We're on the road to nowhere – still.

We're on the road to nowhere – still.

That's OK, it's better than the alternative, which is failing the 50-day moving average at 4,423 on the S&P 500 and re-visiting our March lows – we're saving that for mid-April… For now, we're content to drift along as if the War doesn't matter and Resurging Covid doesn't matter and Inflation doesn't matter and Fed Tightening doesn't matter and the Slowing Economy doesn't matter either – it just doesn't matter!

That link is from March 22nd, which was the day the S&P crossed back over 4,500 and I was skeptical then and I'm skeptical now as we struggle to hold it after testing 4,650 and coming back down. The down part I understand – it's the ups that are baffling me. The Fed raising rates 1.75% instead of 2% in the next 9 months is NOT rally fuel – it's "not as horrific as we feared" and nothing more.

And we don't even know that what the Fed is doing is going to work, do we? If the Fed tightens 2% and there is still 7.5% inflation – then they HAVE to tighen another 2% but that would be AFTER we suffer through a full year of 7.5% Inflation – again. We already see signs that the consumer is breaking down – I really don't think they can take another 7.5% added to their monthly expenses this year.

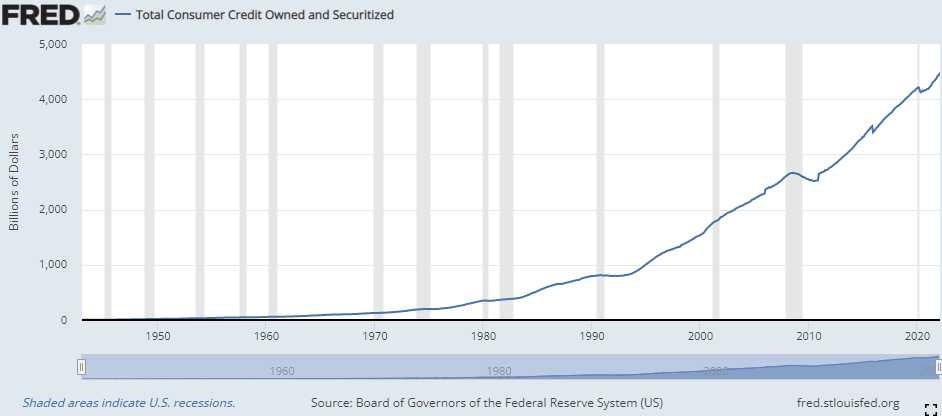

In fact, Consumers went $41.82Bn MORE in debt in February AND January was revised up from $6.8Bn to $8.9Bn and that was $25.17 (151%) MORE than expected by the Leading Economorons who are paid to expect such things. So the Fed is MUCH more behind the curve than they think and Consumers are in MUCH more pain than Economists think with what is now $4.48 TRILLION of outstanding debt.

Half of that debt was Credit Card Debt, now at $1.06Tn and that's costing consumers about $180Bn a year in interest and, as the Fed raises rates – those revolving credit charges rise as well. The other $3.4Tn of debt includes Student Loans ($1Tn currently on hold), Auto Loans, Home Loans and other fixed-rate loans to Consumers and, in 2008 when Consumers were extended and the markets collapsed, we were at $2.8Tn, not $4.5Tn and rising rates will put a lot of pressure on that number very soon.

Biden didn't extend Student Loan forgiveness for 6 months to be nice – he did it to avoid a market collapse as that's 1/3 of the fixed debt people owe and ONLY because that's on pause has everything else not fallen apart – yet. The average investor now is very much like a person watching an economic ice sculpure that fallen into a lava lake of rising rates and says "I'm sure it will be fine." On what basis will it be fine???

Biden didn't extend Student Loan forgiveness for 6 months to be nice – he did it to avoid a market collapse as that's 1/3 of the fixed debt people owe and ONLY because that's on pause has everything else not fallen apart – yet. The average investor now is very much like a person watching an economic ice sculpure that fallen into a lava lake of rising rates and says "I'm sure it will be fine." On what basis will it be fine???

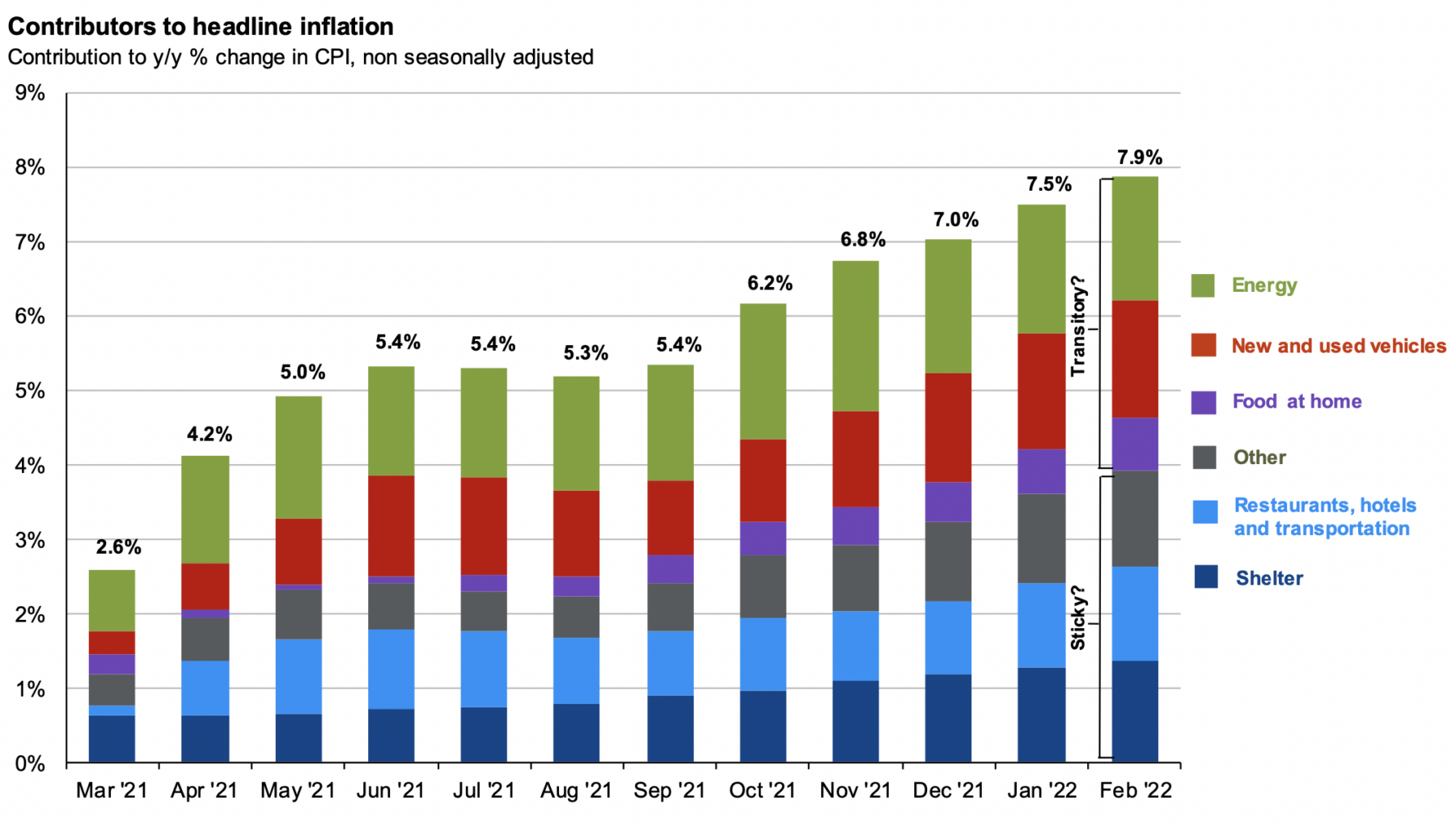

We just bumped up our hedges by $225,000 (20%) yesterday, taking advantage of all the fine-ness to buy more insurance while it is cheap. The next Fed meeting is May and February CPI hit 7.9% with oil PEAKING at $90 that month. Oil hit $130 early in March and has not been below $95 all month and I haven't noticed rents going down or Food going lower or lower menu prices at Restaurants, etc. Have you?

Well, those are the components of the CPI and how do you think the market will react to an +8% reading on the next report? The report that comes out Tuesday at 8:30, by the way… So please, don't be an Economoron – these numbers are right here in front of us and we KNOW they are going to be terrible so PLEASE make sure you are well-hedged going into the weekend – the weekend when Putin might make a harder push into Eastern Ukraine and ratchet up tensions even further.

Have a great weekend,

– Phil