2.9%.

2.9%.

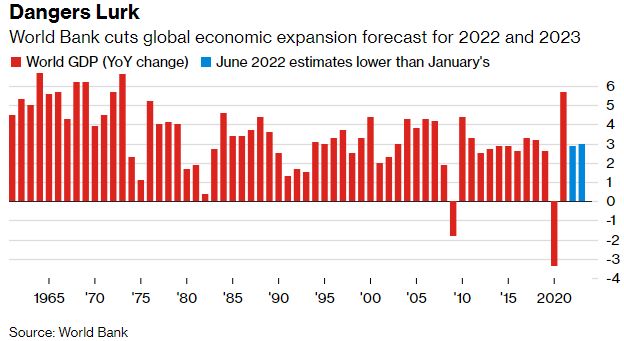

That's the new World Bank forecast for Global GDP growth and it's down 1.2% (29%) from their January estimate. Even worse, the World Bank does not expect growth to come back in 2023 – or 2024. We are essentially just one more downgrade away from a World-wide Depression. The World Bank said we are now entering what may be “a protracted period of feeble growth and elevated inflation” (which would be STAGFLATION):

“The war in Ukraine, lockdowns in China, supply-chain disruptions, and the risk of stagflation are hammering growth. For many countries, recession will be hard to avoid,” World Bank President David Malpass said.

The World Bank’s June report offers what it calls the “first systematic” comparison between the situation now and that of 50 years ago – a period of intense stagflation which required steep increases in interest rates in advanced economies and triggered a string of financial crises in emerging market and developing economies. Clear parallels exist between then and now, it said. Those include supply side disturbances, prospects for weakening growth, and the vulnerabilities emerging economies face with respect to the monetary policy tightening that will be needed to rein in inflation.

Meanwhile, the Fed has drastically lowered their own GDP outlook for the US, from 1.3% to 0.9% for Q2 (the one we are in) and that too is a 30% reduction – but over just the past two weeks!

Meanwhile, the Fed has drastically lowered their own GDP outlook for the US, from 1.3% to 0.9% for Q2 (the one we are in) and that too is a 30% reduction – but over just the past two weeks!

As you can see, the forecasts of Leading Economorons (the ones you hear yammering on in the Financial Media) is still at 3%, giving people a 200% WRONG impression of what to expect in Q2 earnings. When there is this much room for downside surprises – it pays to be very, very cautious with our portfolios.

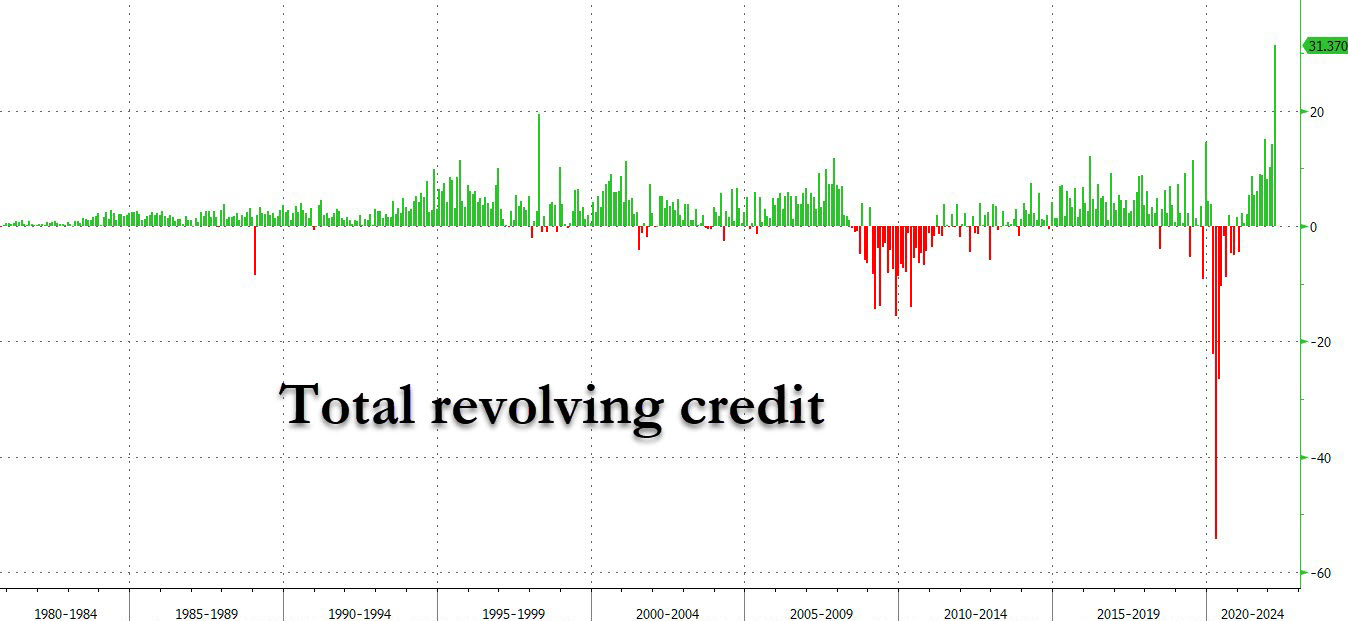

One of the things we are watching for signs of strain is Consumer Credit, which popped $38.1Bn yesterday vs $35Bn expected. That indicates Consumers are still dipping into their savings and borrowing to keep up with inflation and that's not a trend that can go on forever. Credit card debt alone popped $17.8Bn – to an all-time record just at the time when interest rates are on the rise (Fed meeting next Wednesday).

With inflation largely outpacing wage growth, consumers have leaned on both savings and credit cards to pay for everyday essentials and discretionary purchases. The savings rate is at its lowest level since 2008, and a record 537 million credit card accounts were opened in the first quarter, according to the New York Fed. There's only 330M of us so that means the average eligible person got 2 new credit cards in Q1 – in order to pay for rising expenses. How is that going to end well?

Those credit cards are already running out as Card Spending for May was 4.3%, down from 6.8% in April and way below the 8.2% increase in the Consumer Price Index. Affirm (AFRM) Holdings is a big warning sign – the company repackages (bundles) loans made to Gen Z shoppers for clothing and electronics (via store cards) in "buy now, pay later" deals and they lent out $3.9Bn in Q1 but the stock is crashing because, guess what? They can't pay later!

Don't worry though, the Government is on the case: “There’s no question that we have huge inflation pressures, that inflation is really our top economic problem at this point and that it’s critical we address it,” Yellen said to Congress yesterday. “I do expect inflation to remain high although I very much HOPE that it will be coming down.”

As our Members know, hope is not a valid investing strategy and it is not a valid policy strategy either! “Putin’s war in Ukraine is having impacts on energy and food prices globally,” Yellen said. “It’s virtually impossible for us to insulate ourselves from shocks” like that from the war, she said. Someone should tell these people that Russia was at war in Afghanistan for 20 years so, if we're waiting for this to blow over – it might be a while…