There's no recession in Las Vegas.

There's no recession in Las Vegas.

I just got back from speaking at Benzinga's FinTwit Conference (my segment is here – covering the basics) and the casinos were packed and the restaurants were full and everyone was paying way, WAY more than they did last time I was there (2019) for shows, rooms, food, etc. Inflation is all over Las Vegas but it's certainly not stopping people from going there – nor did it stop casinos from taking in $1,355,230,000 in gaming profits in March alone – up 27% from last year's record highs.

I would say less than 10% of the people were wearing masks, not even people serving you food in many places and, though Nevada has a bit more Covid than most places, it's not enough more that I'd say it matters – though I did fight off a flu Wednesday and Thursday but it wasn't a big deal. Nice to know my immune system still works after 2.5 years of isolation.

Yes, going somewhere, ANYWHERE, is amazing – I highly recommend it and Americans seem to be taking my advice as the airports are packed and the airlines are fully booked, etc. Therefore, I'm not going to be tooo down on the economy or the markets – NOW that we've gotten a 20% discount off the top. I do not think we are going back to 4,800 on the S&P but I'm certainly not going to run out and short 4,000 – not with the robust activity I saw on this trip.

Now, obviously, the people who are in Vegas paying what is now $225/night for average hotels (was $125 in 2019- early 2021) and $120 for cheap seats to the big shows (was $69) are not the sort of people who are likely to be struggling. I do my research playing poker and ask people about their businesses and the economic conditions where they live, etc. – it's all market research – not gambling…

Now, obviously, the people who are in Vegas paying what is now $225/night for average hotels (was $125 in 2019- early 2021) and $120 for cheap seats to the big shows (was $69) are not the sort of people who are likely to be struggling. I do my research playing poker and ask people about their businesses and the economic conditions where they live, etc. – it's all market research – not gambling… ![]()

Anyway, people seem to be pretty upbeat – let's not discount the goodwill of Covid winding down (assuming it is) and things getting back to "normal". My issue with 4,800 (and the other highs, of course) was that it was based on an extrapolation of conditions when we were getting extreme stimulus (25% of our GDP) and, now that it's over and the Fed is "normalizing" rates – we can see how the market is reacting BUT – it's only going back to "normal" as well.

Rather than fearing inflation we need to embrace it because, as stock investors, our stocks will inflate too. That's because you buy stocks with deflating Dollars AND the Earnings and Revenues of those companies are also priced in weaker Dollars, so they also inflate. If YUM sells $6.5Bn worth of fried chicken and tacos at a 20% Profit ($1.3Bn) in 2021 and in 2022 10% inflation brings them to $7.8Bn in Revenues with a $1.56Bn profit, then their profits are up $260M (20%) and things look great – even though they sold the same amount of chicken and tacos with no actual growth.

The market simply is not smart enough to take that into account and don't expect that to change so we can expect the PRICE of the stocks to reflect those bottom-line gains as well, down the road. It's nothing unique – when I was a kid I used to by a pack of M&Ms for 6 cents and now they are $2 on sale and Mars now does $40Bn in annual sales for their 110th year in business. There's been Inflation, a Depression, several Recessions, two World Wars and two Pandemics along the way but I still bought a pack of M&Ms for the plane ride in 2022 – and it wasn't on sale…

The market simply is not smart enough to take that into account and don't expect that to change so we can expect the PRICE of the stocks to reflect those bottom-line gains as well, down the road. It's nothing unique – when I was a kid I used to by a pack of M&Ms for 6 cents and now they are $2 on sale and Mars now does $40Bn in annual sales for their 110th year in business. There's been Inflation, a Depression, several Recessions, two World Wars and two Pandemics along the way but I still bought a pack of M&Ms for the plane ride in 2022 – and it wasn't on sale…

As you can see from this chart on family wealth, there's an awful lot of money to be made providing consumers what they want and you can go several ways – you can provide to the masses (Walmart, Mars and Reliance, which is an Indian Telcom giant) or you can provide to the rich (Hermes, Chanel, Fidelity) or you can provide necessities, which I guess you can also call Reliance along with Koch and Al Saud.

These are the kinds of businesses that stand the test of time and, when times are tough, these are the kinds of businesses we should be investing in. Foot Locker (FL) may be having supply issues and may be having trouble passing rising costs on to their customers but they have had those problems on and off since 1879 yet they managed to grow to having 2,858 stores in 28 countries with $8.5Bn in revenues ($3M per store!) and easily $500M in profits yet you can buy the whole company at $29.77 per share for $2.86Bn, which is only 5.72x earnings.

The company is debt-free (net of cash) and, if you want to own the stock, it pays a lovely $1.60 dividend (5.37%) while you wait but we're not going to and, for our Dividend Portfolio, we can add the following trade:

- Buy 1,000 shares of FL for $29.50 (it's down today ahead of earnings)

- Sell 10 FL 2024 $35 calls for $5 ($5,000)

- Sell 10 FL 2024 $25 puts for $5.35 ($5,350)

We're setting a very modest exit target at $35 and we're agreeing to buy 1,000 more shares at $25 but those short option contracts bring our net cost down to $19,150 or $19.15 per share – a 35% discount off the current price and, if we are assigned another 1,000 shares at $25,000 – our average cost per share would be $22.075, 25% off the current price. That is our WORST case.

Our best case is that they keep paying that dividend and we get 7 payments of 0.40 ($2,800), which brings our net down to $16.35 and, if we are called away at $35 ($35,000) we make $18,650 (114%) in less than two years. That's what we can make betting a rock-solid retail stock goes up 15% in 18 months – why should we gamble?

As I spoke about in my lecture this weekend, we're Being the House – NOT the gambler and selling premium to people who think FL will go much higher and people who think it will go much lower and we don't care which way it goes because – as long as it doesn't fall more than 25% – we're going to make money!

In fact, for our Long-Term Portfolio, let's just keep an eye on them by selling 20 of the 2024 $30 puts for $8 ($16,000). That way, we collect $16,000 for promising to buy 2,000 shares of FL for $30 but we would keep the $16,000 so our net cost would be just $44,000 or $22/share – $7.50 (25%) less than the current price. Because we have plenty of margin in the LTP – we can make almost as much as we would in the Dividend Portfolio, without even bothering to own the stock.

Now, to put more tools to work, in our Earnings Portfolio, let's do the following spread:

- Sell 10 FL 2024 $30 puts for $8 ($8,000)

- Buy 25 FL 2024 $25 calls for $9 ($22,500)

- Sell 20 FL 2024 $40 calls for $3.75 ($7,500)

That puts us into the $37,500 spread for net $13,000 and it's my intention to make that up by selling 5-10 short calls per quarter along the way. For example the Aug $35 calls are $1.85 so we could collect $1,850 selling 10 of those but, since it's just ahead of earnings and we feel the market is underestimating FL – we'll take a chance and wait for the results first. We have 613 days so sell so 6 sales like that would put $11,100 back in our pockets and blow the doors off the dividends.

Our downside risk is more since we put cash on the table and we have aggressive short puts so, if we lost the entire spread and were assigned 1,000 shares at $30 AND we didn't sell any short calls (which would be silly), then we'd be in 1,000 shares at net $43,000 ($43/share). Remember, that first trade makes us $18,650 at $35 and our worst case is spending $44,000 for 2,000 shares. If all goes perfectly here and we sell those calls, our net goes to $1,900 and we make $35,600 (1,873%) at $40.

As long as we are ready, willing AND able to double down on FL if we have 1,000 at $43 and FL is at, let's say $20, then we'll own 2,000 shares at net $31.50 and we sell puts and calls for $10 and PRESTO – our net would be $21.50(ish) so that's what we really feel the worst case is and I doubt that will happen – so we make the trade!

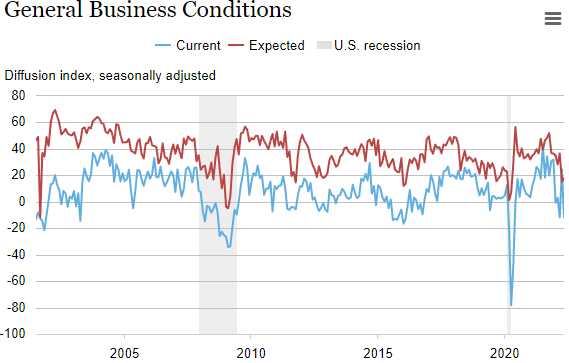

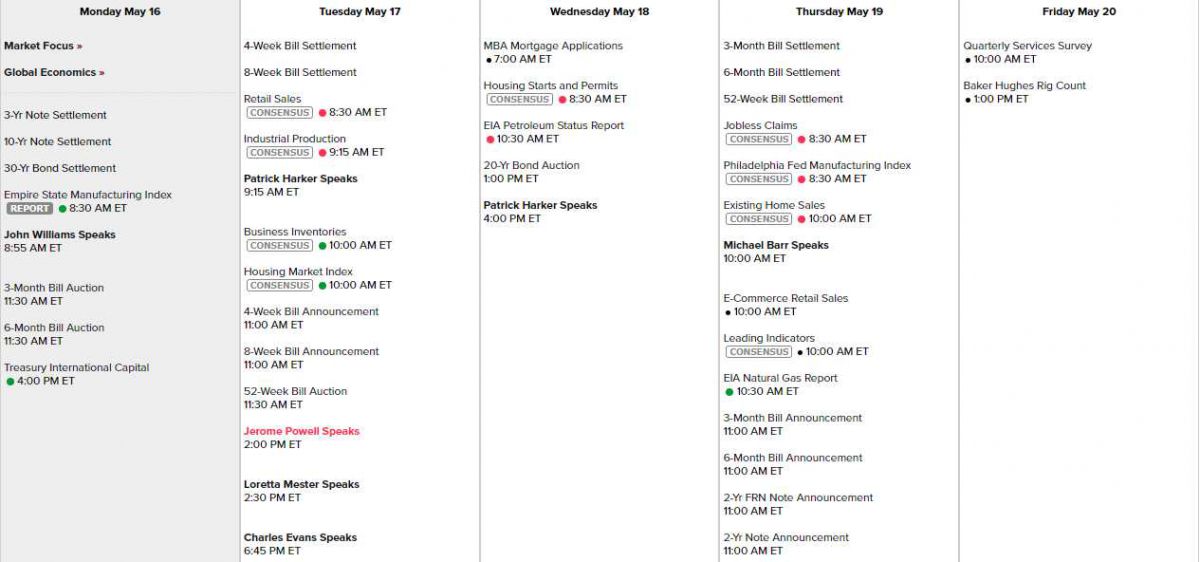

There's not much going on this week but Powell is speadking tomorrow at 2pm followed by Mester and Evans. We had Williams this mornning he's been no help and Harker goes tomorrow morning and Wednesday afternoon and Barr at 10am Thursday so the Fed is looking to send a very clear message that there WILL be 0.5% rate hikes over the summer. Meanwhile, we can mull over Retail Sales and Industries Production tomorrow, Housing Data Wednesday and the Philly Fed Thursday will follow this morning's Empire State Manufacturing Index, which killed the Futures with a surprisingly negative reading (-11.6) – this will be a huge concern if Philadelphia follows suit:

There's not much going on this week but Powell is speadking tomorrow at 2pm followed by Mester and Evans. We had Williams this mornning he's been no help and Harker goes tomorrow morning and Wednesday afternoon and Barr at 10am Thursday so the Fed is looking to send a very clear message that there WILL be 0.5% rate hikes over the summer. Meanwhile, we can mull over Retail Sales and Industries Production tomorrow, Housing Data Wednesday and the Philly Fed Thursday will follow this morning's Empire State Manufacturing Index, which killed the Futures with a surprisingly negative reading (-11.6) – this will be a huge concern if Philadelphia follows suit:

After growing strongly last month, business activity declined in New York State, according to firms responding to the May 2022 Empire State Manufacturing Survey. The headline general business conditions index dropped thirty-six points to -11.6. New orders declined, and shipments fell at the fastest pace since early in the pandemic. Delivery times continued to lengthen, and inventories expanded. Labor market indicators pointed to a modest increase in employment and the average workweek. Both the prices paid and prices received indexes moved lower, but were still elevated. Looking ahead, optimism about the six-month outlook remained subdued.

And then it's a Holiday! Halfway through the year already…. We still have earnings:

I love Clear (YOU) as a service – they just walked me right through 2 airports in record time. I don't play the stock because it's way ahead of itself but it will be interesting to hear how guidance looks now that travel and concerts and sports are back – we may see a very large boost in revenues, but still not enough to justify $6.5Bn in market cap.

WMT is a biggie but gave a wrong signal in 2008 as more and more high-end customers ran to WMT to save money and the low-end customers ran to the Dollar Store. TGT on Wednesday is a bit of a more reliable indicator of how the shoppers are holding up.