This is certainly not going well:

|

As I've been saying, it's more likely we're consolidating for a move down than a move up but we're still hanging on by a thread as only the Nasdaq is red on our lower bounce chart – so far.

- Dow 36,000 to 28,800 would be a 7,200-point drop with 1,440 bounces to 30,240 (weak) and 31,680 (strong).

- S&P 4,800 is 20% above 4,000 and that makes it an 800-point drop with 160-point bounces so 4,160 (weak) and 4,320 (strong)

- Nasdaq is using 13,500 as the base. 14,100 is the weak bounce and 14,700 is strong.

- Russell 1,600, would be about an 800-point drop with 160-point bounces to 1,780 (weak) and 1,960 (strong).

We touched 14,100 this morning but bounced back quickly but the catalyst that's driving us lower is rising tensions in the Ukraine as the U.S. and its allies are withdrawing diplomatic staff from Kyiv in a sign Western capitals see diplomatic options narrowing. Companies are also taking precautions. Dutch airline KLM has stopped flying in Ukrainian airspace. Shares of Air France KLM, the Paris-listed holding company, dropped 5%.

Russia is the World's largest exporter of Natural Gas (/NG) and, fortunately, that was our war hedge over the weekend and we got a huge 0.15 bump in /NG this morning, allowing us to cash out with a huge profit (/NG contracts pay $100 per penny move). If Moscow were to attack and the U.S. and its allies responded with sanctions, the hostilities could affect the world economy and markets in unpredictable ways – so it's a very tricky week for the markets but all this is trading on rumor – so we can't take it too seriously and we need to get profits off the table.

Russia is the World's largest exporter of Natural Gas (/NG) and, fortunately, that was our war hedge over the weekend and we got a huge 0.15 bump in /NG this morning, allowing us to cash out with a huge profit (/NG contracts pay $100 per penny move). If Moscow were to attack and the U.S. and its allies responded with sanctions, the hostilities could affect the world economy and markets in unpredictable ways – so it's a very tricky week for the markets but all this is trading on rumor – so we can't take it too seriously and we need to get profits off the table.

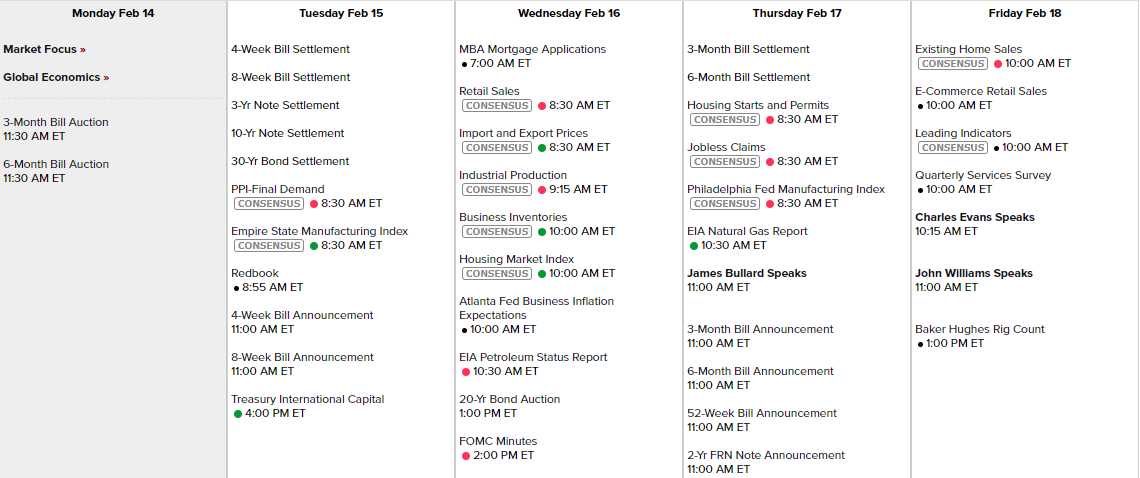

We have two Fed speakers scheduled right after Learing Economic Indicators are announced on Friday and that adds weight to our theory that that is going to be a bad number and Evans and Williams will be on spin patrol. Monday is a market holiday and they do not want to go into a 3-day weekend on a down note. The rest of the week is light on data, so the spotlight will remain on Earnings – mostly smaller-caps at this point:

There's a few stocks here we're already watching or playing like GNRC, VIAC, MAR, GOLD, CSCO, YETI and WYNN – so it will be an interesting week for us, in any case. Congratulations to the Rams for winning the Super Bowl but our bet was on SOFI – who had their name on the stadium and got hundreds of mentions and my trade idea for our Members was:

February 10th, 2022 at 3:47 pm | (Unlocked) | Permalink

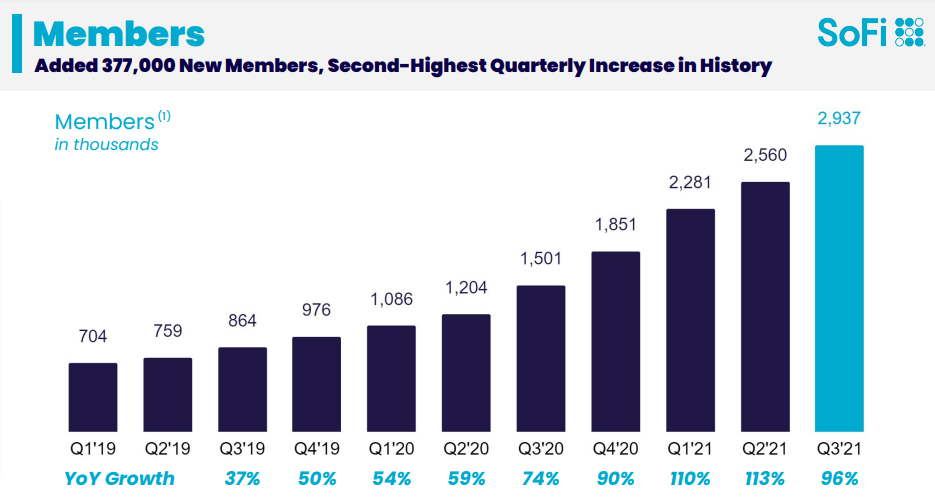

Speaking of the sidelines. SOFI stupidly bought the name rights to a stadium ($30M/yr for 20 years) but who's laughing now as the Super Bowl is there and their name will be mentioned several hundred times during the Super Bowl. SOFI got the bank charter that wanted and they are pre-profit but not pre-revenue, as they punched up to $1Bn last year and project $1.5Bn in 2022 (losing $250M).

They are back near their IPO price and that makes them interesting enough to add them to our Future is Now Portfolio by selling 30 of the SOFI 2024 $10 puts for $3.20 ($9,600) as that adds to our cash position and we only risk owning $21,000 worth of SOFI at a 30% discount to their IPO – even after the risk of not getting a bank charter is behind them.

It's tempting to be more aggressive as they could get a squeeze higher on Monday (name recognition) but there's about 1Bn shares so it's not like there's a shortage. March $15 calls are 0.67 and they are a fun play and I'd take half off the table if they double and then see how high the free shares take you and, if you put a stop on them at 0.40, you risk losing 0.27 so say 40 contracts at $2,680 risks losing $1,080 but, if they pop, then you have no cost basis on 20 contracts and hitting $1 would make you $2,000 in profit. That's a fun Super Bowl bet!

We'll see how much of a pop they get this morning. The Rams may have won the game but they failed to beat the 4-point spread, which is a nice consolation for Bengals fans and the basis behind our options system, which sells Premium (spreads) to people who think they know which way the market is going to go (options buyers). Like any good bookie – we don't really care which way things go – we're going to win half our bets every time and, ofetn enough, even when people make a winning bet – they don't win by enough to cover the spread. That's where we clean up!

Happy Valentine's Day,

– Phil