We hit all our downside goals – so now what?

We hit all our downside goals – so now what?

As you can see from our S&P 500 chart, there's been a lot of damage done since the Death Cross last month but it's only within our predicted range – nothing to shake us out of our overall strategy. We anticipate the 4,000 line (blue) to evenually settle down as the middle of the range between 3,680 and 4,320, where the S&P should consolidate into July earnings reports and then we'll see how they go.

That means it's not likey we recover to more than 4,320 and, if I'm right, we'll see upside resistance at 4,000 and very strong resistance at 4,160 (weak bounce). That will bring the 200-day moving average down to 4,320 around the end of June and the 50-day should then be down at 4,160 and we'll just have to get used to the lower trading range.

These ranges, by the way, are based on VALUATIONS – we just use the chart to illustrate our point. We only seem like TA geniuses because our valuation models are so good…

To that end, next week we will be putting the rest of our plan into effect as we look to re-distribute about $1M in CASH!!! from our Short-Term Portfolio (which is where we hedge) to our other portfolios, where we will be analyzing and improving our positions. That's the only reason we didn't cash out compeletly last month – we wanted to ride out the crash to demonstrate how our system holds up through a crash and recovery cycle though, sadly, we don 't forsee too much of a recovery.

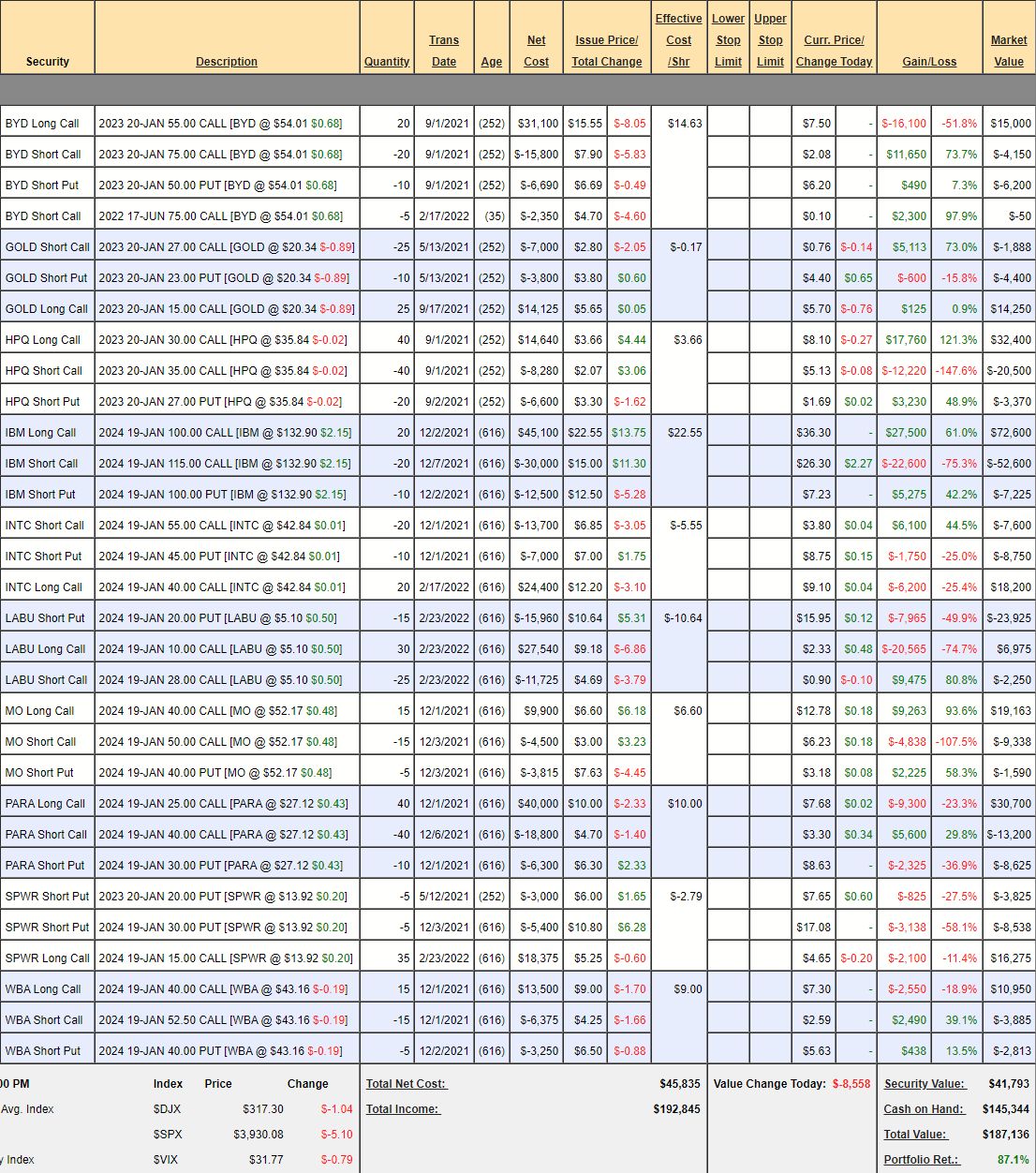

For example, our Money Talk Portfolio hasn't been touched since we were on the show on Feb 16th and, at the time, the portfolio was at $240,926 – up 140.9% in two years from a $100,000 start. We expected a rough quarter ahead so we left ourselves with $145,000 in CASH!!! to get us through the downturn. Now we have our downturn and the portfolio's net balance is now $187,136 down $53,790 (22.3%) on about a 15% drop in the S&P. Our options leverage cuts both ways, of course, and we suffer a bit more in a downturn. Nonetheless, this is the OPPORTUNITY we had hoped for to add positions as well as improve our existing ones:

- BYD – Good for a new trade. Not likely we'll adjust this as we have posiitons more in need of fixing than this.

- GOLD – A great inflation hedge and our position here is sound but we will take advantage of the dip to roll our long Jan $15s out to 2024.

- HPQ – Still at the top of our range so nothing to adjust. Net $8,530 on the $20,000 spread still makes a nice trade with about 120% upside potential if HPQ simply holds $35.

- IBM – Way ove the top of our range but only about $13,000 out of $30,000 potential is good for a new trade, of course.

- INTC – Good for a new trade.

- LABU – This Biotech ETF has been a disaster and I think, on the whole, I'd rather put the money into MRNA than a basket of Biotechs – so probably that's what we'll do next week.

- MO – Still over our target.

- PARA – Good for a new trade. I can't believe this thing is still this cheap. We'll be adding to this since it turns out our other positions don't need much fixing.

- SPWR – Good for a new trade. The Government is to blame with their tariff review that is holding everything up in Solar. Our long calls have not taken much damage and owning 1,000 shares of SPWR at $25,000 is not something that worries us so we'll probably sell 10 more puts and otherwise wait.

- WBA – Good for a new trade. I don't like that they are selling off Boots so I'm not adding more but the position is fine.

So a portfolio we haven't touched in 3 months is down 22% but there's really nothing to adjust (other than LABU) – this is just a normal pullback so I guess we'll be adding positions next Wedanesday.

Have a great weekend,

– Phil