$2,722,442!

$2,722,442!

That is up $203,740 since our January 19th review of our paired Long and Short-Term Portfolios.and that was up $309,256 from December so we are rocking AND rolling during all this messy volatility and we're up $2,122,442 from our $600,000 ($500,000 for the LTP, $100,000 for the STP) start back in October of 2019.

Our paired portfolio strategy is fairly simple, we buy long positions in the LTP and we buy hedges in the STP but THEN we look to hedge each portfolio internally – so we are always looking for ways to sell premium against our existing positions – which forces us to be balnaced – which make us the most money in a flat, choppy market (high premiums and we make money on both ends) – which is exactly the sweet spot we've moved into since early Novermber:

It's not that we can't make money in an up market – we ground out $1.6M worth of gains in the first two years but, in the last two months, we were able to make over $500,000 – though it's certainly not a pace that we're likely to keep up. Whenever we are making more money than we're supposed to – we have to be concerned that we're heading into a period where we'll make less money than we expect to and, BEFORE that happens, we need to be sure the battle will be worth the fight – or the risk!

However, we have a wonderful balance between the LTP and the STP and we just did our LTP Review in yesterday's Live Member Chat Room along with the Money Talk Portfolio Review yesterday morning and our STP Review was Tuesday, where we determined with have $726,610 of downside protection against a 20% pullback in the market. The trick to being balanced is that we make about as much as we lose on the way down (anything better than covering half our losses is acceptable) while, on the way up, we expect our hedging losses to eat up about 1/3 of our gains. It's very hard to get that balance right but we've spent 2 years on it and now it's working like a charm.

If we are balanced properly, the rest is simply a matter of taking about 1/3 of our gains and putting them into more hedges on the way up and, when the market dips, we put more money into the positions we are most confident will rebound – like we did with Sunpower (SPWR) yesterday during my live appearance on Bloomberg's Money Talk (recording not yet available). As we essentially discussed in yesterday morning's PSW Report (which you can subscribe to here):

MONEYTALK PORTFOLIO ADJUSTMENT: SPWR-NASQ

§ Buy back 25 SPWR short 2024 $35 calls at $2.09 ($5,225)

§ Buy back 15 SPWR short 2023 $25 calls at $2.11 ($3,165)

§ Roll 35 SPWR 2024 $25 calls at $3.65 ($12,775)

to 35 SPWR 2024 $15 calls at $6.75 ($23,625)

SPWR had earnings last night and they had record-high revenues of $384M but posted a 0.07/share loss ($7.6M) vs flat expected though, for the year, they are projecting to make $1 per $16.50 share – so I really don't know what the big deal is. Still it's down this morning and that's great because it will be easy to get good prices for our adjustments. This is a long-term play on the overall trend of solar energy – we don't really care about quarterly results so we simply buy more on the dips.

And, by the way, that's what they expect to earn AFTER taking $20M off the table in potential earnings from the sale of their commercial division to TTE – a deal which is putting $350M in their pockets. That is quite a lot of forward working capital for a company that only makes $100M/yr. That probably makes this a great time to be long on SPWR and our system essentially forces us to make the proper play and add to it when it's down.

Now, we'll take a look at our other Member Portfolios and see how they are faring:

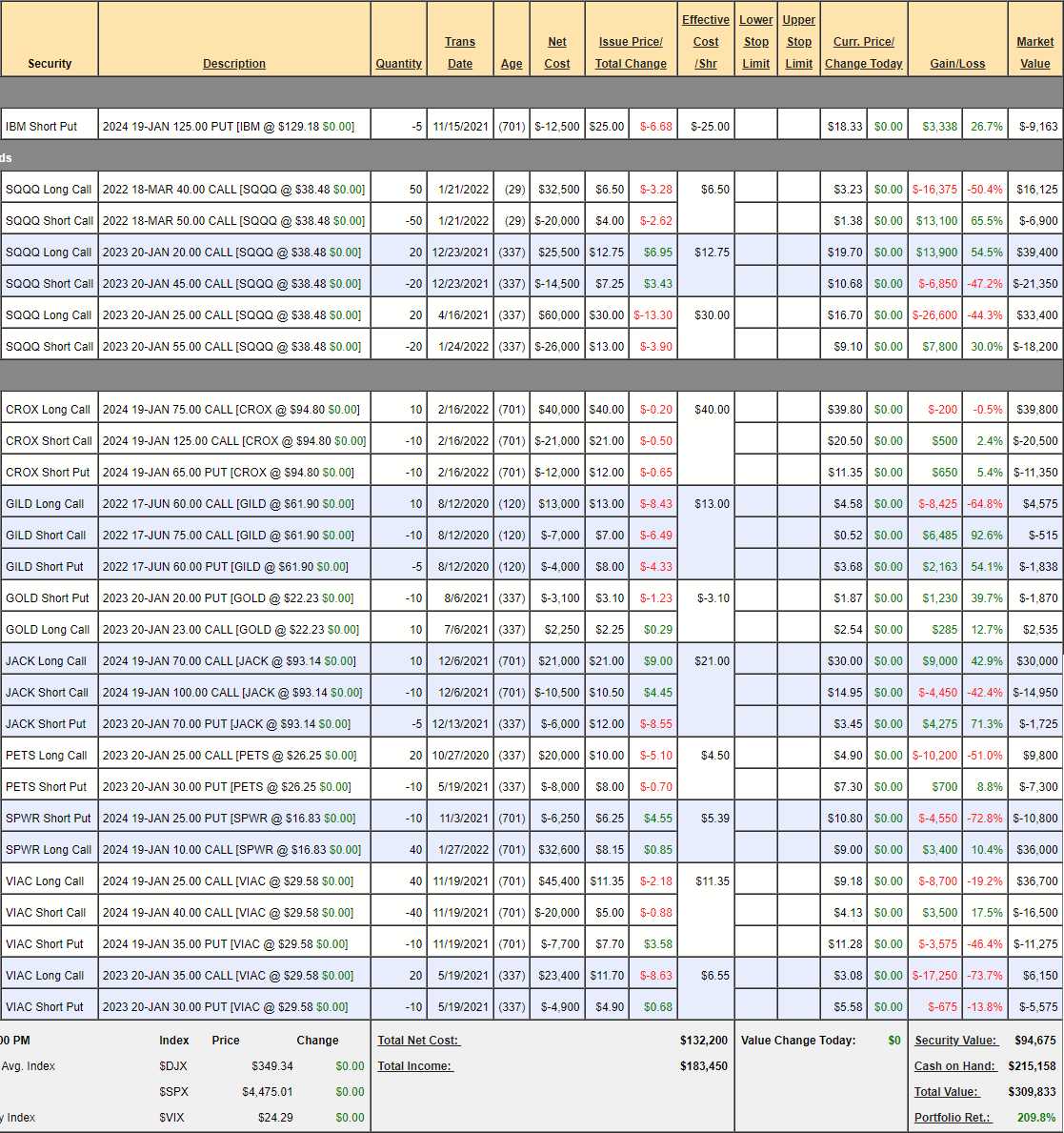

Earnings Portfolio Review: If earnings season isn't a good time for an Earnings Portfolio Review – I don't know when is? I am proud to say that we have made essentially no progress since our January 21st review, when we were at $308,733 and now we're at $309,833 so up $1,100 in a choppy market is fine by me in our self-hedging portfolio. We did a detailed review last month and we had $138,826 in upside potential and that hasn't changed and yesterday we added a brand-new net $7,950 trade on CROX, which has an upside potential of $42,050 (528%) that's still there for the picking this morning – so don't say I never gave you a present!

That means our upside potential is now about $180,000 and that's worth playing for and, if we're well-balanced – then it's just a matter of time before that short premium expires and we collect our winnings. That's the beauty of our Be the House strategy – we don't care if the market is up or down or sideways – as long as it's not up too much or down too much – we will do very well.

The strategy for the Earnings Porfolio is that we pick up companies that were unfairly trashed on their earnings reports. We take the opportunity to initiate trades at what we feel are steep discounts and then we simply wait for normalcy to return. It's a very low-touch portfolio and we made no changes in last month's review but we did adjust our hedges later on in our Live Member Chat Room and, of course, added CROX yesterday.

- IBM – Short puts are a great way to initiate a trade as we are PAID money (in this case $12,500) in exchange for our promise to buy shares (500) at a certain price ($125). Since we collected $25 per share, our net entry on IBM would be $100 per share and, during the November sell-off – we were very confident that $100 would hold – even though the chart was terrifying. As one of the last Fundamental Investors left on the planet – I work, very hard to break people of their chart-watching habits….

SQQQ – These hedges are insurance and, if your longs are doing well, your insurance will NOT pay off. Our older SQQQ spread, the $25/55 spread from April, has lost net $19,600 – though I'm sure we sold some other calls along the way to offset it. We bulked that up into Christmas with the $20/45 spread, which is doing well as the timing was good and, in January, we felt we needed more protection and added a big $40/50 hedge through March – just in case things went really badly.

- I am now going to teach you the greatest trick in hedging and it's called the Salvage Play – and it's featured in detail in our Strategy Section so here we're just going to do it. On the Jan (2023) $25/55 spread, we invested net $17 in the hedge and now the 2023 $25 calls are down to $16.70, though this morning the Nasdaq is down and we should get $17. By rolling that call, we are taking the $17 off the table and we can establish another spread that will cover the short $55 calls while buying us more protection so, we're going to roll the 20 2023 $25 calls at $17 ($34,000) to 80 of the 2024 $40 ($18)/60 ($14) bull call spreads at $4 ($32,000) so we're taking $2,000 off the table and now we have a $160,000 spread that's at the money covering the 20 (1/4) short Jan $55 calls, which have $9.10 ($18,200) of pure premium.

We have SALVAGED our original investment and INSURED our postiions for another 12 months while taking the small(ish) risk that the $55 calls will go in the money but not before our net $24,000 spread is $100,000 in the money at $55. You can't do that with term insurance, can you?

- The same goes for the March $40/50 bull call spread, which we won't need if 14,100 holds on the Nasdaq so we'll happily close it take the $3,275 loss there and be happy things were not worse for our longs. Keep in mind it's not really a loss as having the hedges allowed us to keep the longs in play and ride out the dip. Without the hedges, we would have capitulated on the longs and lost a lot more than $3,275!

So we now have the $160,000 2024 $40/60 spread that's currently net $32,000 so we have $128,000 of downside protection there along with the 2023 $20/45 spread that is mostly in the money and is a $50,000 spread at net $18,050 so another $31,950 of downside protection if the Nasdaq even twitches lower. That ($159,950) seems like plenty of protection to me – enough so that we can look to deploy some of our $215,158 in CASH!!! and add a bit more upside to our $180,000 projection.

- CROX – Even cheaper today than it was yesterday and I love this spread!

- GILD – They took a huge dive recently – almost back to where we started and I love them too but now we don't know if June is enough time so, again, we SALVAGE our investment by rolling the 10 June $60 calls at $4.58 ($4,575) to 30 of the 2024 $60 ($7.50)/75 ($3.15) bull call spreads at net $4.35 ($12,450) and we'll pay for some of that by selling 5 of the 2024 $60 puts for $9 ($4,500) so we are spending net $7,950 and now we have a $45,000 spread that is 1/3 covered by our original short puts and that spread was net $2,000 so we're now in for $9,950 overall with $35,050 (352%) upside potential.

- GOLD – We're aggressively long and it's taking off again but far too early to cover.

- JACK – On track.

- PETS – Also aggressively long and painfully so. Since we are way ahead overall I don't mind spending $9,800 more to double down on our Jan $25 calls and we will cover them at around $35 if all goes well. They made 0.21 in the last earnings (1/24), missing by 0.08 and the stock is up since so I believe the sellers have exhausted themselves at this point. They also pay a nice $1.20 dividend as the company generates plenty of cash.

- SPWR – Another one I love! We are already aggressively long so we'll just let it ride.

- VIAC – They just took a dive back to $30 but there's really nothing to change on the 2-year spread. The Jan $35s at $6,150 are what's left after we bought the short calls back but I think we have long enough to recover. At this point, if I had $19.25Bn, I'd buy the whole company!

So there you go – it's a rag-tag, beaten down bunch of positions that need time to heal and most of them have 2 years to make what is now well over $200,000 and we are still about 2/3 in CASH!!! – ready for the next opportunity that comes out way.

Next we will look to raise a bit more cash selling some short puts and then we'll look for a couple of more spreads as I think our hedges have us covered.

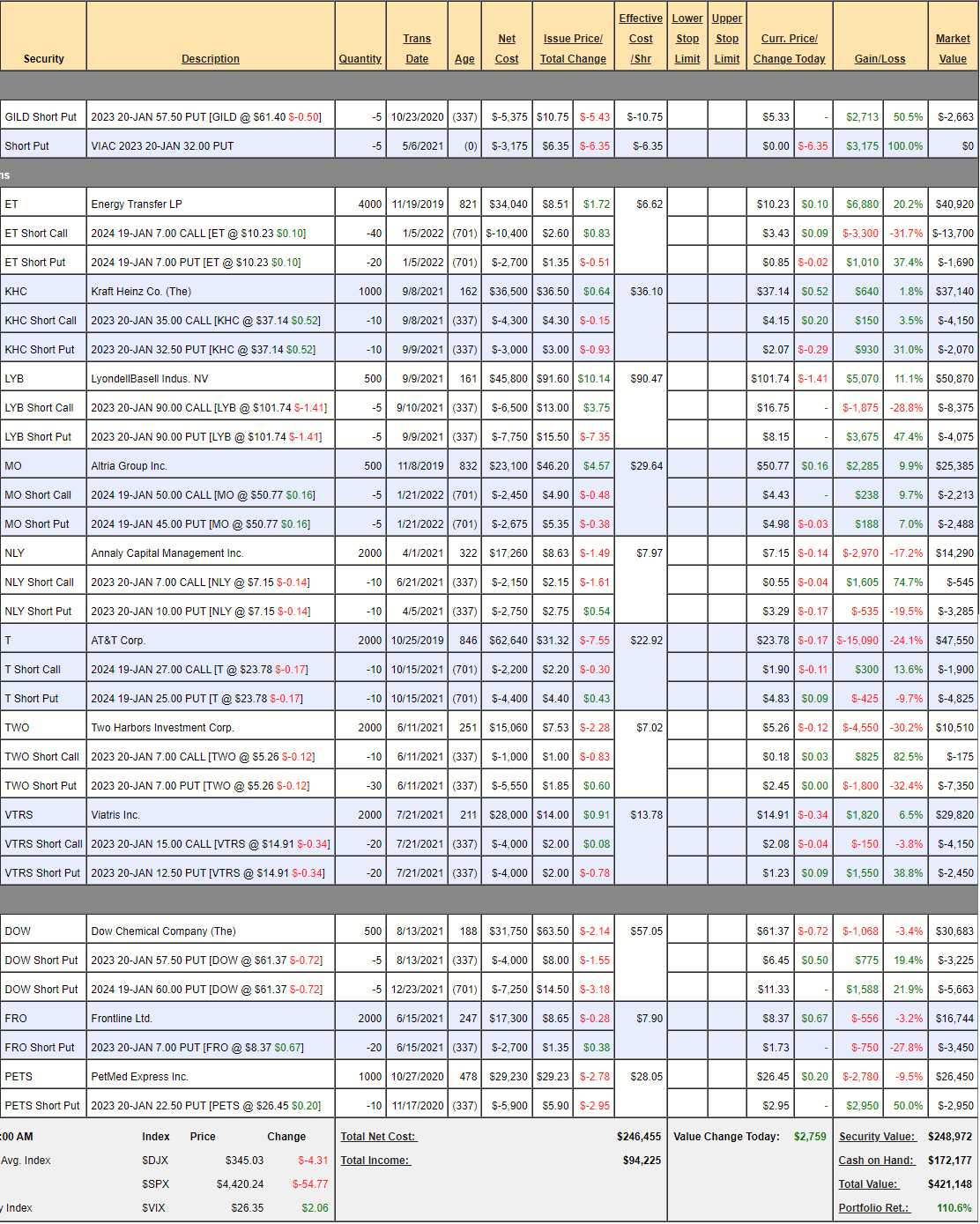

Dividend Portfolio Review: We only made one change in the last review on Jan 21st, when the portfolio was at $411,146 and that was just re-selling the expiring MO short puts and calls – very automatic. This is a very low-touch portfolio and this morning we're at $421,148 – up $10,002 for the month, which is all we ever plan on as this is a portfolio that's aimed to make about 20-30% annually, mainly by collecting dividends.

When we first started back on October 25th, 2019, we made the mistake of over-extending early on and the March crash hit us hard and the portfolio was down almost 50% so we transferred $100,000 from the STP (which is what the hedges are for, of course) to the Dividend Portfolio (which was originally $100,000) and we pretty much doubled down on everything at the bottom. That is why we are up 110% after two years and not the planned 50% but, going forward – we're not at all planning to repeat that performance so $10,000 a month is right on track for us.

Even that is too much as we're supposed to be making 30% of $200,000, not $400,000. We are almost half cash now and we can deploy a bit more capital – I just wanted to ride out the correction (still in progress) before making the same mistake we did in 2019.

- GILD – Up 50% already and not worried about them, depsite the recent dip.

- VIAC – This symbol is broken at the moment as they are changing it to something relating to Paramount, either PARA or PARAA, apparently. Either way, our net entry is $25.65, so we're not at all worried.

- ET – We expect to be called away at $28,000 but, for now, we're well-protected and collecting dividends.

- KHC – Just had great earnings and we're in the money already.

- LYB – On track.

- MO – On track.

- NLY – Back at our $7 target, happy to be assigned more shares at net $7.25 so nothing to worry about. We came in in April at $8.63 and we aggressively sold the $10 puts because we wanted to have some nice gains if they did pop but the net $7.25 entry was no problem against the fairly small amount we started with. NLY pays an 0.88 dividend (12%) and we are always happy to buy more when it's on sale. Let's take this opportunity to buy back the short $7 calls – as they are already up 75% with a year to go.

- T – The only reason we don't have more is because they are doing a stock split and it will be messy but I'd be thrilled to own 2,000 more shares at these prices.

- TWO – Another big-paying REIT and we already sold a lot of puts. REITs are simply out of favor as people are afraid of rising rates but that's why we only pick REITs with great management teams who know how to navigate shifting Fed policy. There's no point to the short $7 calls so let's buy them back and see if we get a pop for a better sale.

- VTRS – Right on track.

- DOW – Over our target already. Pays a nice $2.80 dividend against our net $41 entry.

- FRO – Finally taking off again. I couldn't understand why people were not backing the tanker companies as they are fully booked and in shortages. That's why we bought back the short calls and got aggressive. Very happy about that now.

PETS – Another one we got aggressive on but still waiting for them to pop. .

That was easy! It's a very simple portfolio and the maintennance moves are pretty much automatic – just taking advantage of the dips to be a bit more bullish but no major changes overall. And, of course, we're in it for the dividends – profits on the underlying stocks are a nice bonus but the real point of this portfolio is to pay back what we put in every 6-8 years and then we double it and, if on schedule, it's $200,000 in 2020 and $400,000 in 2028 and $800,000 in 2036 and $1.6M in 2044 and $3.2M in 2052 at which point, the dividends alone should be over $200,000 per year (our starting investment) and THAT is how you set up a retirement plan!

IN PROGRESS