It was a fairly uneventful weekend.

It was a fairly uneventful weekend.

Except for one thing… China began to re-open and that additional anticipated demand sent Oil (/CL) prices soaring from Friday's $115 to just under $120 this morning. That's putting retail Gasoline (/RB) prices over $5 per gallon in almost all of the country as we're now over $4 wholesale and, at the same time, the Dollar has popped back up from 101.30 to 102 – and that's puttting pressure on both indexes and commodities (thank Goodness in the case of Oil).

Oil may pop over $120 today as EU leaders are aligning to back an embargo of Russian Oil. This would be the 6th set of sanctions against Russia but the EU only consumes 2.3Mbd of the 7.8Mbd Russia exports and, oil being what it is – it's likely to be bought somewhere else – so it's hard to say how effective this will ultimately be. In theory, it will force Russia to sell oil in Asia, where oil is $34 cheaper per barrel and that will cost them $10Bn a year in lost revenues.

The definite effect is that it's going to make oil much more expensive in Europe, where Brent Crude is already $123 per barrel. The bottom line is inflation is still out of control and the ECB is planning rate hikes and Biden is meeting with Powell this afternoon to see if there isn't more we could be doing in the US.

The definite effect is that it's going to make oil much more expensive in Europe, where Brent Crude is already $123 per barrel. The bottom line is inflation is still out of control and the ECB is planning rate hikes and Biden is meeting with Powell this afternoon to see if there isn't more we could be doing in the US.

Over in Europe, German Inflation is flying, now at 8.7%, which is the most since 1963 in a country that deeply fears inflation (one of the things that led to WWII):

“Inflation is an enormous economic risk,” German Finance Minister Christian Lindner told a news conference in Berlin. “We must fight it so that no economic crisis results and a spiral takes hold in which inflation feeds off itself.”

Looks a bit like it's feeding off itself already, doesn't it?

I was in Miami this weekend and there were a lot of restaurants that are closing 1 day a week to manage their staffing shortages so we're not out of the woods in the US either. 5.260 flights were cancelled this weekend due to weather and staffing issues. Nursing Homes (another Florida issue) are also facing extreme staffing shortages and Trucking Companies are offering $30,000 bonuses to new drivers, the Army is offering $50,000 to new recruits and hotels aren't cleaning your room every day anymore. So don't think for a second we are near the end of this – still early innings, actually.

Staffing shortages and the mental health of the overworked staff were the top two concerns for Patient Health in 2022 in a study released by the Emergency Care Research Institute. We talk a lot about hedging stocks here at PSW but what about hedging other aspects of your life? Do you know which is the best hospital in your area to go to in the case of an emergency? This may be a good time to do a little research – just in case…

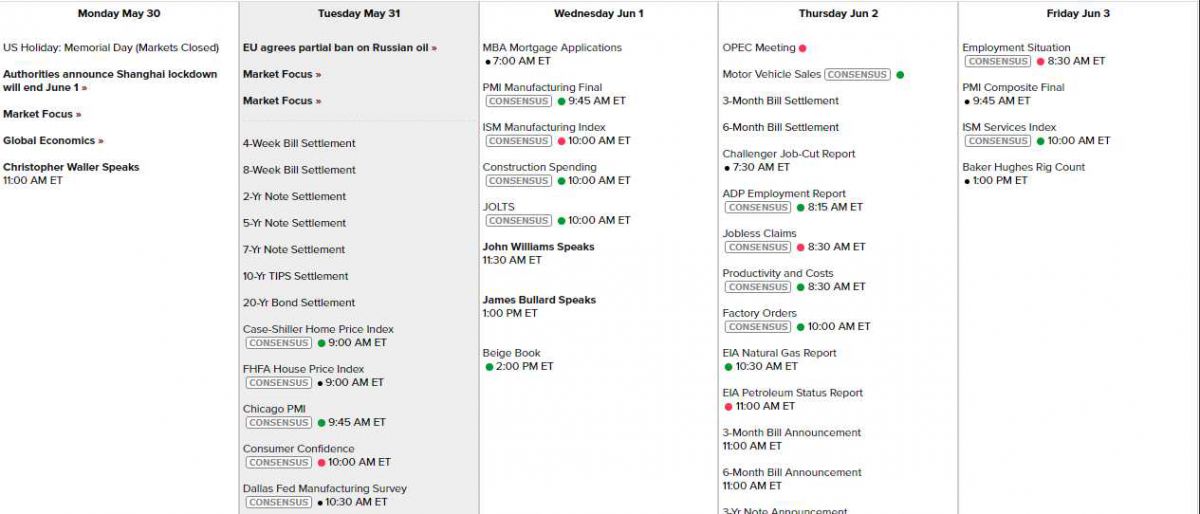

We have a busy, busy data week ahead with our 4 remaining Fed Speakers all bunched up on Wednesday and Thursday around the Beige Book – which may be showing signs of Stagflation at this point. Case-Shiller, Chicago PMI, the Dallas Fed and Consumer Confidence this morning with PMI & ISM tomorrow with the Beige Book in the afternoon followed by Productivity and Factory Orders on Thursday and PMI and ISM Services on Friday along with the Big Kahuna – the Non-Farm Payroll Report.

Still plenty of Earnings Reports coming across the wire but none that are likely to move the markets – though there are a few we have bets on: