Not so fast!

Not so fast!

While recent gains have been impressive, they have come on the back of a more than 1% pullback in the Dollar and, since stocks are priced in Dollars and earnings are priced in Dollars, that tends to give us a 2:1 move in the indexes so about 2.5% of the last two day's gains have come on the back of the value of EVERYTHING else you own and ALL OF YOUR SAVINGS being diminished by 1.25%.

This is what "THEY" do to manipulate the markets during a sell-off, they push the Dollar higher on any excuse so they can then dunk it to prop up the markets at will. After the Fed failure last week, we desperately needed a boost to avoid a 20% correction so here it is – now we'll see if they can hold the old bounce lines (circa Dec 3rd):

- Dow 36,000 to 34,200 has bounce lines of 34,560 (weak) and 34,920 (strong)

- S&P 4,700 to 4,465 has bounce lines of 4,512 (weak) and 4,559 (strong)

- Nasdaq 16,500 to 15,675 has bounce lines of 15,840 (weak) and 16,005 (strong)

- Russell 2,400 to 2,080 has bounce lines of 2,144 (weak) and 2,208 (strong)

As you can see, the Nasdaq and the Russell are lagging at the moment and the Dow is the most likely to go green on the strong bounce lines but let's watch the S&P's weak bounce line at 4,512 for a clue as to which way things will go. Clearing this bounce zone puts us back to bullish but we do not want to see ANY red in the new bounce zone – as that is the path to a 20% correction!

- Dow 36,000 to 28,800 would be a 7,200-point drop with 1,440 bounces to 30,240 (weak) and 31,680 (strong). We were below our predicted 33,120 mid-point at yesterday's lows.

- S&P 4,800 is 20% above 4,000 and that makes it an 800-point drop with 160-point bounces so 4,160 (weak) and 4,320 (strong) is where we are this morning (again).

- Nasdaq is using 13,500 as the base and we bottomed yesterday at 13,706. 14,100 is the weak bounce and 14,700 is strong.

- Russell 1,600, would be about an 800-point drop with 160-point bounces to 1,780 (weak) and 1,960 (strong).

That's the nice thing about the bounce charts – they take the guesswork out of whether or not the market is really getting stronger. As we expected yesterday morning, we got a buy signal as the Nasdaq crossed 14,700 again but it doesn't actually count until we have 2 full sessions without going back under so today and tomorrow are key as 15,840 (weak bounce on the small correction) is not likely to happen this week.

That's the nice thing about the bounce charts – they take the guesswork out of whether or not the market is really getting stronger. As we expected yesterday morning, we got a buy signal as the Nasdaq crossed 14,700 again but it doesn't actually count until we have 2 full sessions without going back under so today and tomorrow are key as 15,840 (weak bounce on the small correction) is not likely to happen this week.

Along with the Dollar's weakness (and causing it) we had some less hawkish Fed speak yesterday from Mary Daly and Esther George, who both felt that the Fed could go slowly and inflation will magically vanish on it's own. Daly has always been a huge dove and never wants to raise rates but the market loves it when she talks. Especially when it's from both sides of her mouth at the same time:

Citing the Fed’s December forecasts, Daly noted that four increases this year — if that is what transpired — would lift rates to 1.25% and “that is quite a bit of tightening, but it is also quite a bit of accommodation.”

How can you go wrong when you make everyone happy at the same time while actually saying nothing? Daly may be angling to be the next Greenspan with that kind of double-speak. Meanwhile, the Fed is still sitting on an $8.9Tn balance sheet because BS'ing about doing something doesn't change the facts – just the perception. How the Fed unwinds $8.9Tn of Mortgages and Treasury Notes will drastically affect us going forward and they haven't done a thing so far to give us a clue.

Our Government is still borrowing $250Bn/month and, if the Fed is no longer buying it, who will? That's a very big question that remains to be answered and the real bond traders don't need to see what the Fed does to do the math and already they have unwound over half of the Bond gains of the past 3 years.

Our Government is still borrowing $250Bn/month and, if the Fed is no longer buying it, who will? That's a very big question that remains to be answered and the real bond traders don't need to see what the Fed does to do the math and already they have unwound over half of the Bond gains of the past 3 years.

That means people who bought bounds at the top in 2020 (getting the lowst interest) have lost 13.3% of their value since. Yes, you still have your $10,000 bond and you still get $100 (1%) annual interest but, if you try to redeem it now, you will only get $8,670 – that's how that works. Any lower than 155 on the 30-year and we put 2.5 years worth of bond purchases ($7Tn) underwater and what will that do for demand for the current $3Tn the Government needs to sell this year?

It will drive the rates higher as bond investors will need more assurance they will keep up with inflation (big miss so far), so of course the Fed has to pretend there's no inflation and pretend their unwinding of $6Tn in Bonds won't be a big deal and their lack of participation in future auctions won't further increase rates, which will put bonds even deeper under water and it becomes a circular disaster that feeds on itself unitl – GREECE!

Greece fell apart because they couldn't print their own money – we certainly don't have that problem but money-printing also causes inflation, which also causes bond rates to rise so, while we may not end up with 30% bond rates and having to sell off the Washington Monument and the Post Office to pay our bills, any bump in rates can be a serious issue when you owe $32Tn in a $20Tn economy that's running a $3Tn annual deficit – don't you think?

Greece fell apart because they couldn't print their own money – we certainly don't have that problem but money-printing also causes inflation, which also causes bond rates to rise so, while we may not end up with 30% bond rates and having to sell off the Washington Monument and the Post Office to pay our bills, any bump in rates can be a serious issue when you owe $32Tn in a $20Tn economy that's running a $3Tn annual deficit – don't you think?

Meanwhile, we discussed a trade example for AT&T yesterday and they are cheaper today as they are cutting the dividend 45% to $1.11 (which we expected) but, as a bonus, you are getting 0.24 shares of the new Warner Media (WBD) stock for each share of T you own and they too will pay a dividend – so it works out. Aside from saving T $8Bn in annual dividend payouts that they can use to reduce the debts they accumulated building the 5G network, they will also get $43Bn in cash from the spin-off, which is 23% of the company's total value. This makes T a better deal, not worse.

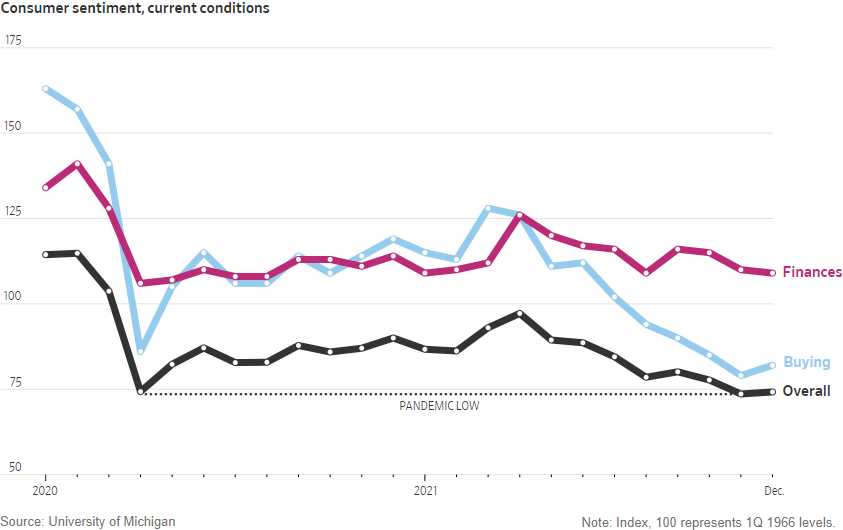

We will obey the signals in the market as it's been prone to ignore facts and data for the past couple of years so why start now but my main concern is that the withdrawal of stimulus from the Fed and the Government at the same time is going to overwhelm the Consumers and that forecasts are not taking this into account. Here's the recent Consumer Sentiment poll:

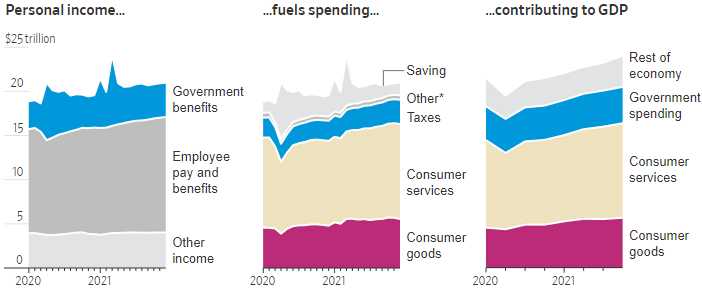

After spending $11Tn, we are no better off than we were when the markets first crashed during the first wave of Covid. While Personal Income has contributed to a recovery in GDP, that too was fuled by stimulus spending, which kept many businesses open during Covid and put Trillions of Dollars directly into people's pockets – the largest stimulus in the history of the World – and now it's over.

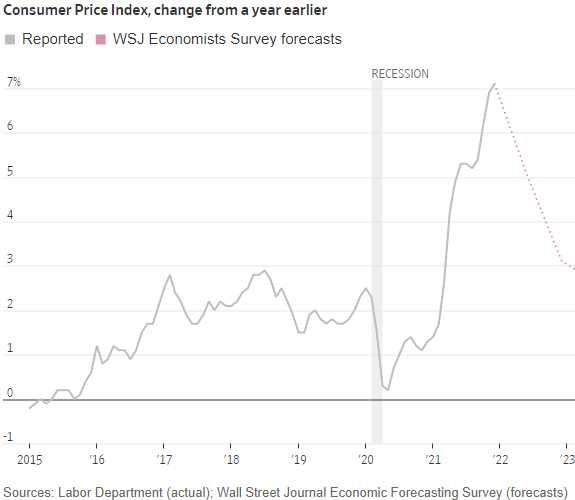

That's why Friday's Non-Farm Payroll Report is going to be important. It's possible we lost jobs in December as the virus hit us in the middle of the month and a strong (over 200,000) showing is what we need to go along with the markets and push back to the highs. If nothing else, the market needs to keep up with inflation – which is not slowing down so far but which leading Economorons believe is going to disappear by the end of the year.

That's why Friday's Non-Farm Payroll Report is going to be important. It's possible we lost jobs in December as the virus hit us in the middle of the month and a strong (over 200,000) showing is what we need to go along with the markets and push back to the highs. If nothing else, the market needs to keep up with inflation – which is not slowing down so far but which leading Economorons believe is going to disappear by the end of the year.

It would be funny but people actually use these projections to plan businesses and Government spending and they've been completely wrong for two years now yet STILL people listen to these forecasters – it's horrifying…

Most Economorons are still forecasting 5-6% GDP growth for 2022 and that is certainly not going to happen. We'll be lucky to hold 3.5% without stimulus and, don't forget, we're still trying to recover from a drop so NONE of these number are impressive – at all.

We NEEDED a correction to get market prices back in line with reality. Bouncing back is not healthy for anyone except the people who are trying to selll their stocks in a low-market enviroment and all you have to do is watch CNBC for an hour and you'll hear their pitch to the retail consumers – BTFD!