Was it all just a dream?

Was it all just a dream?

How much of the rally of the past two years will be erased on this correction? The Dow has already fallen 3,000 points from it's height but it's not done. Strong earnings from AAPL will help it today but it can't hold up the whole, overpriced index now that the value police have woken from their long slumber.

It has literally been two years since valuations have mattered as 0% interest rates meant companies could borrow money for free to cover up mistakes and even to buy their own stock – if no one else wanted it. Decreasing share counts made equities rarer (and made earnings seem larger) so, like BitCoin, demand outpaced supply – especially with fresh money coming in from the side as everyone wanted to play the stock market. On top of that, there was stimulus money – TRILLIONS of Dollars in stimulus in a World where, the Economic Stimulus Act of 2008 (under Bush) was "just" $152Bn.

The amount of stimulus from our Government (and don't forget the Fed) over the past two years has been roughly $11Tn – $6Tn added to our National Debt and $5Tn added to the Fed's balance sheet. Our GDP is only $20Tn so 1/4 of our GDP over the past two years has been stimulus. Where are we going to be without it? And, at the same time as the stimulus is removed, the Fed is cutting back the money supply. They have to – they are now overcompensating for the overeasing they just did (maybe $11Tn was too much), which has now led to massive inflation.

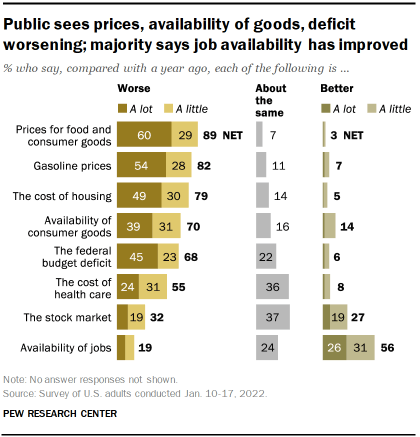

In fact, yesterday's very impressive-sounding GDP growth of 6.9% (over last year's crap numbers) isn't so impressive when you consider that 7% of that comes from inflation. This is not economic growth – this is price growth. Yes you are getting a bigger salary but good luck filling up a 20-gallon tank for less than $75 and, if we still went to movies, how about those $15 tickets and $10 for a popcorn and coke? Everyone is raising prices and rents are rising too – it's not a raise when all you are doing is keeping up with inflation.

In fact, yesterday's very impressive-sounding GDP growth of 6.9% (over last year's crap numbers) isn't so impressive when you consider that 7% of that comes from inflation. This is not economic growth – this is price growth. Yes you are getting a bigger salary but good luck filling up a 20-gallon tank for less than $75 and, if we still went to movies, how about those $15 tickets and $10 for a popcorn and coke? Everyone is raising prices and rents are rising too – it's not a raise when all you are doing is keeping up with inflation.

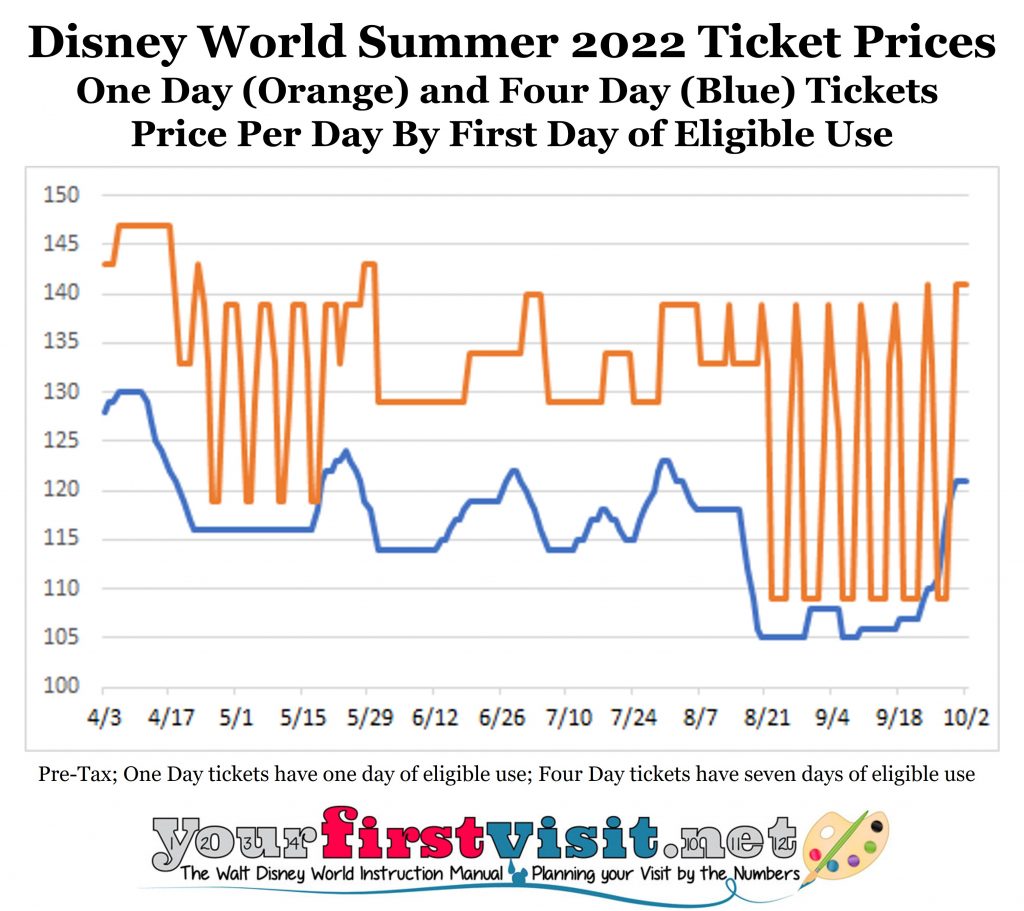

We were shocked last year when Disney (DIS is a Dow component) raised their highest ticket prices to $125 but this year's peak pricing is $147 – 17.6% higher than last year and the AVERAGE ticket price is now over $125 for a single day and around $115 for multi-day. At this rate – if you don't have children yet, in 10 years time a day ticket to Disney will be $743.69 so you'd better get started tonight on those kids or you'll be paying $1,000/day to walk them down Main Street!

We had inflation in the 70s, it was EXPECTED that you would get a 10% raise every year and that was not even keeping up with inflation so we also switched jobs a lot, looking for better pay – something that is happening now as well, but this is only the very early stages if the Fed can't put the inflation genie back in the bottle – something they have never done without tanking the economy.

We have gone through a fairly unique period of about 30 years in which there was relatively little inflation and good economic growth but that was ARTIFICIAL and our Government and the Fed have racked up over $30Tn in debts to paint that economic picture. Now it is time to pay the piper and it's very likely we are about where we were at the start of the last inflationary cycle. The Fed is trying to stop it early in the cycel but how much of this is really going to be under their control – short of raising interest rates to 15%, like Volker did?

Look at the components of the CPI and think about what the Fed can do about it? Food costs are up 8%, Housing up 15%, Clothing up 10%, Education is fairly flat at the moment, Medical Care had their usual 10% increase, Recreation doesn't exist for most of us, Transportation is going through the roof thanks to Oil Prices, etc… People NEED these things to live – they aren't optional – that's why they NEED raises and no, it's not making their lives better because it's too little, too late – that's why Consumer Confidence is dropping off.

Look at the components of the CPI and think about what the Fed can do about it? Food costs are up 8%, Housing up 15%, Clothing up 10%, Education is fairly flat at the moment, Medical Care had their usual 10% increase, Recreation doesn't exist for most of us, Transportation is going through the roof thanks to Oil Prices, etc… People NEED these things to live – they aren't optional – that's why they NEED raises and no, it's not making their lives better because it's too little, too late – that's why Consumer Confidence is dropping off.

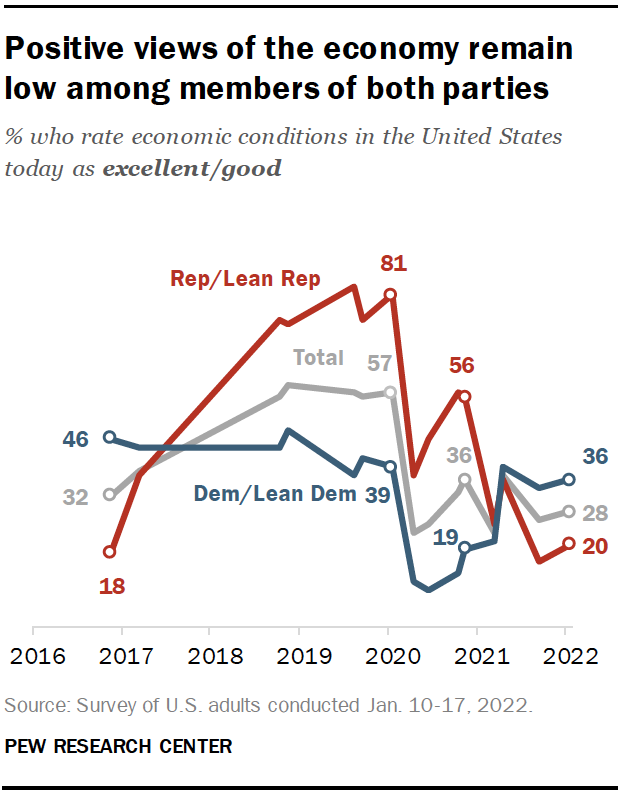

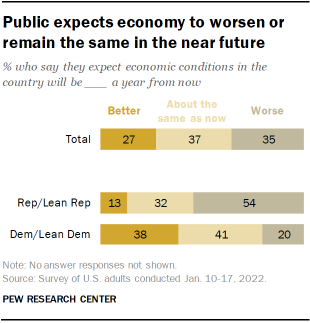

Only 28% of the people in the US rate the economy as being "good" or better and 10% of those people are in the Top 10% – generally clueless that 72% out of the remaining 90% are having a lousy economic time. That number was 23% when the markets crashed in April of 2020 so, 2 years and $11Tn later, we've made exactly 5% more people happy. Even of the 28% who think the economy is good – only 27% think it will get better in the near future, with 37% saysing "same" and 35% saying worse.

That means, even among the people who think things are already bad, there's a large amount of them who think it will get worse than that. Makes me think of something else that was popular in the 70s – punk rock – NO FUTURE!!! And they were right. In 1965 the Dow Jones was at 8,600, two years after Kennedy was shot but then we had a little correction and by 1977 (when punk was getting started), the Dow was around 4,500 and that was 50% off the lows of 1974.

That means, even among the people who think things are already bad, there's a large amount of them who think it will get worse than that. Makes me think of something else that was popular in the 70s – punk rock – NO FUTURE!!! And they were right. In 1965 the Dow Jones was at 8,600, two years after Kennedy was shot but then we had a little correction and by 1977 (when punk was getting started), the Dow was around 4,500 and that was 50% off the lows of 1974.

Punk was a protest by disenfranchised youth who couldn't find jobs to keep up with inflation – screaming at an Elitist Society who thought things were just fine. They also were not too thrilled with being sent off to war to be killed in Vietnam or wherever, but it was an effective way to keep them from causing trouble at home, wasn't it?

"All the power's in the hands

Of people rich enough to buy it

While we walk the street

Too chicken to even try itWhite people go to school

Where they teach you how to be thick

By 1982, inflation-fighting measures has pushed the Dow all the way down to 2,300 but then we were saved by the computer revolution – which was the most important thing that had happened to the human race since fire – and we entered a golden age of economic growth and prosperity – and overpopulation, and pollution and disease and debt – the same things that happen to all civilizations as they peak out….

This time, there are no barbarians at the gate – this time we are doing it to ourselves. Joe Biden is President yet we have gone another year without addressing the Climate Crisis or the Student Loan Crisis or the Affordable Housing Crisis or the Water Crisis or the Pandemic… the list goes on because this Government, no matter who is "in charge" is dysfunctional and we are just drifting along while our problems get worse and worse.

Finally the Fed has woken up and decided that 7% inflation, which is 250% above their mandated 2% level, might be a problem they need to address. God help us if they do!

So, just in case things hit the fan, let's set up a Dow hedge for our Short-Term Portfolio (STP). DIA is the Dow's ETF and it's at $341 with the Dow at 33,724 this morning and we think 33,000 is a good target so figure $310 on DIA. The hedge I like is:

- Buy 50 DIA Sept $350 puts for $27 ($135,000)

- Sell 50 DIA Sept $320 puts for $17 ($85,000)

- Sell 10 DIA Feb $330 puts for $5 ($5,000)

- Sell 20 LABU 2024 $15 puts for $7.50 ($15,000)

That's net $30,000 on the $150,000 spread. We're using LABU (Biotech ETF) as an offset because we don't mind owning 2,000 shares at $15 ($30,000) long-term but you can use short puts on any stock you REALLY want to own to help offset the spread costs. We have 7 months to sell before September so collecting $5,000 for a 20% cover close to our goal in February is fine and we can put a stop on them at $7,500 to make sure they don't do too much damage. If we make 6 more sales like that we'll collect $30,000 and have a no-cost spread so, if the Dow is up or flat, the protection is free and if it goes down, we pay $7,500 to buy back the short puts and our net goes to $37,500 and our upside potential is $112,500, which will pay for the LABU with plenty to play with left over.

Also nice is that this spread is currently $45,000 in the money to start!

That is how we like to hedge – many ways to win, even if the market recovers (which would be good for LABU).

"Pay attention to the cracked streets

And the broken homes

Some call it slums

Some call it nice

I want to take you through

A wasteland I like to call my home

Welcome to paradiseA gunshot rings out at the station

Another urchin snaps and

Left dead on his own

It makes me wonder why I'm still here

For some strange reason it's now

Feeling like my home

And I'm never gonna go" – Green Day

Have a great weekend,

– Phil