We are right back to where we were last week.

We are right back to where we were last week.

It's also the same place we were on December 21st, following our bounce lines at:

- Dow 36,000 to 34,200 has bounce lines of 34,560 (weak) and 34,920 (strong)

- S&P 4,700 to 4,465 has bounce lines of 4,512 (weak) and 4,559 (strong)

- Nasdaq 16,500 to 15,675 has bounce lines of 15,840 (weak) and 16,005 (strong)

- Russell 2,400 to 2,080 has bounce lines of 2,144 (weak) and 2,208 (strong)

Actually, the Nasdaq has improved from red to black as it's at 15,862, so too close to give it a color at the weak bounce line and we'll be watching the Nasdaq closely today as well as, of course, the 2,200 line on the Russell, which remains our best market indicator. Volume was back to low (74M on SPY) yesterday – so we're not putting a lot of faith in these levels after just one day. Yesterday Powell boosted the markets telling us he can beat inflation without harming the markets – he's MAGICAL!

Silly or not, that's what traders want to hear and a small number of them rushed in and bought up the indexes despite 1.3M Covid cases on Monday (30% more than the previous record) and despite the most inflation since the "Carter Disaster" of 1982 (a year after Reagan took office) and despeit the fact that our grocery stores now look like Russia in 1982:

Economists surveyed by The Wall Street Journal estimate the Labor Department’s consumer-price index—which measures what consumers pay for goods and services—rose 7.1% in December from the same month a year earlier, up from 6.8% in November. That would mark the fastest pace since 1982 and the third straight month in which inflation exceeded 6%. Powell said he was optimistic supply-chain issues would ease this year and help bring inflation down.

And, by the way, this record-high inflation is WITH Omicron knocking down prices for travel, recreation and other in-person services – our inflation would be A LOT higher if airfares and live-event tickets hadn't collapsed last month. Oil prices were also down in December (though back now) – helping keep the monthly total below a Brazil-like 10%.

Despite disruptions from Omicron, there are some indications of improvement in supply-chain woes. A December survey of manufacturers by the Institute for Supply Management showed a decline in prices and delivery times, signaling that materials shortages might be easing – that's the data Powell is hanging his hat on – but it's just the one data point so far.

We have CPI and Business Expectations this morning and the ever-dovish Neel Kashkari speaks at 1pm, along with a 10-year note auction that will be interesting and then, at 2pm, we'll get a look at the Fed's Beige Book and hopefully get some clues about how Q1 is looking but, as you can see, Q4 seems to have seen 6.7% GDP growth – albeit off a terrible Q4 in 2020.

We have CPI and Business Expectations this morning and the ever-dovish Neel Kashkari speaks at 1pm, along with a 10-year note auction that will be interesting and then, at 2pm, we'll get a look at the Fed's Beige Book and hopefully get some clues about how Q1 is looking but, as you can see, Q4 seems to have seen 6.7% GDP growth – albeit off a terrible Q4 in 2020.

Of course, if inflation is 7.1% and your GDP growth is 6.7% then your economy actually SHRANK 0.4% – you just paid more money for the same stuff you bought last year — sucker!

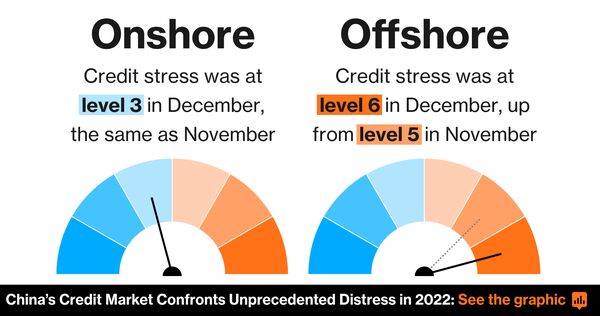

Despite the markets bouncing back, we are still very concerned about China and their property crisis going into the Chinese New Year (Feb 1st) and we doubt the Chinese Government will allow the economy to collapse ahead of the holiday week but after is anyone's guess so we're mostly watching and waiting at the moment – for a few more weeks. $197Bn in Chinese bonds were maturing in Janaury and companies like Evergrande and Guangzhou have only prevented default by pushing back their dates – nothing is being solved.

A selloff in Chinese high-yield dollar bonds, dominated by property notes, is set to continue for an eighth day. The notes fell 0.5 cents to 2 cents on the Dollar Wednesday morning, according to credit traders. Prohibitively high borrowing costs in the offshore market have effectively frozen many builders out of the offshore bond market, making it difficult to roll over that debt. This is the kind of disaster that leads to a Global Financial Crisis – usually…

A selloff in Chinese high-yield dollar bonds, dominated by property notes, is set to continue for an eighth day. The notes fell 0.5 cents to 2 cents on the Dollar Wednesday morning, according to credit traders. Prohibitively high borrowing costs in the offshore market have effectively frozen many builders out of the offshore bond market, making it difficult to roll over that debt. This is the kind of disaster that leads to a Global Financial Crisis – usually…

But these are not usual times so we hang onto our longs and hedge in case of disaster – which is always just around the corner but, so far, has not come.

As to Covid – I have nothing to say at this point. It gets worse every day and people seem to double down on ignoring it:

The Civil War was the "bloodiest battle" in American history and 504 people per day died fighting that one. Covid has already killed more Americans in two years than a war between the states with guns did in 4 years – though I bet, with the guns we have now, we can beat that record in the next civil war. The way things are going – we'll probably find out soon!