"I was gonna pay my car and note until the market got high

I wasn't gonna gamble on the boat but then the market got high

Now the tow truck is pullin' away and I know whyI messed up my entire life because the market got highI lost my kids and wife because the market

Got high

Now I'm sleepin' on the side walk and I know why'Cause the market got high

Because the market got high

Because the market got high" – Aftroman

January has, indeeed, been a manic month.

As noted above though – it's not the market corrections that kill your portfolio – if you had gone away in the crash of 1930 and kept your shares of GE, GM, XOM and X for the next 92 years – you'd be about as rich as Buffett's original investors are now. While not every company survived the Great Depression, there are always solid trends you can spot and picking large-cap Blue Chip stocks is a very good thing to do when the chips are down.

That's what I've been stressing to our Members this month and we've added VIAC, MRNA, CRSP and YETI to our Top Trade Ideas in January, taking full advantage of the market sell off. More importantly, we're not panicking out of our longs because we are ALWAYS prepared for a sell-off and, in this case, we were perfectly prepared into the end of 2021:

12/22 – Will We Hold It Wednesday – Russell 2,200 Edition (again)

After shooting up to it last Winter on a stimulus-fueled 50% run, the Russell kind of lost interest in going anywhere this year and, once again, it's looking to prove itself on one side or the other of the 2,200 line. Perhaps that's because despite the Russell having a forward (dreamland) p/e ratio of 30 at 2,200 – it has a trailing (reality) p/e ratio of 642 times earnings.

12/23 – Thursday Failure – UK hits new Record Number of Covid Cases – US Right Behind

Keeping the malls open through Christmas is very likely to cost us Q1 (again) as we have to shut down eventually to get this thing under control. It is critical to have hedges in place and, now that we're back to 4,700 on the S&P 500 – I'm tempted to take this opportunity to cash out our portfolios completely and not risk another market melt-down when traders are "surprised" that we are once again overwhelmed by Covid…

…What "THEY" have all decided to tell us, so far, is that Omicon is no big deal and, amazingly – despite clear scientific and stastistical evidence to the contrary – people are believing it – even though this same group of people just lied to us the exact same way about Covid 2 years ago (it's Covid (20)19, remember?).

So PLEASE, make sure you are well-hedged – just in case it turns out they are lying to us again.

8/27 – Still-Merry Monday – Markets and Covid Cases Remain at All-Time Highs

None of this seems to be bothering the stock market, even though it's clearly going to affect productivity, etc. for Q1. Holiday sales were up 8.5% over last year as consumers spent more money on clothes, jewelry and electronics, according to a report from Mastercard SpendingPulse. Of course, those of us who are actually shopping know that the 8.5% increase is not because we're buying more stuff but because the stuff we are buying is more expensive. There was a lot of sticker shop at those retail stores and a lot less sales than usual. People may be making a little more money in a tight labor market but it's not making it to the bank with so many rising expenses along the way.

12/28 – Tree Topping Tuesday – S&P 500 Tests 4,800 Up 6.66% for the Month!

"THEY" have taken full advantage of the low-volume, holiday markets to bring the S&P up to new highs at just under 4,800 and we have Dow 36,272, Nasdaq 16,654 and only the Russell, at 2,264 is not at the all-time high – which was 2,460 back in November – so we're 8% below that level still.

Does that mean we should bet the Russell to catch up and make all-time highs? Not necessarily. There's no way to know that these low-volume rallies can stick once the participants return and start selling so we're just in a "watch and wait" sort of mode at the moment – we did all our bargain-hunting during the dip – now we are reaping the rewards on our bullish bets.

12/29 – Weakening Wednesday – 543,415 New Covid Cases Hard to Ignore

For perspective, the entire World shut down in the Spring of 2020, when we peaked out at just over 30,000 cases per day in the US – that is 1/18th as many cases as we had on Monday alone. Does it make sense to you that the "messaging" you are getting from the Government and the Corporate Media is now to just grin and bear is as the virus spreads completely out of control. As we suspected would happen on Monday, already the Government is "solving" the problem by officially telling people they only need 5 days of isolation instead of 10 days – because they want everyone to get back to work.

Can the markets keep ignoring this surge in cases? Certainly not if we're talking 1M cases per day next week. Even if Omicron were as mild as the flu – having 7M people per week get sick would be damaging to the economy. At the moment, "THEY" keep pointing out that hospitalizations and deaths are not maching the record highs – but that's because those are LAGGING indicators that FOLLOW the infections. Yes, that's very obvious but, unfortunately, you have to actually say these things out loud to cut through the BS that's pumped out by the Corporate Media.

I think I'm going to get a bit more hedged into the weekend, while the shorts are cheap.

As I mentioned above, I'm going to use 4,780 as the shorting line for the S&P Futures (/ES) and I think 2 to start there and 1 more at 4,790 and 1 more at 4,800 if it goes any higher and that would make a nice hold over the weekend with an average of 4,787.5 on 4 shorts.

I'm not going to go through everyting we said but you get the idea. We were fully expecting a major correction and we nailed the top of the S&P 500 and the Nasdaq with great short plays but, whether you are hedged or not, you still need to have the right stocks to ride through a dip and recovery but what you also need is a realistic outlook on what can be expected down the road because – the fall doesn't kill you – it's when you are forced to stop at the end…

As an example, look at AT&T (T) – They joined the Dow in 1939 and they are still there and the all-time high was $60 and currently they are trading at $25.13. Generally the stock has ranged between $20 and $40 this century so this is likely the low end of the range at $180Bn in market cap for a company that drops $22Bn a year to the bottom line, so trading at about 8x earrnings. T also pays a $2.04 dividend while you wait so, very simply, you can:

- Buy 2,500 shares of T for $25.13 ($62,825)

- Sell 25 T 2024 $27 calls for $2.50 ($6,250)

- Sell 15 T 2024 $20 puts for $2.25 ($3,375)

That's net $53,200 and, if called away at $27, you will get back $67,500 for a $14,300 (26.8%) return over two years but you will also collect $10,200 in dividends and that's another 19.2% so $24,500 back on $53,200 over 2 years is 46% over two years just making a nice, conservative play on T.

On the downside, if T is below $20, you would be forced to buy 1,500 more shares at $20 ($30,000) and then you'd be in 4,000 shares for net (assuming they still pay the dividend) $73,000 or $18.25/share. That's a 27% discount to the current price as your worst case (unless they cut the dividend and cost you $2.55/share). So, unless something catastrophic happens to T, you are dropping your cost basis by 27-46% over the next two years.

If we repeat that cycle 2 more times, your cost basis would be near zero (all the money back in your portfolio) by 2028 yet you'd still have at least 2,500 shares and even if they are down at $20, they would be worth $50,000 and still paying you $5,000/year in dividends. On top of all that, we can augment the income by selling, for example, 5 April $25 calls for $1.30 ($1,650). That uses 73 days of the 718 days we have to sell and, if we repeat that everry couple of months, we'd be collecting $16,500 (31%) against our $53,200 – that can cut the date we get all our cash back to 2026 – just 4 years!

Getting all our cash back is effectively doubling our money every 4 years. Even if we started with just $73,000 now (the amount we need if assigned) and had $27,000 on the sideline in a $100,000 portfolio, in 2026 we'd have $150,000 (simplifying) in cash and $50,000 in stock and then we buy another block of stock for $50,000 and we still have T so in 2030, we have $250,000 in cash and $100,000 in stock and then we buy another $100,000 block of stock and, in 2034 we have $450,000 in cash and $200,000 in stock and, by 2038 (16 years), we have over $1 MILLION DOLLARS. Is that too boring for you?

If you have $1M to play with now, using $200,000 of it to invest in a nice, "boring" play like this will help make sure that you have $2M in 16 years, no matter how stupidly you play your other $800,000. You have to make room for sensible investments in your portfolio – and these market dips are the ideal time to set them up as the premiums are high – which favors this strategy.

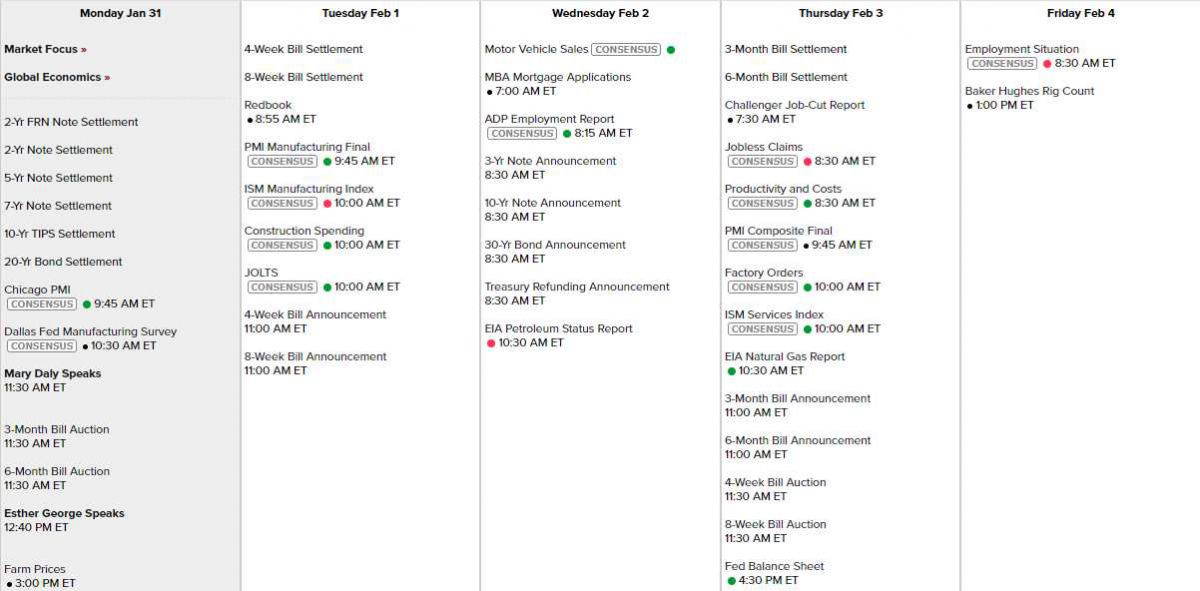

The indexes are down a bit this morning but Mondays are silly so we're going to ignore them. What matters at the end of this week is what kid of bounces we make and we'll take a look at that tomorrow. For now, we have a week with very little Fed speak so earnings and data will matter more. Non-Farm Payrolls are the star of the week on Friday but we have PMI and ISM while we wait:

And, of course, lots of earnings reports:

That 2nd chart is very cool.

If things stay positive, we'll keep shopping. We put up a Watch List of stocks we'd like to buy if they got cheaper on Dec 30th and, as I noted last week, our short puts are also a Watch LIst that we use to remind us of stocks we'd like to buy on sale. Out of 10 stocks, ALK, BA, DIS and GNRC are lower now than they were then, so those are the stocks we'll be taking a close look at today to see who we should be adding to our Long-Term Portfolio (LTP) and DIS, like T, is a stock we can expect to be around for many, many years.

Be casreful out there.