This is How Stocks Bottom

Courtesy of Michael Batnick

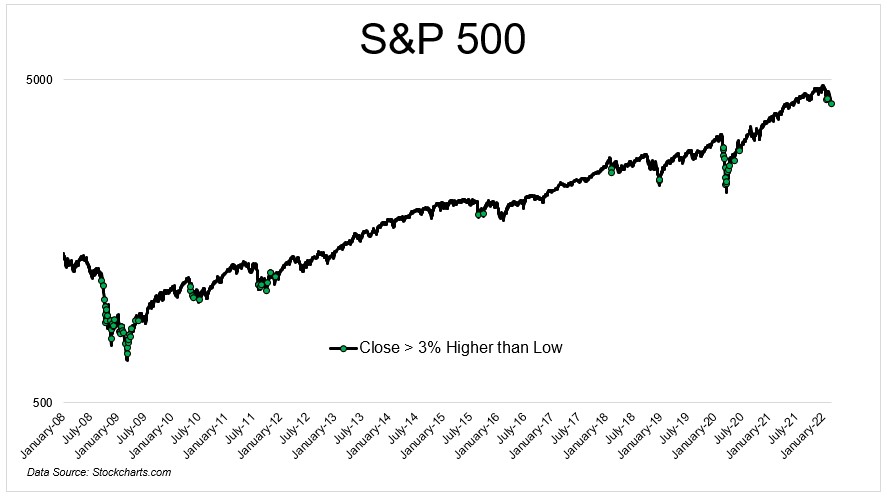

When the market opened yesterday, the S&P 500 was down as much as 2.6%, leaving it 14.6% below December’s highs. But then the selling stopped and the buying started. It picked up steam and was a full-blown panic by the end of the day. By the close, stocks had rallied 4.1% off the lows.

If you’re looking for signs of a bottom, the good news is that this is how they happen. The bad news is that this type of volatility is also what you see before things get a lot worse.

At every major market bottom over the last decade, we saw heavy buying off the lows. But we also saw this activity on the way down before a floor was reached. 2008-2009, 2011, and 2020 all experienced multiple failed rallies along the way. That type of “phew it’s over, ugh, no it’s not” is really demoralizing.

Obviously, there are much bigger things in the world to worry about right now than your portfolio, but just from a market point of view, that’s not what you want to see.

We spoke about everything that’s going on yesterday with our friends Phil Pearlman and Linette Lopez. Linette’s been covering geopolitics for a long time so it was especially good to hear her break it down for us. We’re thinking of all the people whose lives are being destroyed right now.

Seeing some of the heartbreaking videos out of Ukraine should help refocus how lucky we are to live in this country, and what really matters in life.

Hope you enjoy our conversation with Phil and Linette.