These are the bounce lines on the S&P 500 (/ES):

These are the bounce lines on the S&P 500 (/ES):

I made this chart at yesterday's low at 3:21 pm, in our Live Member Chat Room and I said to our Members:

On the whole, it's very well-behaved. Notice at the bottom, the MACD seems oversold. That combined with we are testing 4,000 (which should be very bouncy) and the VIX around 35 means we are very primed for a bounce back up now.

The Fed is kind of a wild card but there are no major earnings likely to rock the markets. PFE is a relatively low-weighted Dow component since it goes by price and PFE is only $47.80. COP is the next biggie on Thursday but how can they have bad earnings? They are not even in the Dow – CVX is. No mega-tech to pull the S&P down either.

On the Calendar, nothing important tomorrow other than Fed rumors but it should be a bit bouncy and then PMI and ISM services and the Fed Wednesday but, if they don't disappoint, then good time to retest the strong bounce.

I sent an alert out to all of our Members and we adjusted our Short-Term Portfolio (STP) just a bit more bullish by cashing in some of the gains we made on our hedges. We were looking for at least a Weak Bounce to 4,160 and, as I said above, hopefully a Strong Bounce back to 4,320. At the moment (8 am), we're at 4,141 and we need some decent news to provide a catalyst if we're going to make it over the Weak Bounce line and have any chance to get to the Strong Bounce. Failing the Weak Bounce would be – BAD!

- Recession is ‘almost inevitable’: former Fed Gov. Ferguson says

- PGIM’s Hunt Says Bond Market Shows U.S. Risks Recession by 2024

- 10-Year Treasury Yield Hits 3% for First Time Since 2018

- Japan Seen Unlikely to Intervene on Yen With Fed’s Jumbo Hike Looming.

- Australian markets set to fall ahead of closely watched interest rate decision

- Korea’s Fastest Inflation Since 2008 Raises Rate Pressure.

- Ukraine Latest: Pentagon Sees Poor Russian Morale, Bad Logistics

- EU Plans to Issue Detailed Guidance on Russia’s Rubles-for-Gas Demand

- Russian TV Warns Britain Can Be 'Drowned In Radioactive Tsunami’ By Single Nuclear Sub Strike

- Kim Jong Un Warns Of 'Preemptive Nuclear Strike' If North Korea Threatened

- Oil Holds Near $105 as Demand for Fuels Offsets China Lockdowns

- Home affordability is nearly the worst on record as mortgage rates spike

- ‘Bubble’ hitting 50% of market, top investor warns as Fed gets ready to meet

- How Do Bubbles Form? Tulips and Gamestop Can Help Explain

- Wall Street Journal Claims "Shadow Crew" Of Billionaires Urged Elon Musk To Buy Twitter

So that's not helping and, meanwhile, over in Los Angeles, the tone at the Milken Conference is kind of doom and gloomy, with Citadel's Ken Griffin warning yesterday that the "West Faces Existential Problems," saying the Fed MUST have inflation down to 4% by the end of the year (less than half the current rate) or a 2023 recession becomes inevitable. This is essentially what the Fed has been hinting at with their more hawkish recent tone.

For all that tone, however, the Fed has only raised rates once in the past 10 years and that was 0.25% at the last meeting – that's speaking loud BS and carrying a microscopic stick… The Fed needs to be back at 2.5% by the end of the year and, in 2017, they only made half of that trip and they started in January. You can't get from here (0.5%) to there without being a lot more serious about this over the remaining 6 meetings – including tomorrow.

For all that tone, however, the Fed has only raised rates once in the past 10 years and that was 0.25% at the last meeting – that's speaking loud BS and carrying a microscopic stick… The Fed needs to be back at 2.5% by the end of the year and, in 2017, they only made half of that trip and they started in January. You can't get from here (0.5%) to there without being a lot more serious about this over the remaining 6 meetings – including tomorrow.

But, 6 x 0.5 is 3% so, I think the Fed has been floating the idea of 0.75% just to let the markets be relieved if they "only" hike 0.5% tomorrow. I don't see them going over 0.5% after that -1.4% GDP Report but they have forward inflation data we haven't seen yet and Natural Gas (/NG) is back at $8 this morning and Oil (/CL) is back at $105 and Gasoline (/RB) is back to $3.50 wholesale, which is averaging $4.20/gallon at the Retail level – just in time for our next Holiday Weekend (28th).

But tomorrow is Star Wars Day (May the 4th be with you) and we'll take things one day at a time. With so many factors undermining stability, Griffin warned that investors will need to be "quick" and "nimble" to take advantage of trading opportunities. He added that the next couple of months will be "incredibly telling" and that we are in a "tough time" to deploy capital, as the overall "pie" has been shrinking.

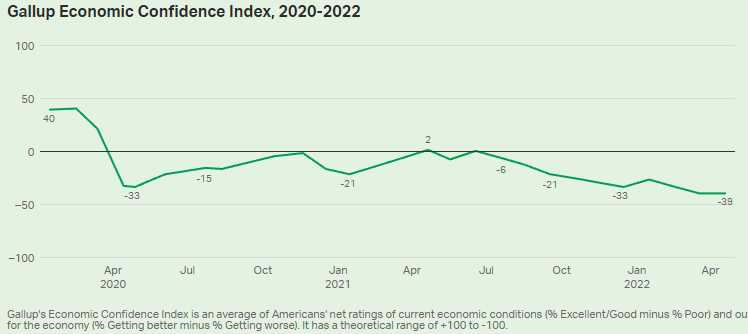

He's certainly right about that as a new Gallup Poll says Economic Confidence is now lower (-39) than it was in May of 2020 (-33), when Covid first hit and the markets were in free fall. Inflation is the top concern of 17% of the people polled in April – up 70% from 10% in February – that is NOT a thing that's improving….

He's certainly right about that as a new Gallup Poll says Economic Confidence is now lower (-39) than it was in May of 2020 (-33), when Covid first hit and the markets were in free fall. Inflation is the top concern of 17% of the people polled in April – up 70% from 10% in February – that is NOT a thing that's improving….

The overall Economy is the top concern of 12% and Oil Prices were mentioned by 6% but 7% of the people were more worried about Immigration vs only 5% who cite Russia as their top concern and only 4% listed Covid while a whopping 20% cited "Poor Leadership" – Fox Nation indeed! Just 2% of the people surveyed said that Economic Conditions were "Excellent" after $11Tn was spent to improve them over the past 24 months. There are many words for that but, on the Titanic, it was "ICEBERG!"

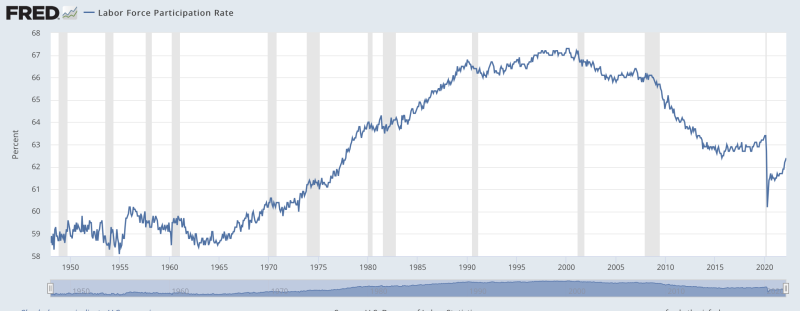

As you know, we have an acute labor shortage in this country and part of the reason is we killed 1M citizens with Covid and half the population has now had Covid and many of those people are suffering long-term symptoms that are still not properly understood. Labor Participation had been in decline for two decades but fell very sharply from 63.5% in 2019 to just over 60% when the Pandemic struck. To what extent did the Fed engineer this inflation to force people to go back to work?

As renters are acutely aware, it's very hard to live on a fixed income when they keep raising your rents and groceries and fuel costs at alarming rates. People who used to be able to make ends meet are now struggling (hence the poll above) and we're about 3M workers short at the moment – about 1% of the population. So the Fed keeps turning the screws (while crying crocodile tears about it) to push 3M people out of Retirement and back into the Labor Force. This is something they'll have to do more and more over time as our workforce ages anyway, so we may as well get used to the whip.

The Crimson Permanent Assurance (Monty Python's) from EpicFilmsGlobal on Vimeo.

Be careful out there!