By Arkadiusz Sieron. Originally published at ValueWalk.

What are the new fundamentals for crude oil to look at this week? Could Asian demand be slowed down by Saudi Arabia raising its prices?

Crude oil prices soared earlier this week after Saudi Arabia said on Sunday it would raise crude oil prices for most regions except the United States. Just days after opening the floodgates a little wider (as announced last week following an OPEC+ meeting), Saudi Arabia wasted no time in raising its official selling price for Asia, its main market. It is worth noting that the country is one of the few OPEC members that has spare oil capacity. Thus, this decision to raise prices happens just when demand, especially in Asia, is increasing.

Q1 2022 hedge fund letters, conferences and more

In the prediction contest, Goldman Sachs raised its forecast for the price of a barrel of Brent to $135 by the end of the year.

Looking at the impact of oil prices on gasoline, we are also starting to see changes in consumer behavior. As we head into the summer, people are likely going to think twice before making long trips by car during their vacation.

As a result, the “crack spread” is clearly narrowing, as you can see in the third following chart.

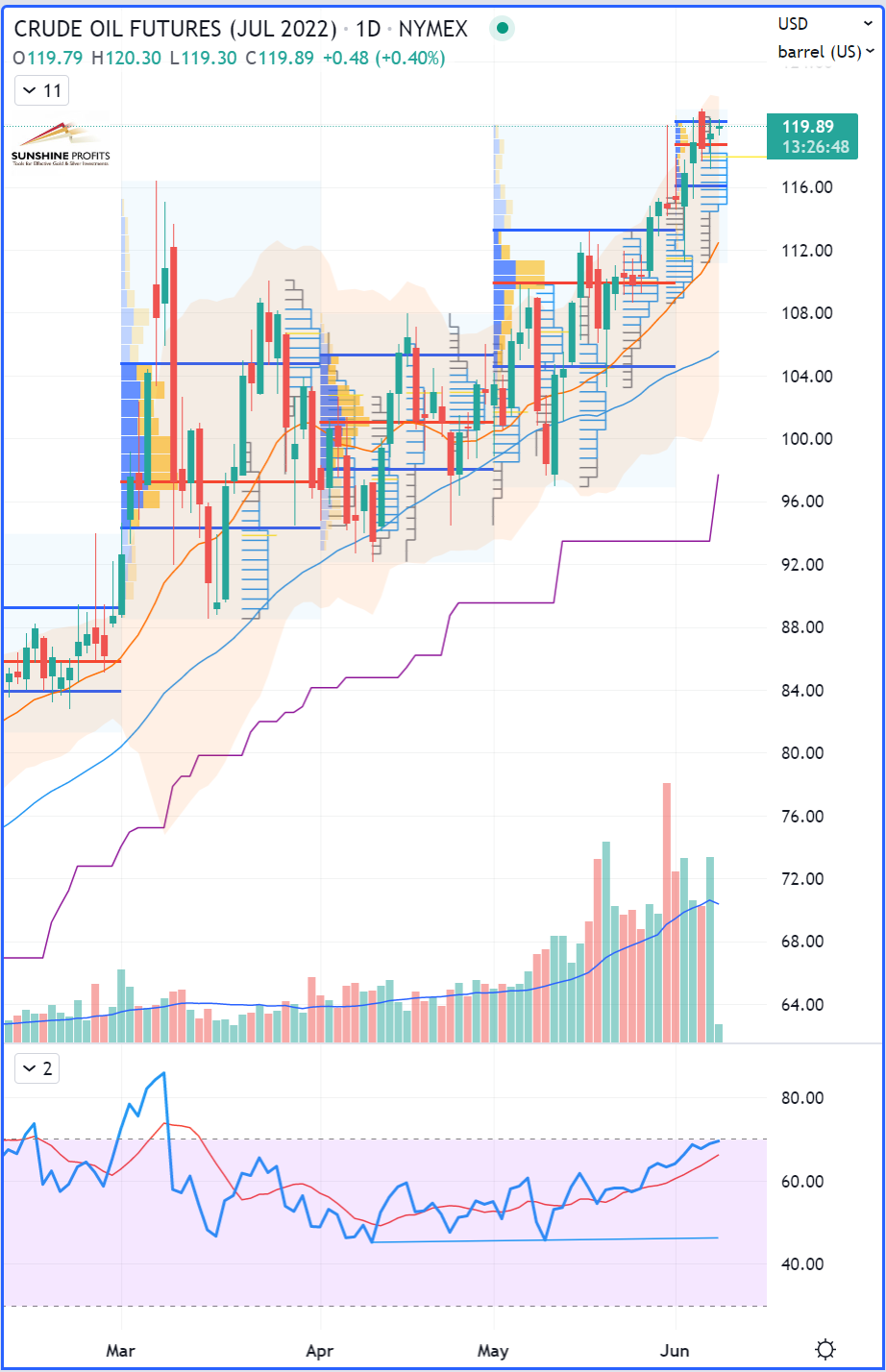

WTI Crude Oil (CLN22) Futures (July contract, daily chart)

RBOB Gasoline (RBN22) Futures (July contract, daily chart)

42 x RBOB Gasoline (RBN22) – WTI Crude Oil (CLN22) “Crack Spread” Futures (July contracts, daily chart)

Question: Is RBOB gasoline taking the lead now to pull crude oil prices back lower with it, or will the RB-CL spread find a rebounding floor around the $50 price mark, acting as support?

Write back and let me know.

That’s all for today, folks. Happy trading!

Like what you’ve read? Subscribe for our daily newsletter today, and you’ll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits’ associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data’s accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits’ employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Updated on

Sign up for ValueWalk’s free newsletter here.