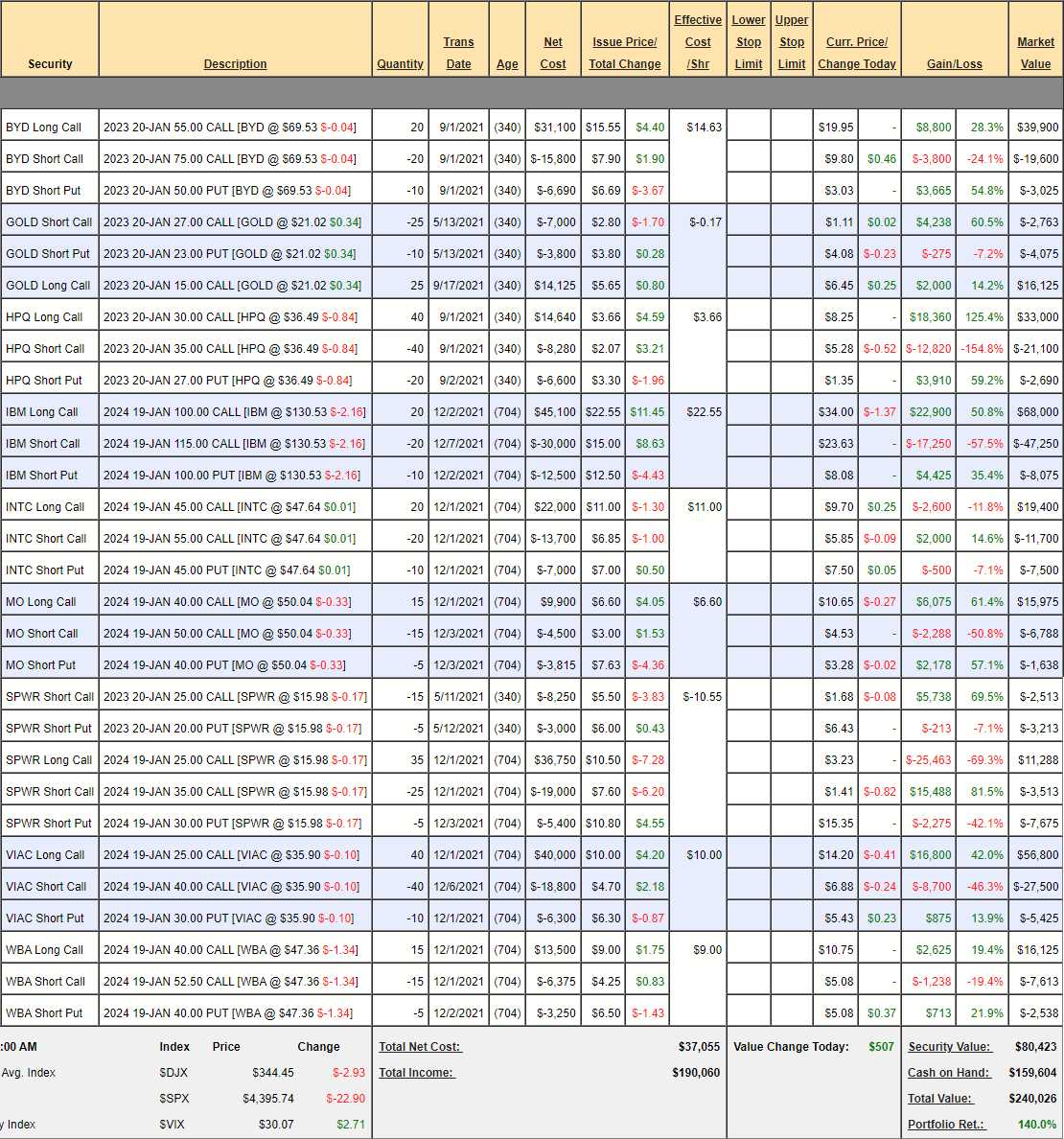

Speaking of doing nothing AND taking things off the table, the Money Talk Portfolio is back to 140% after being down to 120% on the 25th. Of course we're unable to make adjustment between shows but I'm on tomorrow so let's make this our first portfolio review of the week:

- BYD - Pretty new and well on track. Our premise on this one (sports betting) was solid and seems to be playing out and we're at $17,275 out of a potential $40,000 so we still have $22,725 (131%) left to gain. Certainly no reason to get out of that! Good for a new trade, in fact...

GOLD - We rolled our longs lower in September and now we are reaping the rewards. Net $9,287 out of a potential $30,000 leaves us with $20,713 (223%) upside potential and it's a great inflation hedge (and Gold is having a great day today).

- HPQ - Already in the money at net $9,210 out of a possible $20,000 so $10,790 (117%) left to gain if we hold $35. The puts are way out of the money, so no worries there and the spread is tight ($5), so we're not likely to take a big hit in a downturn and we'd be very happy to roll our long 2023 $30s ($8.25) to the 2024 $25s ($13) if HPQ goes lower so no reason not to ride this one out.

- IBM - We were very conservative with this spread so already in the money at net $12,675 out of a potential $30,000 if IBM can hold $115. So we fully expect to make $17,325 (136%) more and, if not, happy to re-invest.

- INTC - Sold off a bit and we're back to where we started at net $200 and that's no surprise with the chip shortage, etc.