$2,814,033!

$2,814,033!

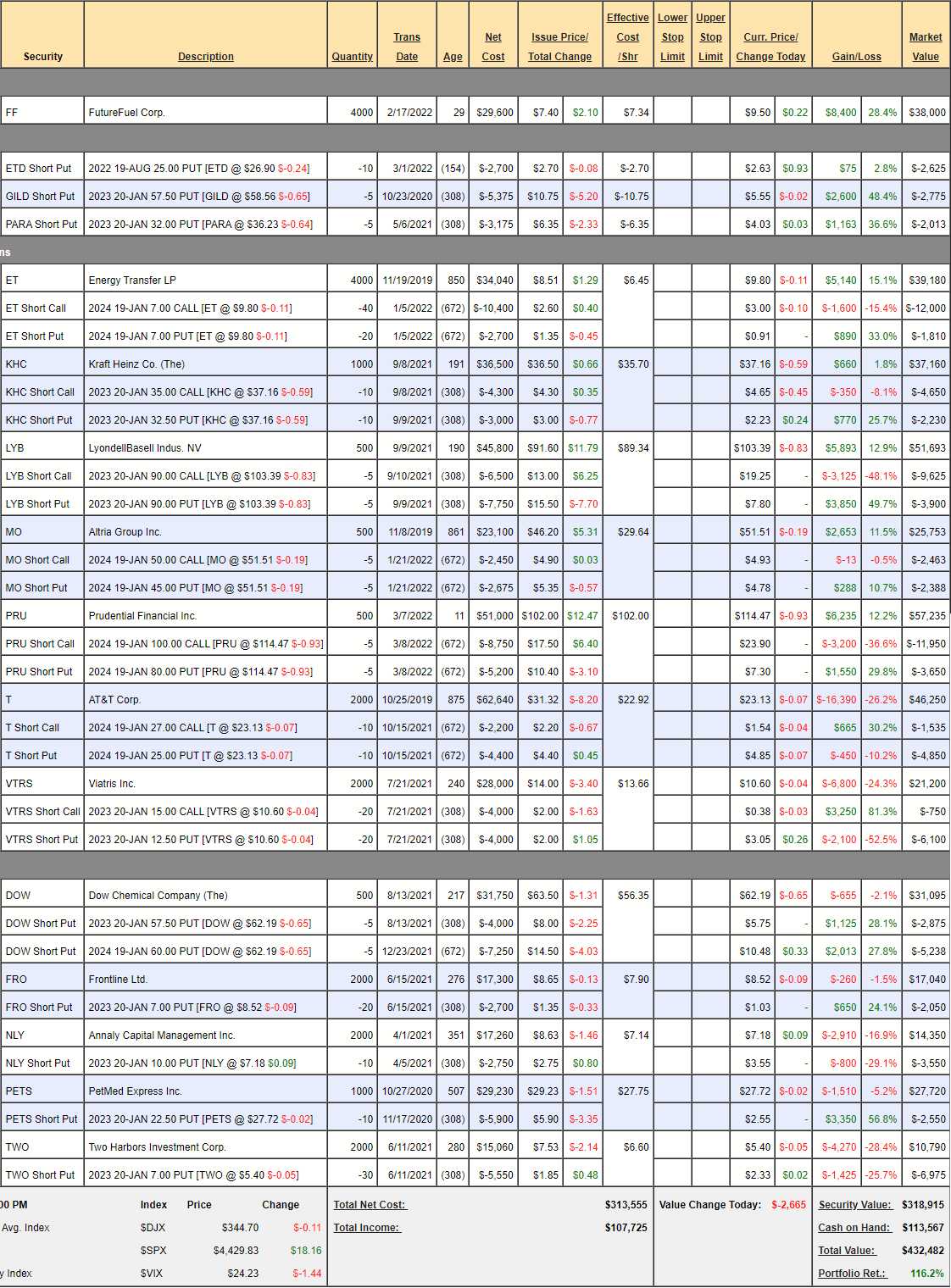

That is up $91,591 since our last review for our paired Long-Term (LTP) and Short-Term Portfolios (STP). Even though we made less money than we did the month before, I'm very proud of the way our positions held up during the drop though – on the whole, the S&P was at 4,464 on the morning of Feb 17th and today it's at 4,372 so not even down 100 points (2.5%) is really not a big deal – though we were down over 300 last week.

And that is the true key to hedging, it enables you NOT to have to sell your stocks in a downturn so you don't have to panic out of positions. At PhilStockWorld, we take hedging to another levels because we use our hedges as a money-pump – which provides CASH!!! to our portfolios during a downturn and that then gives us a chance to be like Buffett and do some more buying when other people are panicking.

It doesn't have to be much, as you saw in Part 1 of our March Portfolio Review on Tuesday, we just make some small little adjustments in our positions and that steers us more bullish or more bearish when we need to. We made no changes at all in our Money Talk Portfolio because we only make them live on the show but those positions have gained $23,615 since Tuesday – almost 10% of the entire portfolio in two days.

It doesn't have to be much, as you saw in Part 1 of our March Portfolio Review on Tuesday, we just make some small little adjustments in our positions and that steers us more bullish or more bearish when we need to. We made no changes at all in our Money Talk Portfolio because we only make them live on the show but those positions have gained $23,615 since Tuesday – almost 10% of the entire portfolio in two days.

That's because of Part 2 of our Strategy – VALUE INVESTING! If you pick good stocks – they will take care of themselves… Yes, they may go down when the market goes down but they are more likely to recover and, when you combine that fact with our ability to adjust our positions when they are down – it's a very powerfull combination as the market recovers.

And notice how much CASH!!! we have in the MTP – that is typical of our strategy and again, it leaves us flexible enough that we actually enjoy these little market corrections the way a lion enjoys a herd of gazelles stuck in the mud – we get to pick and choose whatever we feel like going after, and they become very easy kills. The key is to have the PATIENCE to wait for the right conditions to make your move – that is the hardest thing I try to teach our Members…

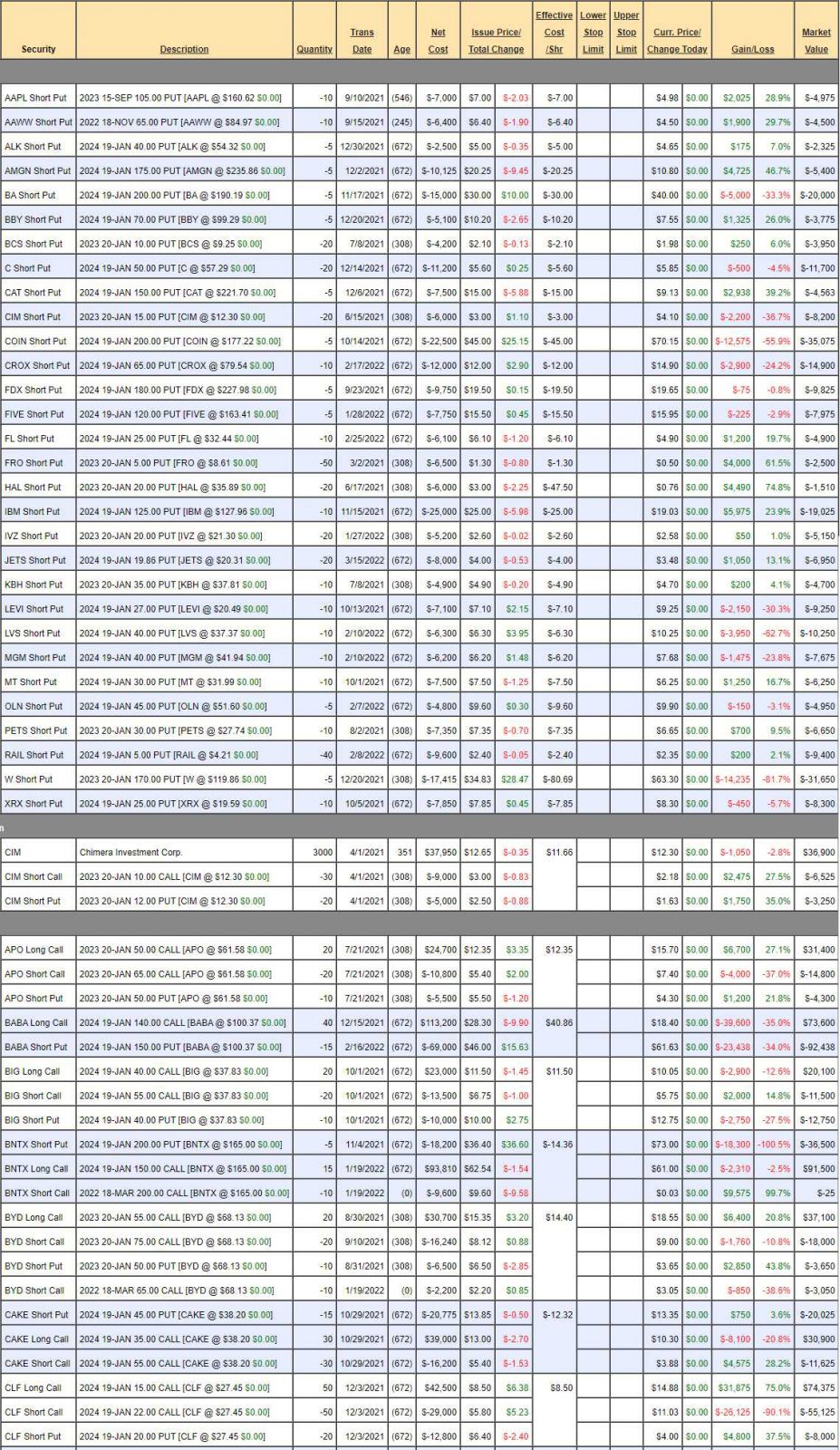

Long-Term Portfolio Review (LTP): And Membership does indeed have its advantages with our LTP now at $2,392,135 (up 378.4%) and that's up $87,532 since the Feb 16th review on that portfolio. and, at the time I said:

Long-Term Portfolio Review (LTP): And Membership does indeed have its advantages with our LTP now at $2,392,135 (up 378.4%) and that's up $87,532 since the Feb 16th review on that portfolio. and, at the time I said:

As usual, I'd love to cash everything out but, as usual, these are positions that have already run the gauntlet in a market I have no faith in – so it's hard to let go and our hedges seem to be in very good shape protecting up (they were all of this month's gains) but hope springs eternal and maybe I'll find some things I can bear to part with this month:

That was an innocent era – before the war. My current thinking is the Government has one more round of stimulus left and we've had our 20% pullback (mostly) so I'm less bearish now, having gone through March in good shape but we are still on the cusp of World War III, so that's a bit of concern until it goes away (or consumes us) and THEN we can go back to worrying about all the other things that are too depressing to discuss on a Friday.

So on to the review:

30 Short Puts – Only a few are giving us serious concern but I think the worst is over for now so we'll see how they recover over the next month. That will be April and, 90 days later, 2025 puts will be coming out and we can roll the losers to lower strikes if we wish but only W gives me serious concern because we don't REALLY want to own W – it's just a leftover leg from an earlier bearish play that made lots of money and we'd hate to buy these back for a loss if we can avoid it but, frankly, I'd be happy to pay $8,000 to be done with them at this point – just not $14,000.

Other than W's unique situation, the LTP is generally a watch list of stocks we'd REALLY like to own if they get cheaper. LVS, for example, we sold the 2024 $40 puts for $6.30 and that gives us a net $33.70 entry and LVS is now at $37.37 so, despite the puts SHOWING us a $62.7% loss, the reality is that, if we PATIENTLY wait for them to expire – it's mostly premium and we'll actually make money at this level.

More to the point, when we see a put that's down more than 50% – it may be time to add a long position to our short puts. That's pretty much how we built most of the LTP, sell a put and then, when the stock is LOWER, enter a bullish spread. It's a strategy that forces us to be PATIENT and encourages us to scale into positions – two things that generally keep us out of trouble.

BA, COIN, CIM and CROX are four others we're going to add long positions to, probably next week if Putin hasn't gone nuclear by then. Remember, PATIENCE!!!

- CIM – Oops, I forgot we already own them. I guess we sold more puts on the dip in June. Well, I do love CIM and our 3,000 shares are about to pay a 0.33 dividend ($1,000) on March 30th. As it stands now, it's net $27,125 and we're collecting $4,000 in dividends (14.7%) while we wait to be called away at $30,000 with another 10.5% gain so call it 25.2% left to gain for the year and then we'll see how the other short puts look.

- APO – On track.

- BABA – See, THIS is what we save our firepower for. BABA is mostly down on China's uncertain tech policy and they just said they will be supporting the tech sector and BABA popped 30% on that news. We were waiting for a bottom and Charlie Munger was right, $100 is a good bottom for them (he's been buying). At this point, we want to spend $6.15 to roll the 2024 $140 calls at $18.20 to the 2024 $120 calls at $24.35 as we're buying $20 in position for $6.15. The $100 calls are $31, so only $7 more to do that roll but think about it: There are two things that can happen – BABA can go up and $120 is fine for a strike or BABA can go down and we'll sell calls to cover, like the $200 calls that are currently $9 and use that money to roll lower. We'll have better information since we wait and the roll will be cheaper if BABA goes lower and we won't need the roll if it goes higher – the only way to lose is to force a decision when we don't need to!

- BIG – We only need to make adjustments if our target changes and $55 in two years still makes sense. While it's tempting to add more it's only a small discount to our initial position and we still have broad-market concerns so we're saving firepower.

- BNTX – Saving it for things like this. $165 is down to a $40Bn valuation for BNTX and they made $3.2Bn LAST QUARTER. They should make about $9Bn in 2022 and people think Covid is going away but it's not, it will be like the flu and we'll need shots every year. Also, BNTX has a lot of things in the pipeline but investors are not patient – so they sell it off. The short March calls will go worthless and we're too low to sell more calls and we're not worried about our net $163.60 entry from the puts on 500 shares so let's just roll the 15 2024 $150 calls at $61 ($91,500) down to 20 of the 2024 $120 calls at $75 ($150,000) so we're spending net $58,500 to be $60,000 deeper in the money and we'll get that back when we cover (the short $250 calls are $30 for $60,000).

- BYD – This one is going too well and we have to roll our 10 short March $65 calls at $3.05 to 10 short May $70 calls at $4.20, so we'll put another $1,150 in our pockets – even though we were wrong about our target. Why is that? Because we are BEING the House and taking advantage of the one sure thing in the markets – ALL Premiums expire WORTHLESS!!!

- CAKE – It's only at the bottom of our range – the short puts aren't even in the red. On the whole, it's a $60,000 spread that pays a net $750 credit to be in so MORE CAKE PLEASE and let's add 20 more long spreads and sell 10 more puts.

See, a little nudge here and a little nudge there while things are cheap and suddenly we're in position to make a fortune if the market improves and, if it doesn't – we already have $1M in hedges and we can always sell more cover calls here.

- CLF – This just blasted higher on us. It's currently net $11,250 on the $35,000 spread that's miles in the money so, if you would like to make $23,750 (211%) in two years if CLF simply holds $22 (now $27), then this is a lovely trade to be in, isn't it?

- DAL – My 2nd favorite airline (ALK is #1). Perfectly good for a new trade and the war keeps us from adding to it for now.

- DOW – What a great, boring stock. On track.

- FB – I hate these guys. We're only in this to make money selling short-term puts and calls and the calls will expire worthless and we didn't sell puts last cycle (thank God!) but now we can (and not sell calls) so let's sell 2 April $220 puts for $15.75 ($30,150) as they can always be rolled and we already have a net $3,210 credit on the spread so – Ka Ching!

- GILD – I don't see why the $50s are so cheap with the stock at $59.30 so let's buy 20 more 2024 $50 calls and wait on selling covers.

- GOLD – We have to be responsible and sell some covers. Let's sell 30 of the 2024 $25 calls for $4.50 ($13,500) to lock in some of those gains and we still have plenty of room for short sales. Also note that $13,500 is $2.70 per long and that's enough money to pay for us to roll down the the $10s (now $13.70), if GOLD goes lower and the roll hits $2.50 or less.

- HBI – We got aggressive and bought back the short calls – not helping yet.

- HPQ – Blew past our goal so we're just waiting to collect.

- IBM #1 – Our Trade of the Year is already over goal 2 years ahead of time. This was a nice, conservative net $3,750 entry where we promised to buy 2,000 shares of IBM for $100 and it's a $75,000 spread so, if IBM manages to hold $125 into 2024, we're up $71,250 (1,900%). Even if you have an IRA and can't use margin – it's still a 35% return on your $203,750 commitment. That's why it was the Trade of the Year!

- IBM #2 – We had made this one earlier in November and it's a lot more aggressive but also on track. Because we were watching IBM closely and had already done our research – it ended up being a finalist and ultimately winning for the best trade of 2022. And that doesn't mean it will make the most money – just that it's the trade I feel has the highest percentage chance of returning 300% or more on cash over the next 24 months.

IBM hasn't even moved much (nor did we expect them to) but both trades are up considerably because OTHER PEOPLE gave us their MONEY because they were betting IBM would move more violently in one direction or the other. Like any good bookie – we took bets on both sides (selling puts and calls) and getting paid a tremendous premium which, as we know, ABSOLUTELY EXPIRES OVER TIME. That's our whole strategy in a nutshell – the only trick is picking the right strikes – like setting a point spread…

- INTC – Now you can see why INTC was not our Stock of the Year (it was a finalist) – supply chain issues and their massive capital spending plan were both headwinds for 2022 but 2023 might be their year if things progress well. At this price, they might have beat out IBM anyway. Great for a new trade at net $16,500 on the $80,000 spread so $63,500 (384%) upside potential at $60.

- KHC – Right on track.

- LABU – Biotech is taking a huge beating. Not worried about being assigned 3,000 at net $23 but let's take advantage and sell 15 of the 2024 $20 puts for $10 ($20,000) and let's roll our 50 2024 $20 calls at $7.60 ($38,000 – up a lot since I took the portfolio picture) to 50 of the 2024 $10 calls at $11 ($55,000). So we're putting net $3,000 in our pocket and pushing our spread $50,000 deeper into the money.

- LMT – Our Stock of the Century! War is very, very good for them and I wish we had more but they never got cheaper. Currently net $39,725 on the $70,000 spread so we're just waiting around to collect the last $30,275 (76%). Yawn….

- MO – Another yawn. Who would have thought people would keep smoking?

- MRNA – Like BNTX, suddenly unloved for no good reason. We already did our rolls and bought back the short puts so I just love this spread as it is. We are certainly not worried about owning 500 shares at net $175 or 1,000 shares at net $140, so the short puts don't matter and we have 20 long $150 calls on a stock that was $450 6 months ago. At $300 we'll get $300,000 against what is currently a net $33,437 spread if all goes well.

- MU – Despite supply chain issues they have blasted up to our goal and are holding it. Still only net $16,200 on the $40,000 spread so, if you want to make $23,800 (146%) in 10 months on a spread that's already in the money – this may be a nice play for your portfolio. Aren't options fun?

- PAA – Our other dividend stock just paid us 0.18 ($1,440) on Jan 28th and that's always nice. Exactly where we want it to be at the moment.

- PARA – Was VIAC and we're finally back on track after a nice pop. This is one we rolled down several times but all worthwhile if we hit our $47.50 goal and collect $162,500. It's currently net $65,075 so almost $100,000 more to gain (150%) from here and now it looks a lot more realistic, right? On the whole, our short call sales paid for most of the rolls so we're in for about $85,000 net of our previous losses.

- PFE – We got all aggressive on them last month and they are blasting back.

- PHM – Holding up well so still good for a new trade.

- QSR – Another one we got aggressive on.

- RIO – Our entry was perfect, already over our goal.

- SKT – It's already a huge position but I still love it as a new trade.

- SPWR – Super aggressive and finally working. They are hitting resistance at $20 but, if we can get over that, $30 is the next stop and that would be up $100,000 (100%) from here.

- T – We've already rolled down and doubled down on the December dip and now we're back to the same(ish) spot. Our spread is ahead because of the premium decay for the people we sold puts and calls to and we have no problem sticking with this trade for a decade or so. As it stands, it's about $50,000 on the $200,00 spread.

- TD – My favorite bank. Doing too well as we'll have to roll our short April calls but we're net $18,560 on the $22,500 spread but the short calls will roll higher so we can widen the spread over time.

- TUP – Brand new spread, already popping – or "burping" I think is the term…

- VALE – Also blasted over our goals already. We can sell 20 of the 2024 $20 calls for $3.25 ($6,500) and still have 10 open calls to sell short calls against, so let's do that.

- VTOL – A flying car play. Doing well already.

- WPM – Already at goal but only net $10,175 on the $35,000 spread so $24,825 (243%) left to gain at $50+.

- X – Blasted past our goal and now net $12,975 on the $36,000 spread so $23,025 (177%) left to gain if they can hold $28

I know it seems like you missed things as we already made $11,775 on our X trade (for example) but that shouldn't stop you from taking what is now far less of a risk to make 177% going forward. We make our initial bets smallish – on X we committed to owning 1,500 shares at $23 ($34,500) and $1,200 in cash. We could roll the puts if things went south so it wasn't even a risk of $34,500 and our allocation blocks in the LTP are $200,000, so this was a tiny entry when X was at $22 in Sept and, if it had gone badly, we'd be very happy to be rolling down and doubling down since we KNOW X has long-term value.

In this case, it took off instead (in a very rocky fashion) and it turns out that our attempt to make $36,000 out of net $1,200 is going to work out. But now, as a new trade, we're at $32, not $22 so there's a huge cushion to the bet and it STILL pays 177% if all goes well.

The biggest trades in the LTP are the ones that DID NOT go well at first. Since we buy our stocks based on STRONG FUNDAMENTALS – we don't get thrown off by market gyrations and, using our paired portfolio strategy, which allows us to be buyers during dips – like we are doing above – we can take full advantages of the downswings without all the stress that stock traders tend to go through.

- YETI – Speaking of things to take advantage of. We're only down 20% on the longs so we simply take advantage and roll the 20 2024 $60 calls at $17 ($34,000) to 30 of the 2024 $50 calls at $21.50 ($64,500) and let's sell 10 more of the Jan $65 puts for $12.60 ($12,600) so we're spending net $17,900 to change a $40,000 spread to a $90,000 spread by moving $30,000 into the money on our longs and we originally had a net $8,860 credit so now we're in the $90,000 spread for net $9,040 with $80,960 (895%) upside potential on a trade that went badly from the outset. Often it works out much better for us if the trade does start out badly….

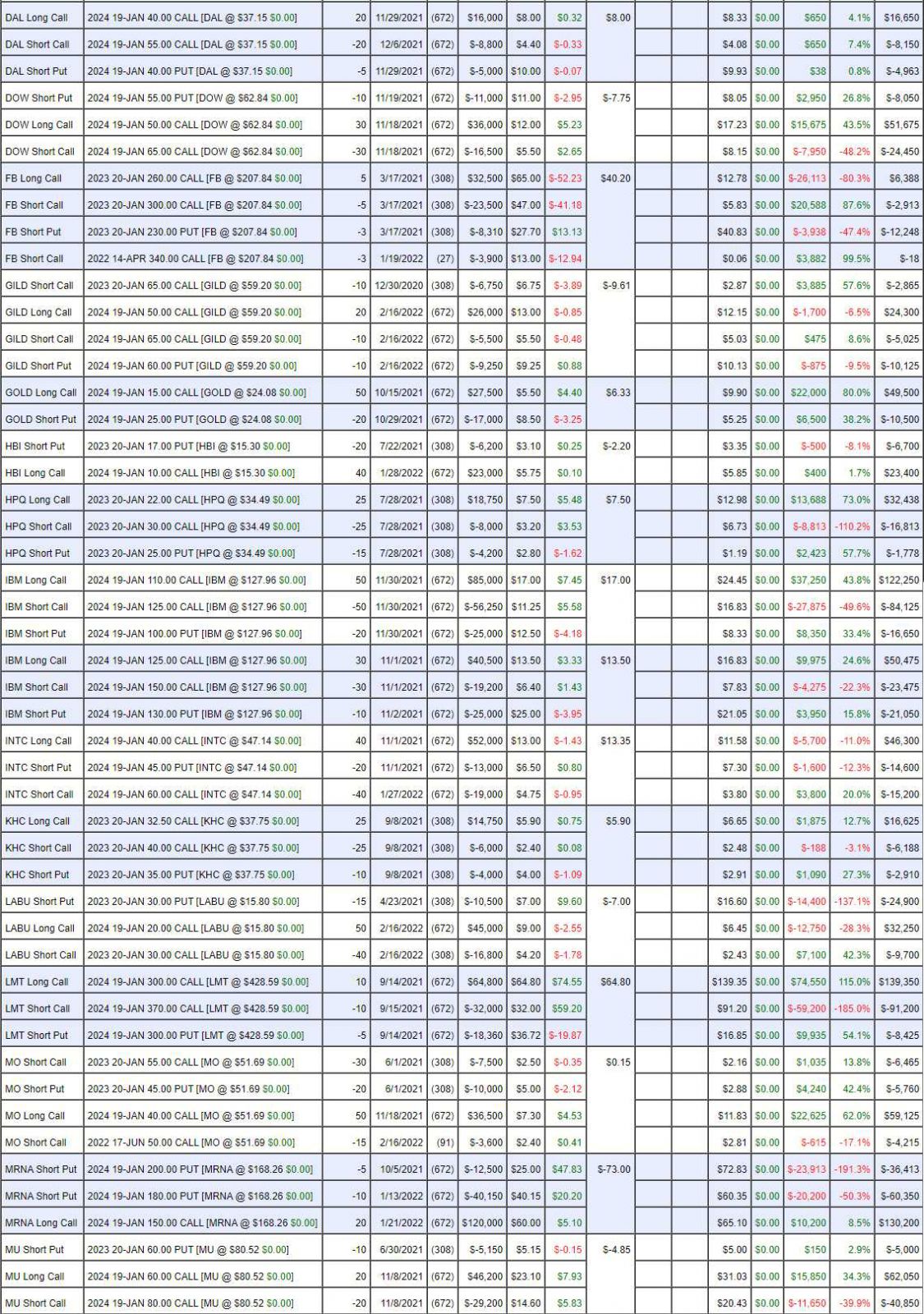

Dividend Portfolio Review: $432,482 is up $11,334 and about half of that is from dividends and the rest was a well-timed entry on PRU on the 7th (thanks Kustomz!). An insurance company was a great diversification entry for us. We're still sitting on $113,567 in CASH!!! but I don't feel too comfortable going below. I would say we'll look for something to cash out but, seeing how it's going with the other portfolios – all the positions we have left are just too darned good to sell!

We do not swing for the fences in the Dividend Portfolio but we do make sensible adjustments when appropriate and that's why we're up 116.2% in just under 2.5 years instead of 75% we expected (30%/yr).

- FF – Another recent addition that's doing well. The Nov (as far as it goes) $10 calls can be sold for $1.40 and let's make sure we don't sell them for less than $1.20 so, basically, if $9.50 fails to hold – we'll do a cover. Too late to sell puts. This stock is so underrated – I can't believe we got in so low.

- Short Puts – All good. Great to use when you are low on cash but have margin to spare. We promise to buy stocks if they get cheaper and, whether they do or don't – we keep the money!

- ET – Deep in the money, no worries.

- KHC – They had hit $40 but inflation concerns are taking them back to our zone. As long as they are over $35 in Jan, we're very happy.

- LYB – Well over our target.

- MO – The same yawn as a stock as they are as an option but the stock pays you 7.6% dividends – so it's actually very exciting!

- PRU – We nailed the entry on this one.

- T – I'd love to double down here but I don't want to use $46,250 of our CASH!!! so let's sell 20 2024 $25 puts for $4.90 ($9,800) which is pretty much net $20, which would drop our basis on 4,000 to about $25.75. If T is not below $25, then we've lowered the basis of what we have to $46,240, which is where the stock is now and, if called away at $27 ($54,000), we make $7,760 plus all those lovely dividends ($2.08/share/year).

- VTRS – What a pullback! Yet another destroyed Biotech. Let's buy back the short $15 calls ($750) and sell 20 of the 2024 $12 puts for $3.40 ($6,400) as a pre-roll (not buying back the 2023 puts, hoping they get cheaper). We'll buy 2,000 more shares for $10.60 ($21,200) so we're spending net $15,550 to get way more aggressive but we sold 20 calls for $4,000 so if we sell 40 for $8,000 or better later on – it's really a great way to improve the position.

- DOW – Another boring company I love.

- FRO – Crazy moves recently and we blew our first chance to re-cover – let's pay more attention next time they pop.

- NLY – We got aggressive on them. Let's sell 10 2024 $10 puts for $4.50 as that's net $5.50 but we're collecting $4,500 and it's already over $7, which is $1,500 in the money for us! The base logic for us is we certainly don't mind owning 1,000 more shares at net $5.50 so this trade is a no-brainer.

- PETS – Lots of aggression at the bottom of the portfolio! They are finally waking up so we'll see how it goes.

- TWO – Another oversold REIT. Now, in this case, the 2024 $7 puts are $3.50 and I don't see any reason I wouldn't want to DD at net $3.50 ($7,000) to average $5.515 for 4,000 shares. So we may as well sell 20 of the 2024 $7 puts for $7,000.

In this portfolio, we didn't want to spend any cash so, rather than buying more shares – we sold more puts PROMISING to buy more shares if they get even cheaper.

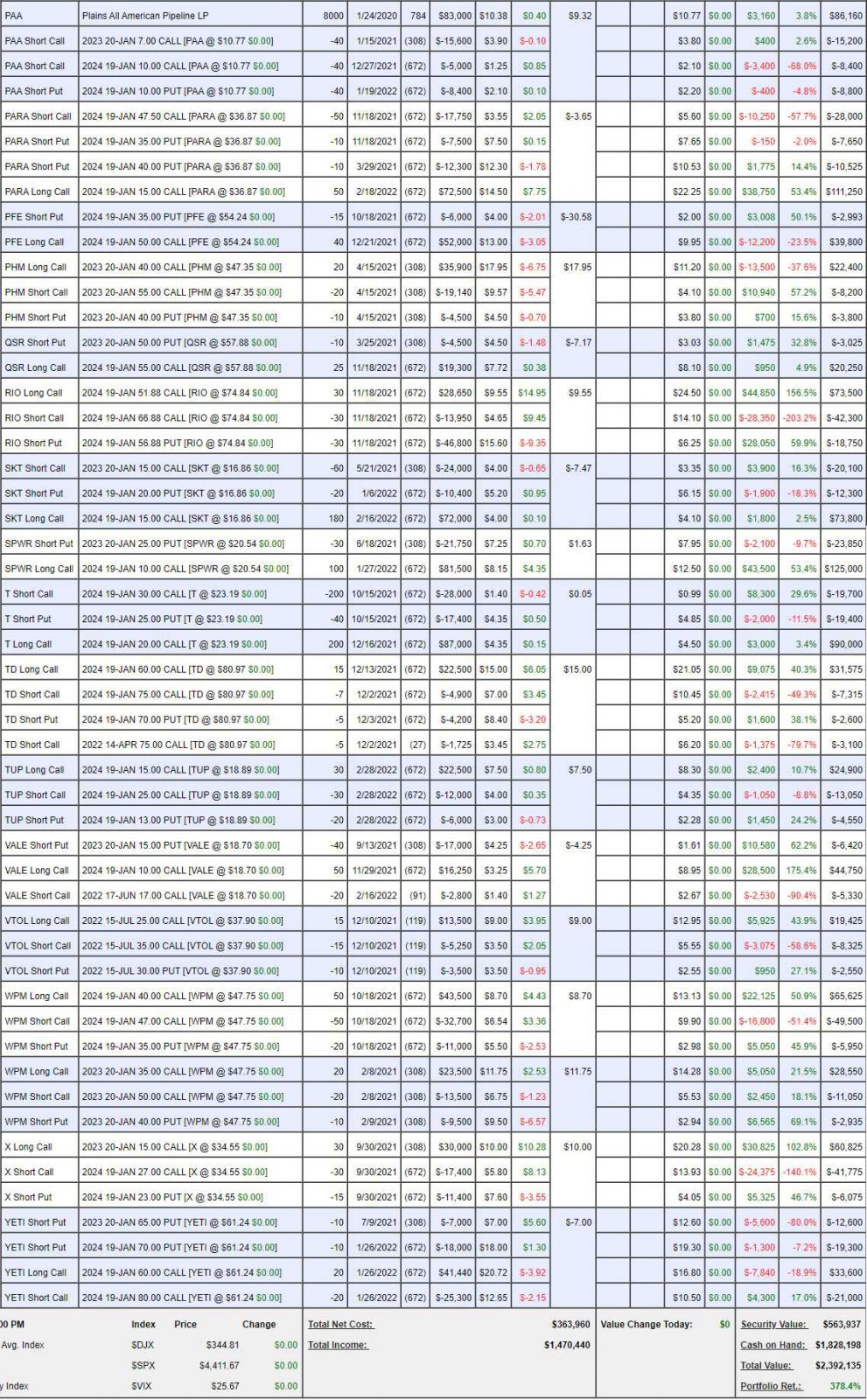

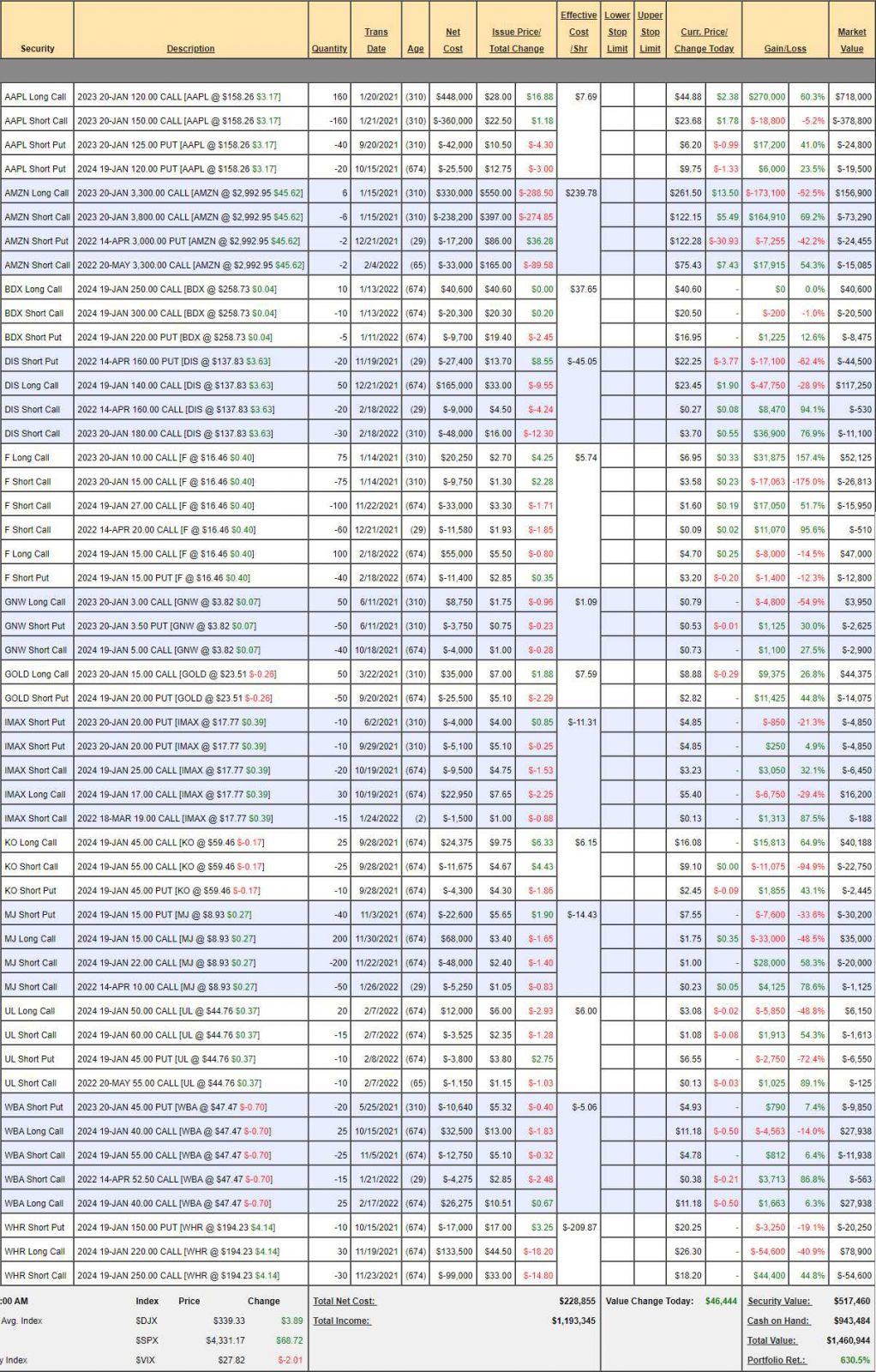

Butterfly Portfolio Review: $1,460,944 is down $60,760 since our 2/17 review but we were up a silly $165,342 then so it was bound to correct. We don't sell many March contracts – that's another factor as we make more money on quarterly expirations (Jan, April, July, October). The VIX is higher and we sell a lot of premium so we always look bad in a sell-off. On the bright side, a lot of short calls that were a problem are not anymore.

We are very AAPL-dependent as well and AAPL is down from $170 to $158 (7%) but we sold the April $155 calls (which we bought back) – so really right where we thought it would be. We have very close to $900,000 (63%) in CASH!!! so lots of room to adjust, so let's see if anything needs adjusting:

?

?

- AAPL – Too low to sell more short calls so we wait.

AMZN – Right in the zone for our short puts and calls to go worthless.

- BDX – Good for a new trade. We should have sold some calls.

- DIS – Thank goodness we covered this one! The short calls made $45,000 – staving off huge losses from the longs. Obviously we'll buy back the short April $160 calls at $530 – maybe we can sell them again on a bounce.

- F – We rolled our longs lower and sold some calls last month. Now we can buy back the 60 short April $20s and the 100 short 2024 $27s, not because I'm raising the target but because we'll sell something for more than $1.60 on a bounce – even if it has to be the $25s.

These little nudges are what we do in the Butterfly Portfolio to take advantage of moves within the channels our stocks make. If we're wrong – we simply sell a lower strike than we hoped but when we are right – it can be extremely rewarding.

- GNW – The spread is in the money and the puts are net $4, so those are on track too so it's still good for a new trade at a net $1,575 credit on the $10,000 spread. This was meant as an example as a simple way to make money playing conservative spreads. Our original cost was net $1,000 to profit $9,000 (900%) so way better payout now. Since we spent net $1 on the bull call spread and we can sell the $3 calls for 0.80 ($4,000) and salvage most of that $1, let's do that and roll them to 100 2024 $3 ($1.70)/4 ($1.10) bull call spreads at 0.60 ($6,000). So we're spending $2,000 on top of our original $1,000 and now for $3,000 we have the $10,000 2024 spread ($7,000 upside potential at a lower strike), 40% covered by the 2023 $5 calls.

It's nice to want to make 900% in 18 months if everything works out perfectly, spending $1,000 to make $9,000 but, when it doesn't go perfectly, the fallback is to spend $2,000 to make $7,000 (350%) in 30 months is not too bad for a trade that didn't work out yet.

- GOLD – We're worried about peace breaking out so we'd better cover, I guess. We got the pop we wanted so we don't look a gift horse in the mouth. It's tempting to buy back the puts but I don't mind owning GOLD at net $14.90 so there's really no point in being cautious, is there? The Jan $15 calls are $8.50 in the money and we can sell the 2024 (yes, a year longer) $22 calls for $5.30, so let's sell 35 (2/3 cover) of those for $19,250 and we only spent net $10,000 on the spread so a double off the table and the $19,000 is plenty of money to roll our $15s to the 2024 $10s (now $13.50) if need be – but I'm sure we'll be more creative than that.

- IMAX – I see blockbusters making good money again and that's all IMAX cares about – they don't do small movies. The March $19s were a perfect sale and will expire worthless and let's give it a chance to pop before we cover again. China lockdown will have some negative effect – hopefully it doesn't spread.

- KO – Nice safety stock. Not worried about them but too low to sell calls.

- MJ – Let's buy back the April $10 calls and see how things go.

- UL – Our newest position (we don't add many). Right on track at the bottom of our projected range. May as well buy back the short May $55 calls as they are already up 90% so we'll wait for the bounce to sell more.

- WBA – Short April calls can be bought back with an 86% gain so let's do that with a month to go.

- WHR – Lets buy back 15 (1/2) of the 2024 $250 calls while they are half price.

Gosh, I'm more bullish than I realized.

The Butterfly Portfolio Review is from Tuesday's Member Chat Room.