As I was saying last week:

Back on May 5th, the day before I left for Vegas, I reminded our Members on "Federally Fueled Thursday – Don’t Get Excited!" – as we were coming off a Powell-fuled rally – that coming back to S&P 4,300 at the time – was nothing to celebrate and, in fact, we took that opportunity to press our hedges. As I said in our Morning Report (which you should subscribe to HERE only if you want to know what the market is going to do before it does it):

As you can see from the chart, that's half of our RECENT drop that we recovered, not half of the 20% retrace from 4,800 to 4,000. And, I say retrace, not drop as a DROP would be 0.2 x 4,800, which is 960 points to 3,840 but, according to our 5% Rule™, 4,000 is the correct major support for the S&P and 4,800 was simply an overshoot by traders who did, in fact, get too exited. That means the move back to 4,000 is a CORRECTION – meaing we are heading back to the correct level – it may be quite a while before we see 4,800 again.

If 4,000 is our correct level then our correct trading range is likely to be 3,200 to 4,800 (20% either way) for years to come. I don't think we'll see 3,200 unless Putin does something very naughty or Covid comes back hard because the Fed and our soon to be elected Government are very unlikely to let that happen and, since Biden has cut the Defict to $2.2Tn from $3.5Tn last year – we've got $1Tn left to play with for emergencies.

That chart now looks like this:

What we really care about today though is our Bounce Chart, which we discussed later that same day in our Live Member Chat Room:

- Dow 36,000 to 28,800 would be a 7,200-point drop with 1,440 bounces to 30,240 (weak) and 31,680 (strong).

- S&P 4,800 is 20% above 4,000 and that makes it an 800-point drop with 160-point bounces so 4,160 (weak) and 4,320 (strong).

- Nasdaq is using 13,500 as the base. 14,100 is the weak bounce and 14,700 is strong.

- Russell 1,600, would be about an 800-point drop with 160-point bounces to 1,760 (weak) and 1,920 (strong)

31,680 on the Dow was green, 4,000 on the S&P was still black, the Nasdaq was all red but now miles below 13,500 at 11,800. Now that the Nasdaq has broken down, 12,000 should be the CORRECT base for that index and that means we re-calculate the drop from 15,000 (never actually hit it) and that's the 3,000-point drop with 600-point bounce lines so 11,400 is an overshoot (hopefully) and we're looking for 12,000 to hold – eventually. Finally, on the Russell, 1,760 went from red to black (on the cusp) and this chart needs to hold or we may have to reconsider where the bottom of the range is.

Still, this is exactly the range we predicted way back in the Fall, when we calculated the true value of the S&P and the Nasdaq (the Dow is too silly to calculate), so it's no big surprise that here we finally are. The real surprise is that it took so long for the market to realize what we considered very obvious.

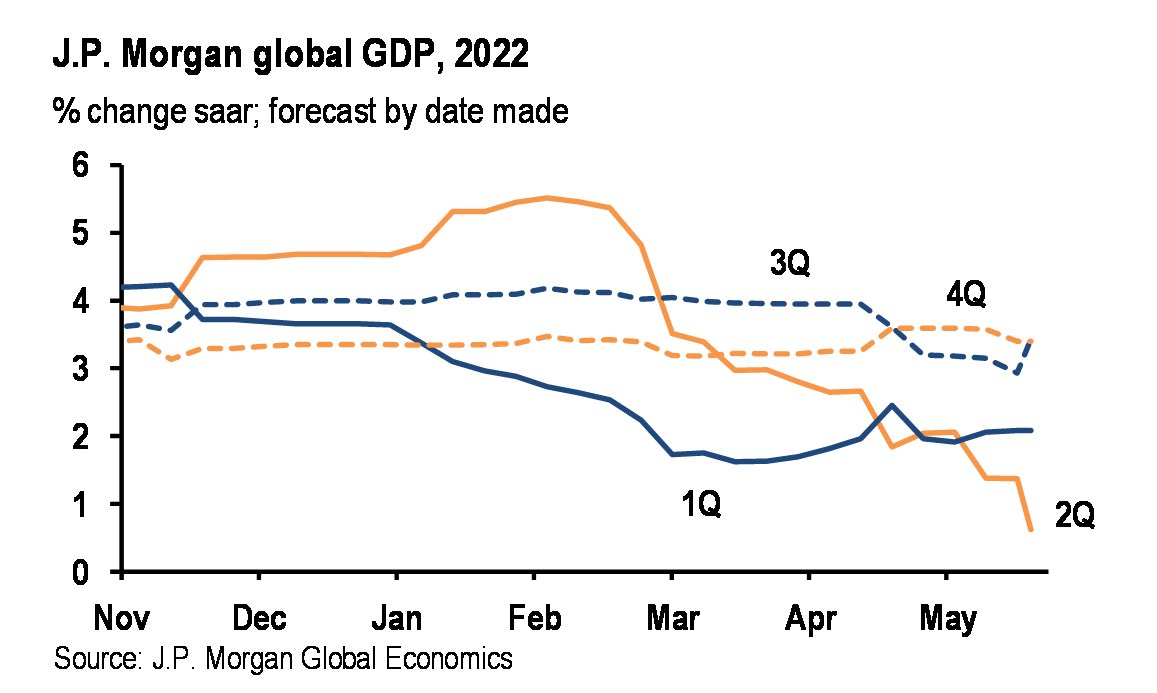

As you can see from JPM's GDP forecast, Q2 is going to be a real bummer – we'll be lucky if we don't go negative on a Global Basis. I don't think the US is going to be hit as hard as the rest of our war-torn, covid-stricken, inflating and on-fire planet as we, very fortunately, have two big oceans keeping us somewhat insulated from the madness (not that we don't grow our own madness right here in the USA, of course).

Anyway, the point is it's a big planet and we either need to spend the next 30 years cleaning it up at a price tag of roughly $5Tn per year, which is "only" 5% of our Global GDP AND it would contribute to the Global GDP anyway but this only works if we stop fighting each other and work together.

If we don't, then God (or Gaia or Karma) will decide who gets stuck with the bills from natural disasters, scarcity and disease. Rich countries like ours, of course, are gambling that the bill our 330M citizens get for NOT doing anything about Climate Change will be less than the bill we'll get for fixing it. Plus, we still get to live in air-conditioned comfort as we burn more fuel traveling to see a Paul McCartney concert (he's in Florida Wednesday) than half the families in the World use in a year.

Whether we sacrifice now or pay the price later – the Economy can't be expected to be the huge growth engine it once was. That means pricing stocks for huge growth is generally foolish – especially established ones like AMZN, NFLX or GOOGL as they've already saturated the market and now they are spending as much time dodging disasters as they do penetrating new markets.

Not only that but Global Population is already below 1% and, thanks to Covid, it's now projected that we top out under 10Bn people before humanity actively goes into decline. From 1968 to 1990 – growth was around 2% a year and that took us from 2.5Bn customers to over 5Bn customers and now we're at 8Bn customers but now that's slowing down and it's hard to grow your company's bottom line without new customers, isn't it?

Not only that but Global Population is already below 1% and, thanks to Covid, it's now projected that we top out under 10Bn people before humanity actively goes into decline. From 1968 to 1990 – growth was around 2% a year and that took us from 2.5Bn customers to over 5Bn customers and now we're at 8Bn customers but now that's slowing down and it's hard to grow your company's bottom line without new customers, isn't it?

In 1971, KO sang that they'd like to buy the World a Coke and the stock was a split-adjusted 0.75 at the time and now it's $62.86 – up 83x in 50 years but the population is pretty saturated with Coke now and we're not going to grow from 8Bn to 16Bn so I can pretty definitely tell you that KO will not be at $5,217.38 in 2072. KO grew at 9.25% for 50 years to get from 0.75 to $62.86, benefitting from the growth of international trade and a doubling of the population. Going forward, they only have population growth to count on and that will only be 25%, not 100% and, since 1971, there's Pepsi and Snapple and Dr. Pepper, etc. so KO will be lucky to grow 5% a year – to $720.84 in 2072.

That's how we have to look at all of our investments. Unless we begin trading with other planets (something Bezos, Musk and Branson are working on), this is a closed market and getting smaller every year so this "growth" that we take for granted is simply not going to be there AND, if we decide to do something about Global Warming to make sure humans make it to 2072, then shrinkage becomes a real possibility.

That's how we have to look at all of our investments. Unless we begin trading with other planets (something Bezos, Musk and Branson are working on), this is a closed market and getting smaller every year so this "growth" that we take for granted is simply not going to be there AND, if we decide to do something about Global Warming to make sure humans make it to 2072, then shrinkage becomes a real possibility.

Just like our parents, who bought $50,000 houses in the 1970s when $50,000 was two or three years' salary – maybe we're not really such clever investors – we've just been blessed with living in a time when the markets and the Global Economy were generally expanding. Now we're going to have to work a little harder to find value and we have to set our expectations for growth to a more realistic level.

At the moment, inflation is substituting for real growth but how long will that last before prices go high enough to send the consumers back into their shells? We're not there yet, we still have Credit Cards to max out and Home Equity lines to tap (just like our parents did) and I still believe the Government has got another round of stimulus in the chamber in order to protect their phoney-baloney jobs.

This inflation cycle, fortunately, began with higher wages (the push for $15 minimum wages) and then scarcity, which leads to higher prices and demand for higher wages, etc. so the consumers are not drastically behind – yet – but we'd better keep our eye on it because this is now a game of musical chairs and someone is going to end up on their ass!

We get PMI at 9:45 and then Powell will spin it at 12:20. New Home Sales are likely to remain slow at 10 and the Richmond Fed could go either way. Tomorrow we have Durable Goods, which have been struggling and would be an early sign that Consumers are cutting back – so we'll watch that closely.