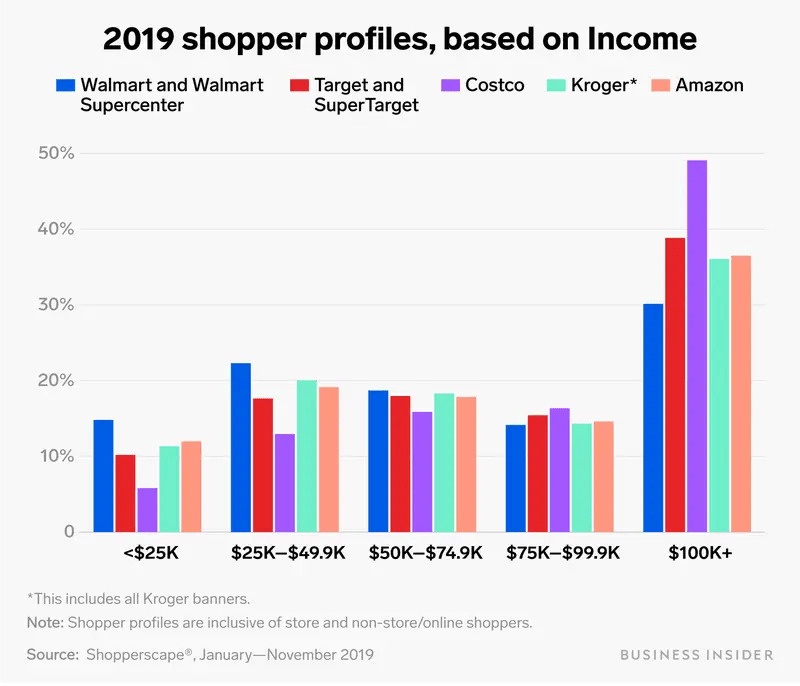

Buying habits are changing.

This is not news to people who've been listening to our Live Trading Webinars for the past few months or followed along in our PSW Reports or our Live Member Chat Room (all of which you can be join right HERE). In fact, just last Thursday we decided TGT was cheap enough and opened the following trade at 1:40 pm for our Long-Term Portfolio:

- We talked about how silly TGT is at $160 and we sold 5 2024 $200 puts in the LTP for $19.85 ($9,925) and there's nothing wrong with that TARGET (so clever!) so let's add 15 TGT 2024 $150 ($32.50)/200 ($13.50) bull call spreads at $19 ($28,500) and that will put us in overall at net $18,575 on the $75,000 spread. If TGT goes lower, we sell 50 more calls and add 10 more longs.

We already had a loss on the puts but we sold 5 2024 $200 puts for $19.95 so our net target on 500 shares is $180.05 and our position looks like this:

| TGT Short Put | 2024 19-JAN 200.00 PUT [TGT @ $159.67 $-1.37] | -5 | 4/7/2022 | (591) | $-9,925 | $19.85 | $30.53 | $-19.85 | $50.38 | – | $-15,263 | -153.8% | $-25,188 | ||

| TGT Long Call | 2024 19-JAN 150.00 CALL [TGT @ $159.67 $-1.37] | 15 | 6/2/2022 | (591) | $48,750 | $32.50 | $-0.48 | $32.03 | $-1.26 | $-713 | -1.5% | $48,038 | |||

| TGT Short Call | 2024 19-JAN 200.00 CALL [TGT @ $159.67 $-1.37] | -15 | 6/2/2022 | (591) | $-20,250 | $13.50 | $-0.65 | $12.85 | $-0.93 | $975 | 4.8% | $-19,275 |

TGT should be down around $145 this morning on the news but taking a writedown on inventory is not really news and TGT expects to return to normal margins (6%) in the second half of the year so, if you are a long-term investor, NOW is the time to be buying, not selling. When a stock plunges 10%, there are things we can take advantage of and thing one will be selling 10 of the 2024 $150 puts for $25. That will be a pre-roll of the short $200 puts but, since we don't think $180 is an unreasonable target – we're not going to buy those back until TGT bounces – perhaps next quarter.

The other thing we can take advantage of is the way the $140 or $130 calls that are in the money will lose significantly more price than the out of the money 2024 $150 calls we have – which will gain premium as the volatility of the stock goes up. We will take advantage of that by rolling our $150 calls (now $32.03) to the $140 calls ($37.50 at yesterday's close) or the $130 calls ($44 at yesterday's close) as long as we can pay less than $5 for $10 worth of position.

The other thing we can take advantage of is the way the $140 or $130 calls that are in the money will lose significantly more price than the out of the money 2024 $150 calls we have – which will gain premium as the volatility of the stock goes up. We will take advantage of that by rolling our $150 calls (now $32.03) to the $140 calls ($37.50 at yesterday's close) or the $130 calls ($44 at yesterday's close) as long as we can pay less than $5 for $10 worth of position.

Assuming we spend $5 to roll to the $140 calls, that would be $7,500 spent for the roll and $25,000 collected on the puts and we paid $18,575 for the overall position so now our net cash in drops to $1,075 for the $140/200 spread that is $7,500 in the money at the assumed $145. We are obligated to own 500 shares at $200 ($100,000) and 1,000 shares at $150 ($150,000) so our commitment is owning 1,500 shares of TGT at $166.66.

As long as TGT stays over $120, then our downside risk is about $45 x 1,500 shares = $67,500 but we would mitigate that by rolling our short puts and selling short calls to cover. For example, if we are assigned the stock at $166.66 and we sell the 2024 $140 calls for $35, then our net would be $131.66

This is a process called "scaling in" to a position – we begin with a small commitment and then, if the stock gets even cheaper for what we consider to be poor reasons – we adjust and add to it. In the case of TGT, sales are not off – they simply have the wrong mix of inventory as consumers are scaling back their spending habits and they need to adjust but $145 is $67Bn in market cap for TGT, who made $6.9Bn last year and, even with the adjustments, should make $4Bn this year and $6Bn again next year so $67Bn is stupidly cheap – and we'll take advantage of it!

This is a process called "scaling in" to a position – we begin with a small commitment and then, if the stock gets even cheaper for what we consider to be poor reasons – we adjust and add to it. In the case of TGT, sales are not off – they simply have the wrong mix of inventory as consumers are scaling back their spending habits and they need to adjust but $145 is $67Bn in market cap for TGT, who made $6.9Bn last year and, even with the adjustments, should make $4Bn this year and $6Bn again next year so $67Bn is stupidly cheap – and we'll take advantage of it!

This is why we like to have plenty of cash (75% in our LTP) on the sideline in a choppy market – you never know when things are going to go on sale…

Investors these days are very impatient – they only care about the current quarter and tend to miss the bigger picture. Just this morning, while TGT was warning, Kohl's (KSS) got a $60/share offer from Franchise Group (FRG) for their whole operation – up almost 50% from yesterday's $42 close. KSS has a market cap of $5.4Bn and $60 would be more like $8Bn, or about 11x KSS's $750M in earnings. 11x for TGT would be $66Bn – which is why we feel very safe adding to it at $145.

At the moment, we're very concerned about the S&P 500s struggles with the Weak Bounce line at 4,160 – it's been a losing battle so far:

It doesn't really matter how good a value our stocks are if the whole market is collapsing, does it? Notice the bullish buying pressure on the MACD line is exhausting itself without having made any progress. Look what happened in February, when the MACD failed to gain any traction – and then April was worse. We really can't afford "worse" from where we are now but I also don't see any real catalysts that are likely to push things higher so we're still leaning heavily on our hedges – just in case…

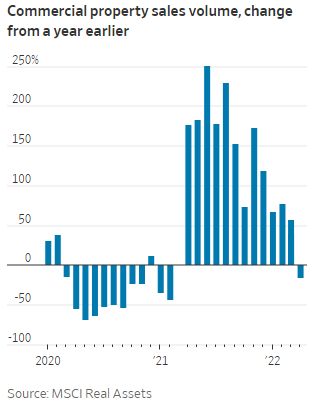

Yellen is testifying to Congress on Inflation today, that's not a positive and, as we expected, Commercial Property Sales are slowing – down 16% from last year. Hotels, office buildings, senior housing and industrial properties recorded big drops in sales. Sales of other property types, such as retail and apartments, rose in April, but analysts and brokers said activity may be now slowing in those sectors, too, as rising interest rates keep some investors from making competitive offers.

Yellen is testifying to Congress on Inflation today, that's not a positive and, as we expected, Commercial Property Sales are slowing – down 16% from last year. Hotels, office buildings, senior housing and industrial properties recorded big drops in sales. Sales of other property types, such as retail and apartments, rose in April, but analysts and brokers said activity may be now slowing in those sectors, too, as rising interest rates keep some investors from making competitive offers.

“To have it go from a very fast pace of growth the month before—the speed of that transition is shocking,” said Jim Costello, chief economist at MSCI Real Assets. A drop in sales can be an early indicator of stress in real-estate markets because prices are usually slower to change, he added.

Investors are finding that with the increased cost to borrow, their near-term rate of return runs below the interest rate on their mortgage. Lenders, in turn, are now tightening their standards for more-speculative deals. In certain sectors, such as smaller industrial and retail real estate, prospective buyers that wrote letters of intent to purchase properties weeks ago are now dropping their bids because the cost to borrow has risen so quickly,

This is a long, slow cycle of rising rates and inflation – don't expect it to all suddenly come to an end – it's more likely early innings.