"The percentage you're paying is too high priced

While you're living beyond all your means

And the man in the suit has just bought a new car

From the profit he's made on your dreams"

– Steve Winwood

Welcome back.

Possibly to reality, as it is now, officially, earnings season and there's no hiding from the truth of Q4 now that traders are back from even the most extended of vacations. The Fed have fired their happy talk guns and their first meeting of 2022 is next Wednesday so the Fed has to go quiet this week and they've already indicated no rate hike – so no upside catalyst from that corner and Biden can't pass a parking ticket – so no stimulus is coming either. That means the market has to impress us all by itself – yikes!

"If you had just a minute to breathe

And they granted you one final wish

Would you ask for something like another chance

Or something sim'lar as this"

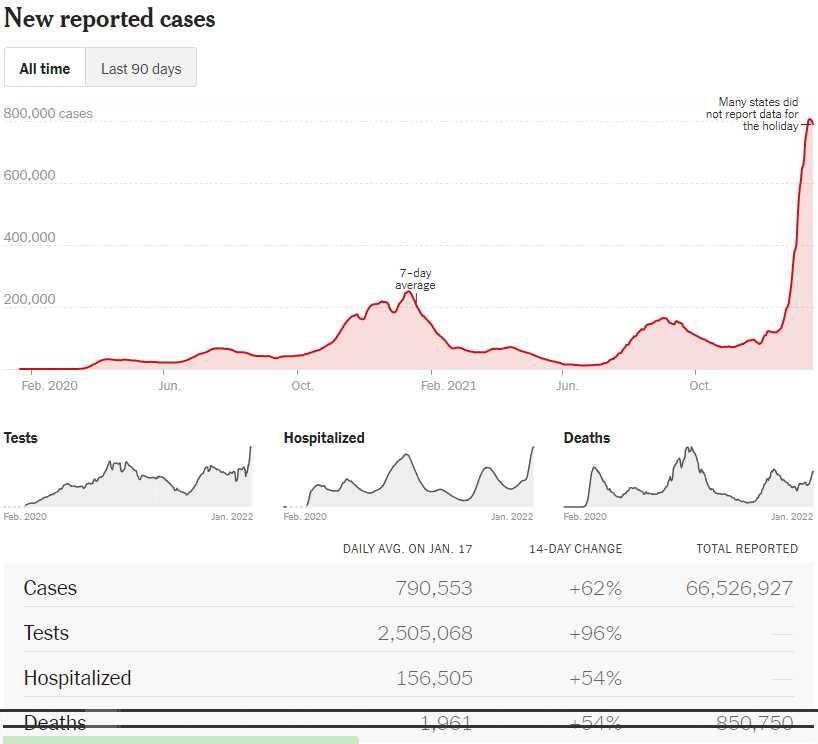

We're back to averaging 2,000 people a day who have just a minute to breathe in the US with 156,505 people per day newly hospitalized and 800,000 newly infected yet you would think this thing is over from the news in the MSM. I know things are bad because I live in Florida and I went to the grocery store and people were wearing their masks! I have NEVER seen so many people wearing masks as I have this week – I guess at this point pretty much everyone has multiple friends and family members with Covid – so the message is finally sinking in.

Notice the "slowdown" over the holiday is due to lack of reporting more so than an actual drop in cases. And, of course, with the milder form of Covid – most cases are now going unreported – just the more serious ones tend to clock in but 66.5 MILLION infections is, by far, a World Record – go USA!

Notice the "slowdown" over the holiday is due to lack of reporting more so than an actual drop in cases. And, of course, with the milder form of Covid – most cases are now going unreported – just the more serious ones tend to clock in but 66.5 MILLION infections is, by far, a World Record – go USA!

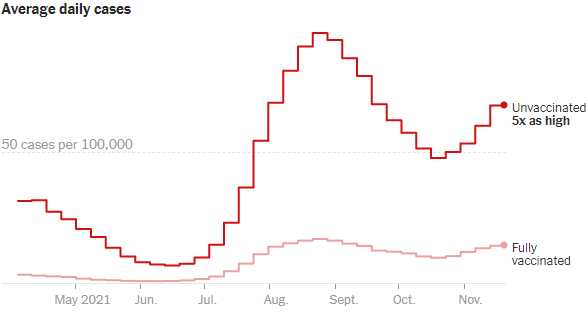

Also notice that more than 1% of the people infected have died so far and more than 1% of the people are dying now – so I'm not really sure what the definition of "mild" really is – and imagine how bad this would be if 63% of us weren't vaccinated. As you can see on this chart, unvaccinated (or Pro-Covid, as they are now known) people are infected at 5 TIMES the rate of vaccinated (or Rational) people.

Also notice that more than 1% of the people infected have died so far and more than 1% of the people are dying now – so I'm not really sure what the definition of "mild" really is – and imagine how bad this would be if 63% of us weren't vaccinated. As you can see on this chart, unvaccinated (or Pro-Covid, as they are now known) people are infected at 5 TIMES the rate of vaccinated (or Rational) people.

The Pro-Covid crowd are also known as Mutant Virus Incubators and we are never going to truly be rid of this thing as long as 1/3 of our population are willing to carry around and nurture the virus until it is able to mutate and infect the Rational/Vaccinated people again. Unfortunately, though Biden wants to strengthen mandates, he has no power and the voters blame him for not doing anything and he'll likely have even less power next year and this thing will go on and on. Sorry kids…

Speaking of voters, they are also going to be scarce in the future as Congress looks like it will fail to pass Biden's Freedom to Vote Act, which contains a slate of proposals to establish nationwide standards for ballot access, in an effort to counteract the wave of new restrictions in states. It would require states to allow a minimum of 15 consecutive days of early voting and that all voters are able to request to vote by mail; establish new automatic voter registration programs; and make Election Day a national holiday. Sorry kids…

Well, they always said Democracy was an experiment – and you know how Republicans feel about science.

At PSW, we do enjoy our facts and there's nothing more factual than actual earnings reports. Here's what were looking forward to in the weeks ahead:

And, for this week:

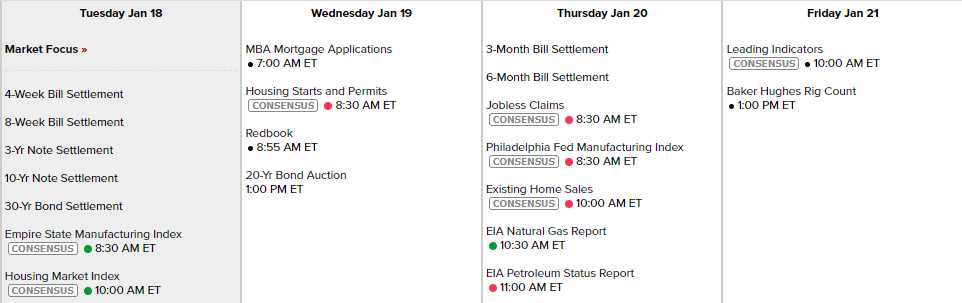

And very little on the Calendar to distract us and no Fed speak:

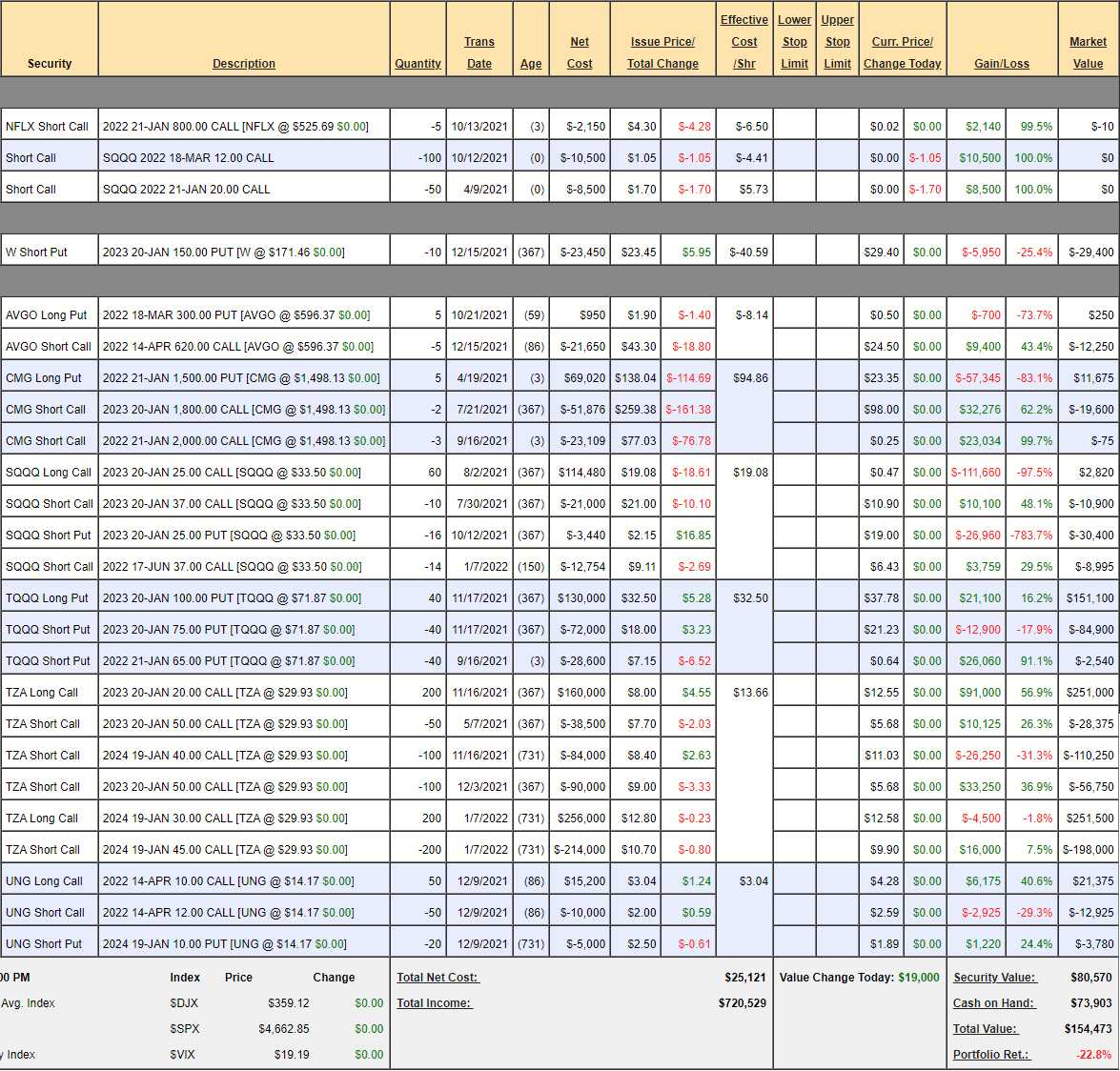

We're very well-hedged going into the action – our Short-Term Portfolio (STP), however, is a bit of a mess as SQQQ reverse-split and TQQQ split – so we are left with messy positions with silly prices at the moment (the long $25 SQQQ calls are showing less value than the short $37 calls, for example) but what really matters is how much protection we can expect should this downturn continue:

- NFLX – Will expire worthless on Friday.

- SQQQ – Will expire worthless on Friday (these are the old strikes, won't matter).

- W – Amazingly, we are rooting for them to go higher. I don't have much faith in these guys, we cashed in the successful short and the plan is to see how earnings go.

- AVGO – I really don't think they are worth more than $600 and our net is $663.30 to break even. Hopefully gain $12,250.

- CMG – Haha! Actually came below $1,500 but a long way to go if we're going to get all our put money back (was part of a cashed-in spread). Looks like our short calls are in good shape – hopefully make $19,600

- SQQQ – OK, new math now. We have just 60 of the 2023 $25 calls but they are at $33.50 and a 20% drop on a 3x ETF should give us $33.50 x 1.6 = $53.60 – so that's our target zone. We're about 1/2 covered at $37 but rollable so I think we can safely say $50 is fair at $16.50 x 6,000 = $93,000 and the current net is -$47,475 (due to wacky prices on the new options) so $140,475 of downside protection on this set. If it were actually possible, I'd add 140 more of the 2023 $25 calls for 0.47 but it's not. Good example of how you can't always trust your broker screen – scary though that may be!

- TQQQ – More new math but less messy with the 2:1 split. The short puts should expire worthless and we are on track for the full $100,000 and currently net $63,650 so $36,350 of downside protection.

- TZA – We set up the 200 2024 $30/45 bull call spreads so we could get the 200 2023 $20 calls off the table. They are fetching $13 this morning so let's cash them out for $260,000 and it's only $53,000 for another 200 of the 2024 $30/45 spreads to cover the $195,375 worth of short calls, so that's a worthwhile investment too. So now we have $400 of the $15 spreads so $600,000 worth of protection but the 2024 $40s are a problem so let's roll 50 (1/2) of the 2024 $40 calls at $11 ($55,000) to 50 of the April $40 calls at $2.75 ($13,750) and we'll sell 50 of the April $30 puts for $4.25 ($21,250) for balance. So we are pocketing net $187,000 and we still have $600,000 worth of downside protection, but it will be messy to collect so it won't be helping too much in the short-run or if the market drops fast.

- UNG – All it has to do is hold $12 and we collect $10,000 and it's net $4,670 now so good for a double from here still.

So that's $808,675 of downside protection and now we have over $250,000 in CASH!!!, which makes me very happy. If critical levels fail we will add hedges that pay off more immediately but I think what we have adequately covers our LTP, which has made some amazing gains in the last month so, to some extent – those gains are also a hedge.

We'll review the LTP in our Live Member Chat Room – see you inside!

– Phil