"Four in the morning

Crapped out, yawning

Longing my life away

I'll never worry

Why should I?

It's all gonna fade" – Paul Simon

That pretty much sums up the market recently as we wrap up an entire year of the Russell 2000 running along the same 2,200 line for what is now the 12th month. There is a certain point at which you stop saying it's consolidating for a move up and start saying we're clearly over-valued at this level.

"When I think back on all the crap I learned in high school

It's a wonder I can think at all"If you took all the girls I knew when I was single

And brought 'em all together for one night

I know they'd never match my sweet imagination

Everything looks worse in black and white" – Paul Simon

We've been getting that kind of action from the other indexes since November and 2022 may indeed be the year we went nowhere, but that will certainly beat the alternative (a major correction) after climbing 120% on the Russell since early 2016. The S&P too was down at 2,000, so it's up 135%, Dow 16,000 to 36,100 is up 125% and the Nasdaq is up from 4,400 to 15,740 – that's a 257% run.

Interestingly the Nikkei is "only" up 100% and the Euro Stoxx Index is up just 43% and Germany's DAX is up just 60% so we have to ask ourselves – are US companies totally superior to other companies or are the US exchanges just ridiculously overvaluing their components? I'm sorry to say but the odds strongly favor the latter.

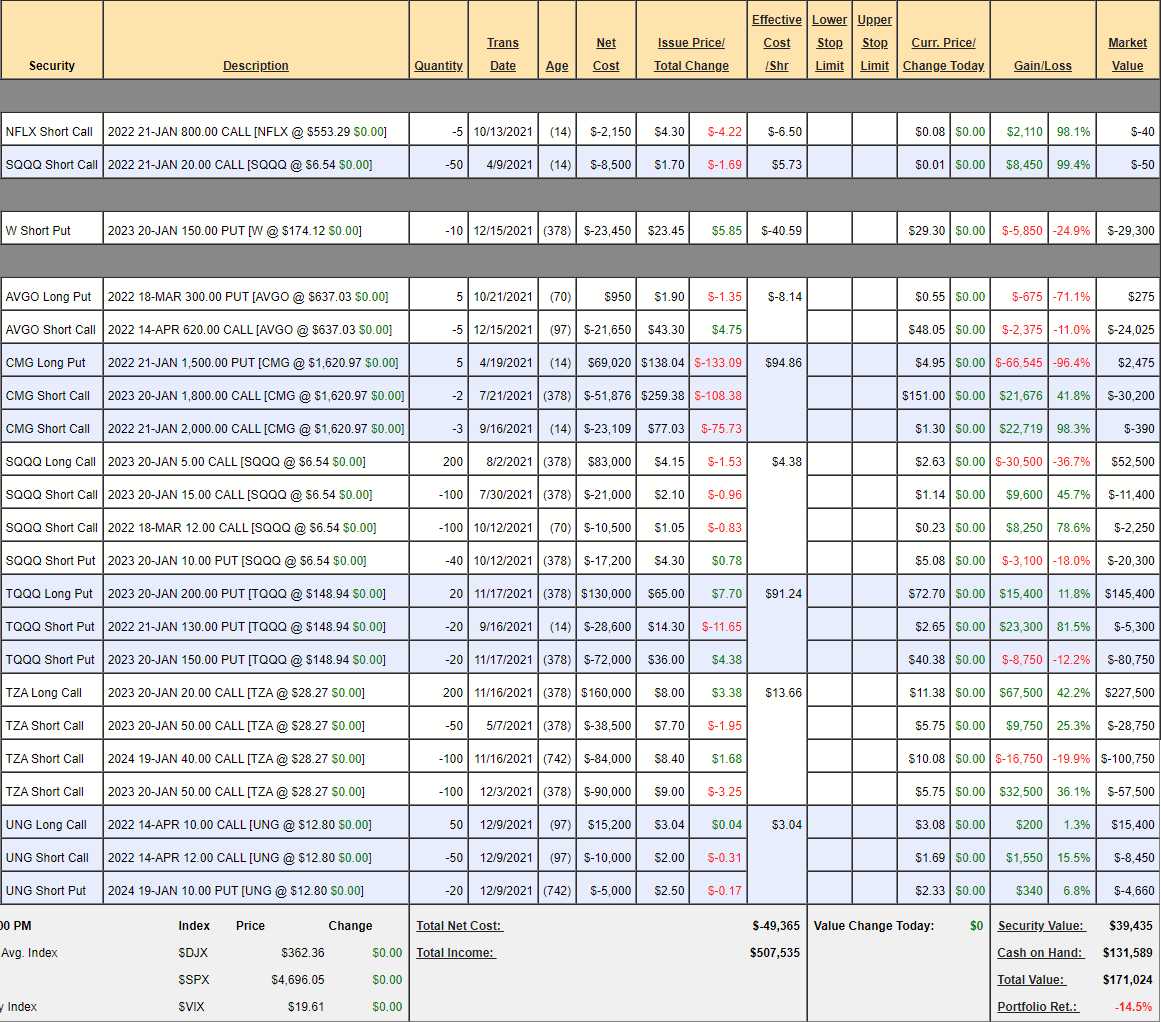

So that brings us back to our Short-Term Portfolio (STP) and, as we noted yesterday, it gained $55,485 in the slight dip since our December 14th review while our Long-Term Portfolio (LTP) has gained $100,000 so we're up $155,000(ish) in less than a month and we could just as easily lose it so the thing to do now is LOCK IT IN WITH HEDGES!

We already have $525,000 worth of hedges against a 20% drop in the market in our STP (see Dec 14th review) and, as a rule of thumb, we like to spend about 1/3 of our unrealized gains to hedge. Yesterday however, in our live Member Chat Room, we pulled $120,000 out of our AAPL position and moved it to a better-protected spread – so we don't have to be as aggressive in our adjustments.

- NFLX – Will expire worthless in 14 days.

- SQQQ – Will expire worthless in 14 days.

- W – It's a $150 short put and W is at $174 so I think we have a good chance of collecting that $29,300. This is a leftover hedge from a short position we have and we thought W was silly at $350 but $150 seems OK, so we don't see any reason to pull it.

- AVGO – Finally pulled back a bit. The long put was pure speculation and a total bust ($950 loss) but it's the short call we sold for $21,650 that we really care about and anything under $663 in April will be a profit. Looking a little safer now than it was at the beginning of the week.

This is the burden of being a Fundamental Investor. We decided AVGO is NOT worth more than $620 so, just because it went over $620, didn't mean we were going to back off our assertion. It's very hard to play with conviciton like this but we took the short on 12/15 (after being burned on our original) and pretty much caught the dead top – I hope.

- CMG – Wow, those $1,500 puts are not too far out of the money but only 14 days to go. They are leftover from a spread and we already cashed the rest so there's nothing to save here. The short calls are in good shape and we can only hope we get lucky and CMG falls another $200 this month.

- SQQQ – This is a 3x inverse ETF on the Nasdaq so, if the Nasdaq falls 20%, SQQQ should go up about 60% to $10.46 and we have 200 long $5 calls that would be worth about $109,200. The short March calls will almost certainly go worthless and we can put a stop on them at 0.50 ($5,000) which then allows us to be more aggressive and buy 100 2024 $5 calls for $3.15 ($31,500) and sell 100 June $10 calls for 0.85 ($8,500) so for net $23,000, we are buying $100,000 more of potential protection.

- The stop on the March $12s means we remove the cap on 100 of the longs, allowing us to benefit from a more than 20% drop in the index. Of course, if the index falls 10%, we simply add more hedges along the way.

- TQQQ – Already in the money is not a good sign for the Nasdaq! The short $130 puts we sold should expire worthless but TQQQ is also a 3X ETF so I'm not comfortable selling more short puts as a 60% drop in TQQQ would take them down to about $60. The $200/150 spread is at $65,000 out of a potential $100,000 so $45,000 more protection left if the Nas simply stays below the current level (and these 3x ETFs decay over time as well, which is why we like them as hedges). Notice we only paid net $29,400 for the spread.

- TZA – We bougtht back 50 of the 2023 $50 calls in the last review to get a bit more aggressive. At $28.27, a 60% bump in TZA would take us to $45.23. The 2023 $20 calls are now $227,000 and we'd love to cash that out so here we'll set up for that in the future by adding 200 of the 2024 $30 ($12.50)/$45 ($10) bull call spreads at $2.50 ($50,000). We don't NEED them, so try not to pay more than $3 at most. That gives us another $300,000 worth of protection and, more importantly, if we get a spike in TZA that we feel will reverse, we can easily take 1/2 (100) of the 2023 $20s off the table.

- Having done this (and spending more cash than we planned today), we'll be looking for any good reason to cash those 100 2023 $20s to put $100,000 back in the cash pile.

- UNG – I'm very pleased with that one. The STP also has side bets, usually based on news catalysts. We have a very nice gain for the first month (out of 4) after spending net $200 on the $10,000 spread. All UNG had to do was hold $12 into spring. Again, it's those annoying Fundamentals we like to play…

So we ended up spending $73,000 – about 1/2 of our unrealized gains for the month, but we added $400,000 of additional protection and we plan on getting at least $100,000 back from the old TZA longs. Now we are clearly over-hedged but that's great because it means we get to go shopping again, buying longs to balance out – just in time for earnings season.

Aren't hedges great?

"When you're down and out

When you're on the street

When evening falls so hard

I will comfort you

I'll take your part

Oh, when darkness comes

And pain is all around"Like a bridge over troubled water

I will lay me down" – Paul Simon

Have a great weekend,

– Phil