It's always something.

It's always something.

This week, "only" 113,964 people a day are catching Covid (2,306/day are still dying) and that's only a bit more than 1% of the population per month – so we should be (relatively) celebrating BUT NOOOOOOOO – now it's the Ukraine and the kind of "Will they or won't they?" thing that keeps TV viewers coming back for more every week.

Putin already invaded Ukraine – in February of 2014, so this is the 8th anniversary of Putin's annexation of Crimea and in 2018, he built a bridge connecting it to Russia – so it's not like we thought he was going anywhere. Now Putin wants the rest, especially Kiev, which used to be the capital of Russia. More importantly, Putin has to pay Ukraine for land access for his oil and gas pipelines and THAT is the real reason all this is going on.

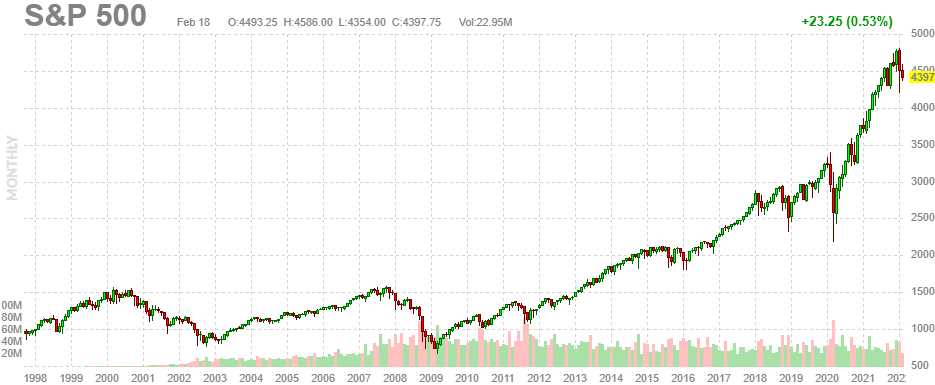

Meanwhile, are you worred about the fate of the poor Ukranians or are you worried about the affect this has on your portfolio? Well, if 2014 is any guide – the market doesn't care. We had a great year in 2014, with the S&P climbing from 1,850 to 2,125 (15%) and oil topped out at $105 but collapsed all the way back to $50 by the end of the year.

Our market is underperforming for other reasons (Inflation, Overvaluation, Supply Chain Issues, Government Gridlock, Lack of Stimulus, Fed Tapering, Rising Rates…), to start saying we are up and down based on the Ukraine is beyond over-simplifying things. Ukraine is just another excuse now to cover the dumping of shares by the Banksters that has been going on since the fall, where we've had endless cycles of low-volume "rallies" followed by high-volume sell-offs – which is what we expect to see when institutions try to dump their shares on retail investors, who are brainwashed to "buy the dips."

Never forget that, in 2008, the Financial Media was telling us to "Buy the Dip" all the way from -10% to -66% and I'm not saying not to buy anything – I'm just saying we need to be selective and we need to be well-hedged – just in case there is another 10-20% left to fall. You really don't know where the bottom (or the top) is until you are looking at it in the rear-view mirror – trying to predict it is a very dangerous game.

Cramer is actually right in the above video, we were doing the same at PSW on that day, playing for the bounce. The difference is that, after the bounce – we watched our Bounce Lines and they told us – and are still telling us – to remain cautious and here we are, right back where we were on January 24th after failing to clear the 40% strong bounce of the fall from 16,500 to 14,000 (2,500 points) which is 1,000 points back to 15,000. The weak bounce line is 20% of the drop so 14,500 and you can see that didn't work either but what does work is our 5% Rule™, which tells you EXACTLY what is going to happen long before it actually does:

My comments to our Members on that morning were:

Thank God for hedges!

As of Tuesday morning's review, we had $800,000 worth of hedges in our Short-Term Portfolio and suddenly, on Friday morning – we're already wondering if that's enough, right? This is why we ALWAYS hedge – especially in a toppy market and, as Fundamental Investors – we know when a market is toppy. We also have RULES about hedging, like putting 25-33% of our unrealized gains into our hedges. That's how our hedges rise proportionally with our portfolios – so we don't let ourselves get complacent in a rally.

So far, we haven't taken too much damage in our long portfolios. That's because we mostly buy the kind of safety stocks people run to when there's a correction and also because, to some extent, our trades are self-hedging – as we tend to sell a lot of premium, which enables us to ride out small dips but, past 10% and things are still going to get ugly!

We had been preparing for that dip long in advance and that happened to be a portfolio review day for our Members and you can see from our lack of changes that we were well-prepared for the dip and our signals told us we hadn't bottomed yet (Nasdaq dropped another 500 points the next week). By Tuesday, the 25th, we had decided Russell 2,000 was the critical line on the Russell 2000 and below that we could get a major collapse. This morning we're back at 2,028 – so have a nice weekend!

We had been preparing for that dip long in advance and that happened to be a portfolio review day for our Members and you can see from our lack of changes that we were well-prepared for the dip and our signals told us we hadn't bottomed yet (Nasdaq dropped another 500 points the next week). By Tuesday, the 25th, we had decided Russell 2,000 was the critical line on the Russell 2000 and below that we could get a major collapse. This morning we're back at 2,028 – so have a nice weekend!

We fell below it for a bit but recovered but any time the Russell is below 2,000, there really isn't a lot of support after 1,900 all the way to 1,500, which would be a tragic correction that would likely drag down all the indexes. We did our Short-Term Portfolio Review this week, along with all of our portfolios and we're well-prepared for a 20% drop, if it comes. If it doesn't, we'll still make plenty of money – just not as much as we could have if we ignored the danger. I know I'll sleep a lot better with the hedges in place this holiday weekend.

Have a good one,

– Phil