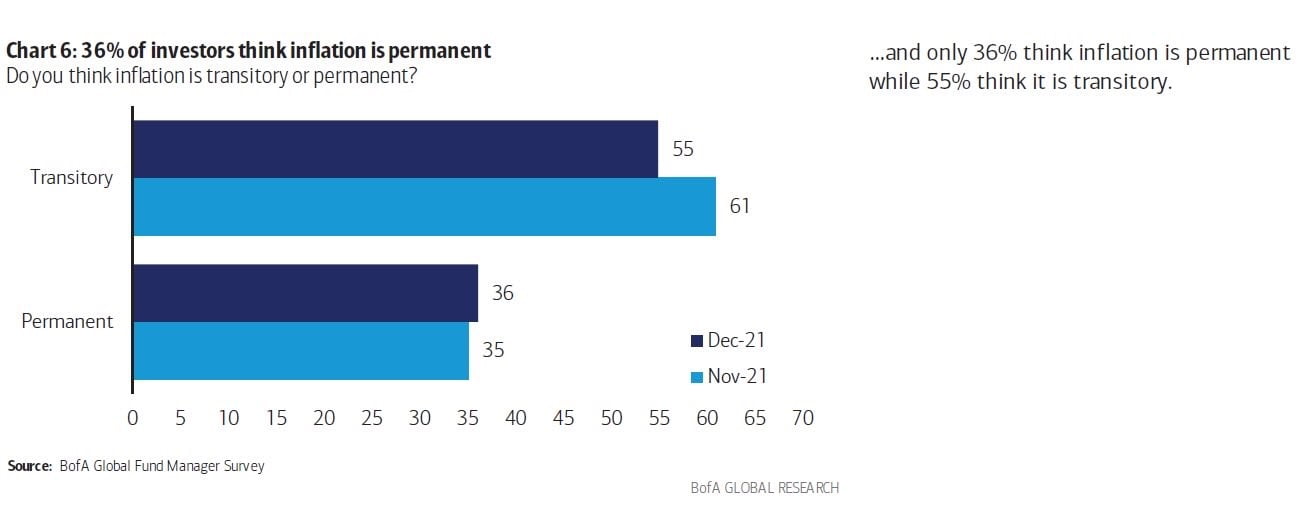

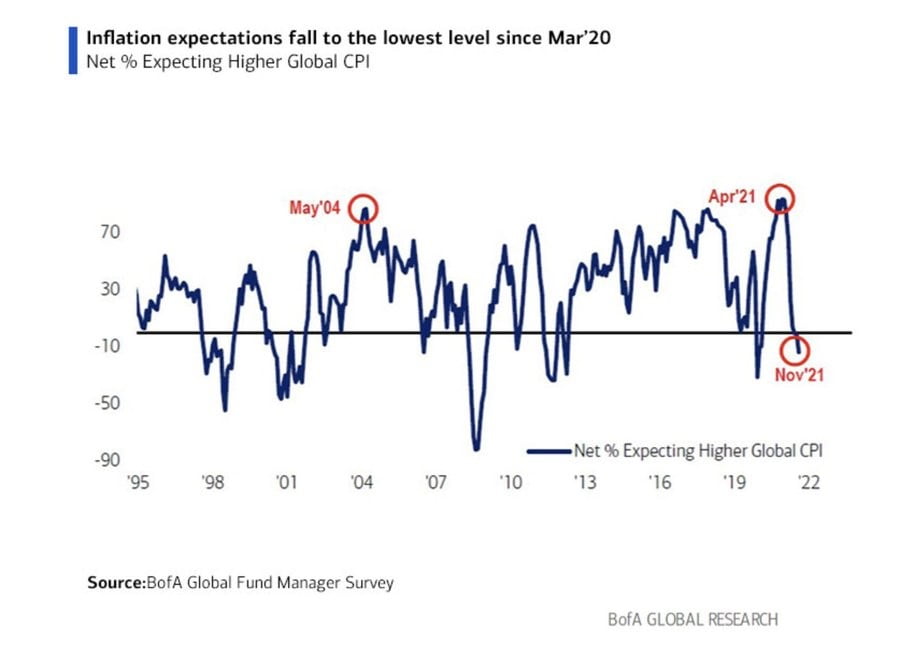

Despite all this evidence, courtesy of Bank of America we can see that the majority of investors—perhaps conditioned by 40 years of disinflationary complacency (the average portfolio manager is only 44 years old)—still don’t believe that inflation is a problem (which is likely why gold has yet to take off):

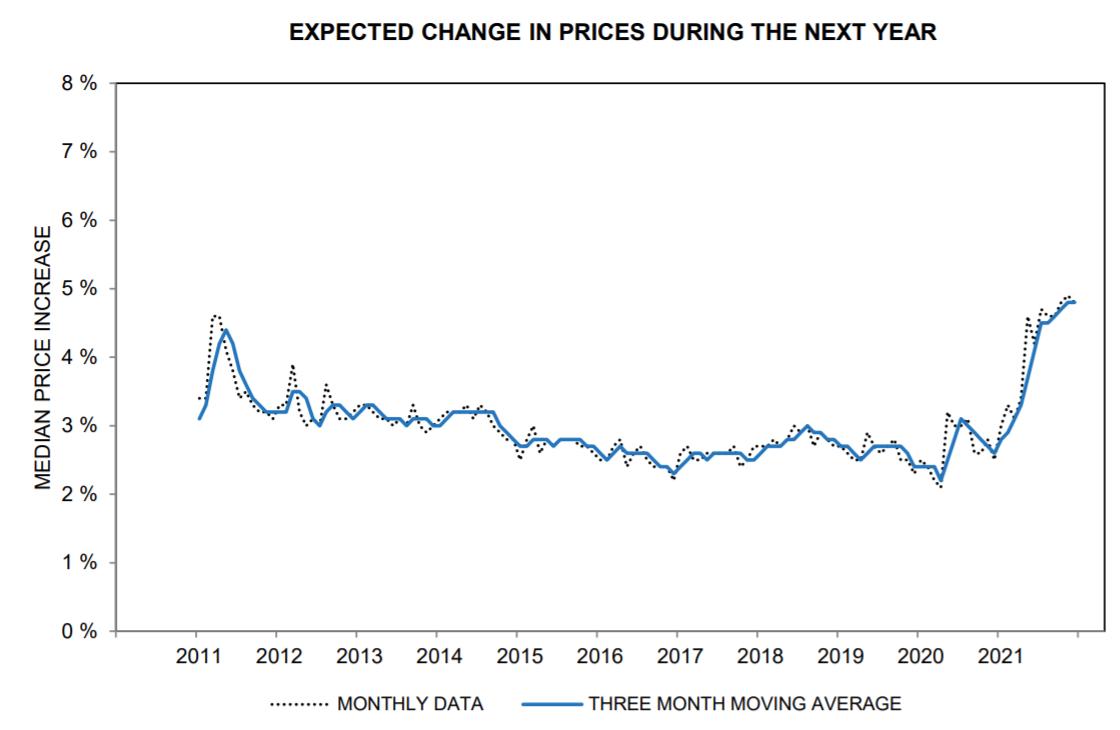

And courtesy of the latest University of Michigan survey, we can see that although short-term consumer inflation expectations have soared…

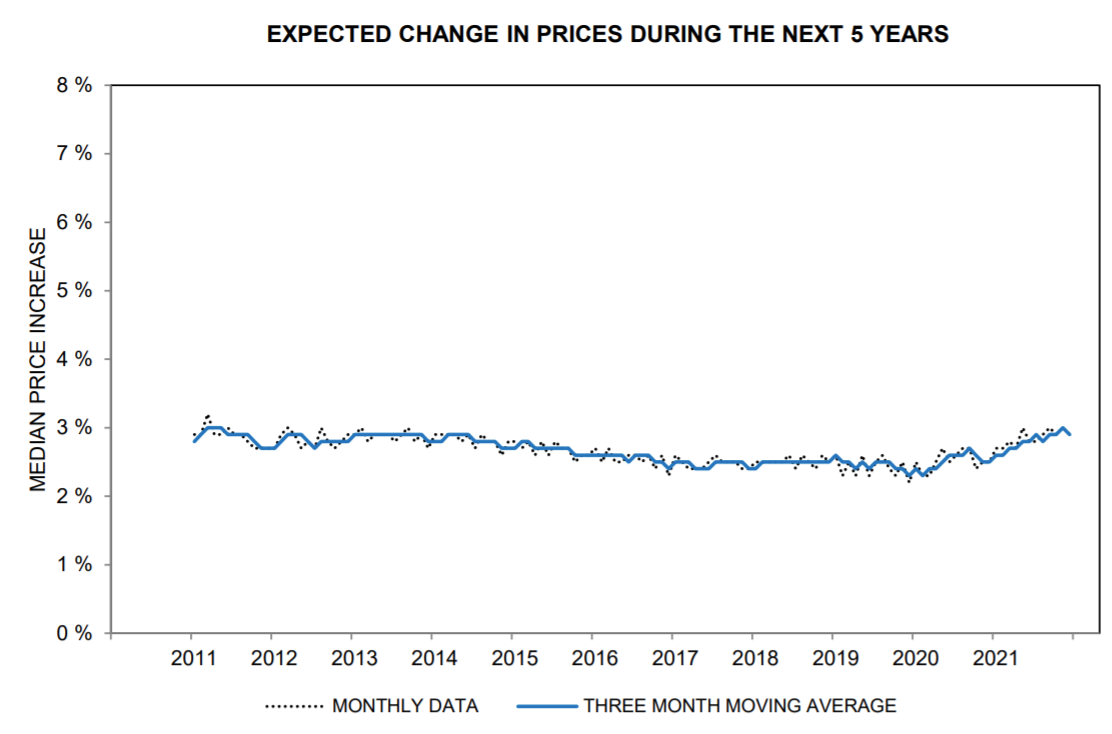

that fear is just starting to creep into longer-term expectations:

Meanwhile, the similarities between the stagflationary early 1970s and “now” remain uncanny:

What did the U.S. economic situation look like in 1973?

- Soaring energy costs

- Soaring fiscal deficits

- Soaring labor costs

- CPI >6%

- Stocks about to enter a bear market as inflation was about to crush PE ratios

- The price of gold about to soar

What does the U.S. economic situation look like today?

- Soaring energy costs (as developed nations “go to war” on fossil fuels)

- Soaring fiscal deficits

- Soaring labor costs

- Low-cost China cut out of supply chains (an inflationary factor not found in the 1970s)

- CPI >6%

Thus, just as in the 1970s, I believe stocks are entering a bear market as inflation crushes their PE ratios, while continuing deeply negative real interest rates will eventually cause the price of gold to climb.

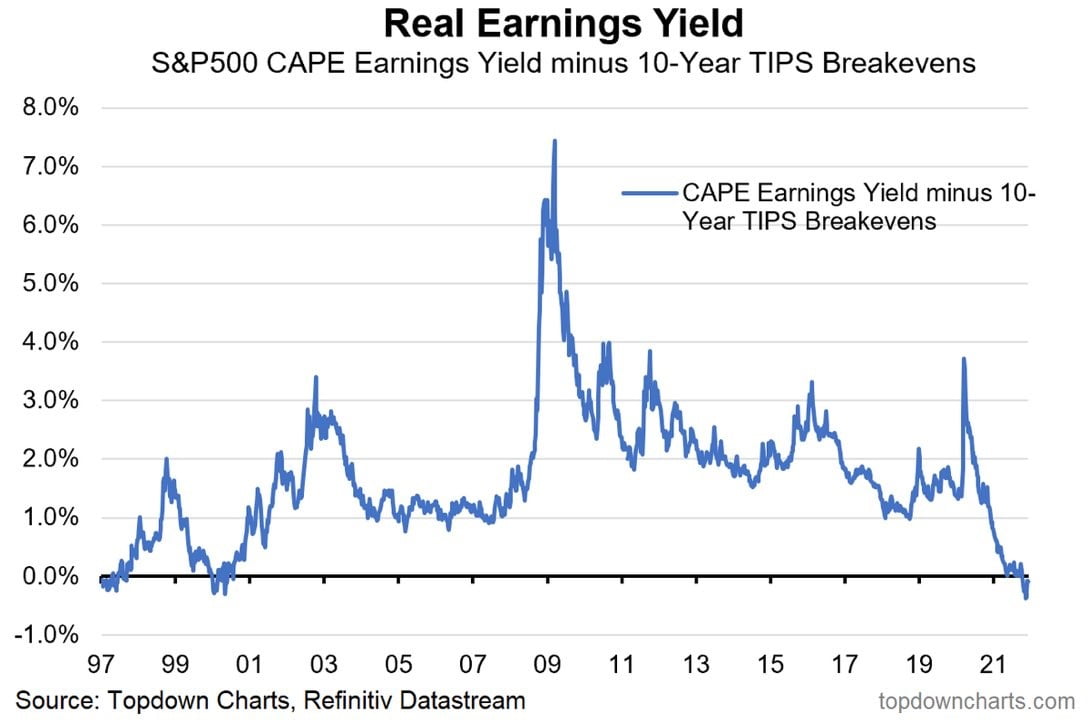

Meanwhile, equity indexes are so stretched that myriad exogenous events (both “known unknowns” and “unknown unknowns”) could pop this market even independent of inflation or Fed actions. Courtesy of @MichaelAArouet & TopdownCharts we can see that the S&P 500’s CAPE real earnings yield is down to levels only seen before previous crashes…

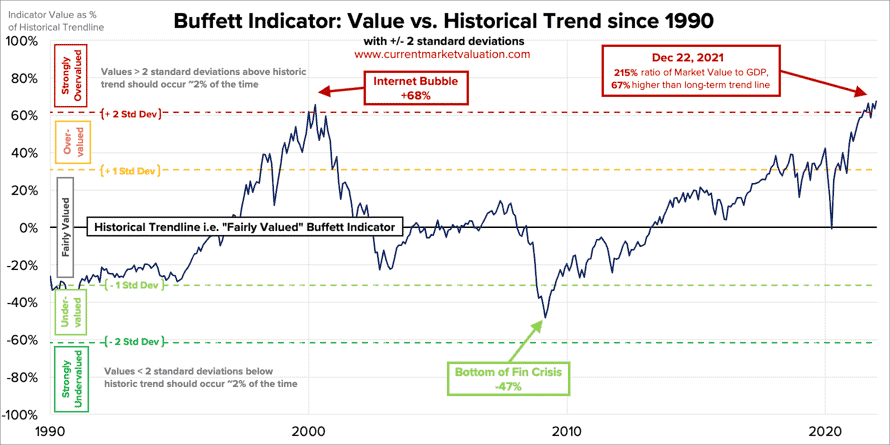

…while from CurrentMarketValuation.com we can see that the U.S. stock market’s valuation as a percentage of GDP (the so-called “Buffett Indicator”) is astoundingly high…

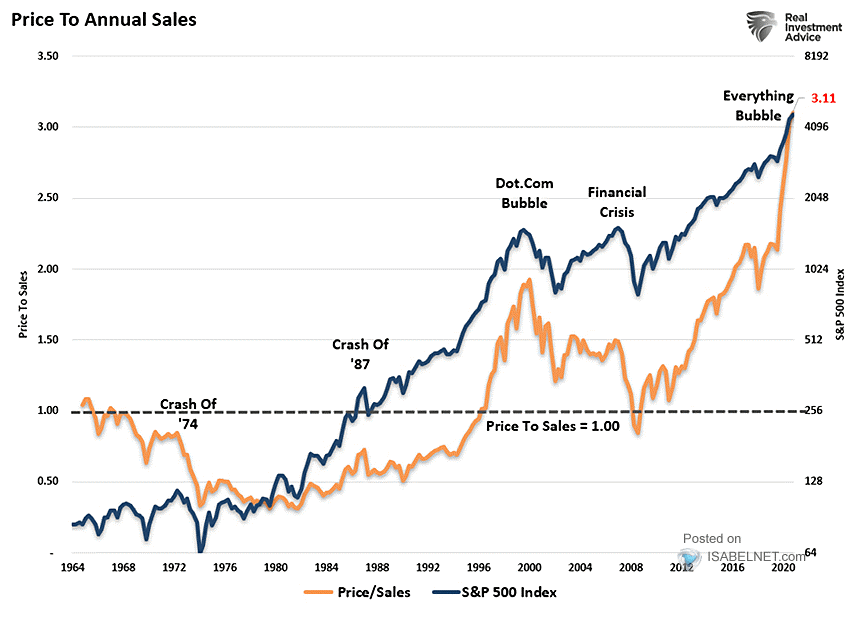

…as is (courtesy of @ISABELNET_SA & @LanceRoberts) the S&P 500’s ratio of price to sales:

Long Positions

Here then is some additional commentary on some of the fund’s positions; please note that we may add to or reduce these positions at any time…

NuScale Power

New to the fund this month is a long position in NuScale Power, which is going public in the first half of 2022 by merging into a SPAC with the (temporary) ticker SV. I believe that the world will soon acknowledge that the only practical way to decarbonize is via nuclear power, and NuScale designs small modular reactors (SMRs) using passive safety that have the only design (so far) approved by the Nuclear Regulatory Commission. This is a capex light company (NuScale provides only the engineering services), and although the first reactors in the pipeline won’t come online until the end of this decade, the cash flow begins much sooner as the company is paid as construction progresses. At a pro-forma enterprise value of just $2 billion with great strategic holders and (according to management) enough cash on hand to become cash flow positive, I believe this is an interesting speculation in a very “sexy” story, with the added advantage that pre-merger the price should have a floor of around $10 as that’s where holders are permitted to redeem their shares, thereby making this trade rather asymmetrical for at least the next few months. Have a look at the company presentation.

Volkswagen

We continue to own a long position in Volkswagen AG (via its VWAPY ADR, which represent “preference shares” that are identical to “ordinary” shares except they lack voting rights and thus sell at a discount), as the stock has been punished lately due to short-term chip shortages and short-term uncertainty regarding the future of its current CEO. However, Volkswagen controls a massive number of terrific brands whose EVs (several of which are more technologically advanced than Tesla’s) combine to outsell Tesla in Europe and by late 2022 should match Tesla’s EV sales in China. (Thanks to October’s introduction of the $25,000 ID.3 there, VW’s Q4 China EV sales will be at least 60% of Tesla’s.) In total, VW sells around 10 million cars a year (plus lots of trucks), vs. around 1 million a year for Tesla. Yet Tesla’s diluted market cap is over 9x VW’s, meaning that an investor pays over 90x as much for each Tesla sold as for each VW sold! And VW sells for less than 6x estimated 2022 earnings!

General Motors

We continue to own a long position in General Motors (GM), which currently sells at only around 8.5x 2022 earnings estimates. GM is doing all the right things in electric cars, autonomous driving (via its Cruise ownership) and software, yet it’s extremely cheap because, as with other established automakers, investors have (for now) forsaken it in favor of “electric car pure-plays,” a sector which has thus become the largest valuation bubble in history. You can read an outline of GM’s future plans (given on an investor day in early October) in this press release. And regarding “autonomy,” keep in mind that unlike Tesla, which sells a LiDAR-less fraud to rubes, Cruise is already running a fleet of fully autonomous cars in San Francisco; you can see many videos of this on its YouTube channel.

I thus consider these positions (GM and VW) to be both “freestanding value stock buys” and “relative value paired trades” against our Tesla short.

Updated on

Sign up for ValueWalk’s free newsletter here.