Come on, this is silly:

Come on, this is silly:

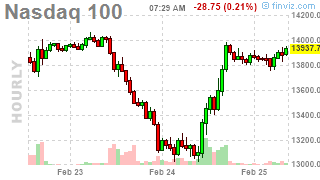

Now the entire stock market is trading like BitCoin. It's hard to call yourself an investor when the market can swing like this in a 24-hour period, isn't it? At least in Vegas, you know why you won or lost – the little ball fell on a red number, not a black or whatever. Try, on the other hand to explain why the Nasdaq fell 7% on Wednesday and then gained 7.6% on Thursday – there's no logic to it.

That's because the market is now trading on emotions instead of reason and that's why we have our Bounce Chart and that's why our bounce chart needs to see two (2) trading days above or below a major support level before we can confirm tha status has changed. The Bounce Chart is part of our 5% Rule™ and the 5% Rule™ is not TA – it's just math. It gives us insight into the Algorythmic Trading that underlies the market and gives us a feeing for which way the programs are turning or, more accurately, what instrustions they are being fed by those emotional humans.

- Dow 36,000 to 28,800 would be a 7,200-point drop with 1,440 bounces to 30,240 (weak) and 31,680 (strong).

- S&P 4,800 is 20% above 4,000 and that makes it an 800-point drop with 160-point bounces so 4,160 (weak) and 4,320 (strong) is where we are this morning (again).

- Nasdaq is using 13,500 as the base and we bottomed yesterday at 13,580. 14,100 is the weak bounce and 14,700 is strong.

- Russell 1,600, would be about an 800-point drop with 160-point bounces to 1,780 (weak) and 1,960 (strong).

The only change since yesterday morning is the Russell 1,960 strong bounce line has gone from red to black (on the cusp) and the Dow did not fail it's strong bounce line yesterday though the S&P did test the weak bounce at 4,160. The Russell bottomed out at 1,880 before shooting up like a rocket to re-test 2,000 (failing) but 1,960 is holding so far.

|

So yesterday was, indeed, a whole lotta nothin' and we took advantage of the dip to cash in some of our hedges but any sign of weakness this morning and we're more likely to add a new hedge into the weekend as the strength doesn't reassure me more than the weakness scares the crap out of me. The S&P ETF (SPY) was at about 450 this month, until the 10th so we can call that consolidation but then we fell to 411.02 as of yesterday morning and now back to 428 (halfway) with 6 out of 10 days red along the way and only 3 green (one was neutral).

| Date | Open | High | Low | Close* | Adj Close** | Volume |

|---|---|---|---|---|---|---|

| Feb 24, 2022 | 411.02 | 428.76 | 410.64 | 428.30 | 428.30 | 213,570,500 |

| Feb 23, 2022 | 432.66 | 433.26 | 421.35 | 421.95 | 421.95 | 132,578,000 |

| Feb 22, 2022 | 431.89 | 435.50 | 425.86 | 429.57 | 429.57 | 124,391,800 |

| Feb 18, 2022 | 437.33 | 438.66 | 431.82 | 434.23 | 434.23 | 132,454,300 |

| Feb 17, 2022 | 443.22 | 446.57 | 436.42 | 437.06 | 437.06 | 102,259,100 |

| Feb 16, 2022 | 443.93 | 448.06 | 441.94 | 446.60 | 446.60 | 84,863,600 |

| Feb 15, 2022 | 443.73 | 446.28 | 443.18 | 446.10 | 446.10 | 88,659,500 |

| Feb 14, 2022 | 439.92 | 441.60 | 435.34 | 439.02 | 439.02 | 123,006,300 |

| Feb 11, 2022 | 449.41 | 451.61 | 438.94 | 440.46 | 440.46 | 153,064,100 |

| Feb 10, 2022 | 451.34 | 457.71 | 447.20 | 449.32 | 449.32 | 140,103,700 |

| Feb 09, 2022 | 455.22 | 457.88 | 455.01 | 457.54 | 457.54 | 92,589,900 |

So, even counting yesterday as a green day (much of the volume was very red in the morning), the down volume was 785M and the recovery volume was 387M so, even if you say we replaced the bullish bricks to rebuild our market wall – the bricks may look the same but they weigh half as much and that will not do you a lot of good the next time the big, bad, wolf comes to blow your portfolio down!

Until we are satisfied that there are an adequate number of sellers willing to buy our stocks when they get cheaper – we will continue to be "Cashy and Cautious". The main thing that turned the markets around yesterday were statements by some Fed Governors that a 0.5% rate hike is now pretty much off the table for March. Of course they said that when then Nasdaq was down 1,000 – then it regained 1,000 so maybe now they've changed their minds again?

Until we are satisfied that there are an adequate number of sellers willing to buy our stocks when they get cheaper – we will continue to be "Cashy and Cautious". The main thing that turned the markets around yesterday were statements by some Fed Governors that a 0.5% rate hike is now pretty much off the table for March. Of course they said that when then Nasdaq was down 1,000 – then it regained 1,000 so maybe now they've changed their minds again?

You'll never find out from watching CNBC, who have been running the headline "Nasdaq gainst 3.3% in Epic Rebound" all morning and you have to dig deeply to realize that's after it was down 3.5% in the morning and still only flat for the week and still down 1,000 (6.66%) since the 10th.

Our bounce rules teach us to be smarter than CNBC wants us to be while they push their suckers viewers to "Buy the F'ing Dip." It's the same tactic they pulled in 2008, when they constantly told their suckers viewers that -20% was the opportuntiy of a lifetime – and then -40% was the opportunity of a lifetime – and then, oddly enough – at -60%, they threw in the towel and THAT was when it was time to buy! Oddly enough, CNBC's sponsors, hedge funds and banks and fund managers, were doing the opposite of what CNBC was advising.

By the way, if you know how to download and save a video – save this one as it is being scrubbed, site by site, from the Internet. Soon it will be like it never happened.

Now, I'm not saying we're going to have another 2008-style meltdown – we don't have a gigantic real estate bubble that has essentially generated fake profits in the Trillions but we do have many, many, ridiculously over-valued companies that need to come down to Earth and DO NOT expect them to retake their highs – which were based on unrealistic expectations. So we're not jumping all over this dip because it's more of a CORRECTION, where stocks come down to their CORRECT level – that's not the same thing as a dip – when things will bounce back.

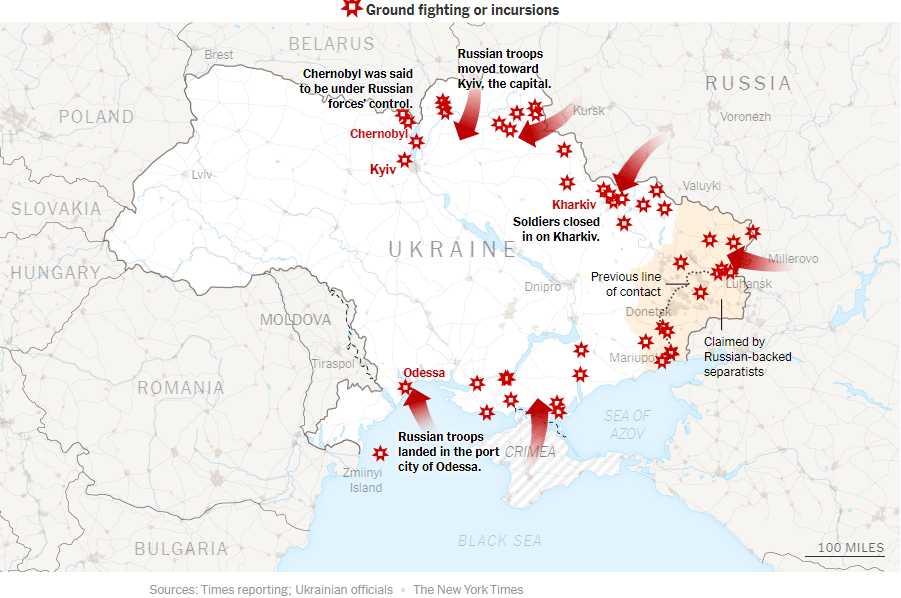

At the moment, the Banksters are pumping up the markets on low volume and selling as much as they can to all the suckers that the Financial Media can push into the market. Inflation will keep the market moving higher – any chance we had of getting that under control went out the window as soon as Russian boots touched Ukraine soil.

Belarus is not in NATO, nor is Moldova – what is our plan for them when Putin comes knocking? This is not a good time to be complacent about the markets so we'll be reviewing our hedges today in our Short-Term Portfolio and making sure we feel comfortable into the weekend. It's those hedges that allowed us to sit back and relax while the Nadaq went up and down 1,000 points and it's those hedges that allowed us to carry our bullish positions into this uncertainty.

Belarus is not in NATO, nor is Moldova – what is our plan for them when Putin comes knocking? This is not a good time to be complacent about the markets so we'll be reviewing our hedges today in our Short-Term Portfolio and making sure we feel comfortable into the weekend. It's those hedges that allowed us to sit back and relax while the Nadaq went up and down 1,000 points and it's those hedges that allowed us to carry our bullish positions into this uncertainty.

Have a great weekend,

– Phil