By Jacob Wolinsky. Originally published at ValueWalk.

Comus Investment commentary for the year ended December 31, 2021.

Q3 2021 hedge fund letters, conferences and more

Dear Partners,

Comus Investment’s Performance

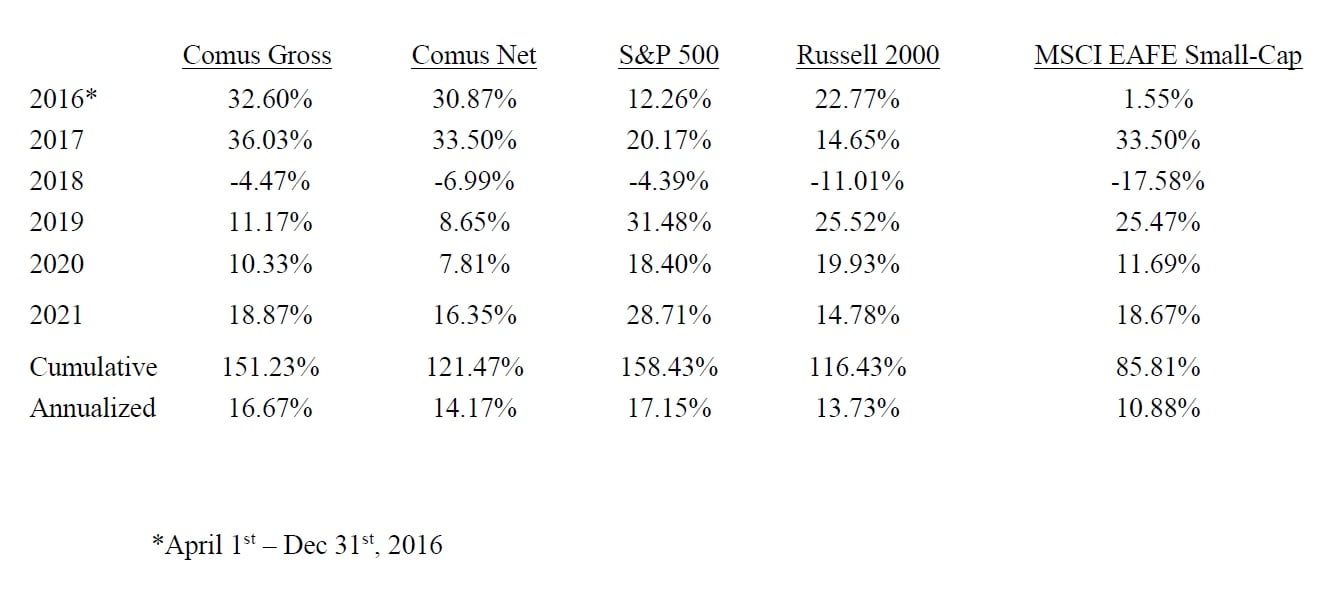

In the fourth quarter of 2020, our investments experienced a total return of -1.42% before fees and -2.05% after fees, versus 11.03% for the S&P 500 index. For the year, we generated a total return of 18.87% before fees and 16.35% after fees, versus 28.71% for the S&P 500 index. At this point, you will have received reports with the details on your balance, fees, holdings, and performance from InteractiveBrokers for the past quarter.

With perfect timing to end the year, we endured a 10% drawdown in December, coinciding with another historic quarter for U.S. stocks, to mark another year in which we cannot match American stocks in rising by a third. The lovely Hang Seng index was down about 15% in 2021 and managed to pull us down with it as it dove the extra 10% through the holidays. It is of course my decision to invest and accept risk in places where others are sharply pulling money, and I expect it to pay off, but under these conditions you would do better throwing darts at the U.S. stockboard- many of those will rise splendidly for you. Our portfolio is comprised of many stocks, most of which are highly volatile, and we will experience much more dramatic swings than we have in past years, but it is nonetheless disappointing for a good performance in the calendar year to vanish with the whims of foreign selling within weeks. Unfortunately, I wasn’t investing from 2009 to 2015- the gains will be harder now, and the opportunity set also much smaller until things change. Of course, my blunders the past few years in selecting some stocks without the necessary upside potential and without some of the qualities I now seek didn’t help.

This remains a time when everyone makes money in stocks; when confidence is high, and uncertainty is low. As I heard recently from a newfound retail investor: “I’m up 40% in 2021, it’s okay, but not a great year”. It must’ve been a down year for him, but it’d be nice if he conferred that energy upon us.

Many investors seem to know what will happen in the future, and they focus on it at the expense of the past and present. What’s currently happening interests very few people. This high conviction thesis-investing, which frequently relies on the equivalent of intuition since it is supported by little other than reasoning, has allowed for the lofty valuations of loss-making companies. In fact, it frequently requires loss-making companies for the reasoning and valuations to continue, because when revenue growth slows and companies reach their purported mature scale, their profitability frequently disappoints. Until then, expected future profit margins in maturity can be as high as we like, since there exists no evidence yet to disprove any estimate.

The Concept Of Intrinsic Value

Thesis investing ties hand-in-hand with the concept of intrinsic value, the all-important but equally useless term which suggests investors can estimate what companies are worth, with these estimates frequently supported by data which don’t exist, or which are expected to appear in the future, and which often deviate substantially from that shown in the past or present. These estimates of intrinsic value can vary dramatically based on our inputs of growth and profitability, and they are all incorporated into the stock pricing we currently see. Rivian, for example, with its $90 billion valuation and complete lack of any revenue (though it does have pre-orders), must incorporate the idea that this venture, which is currently smaller than your local coffee shop, will be wildly successful. People are clearly paying good money for it and have optimism about its future.

There is usually no reliable way to know how things will turn out later for these early-stage companies (which may or may not be unprofitable cash-burners), or how anyone comes up with their expected margins a decade from now, but it’s currently the dominant frame of mind that anyone without some estimate of these things isn’t investing properly. To sum up: the estimates might not be good, but at least everyone has them!

This mindset that a definitive estimate must be made and if it cannot be, then there must be a refusal to invest brings us to the next point. I have little interest or confidence in any estimated future, and carry a lot of uncertainty, even for many stocks we own. The thing is, nobody else knows what exactly will happen either, but they frequently rig prices for us based on extreme beliefs to such an extent that if they are wrong to the slightest degree, we can do very well. I don’t need to have any insight or knowledge of what will happen, if only our beaten down stocks can do better than the often unfounded expectation of complete ruin. I’m not the one assessing intrinsic value, the market is, but through a crooked lens. We won’t profit from my beliefs, but from the beliefs of others which may not be accurate. Bad things are usually followed by good; very few companies excel or fade forever. Sports teams do not lose games forever, the weather is constantly changing, and most companies have bad years mixed with good years.

Based on this logic, as noted recently, our portfolio is dispersed among many stocks, some of which are low conviction. I do my best to buy in a variety of countries but am usually be forced to buy where things look bleak, though preferably avoiding most political risk or the wild currency risk of some developing countries. Given the past month, I’d categorize this as another bad year, even though this was our best year we’ve had relative to a local index. And I have to say, if I weren’t managing or reporting for others, it wouldn’t mean much to me. Hopefully we will eventually have some good years after the bad. For us to show some value compared to the S&P 500, things will likely have to change in America, where 15% is now considered a bad year- no promises there.

As always, feel free to contact me at any time with questions, comments or concerns.

Best,

Aaron J. Saunders

Owner & Manager,

Comus Investment, LLC.

asaunders@comusinvestment.com

Updated on

Sign up for ValueWalk’s free newsletter here.