Want to make a quick $10,000?

Want to make a quick $10,000?

S&P 500 Futures (/ES) pay $50 per point and we're below the 50-day moving average at 4,416 – so that would be the stop line and 4,320 is the strong bounce line and, failing that, we have no support at all until the weak bounce line at 4,180 – 200 points below where we are this morning (4,385). If we call 4,400 the stop line – then we risk losing $50 x 15 points = $750 against the potential gain of $10,000 if the S&P falls back to where we were a month ago.

We still have the war, we still have Covid, the Fed is still raising rates because we still have inflation – am I missing something? In fact, speaking of the Fed, St Louis President, James Bullard just said this morning that his target rate for THIS YEAR is 3.5%, not 2.5%.

Bullard cited the Taylor rule, a suggestion developed by Stanford College’s John Taylor that makes use of inflation, the unemployment fee and an estimate of the impartial rate of interest — a fee neither contractionary nor expansionary — to give his estimate. “I believe it behooves us to get to that stage by the tip of the year,” Bullard mentioned. This is clearly an indication that Bullard sees no chance that 0.25% rate hikes are going to put even a mild dent in inflation – as evidenced by Consumers putting inflation on their charge cards last month.

Bullard cited the Taylor rule, a suggestion developed by Stanford College’s John Taylor that makes use of inflation, the unemployment fee and an estimate of the impartial rate of interest — a fee neither contractionary nor expansionary — to give his estimate. “I believe it behooves us to get to that stage by the tip of the year,” Bullard mentioned. This is clearly an indication that Bullard sees no chance that 0.25% rate hikes are going to put even a mild dent in inflation – as evidenced by Consumers putting inflation on their charge cards last month.

There was a brief, shiny moment, at the beginning of this month, when the Fed and the Leading Economorons all agreed that Q1 GDP was growing at 1% but there's no money in agreeing with the Fed so the Economorons have raised their guidance to 2.5% for Q1 and now they get to be interviewed by the Financial Media to explain what it is they see that the people who actually use the data to report the official number do not.

There was a brief, shiny moment, at the beginning of this month, when the Fed and the Leading Economorons all agreed that Q1 GDP was growing at 1% but there's no money in agreeing with the Fed so the Economorons have raised their guidance to 2.5% for Q1 and now they get to be interviewed by the Financial Media to explain what it is they see that the people who actually use the data to report the official number do not.

We get the actual Q1 GDP next Thursday morning – so tune in for that market-mover and on Tuesday we get Durable Goods, Consumer Confidence and New Home Sales – key components in the GDP. Tomorrow we get Existing Home Sales but they are likely to be down as Mortgage Rates skyrocketed in the past 45 days. We'll also get Leading Economic Indicators along with the Philly Fed. Next Wednesday we also get the Beige Book – which will also give us a good feel for the upcoming GDP Report.

Whatever the GDP is next week, it's down from 6.9% in Q4 and let's do some math here to see where we really are. Let's say in Q1 of 2020, we were at $20Tn in GDP and then we dropped 9% in Q2 – that's $18.2Tn, right? Q3 was down 3% so $17.65Tn, Q4 another 2.5% down to $17.2Tn – that was where we bottomed out.

Whatever the GDP is next week, it's down from 6.9% in Q4 and let's do some math here to see where we really are. Let's say in Q1 of 2020, we were at $20Tn in GDP and then we dropped 9% in Q2 – that's $18.2Tn, right? Q3 was down 3% so $17.65Tn, Q4 another 2.5% down to $17.2Tn – that was where we bottomed out.

Q1 was a 1% increase, back to $17.38Tn, Q2 12% took us all the way to $19.47Tn, Q3 5% to $20.44 and last Q 5.5% and that's $21.56Tn. So, on the whole, we're up about 7.5% from where we started 2020 and that's not too bad for 2 years. Of course, it cost our Government $11Tn to get us here and now we have Inflation raging out of control but we didn't lose the patient – so far. Of course, my big issue with this is the S&P 500 was at 3,200 in Jan of 2020 and now it's 4,385 so up 37% on that 7.5% increase in GDP and that's just silly – especially when the boost was artificial and not likely to continue.

In fact, the Fed is ABSOLUTELY looking to reverse it – not only raising rates to AT LEAST 2.5% but WITHDRAWING $1Tn of QE PER YEAR for the next 5 years. To think that's not going to have a massive effect on our economy is nothing less than willful ignorance – though that's pretty much all you hear in the mainstream media.

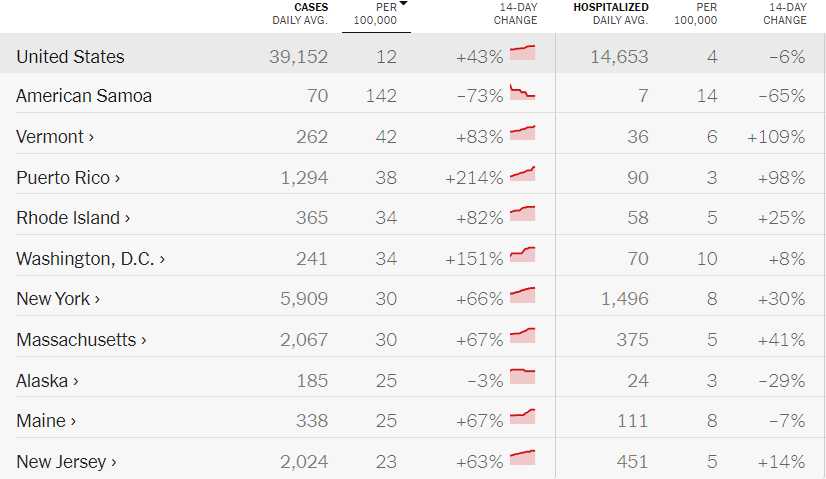

And, speaking of willful ignorance – a Trump judge has just invalidated the mask mandate on transportation – including Uber. So welcome to the newest GOP-backed experiment, America – can you survive another summer of denial? So far, 1M of you didn't but, as noted yesterday, that has slowed down to a rate of just 186,515/yr in Q1 and we can't have that so now the 10M people who fly in planes every day – along with trains, cabs, etc. – won't be wearing masks, despite being in close contact with poor air circulation for hours at a time. Let's see how that goes!

Isn't it amazing, by the way, that we can talk about 1,000,000 dead Americans, 1 in 300 of us, that have died of Covid in the past two years as if it's not a big deal? 58,000 Americans lost their lives in Vietnam and we put up a memorial. 405,000 in World War II, 116,000 in World War I and 655,000 in the Civil War. The nice thing about Covid is you don't have to go overseas or put on a uniform to be killed – it's right in your neighborhood!

So, once again this summer we are rolling out the red carpet – even as China is shutting down as they see a very dangerous threat from the new strains and would rather kill their economy than kill their citizens. In the US – we are working to do both at the same time.

Good luck to us all….