From this morning's PSW Report:

Moderna, MRNA, has fallen more than 50% below it's peak and yes, it's peak was silly, but $222/share is $90Bn in market cap for a company that will make $11.5Bn in profits this year. It's being sold off because people think it's a one-trick pony but the Covid vaccine was more of a proof of concept for their process and they now have $22Bn (2 year's profits) to play with in the R&D department:

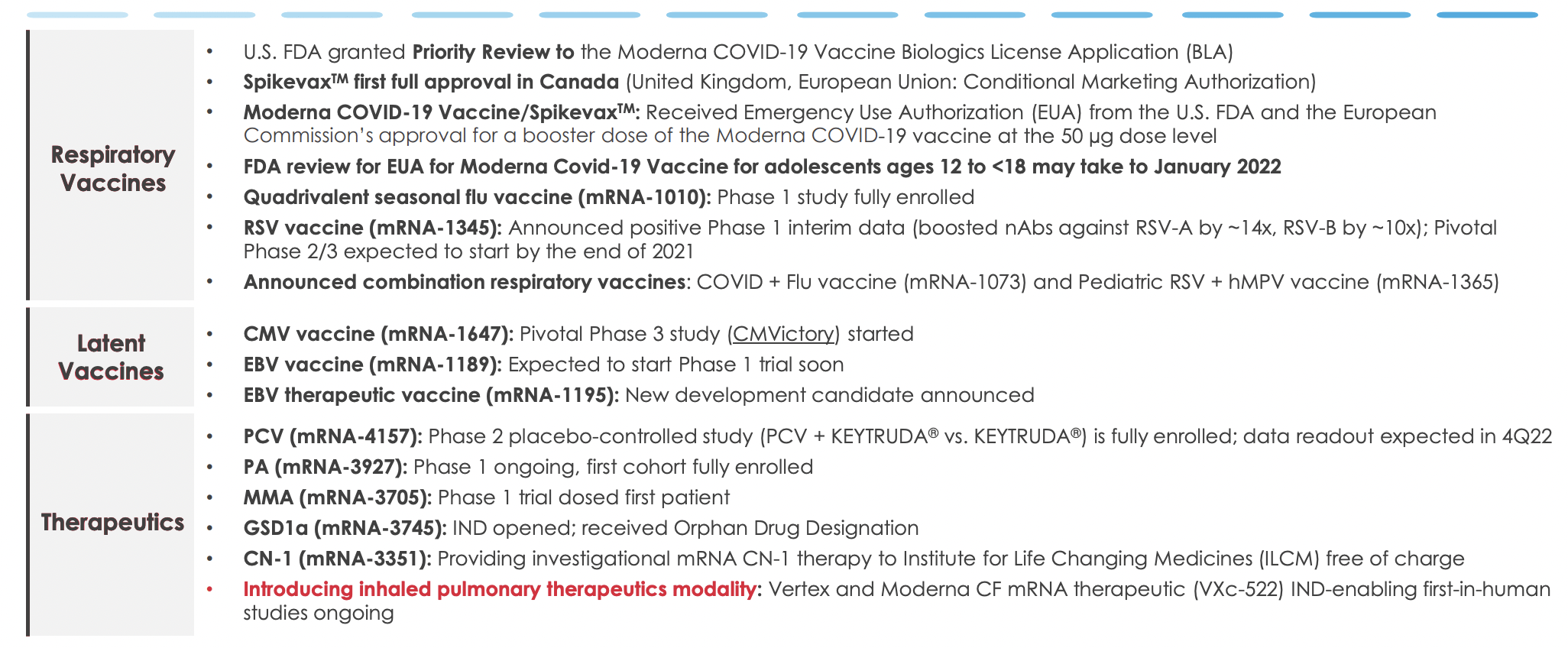

The thing about the mishandling of the pandemic is that we gave the virus a chance to spead so widely that it is now ENDEMIC, like the flu – and we're never going to be completely rid of it. That means MRNA will make money for many years to come on covid vaccines so, even if they are a one-trick pony, that trick may last a lifetime. Still, they have a robust pipeline – as noted in their recent report:

We have been waiting for MRNA to bottom out so we could get back in (we sold our old position near the top) and we discussed making a move in yesterday's Live Trading Webinar (replay available here). We sold 5 of the 2024 $200 puts for $25 and they are now $50 so we're down 100% on those but our net entry is $175 and MRNA is at $222 so it's only a loss on paper – we intend to stick it out. As a full trade for our Long-Term Portfolio (LTP), I would like to add:

- Sell 10 MRNA 2024 $180 puts for $40 ($40,000)

- Buy 20 MRNA 2024 $200 calls for $78 ($156,000)

- Sell 20 MRNA 2024 $250 calls for $59 ($118,000)

That's a net credit of $2,000 on the $100,000 spread. There's a heavy obligation there to buy 1,000 shares of MRNA at $180, or net $178 but that's a 20% discount to the current price.