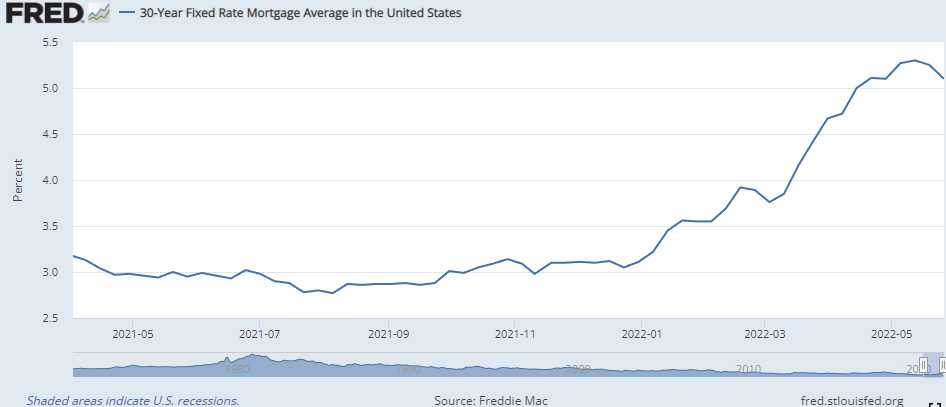

5.5%.

5.5%.

That's where morgage rates are this morning – up from 2.5% last year. If you have a home with a $400,000 mortgage at 3% interest rate, your monthly payment (not including taxes, etc) is $1,687. If you have a $400,000 mortgage at 5.5%, your monthly payment is $2,271, $584 (34.6%) higher. Not a lot of families can just snap their fingers and come up with an extra $7,000/yr to pay for their homes – especially with taxes and other home-related costs also rising sharply.

States and towns MUST balance their budgets and they too are getting hit by higher labor costs, fuel costs, materials costs, etc. and fiscal budgets are usually June to June so it's right now, in your towns, that these costs are about to be passed on to you, the taxpayer. This is another one of those inflationary surprises that no one has taken into account yet and it's yet another one of those things the Economorons will say "no one could have seen coming".

Property tax increases could easily outpace inflation, especially in areas where businesses were given tax-free incentives to locate in your area – meaning they will not be shouldering the burden of the increased costs. Not only are the tax RATES going to increase but, thanks to inflation, the taxable value of your home will increase as well – hitting homeowners with a double whammy.

- https://www.texasmonthly.com/news-politics/high-property-tax-home-appraisals/

- https://www.inquirer.com/news/philadelphia/property-assessments-taxes-philadelphia-increase-20220515.html

- https://www.seattletimes.com/business/real-estate/king-county-property-values-rise-at-unprecedented-rates-tax-hikes-likely/

- https://theaugustapress.com/column-the-ugly-truth-about-local-property-tax-increases/

It's everywhere, that just gives you an idea. The bigger problem is, if you are an old person who simply can't afford to pay more money for the same house – moving is now very expensive and so is a new mortgage and so are apartments and so are nursing homes, etc. Generally, you are screwed.

What's the solution? Well, according to the 1930s playbook, you can start getting that room your kids just moved out of ready for your parents to move into but leave some room for your kids to boomerang back as well as 17% of 25-34 year-olds are already living at home and that number is climbing fast!

What's the solution? Well, according to the 1930s playbook, you can start getting that room your kids just moved out of ready for your parents to move into but leave some room for your kids to boomerang back as well as 17% of 25-34 year-olds are already living at home and that number is climbing fast!

JPM's Jamie Dimon says US Consumers have 6-9 months of spending power left in their bank accounts before the whole thing hits the fan – so enjoy it while you can. That correlates with what we were discussing in yesterday's Morning Report as well as yesterday's Webinar – we're not in a Recession – YET!

U.S. households boosted spending for a fourth straight month in April, but the rate at which they were setting aside savings fell to its lowest point in 14 years, according to data released last week. That raised concerns that consumers were tapping into savings to keep up with inflation and that the pandemic stimulus had run out. At the same time, the cost of borrowing is reaching multi-year highs as well – that's a real recipe for economic disaster…

We have mountains of hedges protecting our longs at this point so this is mostly a spectator sport for us. In yesterday's Live Trading Webinar, we determined that we'll still do better if the market drops 20% than if it goes up 20% but we're pretty good either way.

What's not good is the broken "W" pattern that's forming on the S&P 500 as it's failing at our Weak Bounce line at 4,160 and any break back below 4,000 is going to be a reason to get even more bearish than we are now:

8:30 Update – Productivity was down 7.3% in Q1 and Unit Labor Costs were up 12.6% and that is TERRIBLE – the worst decline in productivity since Q3 1947. Output dropped 2.4% despite hours worked rising 5.5% with hourly compensation up 3.2%. Unit Labor costs are up the most since 1982 – the year Reagan replaced Carter.

This does not bode well for Corporate Profit Margins or the economy in general.

Be careful out there!