WAR!!!

WAR!!!

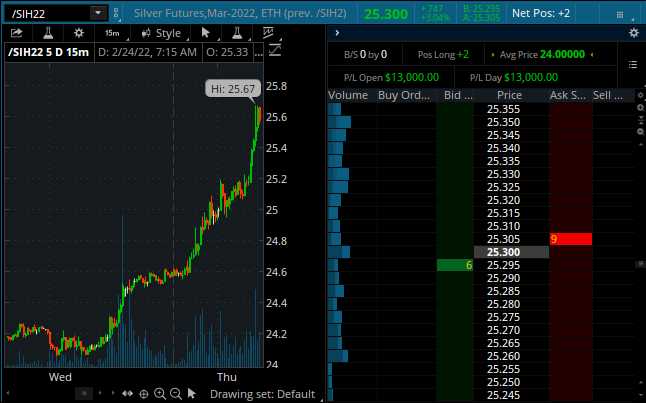

What is it good for? Well it's great for commodities as Oil (/CL) has jumped up to test $100 per barrell and Gasoline (/RB) has popped over $3 and Natural Gas (/NG) is surprisingly lagging at $4.83 – but it will get there shortly (we played it long at $4.57 in yesterday's Live Member Chat Room). Silver (/SI) which we've been playing over $24 since last week, hit $25.67 so our stop is now $25.50 for a massive short-term gain – something else we discussed in yesterday's Live Trading Webinar.

As we discussed in yesterday's PSW Report (subscribe here if you want to know what's going to happen in the markets), war makes people nervous and nervous people tend to dump risky stocks in favor of commodities and CASH!!! and, as we discussed in last week's Portfolio Reviews (again, subscribe!), we have plenty of that in our Member Portfolios and plenty of hedges as well.

As we discussed in yesterday's PSW Report (subscribe here if you want to know what's going to happen in the markets), war makes people nervous and nervous people tend to dump risky stocks in favor of commodities and CASH!!! and, as we discussed in last week's Portfolio Reviews (again, subscribe!), we have plenty of that in our Member Portfolios and plenty of hedges as well.

Our Short-Term Portfolio, which we reviewed last Tuesday at $384,818 and contains our hedges, closed yesterday at $442,998 so up $58,180 for the week and today likely to be up another $50,000 on this dip and, of course, we begain with $200,000 so we've doubled up on our hedges during this downturn, which mitigates the losses our long positions are taking.

Having good hedges allows us to ride out these downturns panic-free, without margin pressure of fear of losses and, more importantly, the cash inflow from our hedges gives us the OPPORTUNITY to take advantage of stocks as they go on sale. For example, Apple (AAPL) is down to $153 this morning and I don't see how Putin invading the Ukrain is going to stop my daughter and her friends fron geting the newest 5G phones this year. I mean, how can you show your support for Ukranians on TicTok without a new IPhone or the connection service provided by AT&T (T)?

In our Butterfly Portfolio, we sold the AAPL April $155 calls for $21.50 on Dec 22nd and we sold 40 of them for $86,000 to cover our long AAPL position. Yesterday I said we were likely to buy them back as they were up almost 50% but today it's a certainty and we'll take the $43,000 profit off the table as a stop and hopefully do a bit better than that:

| AAPL Long Call | 2023 20-JAN 120.00 CALL [AAPL @ $160.07 $-4.25] | 160 | 1/20/2021 | (330) | $448,000 | $28.00 | $19.30 | $10.94 | $47.30 | $-2.46 | $308,800 | 68.9% | $756,800 | ||

| AAPL Short Call | 2023 20-JAN 150.00 CALL [AAPL @ $160.07 $-4.25] | -160 | 1/21/2021 | (330) | $-360,000 | $22.50 | $2.75 | $25.25 | $-2.50 | $-44,000 | -12.2% | $-404,000 | |||

| AAPL Short Put | 2023 20-JAN 125.00 PUT [AAPL @ $160.07 $-4.25] | -40 | 9/20/2021 | (330) | $-42,000 | $10.50 | $-4.15 | $6.35 | $0.67 | $16,600 | 39.5% | $-25,400 | |||

| AAPL Short Put | 2024 19-JAN 120.00 PUT [AAPL @ $160.07 $-4.25] | -20 | 10/15/2021 | (694) | $-25,500 | $12.75 | $-2.93 | $9.83 | $0.82 | $5,850 | 22.9% | $-19,650 | |||

| AAPL Short Call | 2022 14-APR 155.00 CALL [AAPL @ $160.07 $-4.25] | -40 | 12/22/2021 | (49) | $-86,000 | $21.50 | $-10.53 | $10.98 | $-2.18 | $42,100 | 49.0% | $-43,900 |

As I often tell our Members, "You don't have to be clever, just patient." Apple was around $175 on 12/22 and we sold the April $155 calls that were well in the money as INSURANCE – in case we had the downturn we were expecting. Since then AAPL has had strong earnings and guidance and topped out at $182 in January so we are thrilled to actually hit our target, albeit a bit early, so it makes sense to take it off the table with a huge, early profit – we can always sell something else if $150 doesn't hold.

This is the sell-off we've been expecting and perhaps NOW my Bounce Chart makes sense as we've been tracking the sell-off we expected this year, not the one that already happened and now reality is finally catching up with our predictions – the reason isn't all that important.

- Dow 36,000 to 28,800 would be a 7,200-point drop with 1,440 bounces to 30,240 (weak) and 31,680 (strong).

- S&P 4,800 is 20% above 4,000 and that makes it an 800-point drop with 160-point bounces so 4,160 (weak) and 4,320 (strong) is where we are this morning (again).

- Nasdaq is using 13,500 as the base and we bottomed yesterday at 13,580. 14,100 is the weak bounce and 14,700 is strong.

- Russell 1,600, would be about an 800-point drop with 160-point bounces to 1,780 (weak) and 1,960 (strong).

All that's actually happened this week is that the Strong Bounce Lines on the Russell and the S&P have turned red – that is hardly a reason to throw our our strategy, is it? I say the same things at the bottoms I say at the tops: ONLY if this chart goes all red to we start to rethink our expected trading range – unless something fundamentally changes, of course. War in Ukraine is not a fundamental reason to change – it's merely the catalyst that is forcing market participants to re-evaluate the ridiculous risks they've been taking.

And this little CORRECTION is just that – it's stocks heading down to their CORRECT prices – we do not expect to get back to the highs, not this year at least. That's why our main AAPL spread is $120/150, not $150/180. That's why we sold $155 calls – we may love Apple but our love is not blind – we KNOW what it's worth and we set our trading ranges accordingly. If the market wants to out-perform or under-perform for a period of time – we're happy to take advantage of it but we don't allow ourselves to get caught up in the hype – in either direction.

Q4 GDP's 2nd revision came in strong at 7% vs 6.9% in the first pass so the Fed is still on the table and, as I said, how much is Russia/Ukraine going to affect that?