0.9%!

0.9%!

That's the rate this month in the 4th straight month of increases in Consumer Spending as April keeps it going for the year. As Inflation is 8.3% (officially) and that's 0.7/month, it means that Consumers are buying 0.2% more stuff and the rest is just paying more for the stuff they were already buying. 0.2% x 12 is 2.4% Real Consumer Spending growth – the rest is just BS. In fact, when adjusted for Inflation, Retail Sales FELL 0.7% in March and April is just bouncing back a bit.

But, as I said yesterday, we choose to be optimistic at the moment. My own consumer research indicated spending would be strong and, last Wednesday, we took some of our hedges off the table in our Short-Term Portfolio, lining ourselves up for what we hoped would be at least a weak bounce back to 4,160 – our predicted Weak Bounce Line on the S&P 500.

As you can see, we actually overshot the 4,000 line by a bit but now we're back and ready to do a bit of buying with all that CASH!!! we have laying around – if we can see a bit of strength around our bounce lines. So far, no good as we're barely holding the base-line at 4,000 and, failing that, our downside is now lined up with both Goldman Sachs (GS) and JP Morgan (JPM) who both issued targets yesterday agreeing with our 3,600 (10% below 4,000) low-end range.

Sure we picked the low end of the range for this year around Thanksgiving of last year – but we're happy whenever our slower friends manage to catch up to our analysis…

Speaking of slow friends catching up – PARA is popping 10% this morning as Warren Buffett announces a $2.6Bn purchase – close to 20% of the company! People at the Las Vegas Conference this week know that PARA was my top pick as it was my answer every time when people would ask me "What is your favorite stock at the moment?" and our Members, of course, are really tired of me banging the table on them but this is what it's all been for.

| PARA Short Call | 2024 19-JAN 47.50 CALL [PARA @ $28.02 $0.00] | -50 | 11/18/2021 | (612) | $-17,750 | $3.55 | $-1.38 | $-3.65 | $2.18 | $0.00 | $6,875 | 38.7% | $-10,875 | ||

| PARA Short Put | 2024 19-JAN 35.00 PUT [PARA @ $28.02 $0.00] | -10 | 11/18/2021 | (612) | $-7,500 | $7.50 | $3.35 | $10.85 | $0.00 | $-3,350 | -44.7% | $-10,850 | |||

| PARA Short Put | 2024 19-JAN 40.00 PUT [PARA @ $28.02 $0.00] | -10 | 3/29/2021 | (612) | $-12,300 | $12.30 | $2.23 | $14.53 | $0.00 | $-2,225 | -18.1% | $-14,525 | |||

| PARA Long Call | 2024 19-JAN 15.00 CALL [PARA @ $28.02 $0.00] | 50 | 2/18/2022 | (612) | $72,500 | $14.50 | $-0.13 | $14.38 | $0.00 | $-625 | -0.9% | $71,875 |

As you can see from our Long-Term Portfolio (LTP) position, we initiated with short $40 puts in March of 2021 and, as PARA got lower, we added a full position, selling more puts. Our net entry is $34,950 and we're obligated to buy 2,000 shares at a $37.50 average ($75,000) if PARA is below $35 in 18 months but, above $47.50 – we will get $162,500 back – so I still like this trade very much and we've had no reason to change our minds about our targets – just because The Beautiful Sheeple decided the stock was out of favor for the last 18 months. Warren and I both thank you for all your selling!

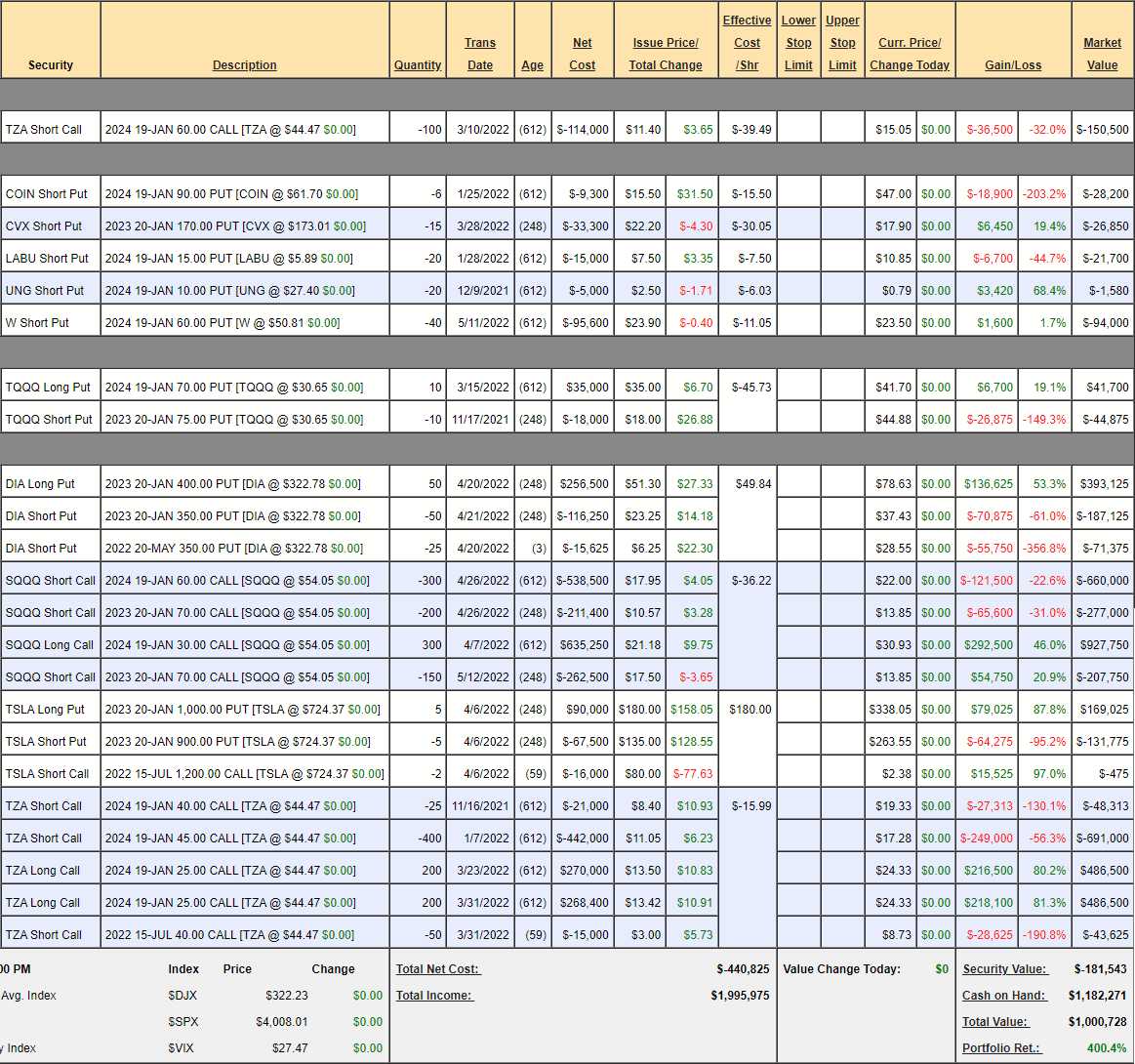

And thank the people who panicked and let us sell them our hedges for CASH!!! last week in our STP, which is now sitting on $1,182,271 in CASH!!! Part of that is "borrowed" from our negative $181,543 equity balance as we flipped bullish last week and we will have to use that money to cover back up if the S&P 4,000 line ends up failing again – that's not a risk we're willing to take:

Our major issues are the uncovered TZA 2024 $60 short calls at $150,500 and the uncovered SQQQ Jan $70 calls at $207,750. Technically, we haven't finished cashing out until we clean those up but we sold a lot of long hedges last week at what we HOPE was the bottom and, if we're right, then those short calls will expire worthless and we keep the cash – so it's worth the risk for the short-term to see how much of a bounce we get.

- COIN – Is another one we think is oversold but not enough so that we want to add to it.

- CVX – What remaings of our short on CVX is now a long and, at $115/barrel – it's a good long!

- LABU – The Biotech ETF has been way out of favor but I still like it.

- UNG – I think the Nat Gas ETF is a safe bet to hold $10.

- W – We just rolled to these from our TERRIBLE $150 short puts. At least now they have some premium to burn off. This is also the leftover leg of a successful short play we made.

- TQQQ – These are also leftovers after we cashed out the main short position. In theory, we should be able to roll the short Jan $75s to a beneficial spread for 2024 once the premium burns off.

- DIA – It's a bit lower than we expected so we'll have to roll the 25 short May $350 puts at $24.50 (big bounce this morning) to the July $350 puts at $27.50. No reason to change the target – our timing was just a bit off. So we originally collected $6.25 and now we're collecting $3 more for the roll so net $9.25 means our break-even is now $340.75 and, of course, we're up net $66,000 on the main spread already and it will be +$109,750 if DIA stays below $350 so all is well on this one.

- SQQQ – We have a lot of short calls now – they outnumber our longs so not good for a hedge. The 300 2024 $30/60 spread is net $267,750 out of a potential $900,000 so $632,250 of downside protection BUT we sold 450 Jan $70 calls against them. If they expire worthless, life is good as we owe $485,000(ish) on them, which is more than our hedges are worth but January is a long way away. I'm comfortable leaving 150 short but, if the S&P fails 4,000 – we'll have to either buy back 200 of the short $70s ($277,000 of our cash) or buy 300 more hedges for $267,750, which would give us another $632,250 of protection. SQQQ is at $54.05 and a 20% drop in the S&P/Nas to 3,600 (SPX) would pop QQQQ 60% to $86.48 and we'd owe 350 short callers $16.48 or $494,400 and that's not so bad if we're collecting $1,264,500 for 600 long spreads – so at least there's a plan – but let's' not delude ourselves that this is currently hedging anything.

- TSLA – All good here. It's a $50,000 spread that's deep in the money at net $37,250, not even counting the short calls.

- TZA – Here we have the perfectly fine main section but now we have 100 short 2024 $60s on top at net $150,500. Ideally, we'll roll them bit by bit to shorter-term calls (that's where the July short calls came from, the 2024 $40s used to be bigger). Since we were able to chew up the 2024 $40s that were extra, I'm confident we'll get rid of the short $60s so I will still count TZA as a hedge and it's an $800,000 spread that is currently net $190,062, not counting the short $60s. We'll call it $600,000 of protection.

So, before the market fell, we had $2M in protection and $400,000 in CASH and now we have $1.2M in cash and $600,000 in protection. We simply cashed out on the fall when we had the chance. By cashing in the longs at the full value of the spread, we don't really increase our risk that much – other than the cost of buying them back at a worse price if we change our minds so we can go right back to $2M in protection and $400,000 in CASH – but hopefully we get to keep the CASH!!!

Watch those lines very carefully!