Non-Farm Payrolls are out at 8:30.

Non-Farm Payrolls are out at 8:30.

Expections are that 500,000 new jobs were added in March and remember, that's extra-impressive since our population hasn't grown at all since 2020 and, usually, we need 150,000 a month just to cover 2M new Americans each year. So 500,000 new jobs with no population growth means LOTS of people are getting paid and, with minimium wages rising as well (we will also get Wages Reports), it means US Consumers have much more money to spend.

Personal Income was up 0.5% for Feb but, unfortunately, PCE Inflation was up 0.6% – so wages are not keeping up with inflation and that's scary, which is why Personal Spending was only up 0.2% – as consumers are starting to cut back and reject these higher prices. A pullback like that is a Recession and Recessions make people sad and prolonged sadness about their economic situation can lead to DEPRESSION, which is where that term comes from – it's an attitude as much as a monetary crisis – people just don't want to spend anymore.

But we're not there yet, not by a long shot because there are lots of jobs and people whose wages aren't keeping up with inflation at their current job have, so far, had a pretty easy time of quitting that job and getting a better one – hence the "Great Resignation" we find ourselves in the middle of. Believe me, it's a lot better than a Great Depression – so have fun finding better-paying jobs, folks!

But we're not there yet, not by a long shot because there are lots of jobs and people whose wages aren't keeping up with inflation at their current job have, so far, had a pretty easy time of quitting that job and getting a better one – hence the "Great Resignation" we find ourselves in the middle of. Believe me, it's a lot better than a Great Depression – so have fun finding better-paying jobs, folks!

As you can see from the chart, Income is not keeping up with spending so, eventually, spending has to be cut back and keep in mind these spending levels were stimuluted in the past two years by stimulus but it's been a whole year since Biden gave us $1.9Tn in the "American Rescue Plan", which was $1,400 per person so about 5% of the average family's wages last year but it was also 10% of our ENTIRE GDP as stimulus – in a year GDP growth was 5.7% so -4.3% without the stimulus.

That's because, in 2020, the US Economy SHRANK by 3.4% and two years of shrinkage is, essentially, a Depression and the Government will spend whatever it takes to avoid that economic label. The Jobs, assuming they keep being added, SHOULD keep us out of major trouble as 500,000 $35,000 jobs is $17.5Bn x 12 months is $210Bn and, while that's nothing compared to a stimulus check for everybody – it's certainly a lot better than nothing.

That's because, in 2020, the US Economy SHRANK by 3.4% and two years of shrinkage is, essentially, a Depression and the Government will spend whatever it takes to avoid that economic label. The Jobs, assuming they keep being added, SHOULD keep us out of major trouble as 500,000 $35,000 jobs is $17.5Bn x 12 months is $210Bn and, while that's nothing compared to a stimulus check for everybody – it's certainly a lot better than nothing.

If only that were the only factor. Unfortunately, however, Inflation has reared it's ugly head and Real Hourly Earning have been shrinking for all workers at an alarming rate. In the past year, the Real Average Hourly Eanrings (adjusted for inflation) for Americans fell from $11.41/hr to $11.11/hr and that affects ALL 165M workers so 165M x 35 hr average workweek x 52 weeks x 0.30 less wages is $90Bn LESS Real Dollars earned by the exisiting workforce which cuts the $210Bn worth of new wages in half – SHRINKAGE!

8:30 Update: 431,000 jobs were added in March, that's a 14% miss but not so terrible but less is less but it's not less enough to take the Fed off the table as the worst kind of inflation is Wage Inflation because that doesn't help our Corporate Masters at all, does it? So the Fed will fight wage inflation with everything it has and adding 431,000 jobs to a stagnant populaiton is a lot of wage pressure – eventually. Remember, our Corporate Masters don't care that the Real Wages don't keep up with inflaiton – more is more to them and it impacts their bottom line and Earnings Shrinkage is the worst kind of shrinkage there is!

And, by the way, just because people have jobs doesn't mean they are making any money. Just ask any realtors you know or car salespeople or mortgage brokers – there are tens of millions of people who are "working" but not making enough money to live on – that's the kind of Stealth Recession that creeped up on us in 2007. Home Sales have been dropping for 3 consecutive months and now Auto Sales are down 16% from last year – both of those jobs pay a lot of commissions and now a lot less than they used to.

And, by the way, just because people have jobs doesn't mean they are making any money. Just ask any realtors you know or car salespeople or mortgage brokers – there are tens of millions of people who are "working" but not making enough money to live on – that's the kind of Stealth Recession that creeped up on us in 2007. Home Sales have been dropping for 3 consecutive months and now Auto Sales are down 16% from last year – both of those jobs pay a lot of commissions and now a lot less than they used to.

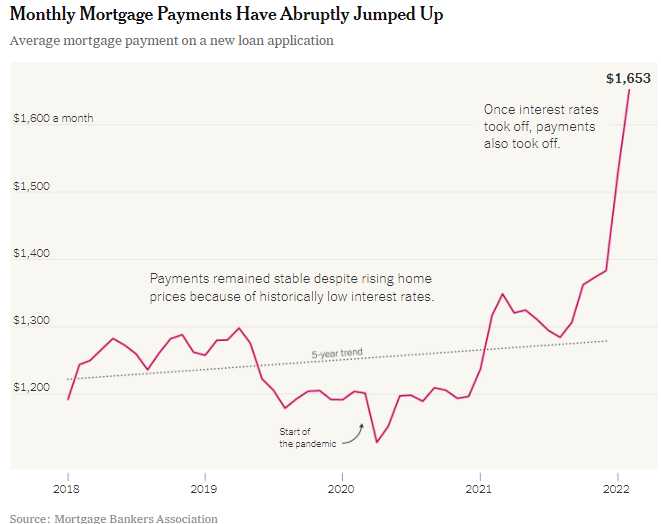

And it's no wonder Home Sales are slowing dramatically as the average 30-year mortgage has shot up to 4.67% from 3% last year and the Fed has only just begun to tighten. We've been disussing this in our Webinars and it's happening faster than we imagined and that does not bode well for home sales going forward as people don't buy a home, they buy a mortgage and a 50% jump in rates in a year with another 50% promised by the Fed during 2022 is a lot to swallow in an unstimulated economy.

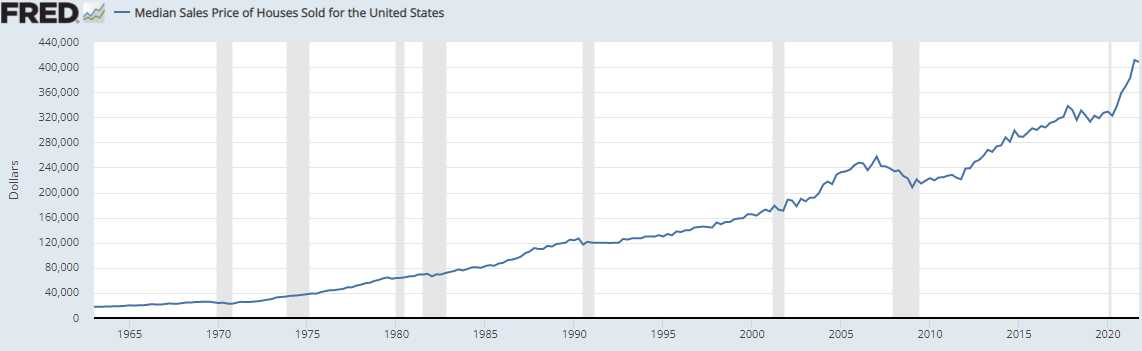

People get excited about these housing markets but what's going on in housing is a lot like what's going on in the market as LESS people are buying homes and paying more for them. With less homes being sold (almost 50% less), who do you think drops out? Not the Top 1% – they move when they feel like it and don't even flinch at the prices so it's less people from the bottom 99% buying their cheap homes who drop out of the market and THAT is what raises the average sales price of the homes that are still transacting.

From 1990 to 2006, home prices went from $120,000 to $240,000 before they crashed BUT post 9/11, rates were coming down and offset the last leg of those gains. We'll call 2010 $220,000 so $440,000 would be up 100% and we're just about there WITH rising rates so I think it's pretty much INEVITABLE that we will have a correction in the housing market of about 20% in the next 18 months.

Unfortunately, for home buyers, that correction in price will be wiped out by the rising rates and homes will be left no more affordable.

Have a great weekend,

– Phil