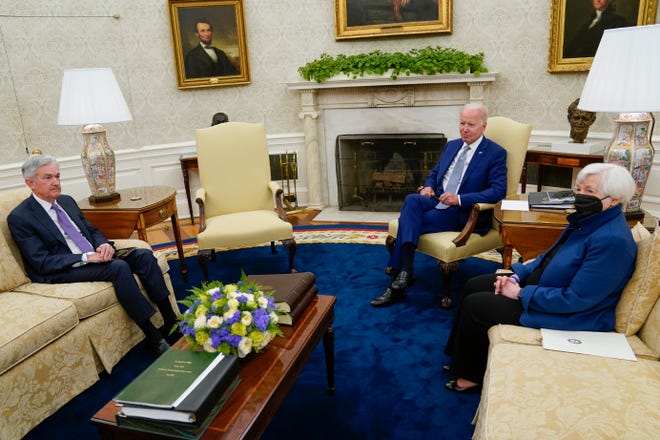

“I’m not going to interfere with their critically important work.”

“I’m not going to interfere with their critically important work.”

That's what President Biden said yesterday when meeting with Jerome Powell and Janet Yellen, the current and former heads of the Federal Reserve. This is a strong indication of support for the upcoming Fed Rate Hikes with 2 0.5% hikes expected over the next two meetings.

In theory, that is already baked in by the market and Biden's support is just another way of showing Wall Street the Administration is serious about tackling Inflation, despite any potential market consequences. The Fed is trying to cool demand to moderate price pressures. But Mr. Powell has conceded that the central bank’s ability to do that without forcing the economy into a recession depends on developments outside the central bank’s control, including global energy markets that have been badly disrupted by Russia’s war in Ukraine and supply chains snarled by the Covid-19 pandemic.

Consumer confidence has slumped amid rising prices of food and gas. Gasoline prices have risen in recent months even as the Biden administration has tapped oil supplies from the U.S. Strategic Petroleum Reserve, releasing one million barrels of Oil (/CL) a day yet oil is still at $116 as of this morning and wholesale Gasoline (/RB) is still over $4/gallon.

Throughout the 1970s, the Federal Reserve both misread the U.S. economy and didn’t believe it had the authority to fight inflation – if that required pushing the economy into a recession. In 1970, President Richard Nixon put a loyal, longtime adviser, Arthur Burns, in charge of the Fed and made clear his low regard for the institution’s autonomy. “When we get through, this Fed won’t be independent if it’s the only thing I do in this office,” he said at the time. Those mistakes prompted the Fed, under Paul Volcker in 1979, to raise interest rates to punishingly high levels, sparking a double-dip recession in the early 1980s that sent unemployment up sharply.

We can certainly afford more Unemployment at the moment as our current problem is not enough workers for the jobs that are available and yes, if you remove Oil increases, food would be lower too as well as many goods, so a great deal of our Inflation situation is a product of oil prices – which means it is, ultimately, a solvable problem. The question is – will the Economy survive long enough to get to "ultimately"?

We can certainly afford more Unemployment at the moment as our current problem is not enough workers for the jobs that are available and yes, if you remove Oil increases, food would be lower too as well as many goods, so a great deal of our Inflation situation is a product of oil prices – which means it is, ultimately, a solvable problem. The question is – will the Economy survive long enough to get to "ultimately"?

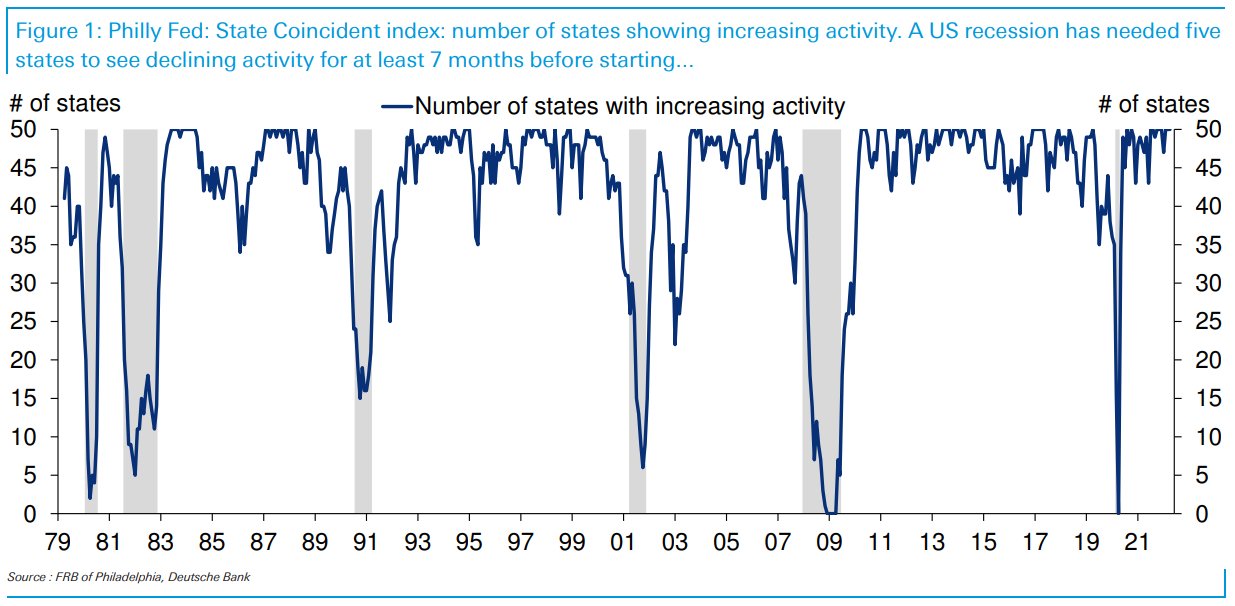

Our economy is still generally strong and, as noted by Barry Ritholtz this morning, there's no indication that we're heading into a Recession at the moment. All 50 states are showing signs of INCREASING Economic Activity and, as you cajn see for this chart – that's a very solid leading indicator that shows we are not likely within 6 months of any sort of real contraction. WILL we get there? Probably yes – seems hard to avoid if the Fed is keen on more than doubling interest rates into next year. It would be a miracle if we don't, in fact – but not today.

That's why we're bargain-hunting this week, looking for oversold stocks to add to our portfolio. Yes, we are very well-hedged – but what's the point of being well-protected if we have nothing to protect?