It Feels Worse

Courtesy of Michael Batnick

It’s hard to believe that the S&P 500 is down just ~13.5% from its high. This was a common response to my post yesterday. It feels a lot worse.

The average stock in the S&P 500 is in a 21.8% drawdown, so it’s understandable why the first number feels off. The thing is, the index is market cap-weighted, so the average decline and the index decline rarely line up.

Let’s examine why it feels so much worse than average and how the S&P is holding up as well as it is.

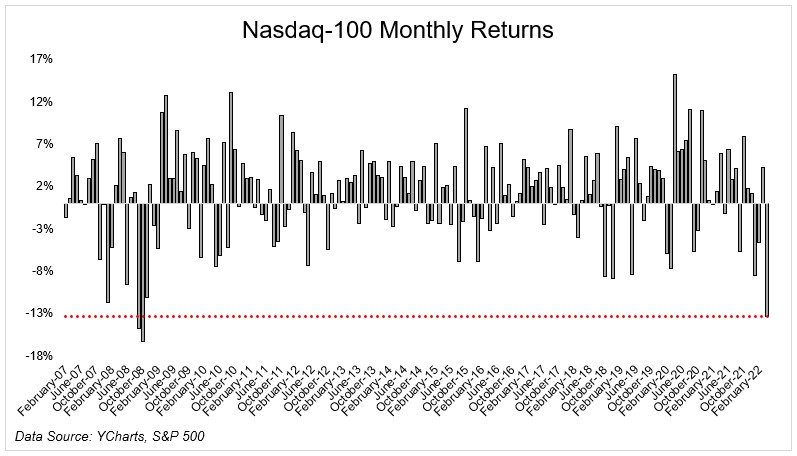

One reason this “it feels worse” dynamic is occurring is that we lost the leaders. Amazon just had its worst day since 2006. The Nasdaq just had its worst month since The Great Financial Crisis and is in a 22% drawdown.

The average FANMAG stock is in the worst drawdown going back to 2013. That’s being dragged lower by Netflix’s 72% crash. But even the median is down 29%, a deep decline and certainly way worse than the 13% decline for the S&P 500.

If you think the S&P 500 being in a 13% decline feels off, how about the equal-weight S&p (RSP) being down just 10%? How is this possible? HOW? Yes, a lot of stocks are blowing up, but a lot aren’t. When you look at the average drawdown by decile (sort by drawdown, take the average of 1-50, 51-100, etc), you can see that many stocks are actually near their 52-week highs.

One hundred three stocks representing 20% of the S&P 500’s market cap are within 10% of their 52-week high. These are some of the largest names holding up the index. Each is within 10% of its 52-week high:

- UnitedHealth

- Johnson & Johnson

- Walmart

- Proctor & Gamble

- Exxon Mobil

- Mastercard

- Coca-Cola

- Eli Lilly

- Pepsi

- Merck

The glaring thing about this list is that these aren’t popular stocks to trade, so they’re not really top of mind*. But those ten names above are $3.5 trillion in market cap, which more than offsets the declines of Amazon, Tesla, Facebook, and Nvidia, which represent $3.1 trillion of market cap.

This is a weird market. Tech investors are experiencing the dotcom blowup redux, while index investors are experiencing a very normal correction.

To this point, we’ve only looked inside the stock market, specifically the S&P 500. Once you factor in the Ark complex blowing up, the bond market getting crushed, inflation not slowing down, home prices rocketing, and the fed removing liquidity from the markets, it’s easy to understand why things feel a whole lot worse than they actually are.**

*More mental attention is spent on Moderna, Netflix, and Paypal, which are all down 70%. Or Facebook and Nvidia which are both down almost 50%

**People feel like things will go from bad to worse, which might or might not happen, but is a reasonable feeling either way.