4,000.

That's out downside for the S&P 500 and it SHOULD provide support but that doesn't mean we can't overshoot to the downside by the same 160 points (weak) or 320 points (strong) that we expect for our bounces off the 4,000 line. An overshoot is not out of the question if people begin to panic and, don't forget, this is a market CORRECTION, not a pullback. A pullback assumes you will retake the previous highs while a correction assumes the previous traders WERE HIGH and now we are heading back to rational levels that can be supported by rational traders using rational valuations.

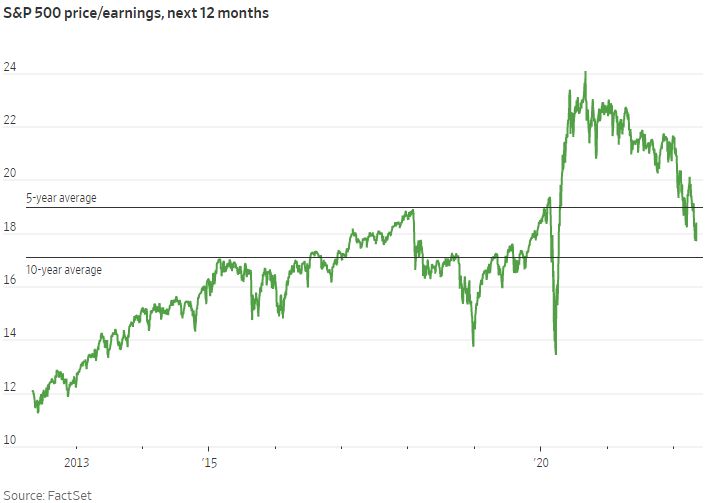

We've taken a very hard fall since the Fed Meeting last week, when we never should have gained 5% in the first place. Overall, the S&P is simply regressing from the 20% overshoot of the 4,000 line and, of course, if 4,000 is the correct middle of our range, then a 20% drop to 3,200 is not out of the quesition either – but we'll cross that bridge when we come to it. As you can see from this chart of S&P P/E Ratios, we're only just now coming into a "normal" range but those averages include the over-stimuluted averages of the last few years so I would say the lower, 10-year average is our best-case for settling in as reality once again begins to take hold.

This is why we pumped up our hedges last week, ahead of the Fed and that will help smoothe out the bumps along the way to 4,000 or even 3,200 but, if 4,000 doesn't hold, we will begin to add even more hedges and even to begin reducing our longs as there's no sense riding out another drop like the one we've already had. In order to find a proper bottom the things that are driving us there have to stop – or at least ease off:

- Is the Fed done tightening?

- Is Covid done infecting?

- Is Putin done invading?

- Are prices done inflating?

- Are jobs being filled?

- Are supply chain issues resolving?

- Is the Earth done warming?

Yes, some of these are going to be tough to fix but we've certainly tried ignoring them and that led to an overpriced market based on willful ignorance of the issues at hand and we're seeing how that works out now, aren't we? After telling us to BUYBUYBUY as the market dipped this year, CNBC is pretty much holding a funeral for it this morning – that's an interesting bit of capitulation. Still, we need to consider that the Energy Sector is up 20% this year and that sector will crash when oil prices come back down because, as usual, it is priced like they never will.

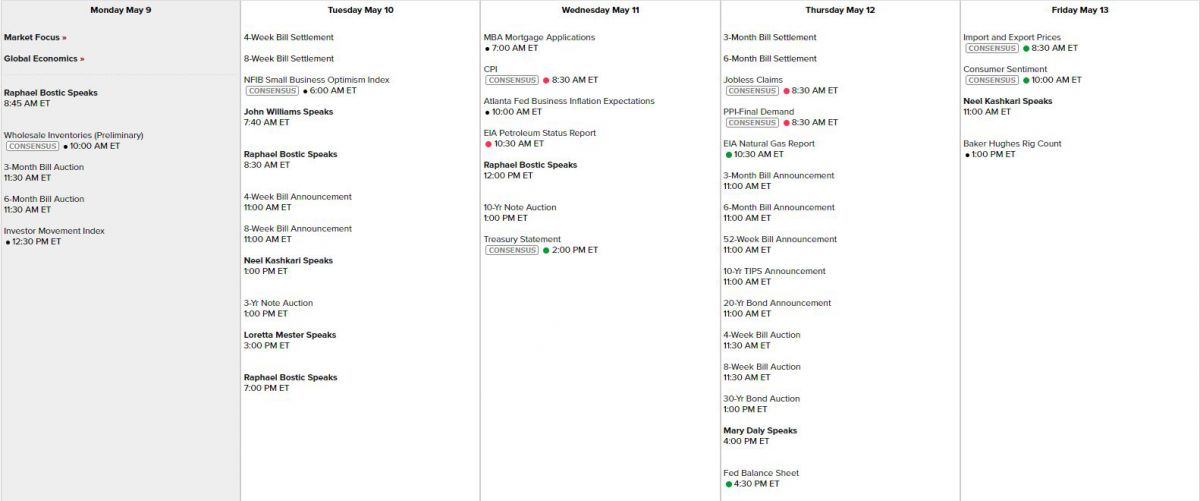

There's not much on the data front to put the brakes on a slide this week. We do have 9 Fed speakers this week but Kashkari was already on CNBC this morning, looking to put out some fires. It's not a big data week with nothing really going on until Wednesday's Atlanta Fed, CPI Report (ruh-ro!) and a very scary 10-Year Note Auction – supposedly with less Fed support for the first time this Century. PPI and the 30-Year Auction on Thursday and Consumer Sentiment Friday – not too much going on

One alarming bit of data left over from last week is Consumer Credit, which jumped $52Bn in March with Revolving Credit up 21.4%, which is terrifying as wages are simply not keeping up with inflation. "All of this newfound debt that Americans have is only going to get more and more expensive in the coming months," said Matt Schulz, chief credit analyst for Lending Tree. And, don't forget, Trillions of Dollars of Student Loan payments are still on hold – I don't even see how people will be able to afford for those to resume.

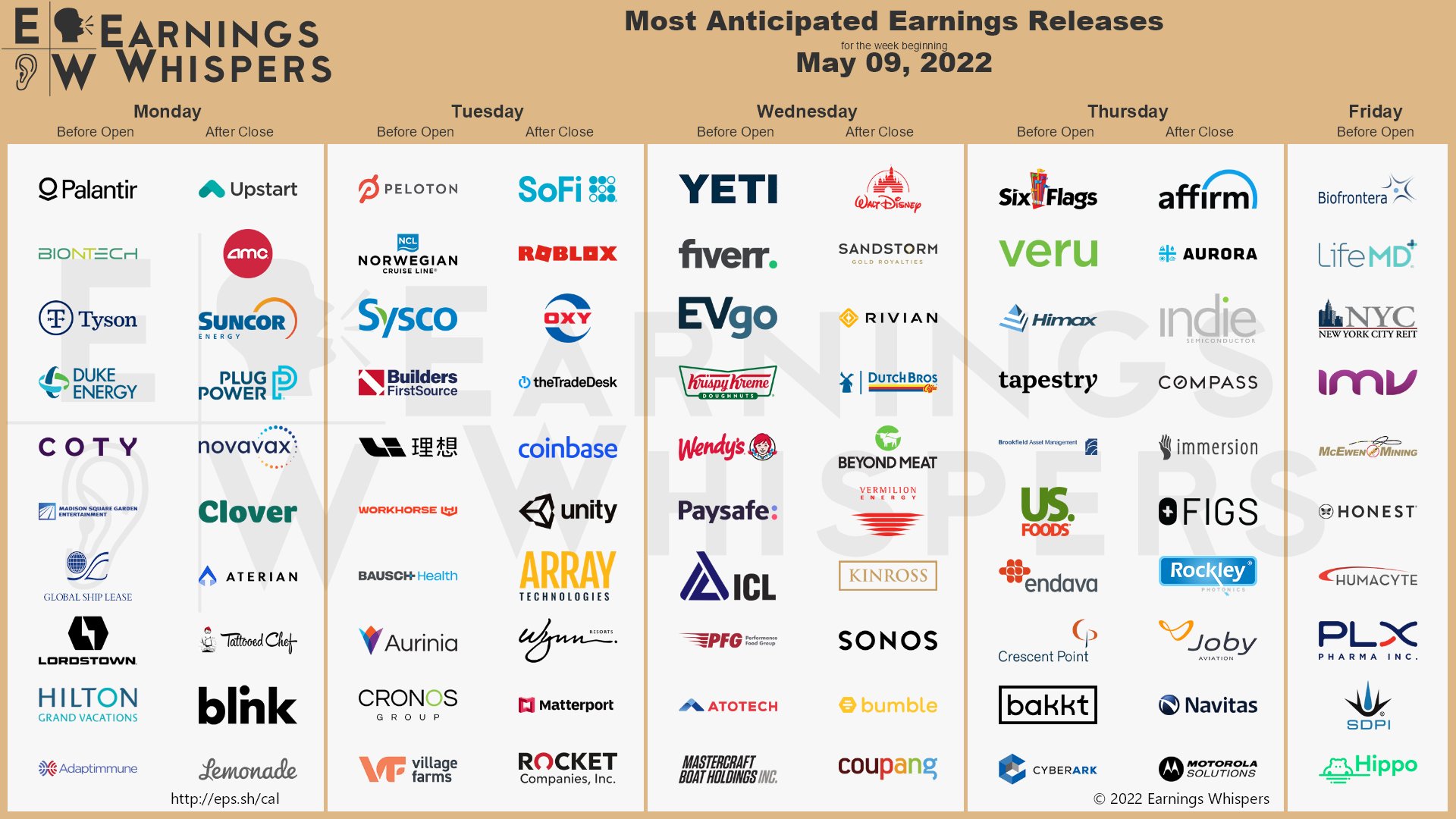

We still have plenty of earnings reports to contemplate as well:

Let's be careful out there!