It's Fed day!

It's Fed day!

It's also Star Wars Day – celebrate what you like. I can see some future Donald Trump saying "Yes, today is the day we celebrate the great Greg Lukos, who envisioned our great Galactic Empire and I will build a big, beautiful Death Star to wipe out our enemies – especially the ones that are hiding in Congress. Don't worry, I've made a list of them and we are already negotiating with Russian contractors to build our Death Star, who have promised us the biggest kickbacks – a great deal, to begin work as soon as they have finished counting the votes for our current election."

Back to the present. We got the bounce we expected yesterday, back to the weak bounce line at 4,180 and we're testing it this morning but there's nothing impressive about a weak bounce in the same way there's nothing impressive about a ball bouncing after you drop it. The bounce is no indication at all that it's going to go higher – that requires an additional catalyst and the market requires the same thing.

In reality, we are 7.5% below the 200-day moving average than that means that each day we do not improve, the 200-day moving average comse down 0.0375% or 1.68 points. We are at 4,491 now so tomorrow, unless we have a fantastic day, the 200 dma will be at 4,489. If we look closely at the chart, we can see the Death Cross occurred at about 4,470 so we have 2 weeks to get back over the 200 dma before very serious technical damage occurs and the 200 dma is in clear decline.

THAT is how you use a chart! NOT to GUESS where things might go but to calculate the probability of where the chart will be in the future – so we know what the TA sheeple will "discover" long before they discover it themselves. Do we have sufficient fuel to push the S&P 7.5% higher to stop the 200 dma from creating a worse chart in the next few weeks? Earnings have been very iffy so far and keep in mind May 15th is halfway through Q2 and the situations have not improved so no help there.

THAT is how you use a chart! NOT to GUESS where things might go but to calculate the probability of where the chart will be in the future – so we know what the TA sheeple will "discover" long before they discover it themselves. Do we have sufficient fuel to push the S&P 7.5% higher to stop the 200 dma from creating a worse chart in the next few weeks? Earnings have been very iffy so far and keep in mind May 15th is halfway through Q2 and the situations have not improved so no help there.

Inflation is still a thing, the War rages on and Congress is now consumed with the abortion battle – so no help there either. Oil is $106 this morning and Natural Gas is $8.33 – have fun heating those pools! The only thing the technicals have going for them are the technicals – which are currently indicating oversold but that means – if we can't get back to at least the Strong Bounce Line at 4,320 and the 50 dma at 4,374 (and falling fast), then we are certainly screwed and it will be time to cash out because hedges may not be able to help us enough to stick with what we have.

We added $560,000 worth of additonal protection in our Short-Term Portfolio yesterday, in our Live Member Chat Room, so our Long-Term Portfolio is now backed up by $2M worth of hedges – and it's "only" a $2M portfolio! Still, we don't just sit by and watch the money drain out of our positions so we're wathing the developments of the rest of this week very closely. Don't forget, Non-Farm Payrolls are Friday but that's minor compared to the OPEC meeting and the Fed meeting.

Though the Fed has hinted at a 0.75% increase, I don't think Powell has the balls to pull the trigger on that and 0.5% will be somewhat of a relief – until the minutes come out and people see that most of the Fed thinks we are not doing near enough to fight inflation. Anyway, so we have a very strong technical push to get back over the strong bounce line (4,320) to at least the 50 dma (4,374) and what we're really looking for is a failure to do so – THAT would cause us to get much more bearish.

Otherwise, we're content to be well-balanced in our portfolios as we watch earnings season move into its more manic phase.

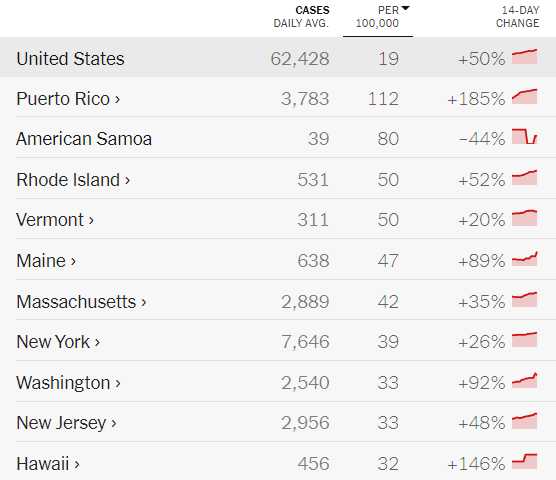

Speaking of manic – how's that ignoring Covid thing working?

Getting great again!