What is wrong with people?

What is wrong with people?

The market dropped 2.5% after yesterday's Fed Minutes were released and all they said was what they announced at the Dec 15th meeting, which is they are going to start tightening in 2022, probably with 3-4 0.25% hikes. You would think they announced the end of the World the way the market started selling off and the day's volume only hit 104M on SPY – not even a major volume day.

Still, as I had noted in our Live Trading Webinar BEFORE it happened, we simply don't have enough buyers to support any kind of selling so, as soon as there's any bad news and people try to sell – the bottom can fall out very quickly. Having a 2.5% drop means we look for a 0.5% (weak) or 1% (strong) bounce and, if we don't get those – then it's likely we're in for another downturn.

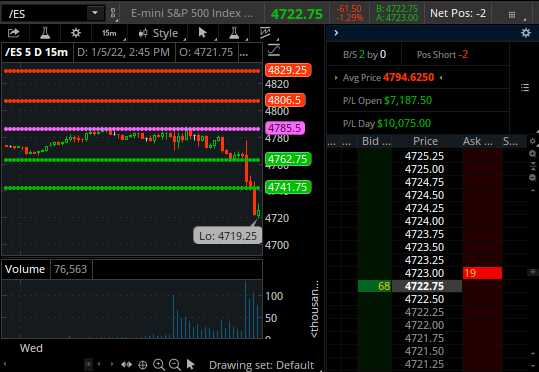

That would be fine with us as we cashed out of our S&P (/ES) 500 shorts yesterday with a $10,000 gain (you're welcome) at 4,720 (we initiated those in last Wednesday's Morning Report and again on Thursday) and now we have switched to shorting the Dow (/YM) Futures at 36,400 but with tight stops above that line – it's what we call a "fresh horse" trade.

That would be fine with us as we cashed out of our S&P (/ES) 500 shorts yesterday with a $10,000 gain (you're welcome) at 4,720 (we initiated those in last Wednesday's Morning Report and again on Thursday) and now we have switched to shorting the Dow (/YM) Futures at 36,400 but with tight stops above that line – it's what we call a "fresh horse" trade.

We're also excited to short more Oil (/CL) at $79.50 as that is just silly. OPEC released a not yesterday that they are expecting the current round of Covid not to affect anything – even as thousands of airlines and cruise ships are being cancelled every day and schools are shutting down and companies are delaying return to work dates. Even Spider Man was empty at the IMAX yesterday (I was waiting for it to get less crowded but wow!).

Just because the indexes have done silly things it doesn't mean we have to pay attention to them and low volume BS for the past few weeks means we have no reason to change our original bounce chart from December's dip – as those zones are still in play.

- Dow 36,000 to 34,200 has bounce lines of 34,560 (weak) and 34,920 (strong)

- S&P 4,700 to 4,465 has bounce lines of 4,512 (weak) and 4,559 (strong)

- Nasdaq 16,500 to 15,675 has bounce lines of 15,840 (weak) and 16,005 (strong)

- Russell 2,400 to 2,080 has bounce lines of 2,144 (weak) and 2,208 (strong)

In fact, the colors we have today are the EXACT SAME colors we had on December 21st so the Nasdaq is still our weakest index (which is why we bumped those hedges in the Short-Term Portfolio) and Russell 2,200 is still our primary directional indicator – right where we are this morning! As I said at the time:

Weakness in the Nasdaq directly relates to weakness in the S&P these days since just 5 stocks (MSFT, NVDA, AAPL, GOOGL and AAPL) are responsible for 50% of the S&P 500s gains since April and for 1/3 of the entire year's gains (300 of 900 points). “If those companies, for whatever reason, stop performing, there’s nothing to support the market,” said Peter Cecchini, director of research at hedge fund Axonic Capital. Expectations that stock prices will fall over the next six months jumped to 42% earlier this month, the most bearish reading in more than a year, according to a weekly sentiment survey conducted by the American Association of Individual Investors. New York Stock Exchange stocks closing above their 200-day moving averages, dropped as low as 41% earlier in December, a 17-month low.

There's little to be determined from this low-volume holiday trading so let's just sit back and relax and enjoy the show.

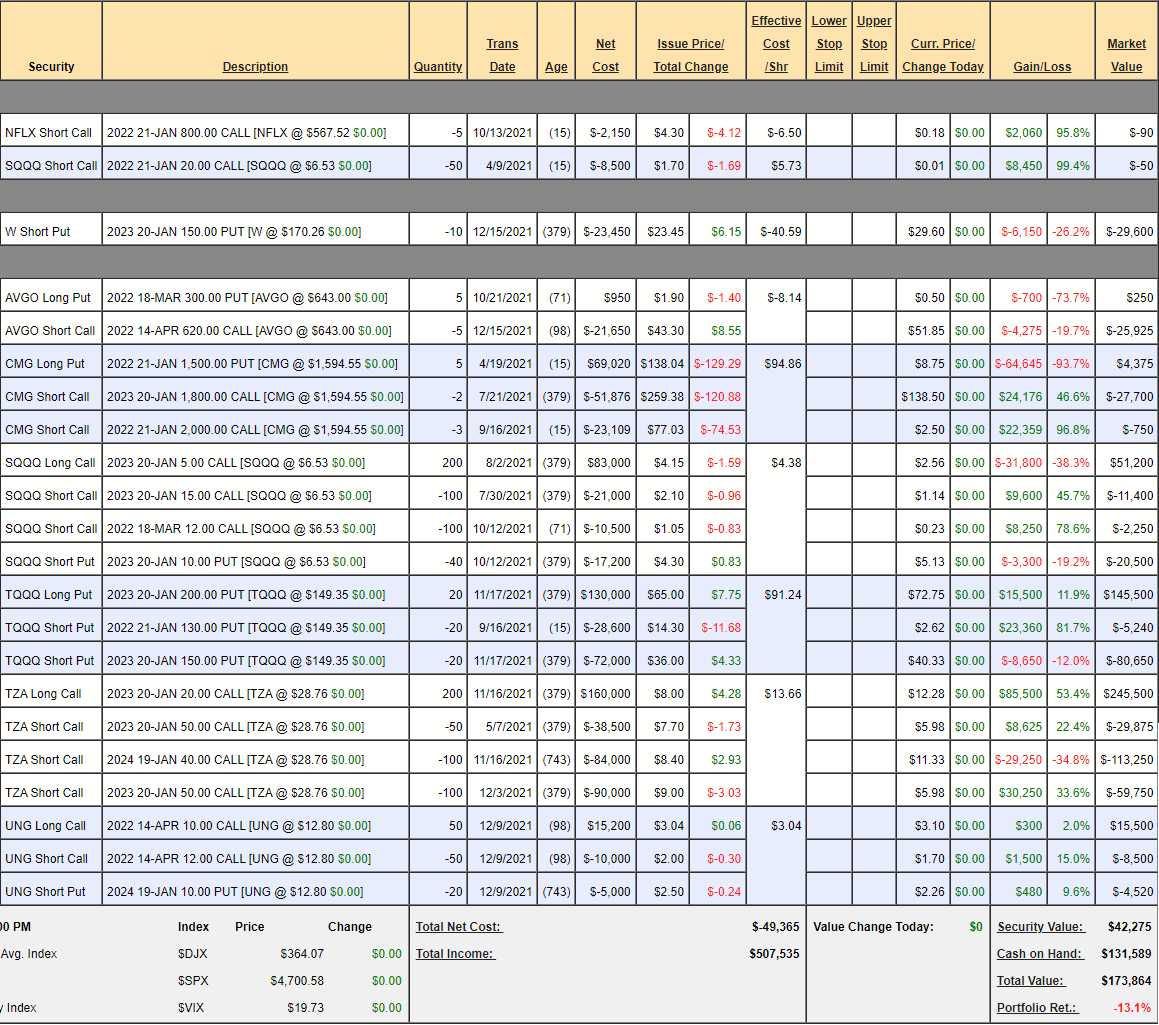

As I predicted, we could have gone on vacation and come back on January 4th (I wasn't even going to bother with Monday) and we would not have missed a thing. Since we were here, however, we did adjust our Short-Term Portfolio (STP) to be a bit more bearish and, as of yesterday's close, we're at $173,874 – up $54,485 since our December 14th review. Even better, our Long-Term Portfolio has actually gained just under $100,000 since our Dec 16th review – so our hedges are more than adequate at the moment.

The STP had $580,000 of hedging potential (against a 20% drop) last month and we're up $55,000 so $525,000 of protection remains. Why are we doing so well? Because the market has been essentially flat for a month – despite all the up and down action – and since we are BEING the House – NOT the Gambler, all that premium we sell pays off on both ends. A flat market is perfect for us and, since we are pretty good at picking value stocks – the ones we expected to bounce back have done so – like our Trade of the Year and the Runner Ups from early December.

We also picked the right indexes to hedge (Nasdaq and Russell) – as they have indeed proven to be the weakest from their tops. We still have plenty of CASH!!! in the STP and we need to deploy some of it to lock in those gains from the LTP – usually we spend about 1/3 of our unrealized gains improving our hedges – so we lock in 2/3 of our winnings.

We'll see how the day plays out. Very simply, we watch the Bounce Box and, if more reds are added – that will be BAD. I think we're on the way to test 15,000 on the Nasdaq (/NQ), so still a long way (4.3%) to go from here.