As I said on Thurdsday – we were halfway there.

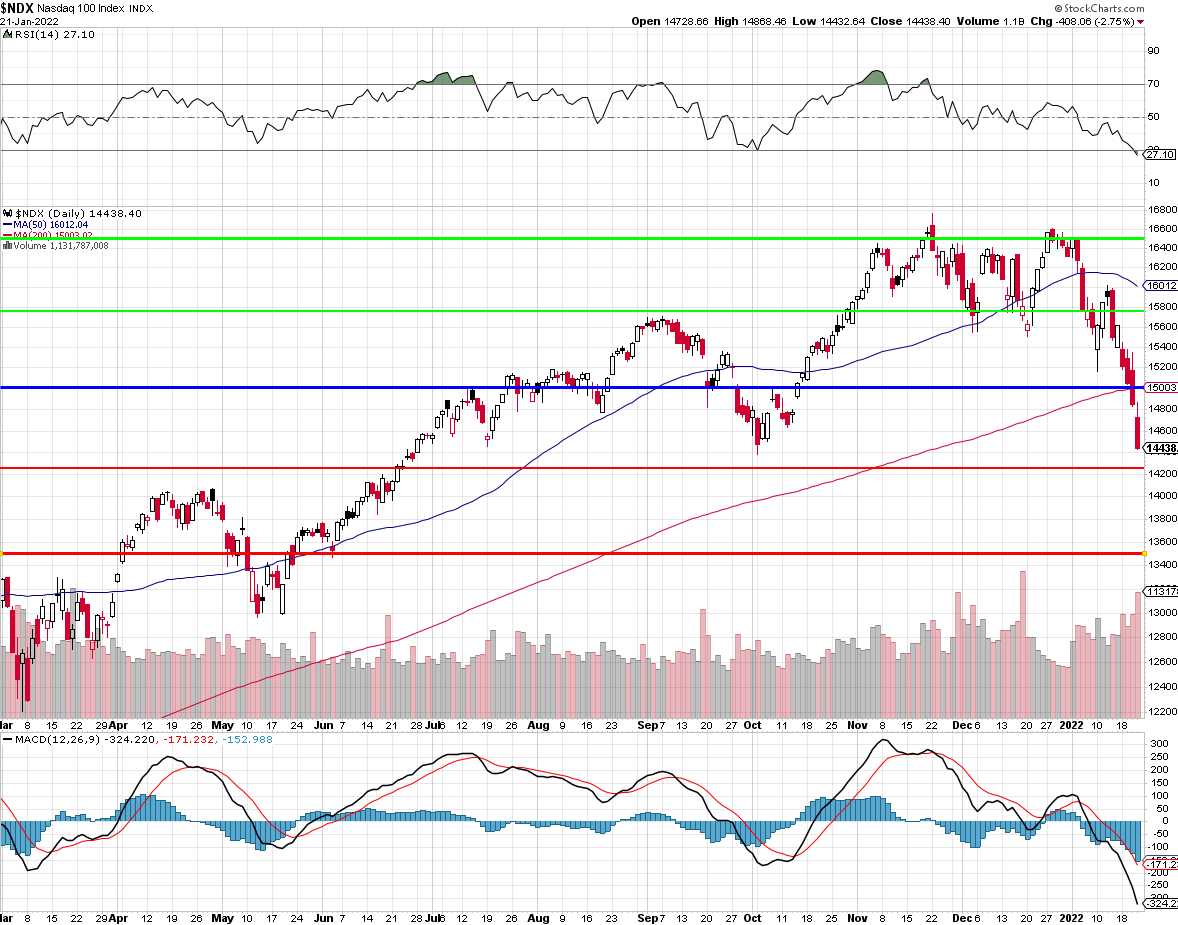

We were at 15,200 on the Nasdaq Thursday morning and our long-predicted correction target of 15,000 was a certainty but now we're "living on a prayer" that 600 points below 15,000 (14,400) is an overshoot of the rapid correction and not the first leg of the run to 13,500 – where we began Q2 of last year.

13,200 is actually the 20% correction from 16,500 but the key line for the Nasdaq is 15,000 and 16,500 was 10% up from there and 13,500 is 10% down – that's what the above chart is measuring, We will, on the whole, be LUCKY if the Nasdaq settles into a range around 15,000 but, in truth, it's likely we overshot the proper range by a mile and 13,500 may be the top of a proper range that centers around 12,000 – which would be a reasonable valuation for the index.

13,200 is actually the 20% correction from 16,500 but the key line for the Nasdaq is 15,000 and 16,500 was 10% up from there and 13,500 is 10% down – that's what the above chart is measuring, We will, on the whole, be LUCKY if the Nasdaq settles into a range around 15,000 but, in truth, it's likely we overshot the proper range by a mile and 13,500 may be the top of a proper range that centers around 12,000 – which would be a reasonable valuation for the index.

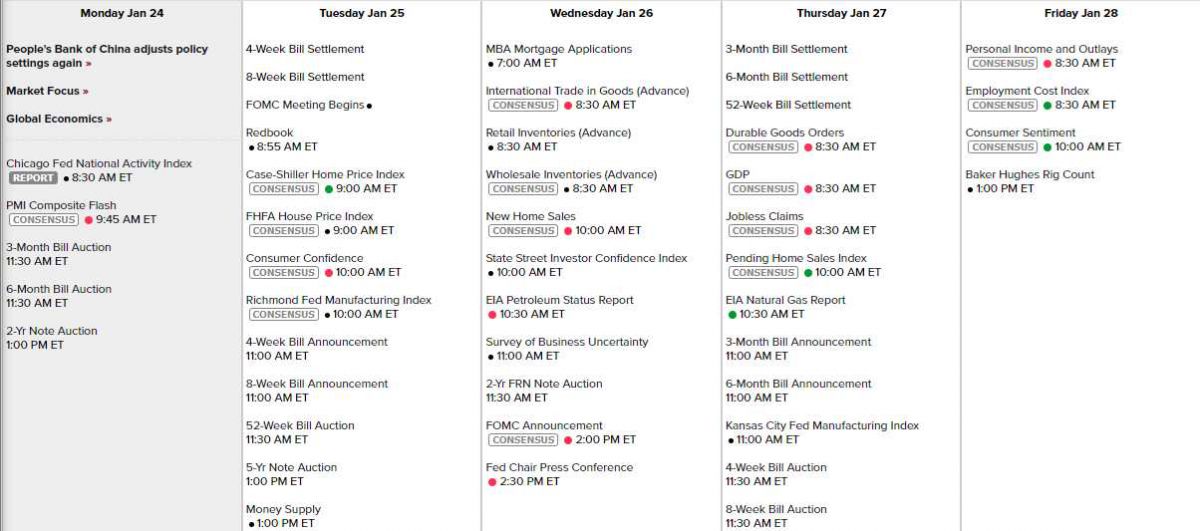

When you are in a slide like this, you need to consider what is going to change the sentiment and, this week, we have a Fed Meeting on Wednesday but what is the Fed going to say that will help? They have already said they were looking to tighten so reversing would be a sign of weakness and they already said not until March, so doing nothing won't help either. I imagine they'll say they will take market conditions into account along with Labor and Inflation and that might calm things down a little, but will it reverse the slide?

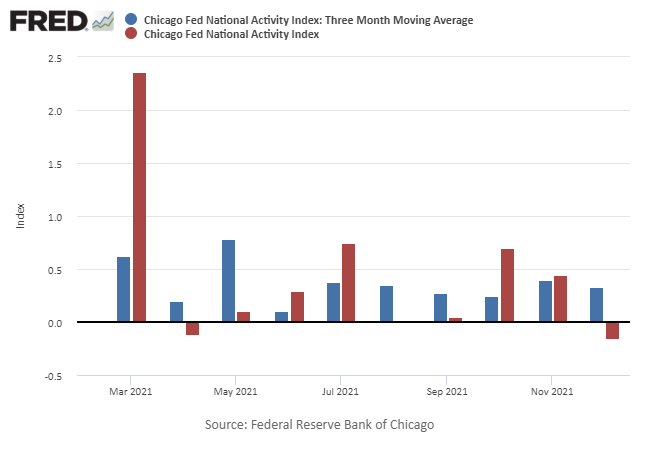

Clearly Congress and the President are not going to break their streak of doing nothing and that leaves us with Earnings Reports, which have not been helping and Economic News – which gets worse and worse as we begin to score the Omicron period. No, this does not look good at all and, as I said, if we get a swell of sellers hitting the market – there are clearly not enough buyers to support any price level until we do make AT LEAST a 20% correction.

|

For our indexes, that would be:

- Dow 36,000 to 28,800 would be a 7,200-point drop with 1,440 bounces to 30,240 (weak) and 31,680 (strong). 33,120 is the mid-point and we'll be seeing that this week, most likely.

- S&P 4,800 IS 20% above 4,000, which we HOPE holds up so we'll use that line and that makes it an 800-point drop with 160-point bounces so 4,160 (weak) and 4,320 (strong) is where we are this morning.

- Nasdaq, like the S&P is using 13,500 as the base but we're already down to 14,200 and 14,100 is the weak bounce and 14,700 is strong.

- Russell 2,000 is, of course, a significant support line and we're down from 2,400, which is 20% over so anything below 2,000 (like this morning) indicates a deeper dive, most likely to 1,600, which would be about an 800-point drop with 160-point bounces to 1,780 (weak) and 1,960 (strong) – which is where we are this morning.

I pay close attention to economic idiocy because these are the same people that Corporations and the Government rely on for their projections so, when they are off by miles (usually it's just one mile), then you can assume ALL of the forward projection that these individual indicators affect are going to be off too and that means big things like GDP forecasts and Corporate Earnings forecasts are going to be missing as well.

We'll get PMI this morning, the Richmond Fed, Case-Shiller and Consumer Confidence tomorrow, Investor Confidence, Business Uncertainty and New Home Sales ahead of the Fed on Wednesday, GDP and Durable Goods on Thursday and Consumer Sentiment with Personal Income and Outlays on Friday. On the whole, which of these reports is likely to change investors' minds about selling?

As to Earnings, Community Bank (CBU) and Philips (PHG) already missed this morning and this week will give us a lot to chew on:

Let's be careful out there…