This has gone just as expected.

This has gone just as expected.

We opened the week at 4,250 on the S&P (/ES) and we're at 4,241 this morning. Anything that happened in-between is just noise, which we are able to ignore by focusing on our Bonce Charts™. Back on the 19th, it was "Technical Tuesday – Indexes Stuck in a Danger Zone" and that was at 4,400 – 3.5% ago.

If not for yesterday's irrational end-of-month window-dressing, we'd be starting at finishing the month at the lows and adding even more hedges than we already did. That's right, just like that – April is over and it's already May so we're already in the middle of Q2 and the war is still on and there is still rampant inflation and China is still locked down again. Our GDP was -1.4% for Q1 and, so far, Q2 is not looking much better.

Two consecutive quarters of economic contraction is called a RECESSION – the one they say won't happen until next year. Well, they can't be more wrong than having it happen in the very first two quarers of 2022, can they? We'll jump off that bridge when we come to it but, for now, we'll keep buffing up our hedges – as we did in our Alert to Members yesterday.

On the good news front – China is taking their foot off the necks of their Big Tech companies, hoping their recovery will boost their teetering economy. That's giving companies like BIDU, DIDI and BABA 10-15% boosts in pre-market trading and BABA is another position that's been killing our Long-Term Portfolio (LTP), with 40 long Jan $120 calls that should be back over $20 this morning and hopefully there's a nice short squeeze we can sell covers into.

| BABA Short Put | 2024 19-JAN 150.00 PUT [BABA @ $90.91 $2.59] | -15 | 2/16/2022 | (630) | $-69,000 | $46.00 | $19.85 | $2.95 | $65.85 | $-4.00 | $-29,775 | -43.2% | $-98,775 | ||

| BABA Long Call | 2024 19-JAN 120.00 CALL [BABA @ $90.91 $2.59] | 40 | 3/18/2022 | (630) | $99,600 | $24.90 | $-7.68 | $17.23 | $0.89 | $-30,700 | -30.8% | $68,900 |

As you can see from our short puts, we set a target price of $150 in two years as that would be $400Bn in market cap and they are dropping about $22Bn to the bottom line so 20x for the company which is growing rapidly at $130Bn in sales vs $540Bn for AMZN – so plenty of room for growth. That was our logic in March but the Chinese Government has since been relentless in their attack on tech and I don't think we can trust them not to go back to annoying them as soon as their economy regains some footing (if it ever does) – so I'm not longer thinking of BABA as a long-term hold, much as I like the company.

Speaking of AMZN at $1.5Tn in market cap with $25Bn in profits (60x earnings), they are down 10% this morning ($150Bn!) as Operating Cash Flow dropped 41% from last year to $39.3Bn and last Q it was $46.3Bn so serious deterioration with Cash from Operating Activity falling $2.8Bn vs gains of $12.4Bn expected by Leading Economorons. Again, the big picture here is that Analysts are idiots and all this sunshine they are blowing up your ass about an improving economy is BULLSHIT!!! Clear enough summary?

We sold 2 May $3,300 calls on Feb 4th for $33,000 in our Butterfly Portfolio, so we're thrilled with this development BUT we'll be looking for an opportunity to sell puts now as AMZN is being affected by supply chain issues and inflation they haven't passed on yet and, of course, the pandemic gave them a huge boost from stay-at-homes and that's easing off so ANY growth they have this year is actually amazing.

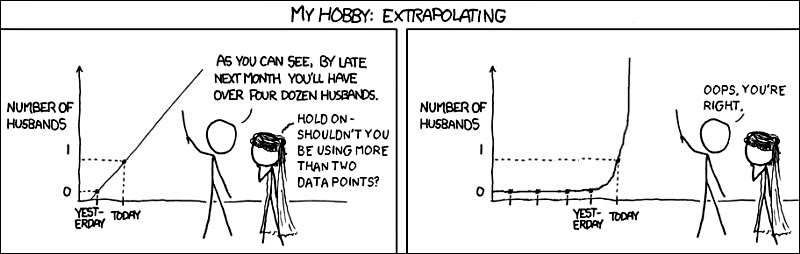

That's right Bezos and Company are just another bunch of Economorons who were extrapoloating their pandemic gains out to post-pandemic years and gave unrealistic forward guidance and Analysts are people who weren't smart enough to be Economorons so it's just a total disaster of expectations and nothing to do with the continuing ramp-up of growth in this dominant company. Still, we'll wait for the Downgrade Police to have at them before we place our short put bets.

Sadly, this is exactly what most Analysts do – they are just as lazy and stupid as the person in your office who drives you crazy with their incompetence. The problem with most of these Analysts is that they generally haven't actually worked in the fields they are analyzing, so they have no more than a basic academic knowledge of how these companies actually make (or lose) money. You know Sally in your office is an iditot because you understand her job and KNOW what she's doing wrong but you don't know the supply chain issues faced by GM or the pricing pressure felt by the dealerships so you let another Sally tell you any sort of BS and you kind of treat it like a fact, don't you?

Get out of that habit and your trading profits will soar!

Meanwhile, this is why I share my readings and observations with you and don't just throw out stock picks – you should understand WHY I am favoring certain trades, shoudn't you? This moring, Personal Income came in up 0.5%, which puts more pressure on Corporate bottom lines and Personal Spending was up 1.1% (but not on AMZN, apparently) with PCE prices up 0.9% so people aren't buying more stuff, they are just paying more money for the stuff they buy and they are dipping into their credit cards and savings accounts to do it – good for V, MA and AXP, bad for savings banks and the overall economy.

Meanwhile, this is why I share my readings and observations with you and don't just throw out stock picks – you should understand WHY I am favoring certain trades, shoudn't you? This moring, Personal Income came in up 0.5%, which puts more pressure on Corporate bottom lines and Personal Spending was up 1.1% (but not on AMZN, apparently) with PCE prices up 0.9% so people aren't buying more stuff, they are just paying more money for the stuff they buy and they are dipping into their credit cards and savings accounts to do it – good for V, MA and AXP, bad for savings banks and the overall economy.

Real Disposable Income dropped another 0.2% in February and there's no indication March will be any better when we get that report at the end of May – that's half a year shot already… The Employment Cost Index is also racing higher and they haven't even begun offering better benefits yet so lots and lots of pain ahead for employers as it's kind of hard to see what magic beans are going to fix the labor shortage – especially if the Republicans are successful in keeping Biden from re-opening the boarders to people who would love to come here and work for a living.

Real Disposable Income dropped another 0.2% in February and there's no indication March will be any better when we get that report at the end of May – that's half a year shot already… The Employment Cost Index is also racing higher and they haven't even begun offering better benefits yet so lots and lots of pain ahead for employers as it's kind of hard to see what magic beans are going to fix the labor shortage – especially if the Republicans are successful in keeping Biden from re-opening the boarders to people who would love to come here and work for a living.

But they are brown people so they don't want them. Maybe that's unfair as Ukranians are white people and the GOP doesn't want them either, do they? They just don't like people, I guess. 7 of the 39 people who signed the Constitution of this country were immigants including Alexander Hamilton and James Wilson, two of the three men who crafted the laws. When did we decide we hate immigants so much – wasn't this "The land built by immigrants" at one point? It still is judging by the landscapers and builders in my neighborhood…

Anyway, so when we see data and we don't see how it's going to improve – we need to make a mental note as it will affect the conditions going forward – especially when it's a major GDP component like Consumer Spending, which is 60% of our Economy. Let's be very careful out there – I'm mostly surprised every day I wake up and things haven't hit the fan at this point…

"WTF Was That!" – Stocks Explode Higher As US Economy Heads Into Recession

Alarmed by Russia’s Aggression, Europe Rethinks Its China Ties.

Ukraine Latest: Biden Seeks Aid, Power to Seize Russian Wealth

Biden’s Ukraine Aid Risks Slowdown as GOP Balks at Covid Tie-In.

Manchin Rejects Biden’s EV Tax Credit as ‘Ludicrous’

Shanghai Covid Cases Rise For First Time in Six Days

Rumors of Stagflation in First Quarter GDP

Yen Traders Brace for Choppy Holiday Week With Fed Poised to Act

Investor Who Called Housing Top and Bottom Says It's Time to Sell

The Permian Basin Oil Field Is Running Out of Workers, Materials—and Cash

Apple Loses All After Hours Gains, Slides After Warning Supply Constraints Will Cost $4-$8 Billion

Have a great weekend,

– Phil