We're happy because we are in CASH!!!

We're happy because we are in CASH!!!

We've had all of our Member Portfolios mainly in CASH!!! all year long, WAITING for this correction and it's finally here. All we have to do now is make sure this is only an overshoot of the 4,000 line on the S&P 500 and not a consolidation move on the way to 3,680 at which point we would have to consider that we over-estimated the mid-range of the S&P 500 at 4,000. That was our estimate for this year from last fall and it is possible we have 20% swings down to 3,200 (where 3,600 would become the midpoint) but we thought 3,680 would be the bottom – though that was a pre-war estimate.

That's what we THOUGHT was going to happen but now let's clear our minds and look at what is ACTUALLY happening (see my almost Nobel Prize-Winning "Microwave Oven Theory of Behavior"). Yesterday, the market was SHOCKED that Retailers are having trouble passing price increases along to Consumers. This is squeezing their margins. Newsflash: The Gas Stations, Restaurants and Utility Companies got to them first – they don't have anything left to give!

Once again, our last two years' Economy was 25% STIMULUS – it was not real. About $4,000 each year went to our beloved consumers and that is about 6.66% of the average family's total pre-tax income and about 10% of their after-tax money. That's gone and inflation has eaten another 10% so Consumers are reeling from shock.

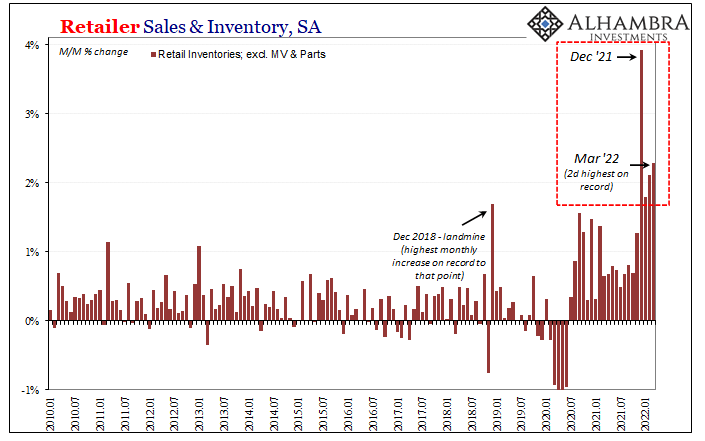

There's also an inventory issue. Last year, people were buying things for their yards and living rooms and this year there's not enough luggage and bathing suits to meet demand as people head out for their first vacations in over two years. Consumer demand doesn't usually flip that fas and big box retailers are used to seeing trends and ordering inventorie over YEARS of change – not months.

There's also an inventory issue. Last year, people were buying things for their yards and living rooms and this year there's not enough luggage and bathing suits to meet demand as people head out for their first vacations in over two years. Consumer demand doesn't usually flip that fas and big box retailers are used to seeing trends and ordering inventorie over YEARS of change – not months.

They are facicing very high shipping costs, rising labor costs, rising fuel costs to heat or cool thier huge stores, higher interest on carried inventory, etc. and they haven't been able to pass those costs along – yet. Also, the mix they have is wrong because, in inflationary times, people tend to switch to cheaper shampoos, etc. and that leaves Retailers "stuck" with items their customers can no longer afford.

Big Data will save the Big Box Retailers – they will take a hit and discount the Biolage and Paul Mitchell to clear the shelves and order more L'Oreal, etc. – it's just going to take them a quarter or two to adjust. One thing I do know from 150 years of watching Retail Trends – the stores will adjust and they will find a mix of products that people WILL buy that fits the store's margin goals. It's the manufacturers that come and go – not so much the Retail Stores themselves.

AMZN has a similar issue on their retail side and their retail side never did make money anyway – it's cloud services that drive their earnings. Even mighty COST has to make adjustments and they have fallen from $600 to $429 (28.5%), which is under $200Bn in market cap but, guess what – they only make $6Bn a year so it's still 33x earnings, which is still silly for a Retailer.

Do you know what the right multiple for a retailer is? 15x – that would be HALF of where they are now but COST is a great grower so let's call it 20x at $120Bn which is 35% below where we are now and that's $278 and, guess what? That's right where they were pre-Covid, pre-stimulus, etc. If you want to know if the stock you are watching has bottomed – check the 2019 levels and add 20% at most – unless something very special happened to change their business since then – that's probably where they are going back to.

- AAPL is 6.66% of the S&P 500 at $2.3Tn – I would say $100 ($1.5Tn) is a bit low as they are making $100Bn a year but AAPL has historically been undervalued so yes, $100 (20% over 2019) is a possible low for them but 20x is $125 and I'm pretty sure that should be a firm bottom.

- MSFT is 5.8% of the S&P at $1.9Tn – They make $70Bn with great growth so let's give them 20x or $1.4Bn but, unfortunately, that's still 26% below the current price so $187 works our right about 20% over our 2019 level.

- AMZN is 2.9% of the S&P at $1.1Tn – They should be making $25Bn but this year they will be lucky to make $10Bn and 100x for a company that's been around for 28 years is just stupid. Of course, if you think that's stupid – WTF were people thinking at 3,500? Here's the real danger as AMZN was trading stupidly in 2019, when it was making $11.5Bn so the danger for them is people getting less stupid and realizing paying 100x earnings is ridiculous because 50x is a 50% drop from here – and that's still too much!

- Well, that right there is 15% (1/6) of the S&P 500 and if $5.3Tn is 1/6.66 then the S&P must be worth $35.3Tn overall at the moment. Below AMZN we have GOOGL at $1.5Tn (lower weighted but higher cap) but they make $75Bn so we can give them a pass at 20x.

- Then we have TSLA, who are also ridiculous at $735Bn making $15Bn so about 50x means they could drop 50% and still not be worth buying. BRK-A is $680Bn and make $30Bn so they could drop 20% easily.

-

And that's it for the big boys, next is JNJ at $461Bn and 16.7x, FB is $520Bn and 15x after falling back to their 2019 levels:

- UNH at $442Bn is 20x, NVDA is $424Bn and 28x so danger there. They have good growth but I'm not paying 28x.

- XOM at $381Bn used to be the most valuable stock in the S&P. They are trading at just 10x their $40Bn in earnings but that's only because oil is so high ($110) at the moment.

- PG, JPM, CVX, V, HD – of that set, V is 25x and that's a worry but the rest are fine. Inflation is good for V but if the Consumers begin to fail – not so much…

So that is how we value the S&P 500 – we actually value each component and come up with an actual number that we can believe in. Getting into the mid and small-cap components (of the large-cap index), we see that they seem to have been sufficiently discounted that we should be OK but AAPL alone could give up $800Bn, $500Bn from MSFT $500Bn from AMZN, $130Bn from BRK.A, $350Bn from TSLA, $100Bn from NVDA, $100Bn from V and the same from MA – that's $2.58Tn out of $35.3Tn that can still drop before Warren and I start buying.

The good news is that's only 7.3% and I doubt the whole rest of the S&P has more than $3.5Tn left to give before becoming a bargain so let's say 17.5% below here would be the very worst case and that's still above 3,600 – which is the worst case we predicted back in November – even with the war factored in.

That means that, if we begin scaling into bargain stocks now, we shouldn't expect more than a 20% drop from here – even if the rest of the market drags us down and that means we can buy our initial stakes with confidence – as long as we are confident in our hedges – of course….

That means that, if we begin scaling into bargain stocks now, we shouldn't expect more than a 20% drop from here – even if the rest of the market drags us down and that means we can buy our initial stakes with confidence – as long as we are confident in our hedges – of course….

Speaking of hedges, this sudden dip was unfortunate for us because, as of Tuesday's STP Review, we had left ourselves bullish in the STP and we have since lost $112,000 when we should have made a gain. That's unfortunate but now we'll see how bouncy 3,840 is and, if we get back over 4,000 by tomorrow, we're safe to stay bullish but, if not, we'll need to re-up our hedges and that would be a shame as we have $600,000 in CASH!! I'd rather be putting to work buying longs.

Adding more hedges is very simple as we just identified that GOOGL, FB and JPM are all fairly priced so we promise to buy them by selling puts and use that to add more SQQQ hedges like this:

- Sell 5 GOOGL 2024 $1,600 puts at $100 ($50,000)

- Buy 200 SQQQ 2024 $40 calls for $30 ($600,000)

- Sell 200 SQQQ 2024 $70 calls for $23 ($460,000)

That's net $90,000 on the $600,000 spread that's $340,000 in the money to start. Upside potential is $510,000 if SQQQ is over $70 and it's now $57 so that's up $13 (23%) and it's a 3x ETF so a 7.5% drop in the Nasdaq would put us in the money. On the other side, we're committing to buy 500 shares of GOOGL at $1,600 and GOOGL is at $2,237 so another 28.5% lower and we already noted they are at 20x now so 14x does seem very unlikely and that would still be break-even.

Note that, while it is fine to sell GOOGL puts in a PM account, as it uses just $36,700.52 in margin to do so, you still risk being assigned 500 shares at $1,600 which is $800,000 or perhaps $400,000 in ordinary margin. That's fine for us due to our huge LTP but, for smaller accounts, make sure you sell puts in stocks you REALLY don't mind owning if the market does drop another 20-40% – we listed some good candidates back on the 11th.

Note that, while it is fine to sell GOOGL puts in a PM account, as it uses just $36,700.52 in margin to do so, you still risk being assigned 500 shares at $1,600 which is $800,000 or perhaps $400,000 in ordinary margin. That's fine for us due to our huge LTP but, for smaller accounts, make sure you sell puts in stocks you REALLY don't mind owning if the market does drop another 20-40% – we listed some good candidates back on the 11th.

And, of course, we already do have short calls against our hedges in the STP – that's why we lost $112,000 in the first place – this would fill in that hole.

So we know what we need to do – now we just have to watch and wait.