This is clearly out of control.

This is clearly out of control.

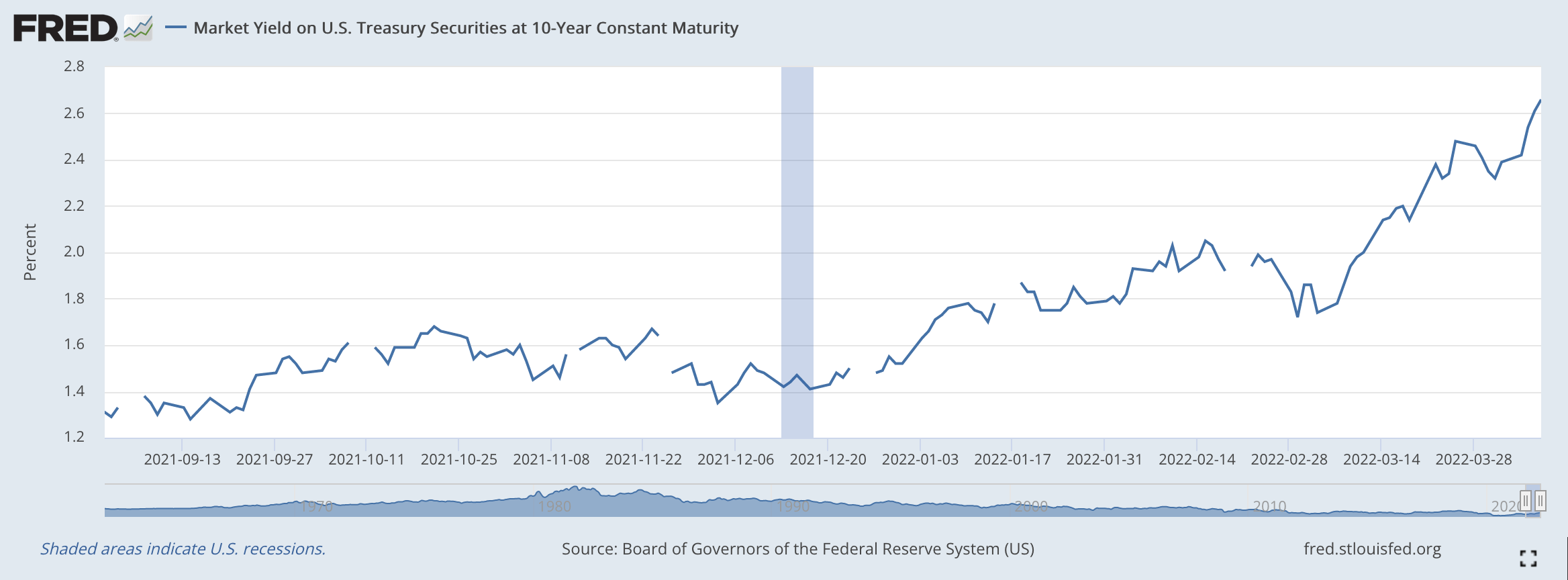

Officially, the Fed has rasied interest rates 0.25% since the start of the year but the interest on a 10-year note has gone up 1.4% and almost 1% of that has been in the past 30 days. This is what happens in 3rd World countries that are on the brink of collapse – not usually in the US of A.

Of course the Fed has told us they intend for Fed Funds Rates to be at 2% a the end of 2022 and that is 1.75% higher than where we began the year and, certainly, if you are going to lend the Government money for 10 years and you know the internal rates will be 2% at the end of the first year (and probably even higher next year), then it would be foolish of you to accept less than 3% – as 10-Year Notes generally command a 1% premium.to the Fed Funds Rate.

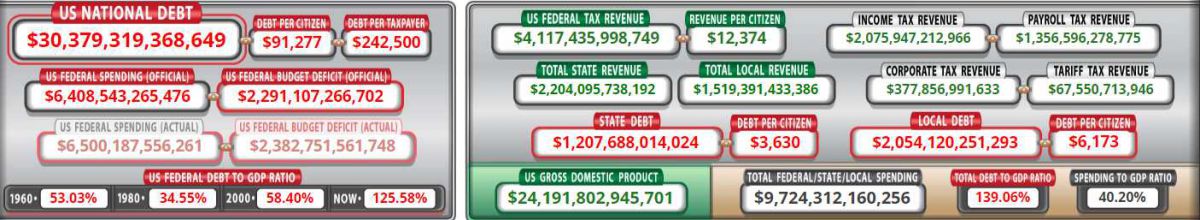

So, to some extent, we can just assume the 10-year is being forward-looking but this is a lot of looking forward so what if there are other factors in play and what if, disguised by the promised rate hikes, there is also a loss of faith in our country's ability to pay the money back? We're already $32Tn in debt so it's not too ridiculous to wonder where the Hell we'll be getting that money from – especially since our 2022 deficit is $2.4Tn WITHOUT any additional stimulus being passed and WITHOUT anything being done to address Climate Change, which is estimated to cost $2Tn a year for the rest of the Decade or, failing to do that, tens of Trillions after that as we have to adapt to a melting planet.

If we are running a $2.38Tn deficit and we currently collect $4.117Tn in taxes – how are we going to "fix" the deficit? The Budget is $6.4Tn so we can either cut Government spending by more than 1/3 or we can increase taxes by more than 50% – those are the choices that lie ahead of us. At the moment, we are choosing to just go deeper and deeper in debt but the rising rates are going to increase our annual interest on the debt from $430.5Bn (1.4%) to $955Bn (3.4%) and that extra $522Bn will then also become more of a defict we'll have to reduce.

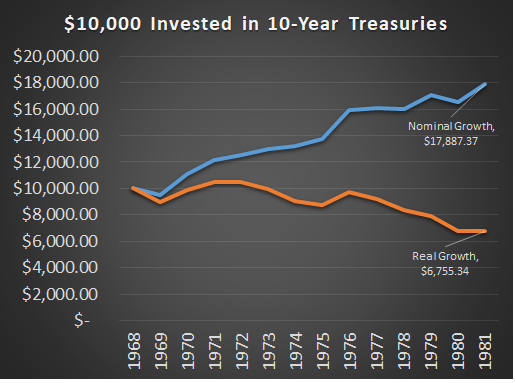

Would you lend us money for 10 years at 3%? Certainly not this morning as CPI just came in at an 8.5% annualized rate so, if you are lending money at 3% for 10 years, you are losing 5.5% per year to inflation so, when you are given you money back, it will have just 45% of the buying power it had when you lent it out. This is what happened last time we had inflation like this in the 70s.

Would you lend us money for 10 years at 3%? Certainly not this morning as CPI just came in at an 8.5% annualized rate so, if you are lending money at 3% for 10 years, you are losing 5.5% per year to inflation so, when you are given you money back, it will have just 45% of the buying power it had when you lent it out. This is what happened last time we had inflation like this in the 70s.

By the early 80s, people lending our Government money were demanding 15% and 18% interest on their money to stay ahead of inflation – Greece topped out at 21% in 2008 – we weren't so far off in the 80s. Of course the Government will tell you that they have things under control and this isn't going to happen again – that's because they need to borrow another $200Bn this month and every month after that.

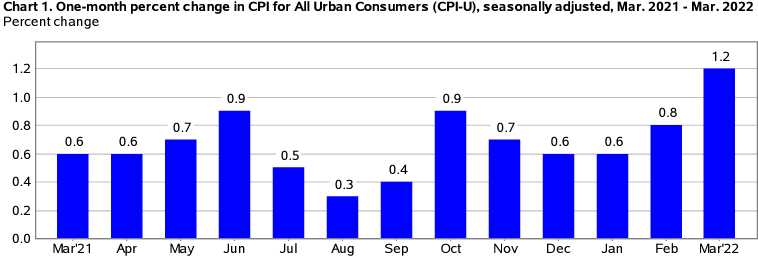

And I would LOVE to tell you that there are signs that Consumer Price Inflation is calming down – but it clearly is not:

As you can see above, February was 33% higher than January and March was 50% higher than February. Oil averaged $104 in March and, so far in April, it's been $100 so a very slight easing there isn't going to help much. The Futures are staging a relief rally of some sort since the Gasoline Index was up 18.3% in March and accounted for half the total gain but, as I said, down 4% in April won't fix that – February's average was $90 for oil and we still came in a 0.8% and if we're averaging 8.5%, then 0.8% in the 4th month won't move the needle much.

Not only that, but Oil and Gasoline are leading, not lagging indicators and it takes time for their prices to bump up the price of food and finished good so fresh horses will keep the CPI rising next month as well. These are the highest Consumer Prices ever recorded:

Not only that, but Oil and Gasoline are leading, not lagging indicators and it takes time for their prices to bump up the price of food and finished good so fresh horses will keep the CPI rising next month as well. These are the highest Consumer Prices ever recorded:

That's a record high, said Stuart Hoffman, senior economic advisor at PNC Financial. "This takes a huge bite out of consumer spending power, Chairman Powell is going to need a bigger rate hike! 50 bps hike in May is a done deal and another 125 bps by year end."

Even the usually doveish Charlie Evans of the Chicago Fed says he sees 2.25% to 2.5% as the necessary rate zone, and he wants us to get there in 12 months of less in order to contain inflation. Nonetheless, the indexes are now up about 1% in the Futures as the Core CPI was "only" 6.5% – as if that's a good thing when 2% is the Fed's goal. At the moment, people are grossly over-estimating the Fed's ability to control prices.

Maybe this time WILL be different but we're keeping up our hedges and we'll be going over our portfolio positions this week in our Live Member Chat Room as we try to surf this wild market wave.