And just like that we're failing at the Bounce Lines.

And just like that we're failing at the Bounce Lines.

4,512 is the weak bounce line on our bullish Bounce Chart (see yesterday's PSW Report for more details) and the S&P Futures (/ES) topped out at 4,514.75 before being rejected at the exact spot our Fabulous 5% Rule™ predicted way back in January. More to the point, for you TA fans – see that "W" that's formed since mid-February? If we can't break higher (4,500), then we're beginning to form a consolidation pattern that's likely to break LOWER, not higher.

Keep in mind however that, in the BIG PICTURE, this is, so far, barely a pullback at all. The S&P 500 was at 2,000 in 2017 and, even if we assume it grew at double the normal rate and gained 15% a year and was positive every year since, that would be 2,300 in 2018, 2,645 in 2019, 3,041 in 2020, 3,498 last year and now 4,022. THAT would be after 5 years of SPECTACULAR growth.

Keep in mind however that, in the BIG PICTURE, this is, so far, barely a pullback at all. The S&P 500 was at 2,000 in 2017 and, even if we assume it grew at double the normal rate and gained 15% a year and was positive every year since, that would be 2,300 in 2018, 2,645 in 2019, 3,041 in 2020, 3,498 last year and now 4,022. THAT would be after 5 years of SPECTACULAR growth.

At the beginning of 2017, our GDP was $18.9Tn and now it's $24Tn so that's up 27% in 5 years – very impressive but the S&P 500 is up over 100% – 4x more than the economy has grown and, as we know, $11Tn of that $5.1Tn in growth was Stimulus coupled by low rates from the Fed – not exactly giving us a genuine reading, is it?

And the S&P isn't just disconnected from the Economy, it has become disconnected from its own sales numbers! As you can see from this chart – since 2007 (before the last collapse), the S&P is up over 200% (this chart only goes to 2021) in PRICE but it's up just 51.5% in Revenues. This does not make sense.

And the S&P isn't just disconnected from the Economy, it has become disconnected from its own sales numbers! As you can see from this chart – since 2007 (before the last collapse), the S&P is up over 200% (this chart only goes to 2021) in PRICE but it's up just 51.5% in Revenues. This does not make sense.

We have to ask ourselves, what is more likely to happen first? Are sales for the S&P going to double or are the prices we pay for stocks going to come down? At the moment, the bond market is crashing and housing is too expensive and commodities are out of control so the stock market still looks pretty attractive BUT, as bond rates move back to 5% (projected at the end of the year), then those "risk-free" 5% gains begin to look very attractive vs a massively overpriced stock market and certainly, by the end of 2022 – we're not likely to see S&P sales up 100%, are we?

So: PREPARE FOR A CORRECTION! I know it never seems to come but math is math and those who deny math end up sailing their ships off the edge of the World. What we have now on that monthly S&P pattern is a "thirsty giraffe" pattern – and we all know what happens when a giraffe takes a drink, right?

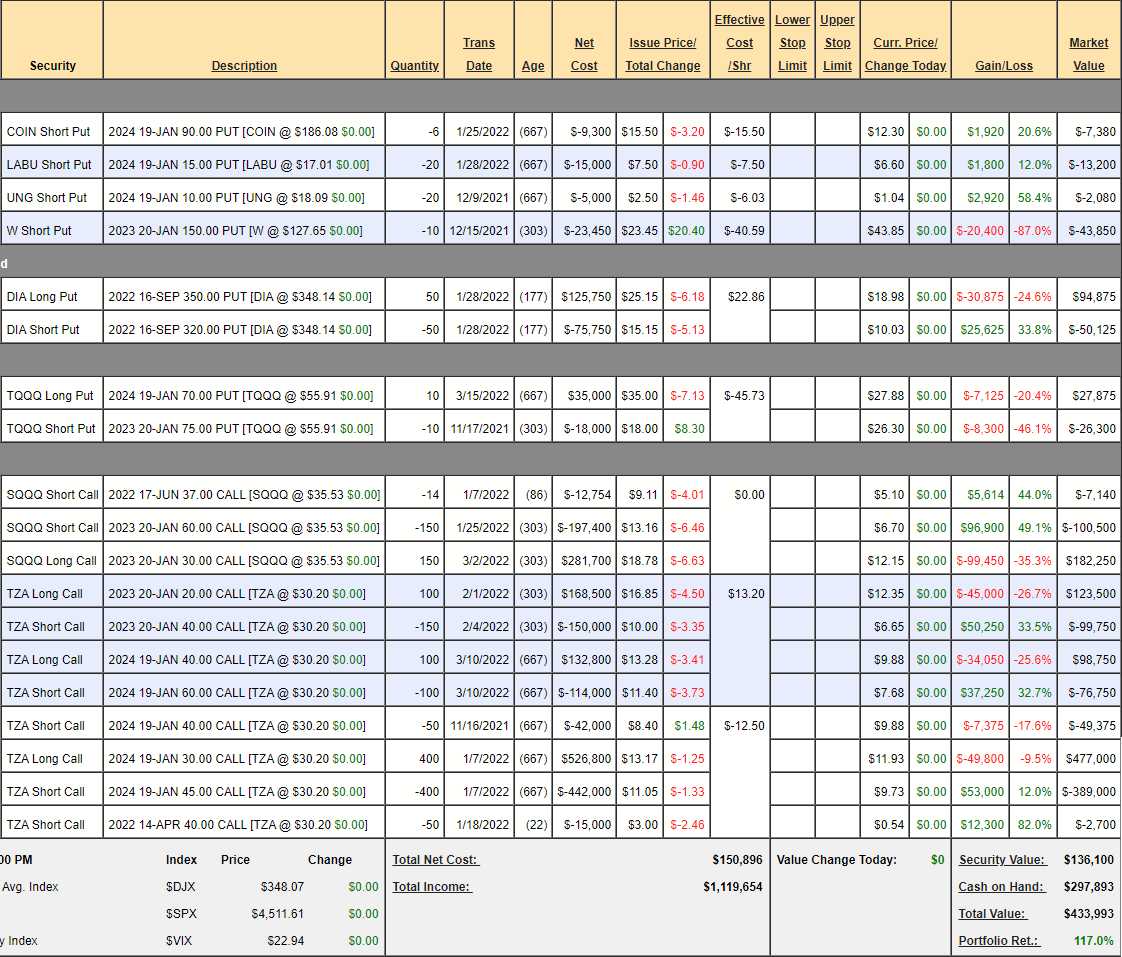

We talked yesterday about taking advantage of market bounces to press our hedges and the Nasdaq is up over 10% since March 15th (13,000) and the Russell is up 8% (1,920) and SQQQ and TZA are the primary hedges in our Short-Term Portfolio and our STP is at $433,993 and our LTP is at $2,579,568 for a combined $3,013,561 and that is up $200,000 since last week's review of our paired portfolios (which began with $600,000 on Oct 28th, 2020). That means we have $66,000 to spend on hedges but, since $3M is where I was planning to cash out – let's spend $100,000 to be a bit more cautious.

As noted in our last review, we have already purged every position from the LTP that we're not ready to ride out a 50% correction with but, at a combined $3M – I'm not sure we should as CASH!!! is by far the best thing to have in a market crash. But, for now, since it's possible there will be more stimulus (China just dropped some on their markets) and the war might end – we still aren't excited about giving up our longs – which leaves us with the option of improving our coverage with more shorts.

Our Short-Term Portfolio (STP) as it stands now:

- Short Puts – COIN finally found a bottom.

- DIA – If we buy back some short puts, we can be more aggressive selling short-term short puts on the dip so let's buy back 15 (since they are profitable) Sept $320 puts for $10 ($15,000). We're at net $36,000 on the $150,000 spread and now uncapped on 1/3 so this is great protection and we already had one successful short put sale where we made $4,400 on the March $335 puts – thanks to last week's rally. Let's call this $110,000 of protection (I'm not going to do all the math this morning).

- TQQQ – We just covered the short Jan puts so not much to do now but wait for expiration.

- SQQQ – The Jan $60 calls are not likely to get hit so money is better spent on the long end. If we buy 50 more $30 calls it's about $60,000 but the Jan $25 calls are only $14, so it will cost us less than $30,000 to roll $75,000 deeper in the money and that then will position us better to sell short calls down the road – so a good investment. Now we are in the $525,000 spread (with 1/4 uncovered) for net $74,610 so it's $450,390 of downside protection.

- TZA 1 – Since they are up 33%, let's buy back 50 (1/3) of the short Jan $40 calls for $6.65 ($33,250). We have $400,000 worth of protection at net $79,000 so $321,000 of downside protection.

- TZA 2 – Let's offer to roll 200 of our 2024 $30 calls at $12 to the 2024 $25 calls at $13.50 (no more than $1.75 for the roll would be a good deal). That will put us $100,000 deeper in the money for net $35,000 and again, it will make it easier to sell short calls. Let's also buy back the 50 short April $40 calls for $2,700 as they can only hurt us. Without the roll, it's a $600,000 spread at net $38,625 (aren't options fun?) that's at the money with $561,375 downside protection.

Of course these downside numbers assume we'll be able to roll out of trouble on any shorts we have sold but there is no severe risk at the moment. Overall, we have $1,342,765 and we've added 33% more downside protection just like that – more than the $200,000 we've gained so I feel good about our hedges again and, when we feel confident in our hedges – it makes us confident to go out and look for more longs, right?

BALANCE is the key to a happy portfolio, and happy trading!