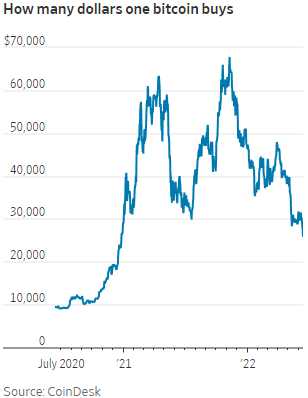

Poor Bitcoin!

Poor Bitcoin!

It's back at $25,000 this morning, giving up all its gains since 2020 but, much, much worse, Crypto-Lender, Celsius, told users Sunday night that it is pausing all withdrawals, swaps, and transfers between accounts due to “extreme market conditions.” This is why crypto is BS – you can't count on the "bank" to give you your money…

Celsius lends out customer deposits to other users to earn a return. The firm managed $11.8 billion in assets as of May 17, according to its website. It offers users annual percentage yields of up to 18.63% on cryptocurrency deposits. The company said it has 1.7 million users. Celsius raised $750 million in funding late last year from investors including Canadian pension fund Caisse de dépôt et placement du Québec.

The short story is that a Dollar, with all of it's Government-backing and inherent deposit protections, is worth MORE than crytocurrencies – not thousands of times less. Until that balances out – be very wary of empty promises and unrealistic expectations in that space. On the whole, Cryptocurrencies are back to about $1Tn, half of where they peaked but still – try to buy a large quantity of Gold with Crypto and see how that goes.

Gold and Silver, meanwhile, have also been disappointing meaning what? NOTHING is an inflation-hedge these days? Why is gold not over $2,000 an ounce with the cost of living 10% higher than it was last year, when gold was hovering around $1,800?

Gold and Silver, meanwhile, have also been disappointing meaning what? NOTHING is an inflation-hedge these days? Why is gold not over $2,000 an ounce with the cost of living 10% higher than it was last year, when gold was hovering around $1,800?

The answer to that is what's also ailing Crypto as well as stocks and what's also holding up the Bond Market (which should be doing worse) and that's the price of the US Dollar relative to, well, everything, as it tests highs not seen since since 2002:

The Dollar is up 15% since last year and, if not for that, inflation would be much, MUCH worse from the US perspective (it is much worse to the rest of the World) and Gold, priced in Euros (or pretty much any othe currency) is already breaking over it's 2020 highs.

The S&P 500, priced in Euros, has fallen from a high of 4,241 in Jan and 4,223 in April to 3,708 on Friday and that's down 533 points or 12.6% vs 4,818 to 3,900, which is 19% priced in Dollars. Measuring in Euros or Dollars is just as arbitrary as switching from Celcius to Farenheit – only with C and F you get consistent results while Dollars and Euros are moving targets.

The upshot of this is that, to any International Investor whose currency is weaker than the Dollar (everyone), the US markets look very good compared to their own. Also, S&P 500 earnings are depressed due to the strong Dollars as they get 60% of their revenues from overseas – paid in overseas currencies. You don't hear about this in the MSM because it's too complex for a sound-byte and it screws with the "BEAR MARKET" narrative they are pushing but SHAME on my fellow analysts, who almost never mention one of the biggest factorts moving the markets.

The upshot of this is that, to any International Investor whose currency is weaker than the Dollar (everyone), the US markets look very good compared to their own. Also, S&P 500 earnings are depressed due to the strong Dollars as they get 60% of their revenues from overseas – paid in overseas currencies. You don't hear about this in the MSM because it's too complex for a sound-byte and it screws with the "BEAR MARKET" narrative they are pushing but SHAME on my fellow analysts, who almost never mention one of the biggest factorts moving the markets.

Even savvy market players like us, who do understand the dynamics of the currency and take it into account, still have to carefully consider what to do next. This down leg of the market started last week, when the ECB said they would only raise rates 0.25% at the July meeting while our own Fed is certain to raise rates 0.5% on Wednesday and again on July 27th and probably again on September 21st. That puts us another 0.75% ahead of the Euro on July 27th and currency traders don't need to get hit over the head with a bat before they start reacting to news like that.

So the Dollar rose 3% in 3 days while the Euro dropped 3% and the Dollar is now 105 and the Euro is down to 1.05 and below this is PARITY (1.00), below which is the collapse of the Euro. It's not likely the ECB will risk that so this week I expect them to act to try to preserve 105. If that works, it will give stocks and commodities a chance to breathe and regain some of what they lost last week.

So the Dollar rose 3% in 3 days while the Euro dropped 3% and the Dollar is now 105 and the Euro is down to 1.05 and below this is PARITY (1.00), below which is the collapse of the Euro. It's not likely the ECB will risk that so this week I expect them to act to try to preserve 105. If that works, it will give stocks and commodities a chance to breathe and regain some of what they lost last week.

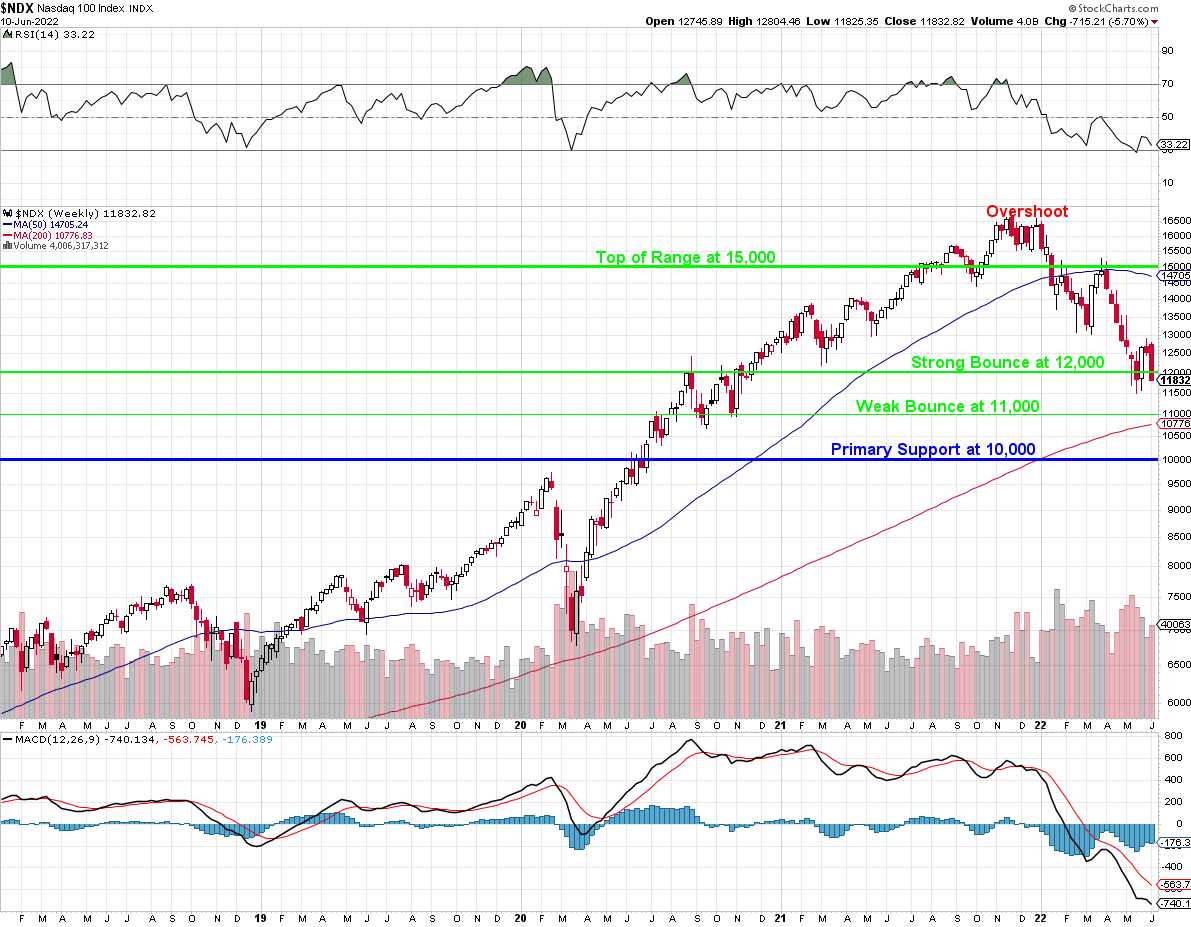

For our own purposes, we're likely to cash in some of our hedges on this morning's dip, which is mainly being caused by the rising Dollar and the Asian and European markets, which are still playing catch-up from Friday's US sell-off. Meanwhile, as noted on our handy Nasdaq chart, 11,000 should be bouncy as it's the Weak Bounce Line which is being met by the 200-WEEK moving average and that is not likely to fail in one shot and a bounce between that and the 50-week moving average at 14,700 would be about 1,000 points – back to the Strong Bounce line at 12,000 so we feel very comfortable cashing in a hedge at this point – not to mention improving some of our long positions.

And look how oversold that MACD line is – that's a good sign too. Of course, it could be a very bad sign if 11,000 fails, but I'm hanging my hat on the fact that there are 12M unfilled jobs in the US and that the inflation we're feeling is mostly demand-driven with housing wealth at an all-time high (although I do expect a 20% real estate correction to adjust affordability to higher rates).

Home prices in the US are up almost 20% this year and are forecast to go up 11.6% over the next 12 months and they were up about 10% during the pandemic as well so let's say the average person who bought a home before the pandemic for $400,000 now has a home worth $520,000 (30% more) with another $50,000 coming in the next year. That's great news for 110M homeowners in the US and let's say just 5M homes are sold in the next year with $150,000 in additional equity – that's $750Bn in bonus equity hitting the economy – 3.4% of our entire GDP.

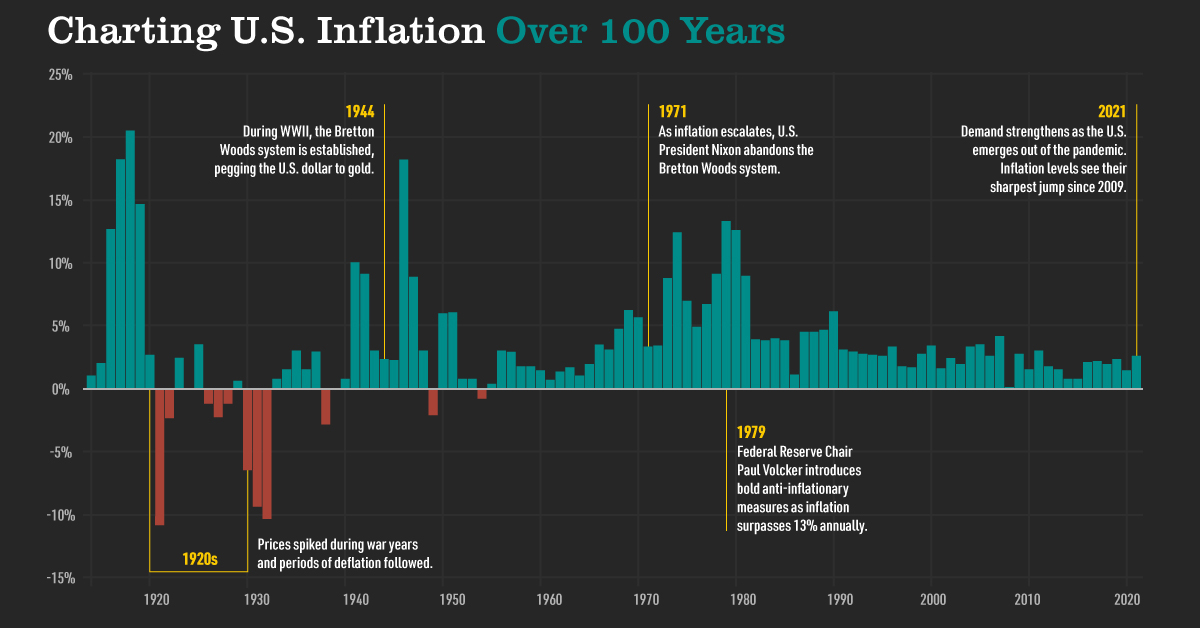

This is why our parents didn't go broke in the 70s, when inflation was often over 10% – they had homes and the improvements in home equity were LEVERAGED, so they gained much more in home value than they lost in spending power. That's also why your parents are religious about OWNING a home – it is the single best hedge against inflation – or it was because now we're probably at the peak.

The inflation spike we had in the 70s was because Nixon took us off the gold standard and fiat currency values fell hard and fast. That's not what's happening here. We have a war, we have demand returning faster than the workers are returning and that's putting pressure on the price of goods and services. We also have a long-overdue cost of labor adjustment and of course all this leads to a decline in Corporate Profits, exacerbated by the stronger Dollar at the moment.

These things shall pass and I predict the Gap (GPS) will still make jeans and Coca-Cola (KO) will still serve you drinks and your kids will still want to go to Disney (DIS) and you'll fly there on Delta (DAL) and gas will normalize before car-pooling becomes endemic and demand drops 20%. There's a push and pull to everything – it's just not going to happen overnight.

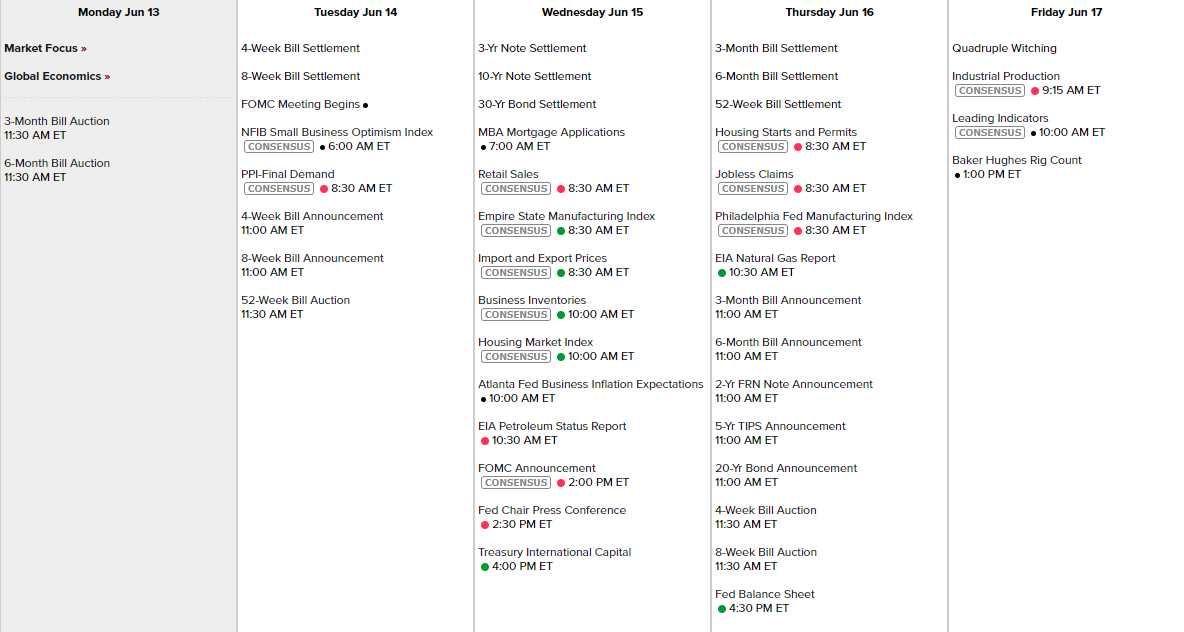

If we're going to be LONG-term investors we need to look at long-term factors when making our decisions and not panic with the whims of the market. On the calendar this week we have the Fed on Wednesday and it's an options expiration week as well – so this should be fun. Tomorrow I see PPI and Small Business Optimism (or lack thereof), Empire Fed, Housing and Business Expectation precede the Fed on Wednesday and Thursday we have the Philly Fed followed by Industrial Production on Friday along with Leading Economic Indicators – not too exciting.

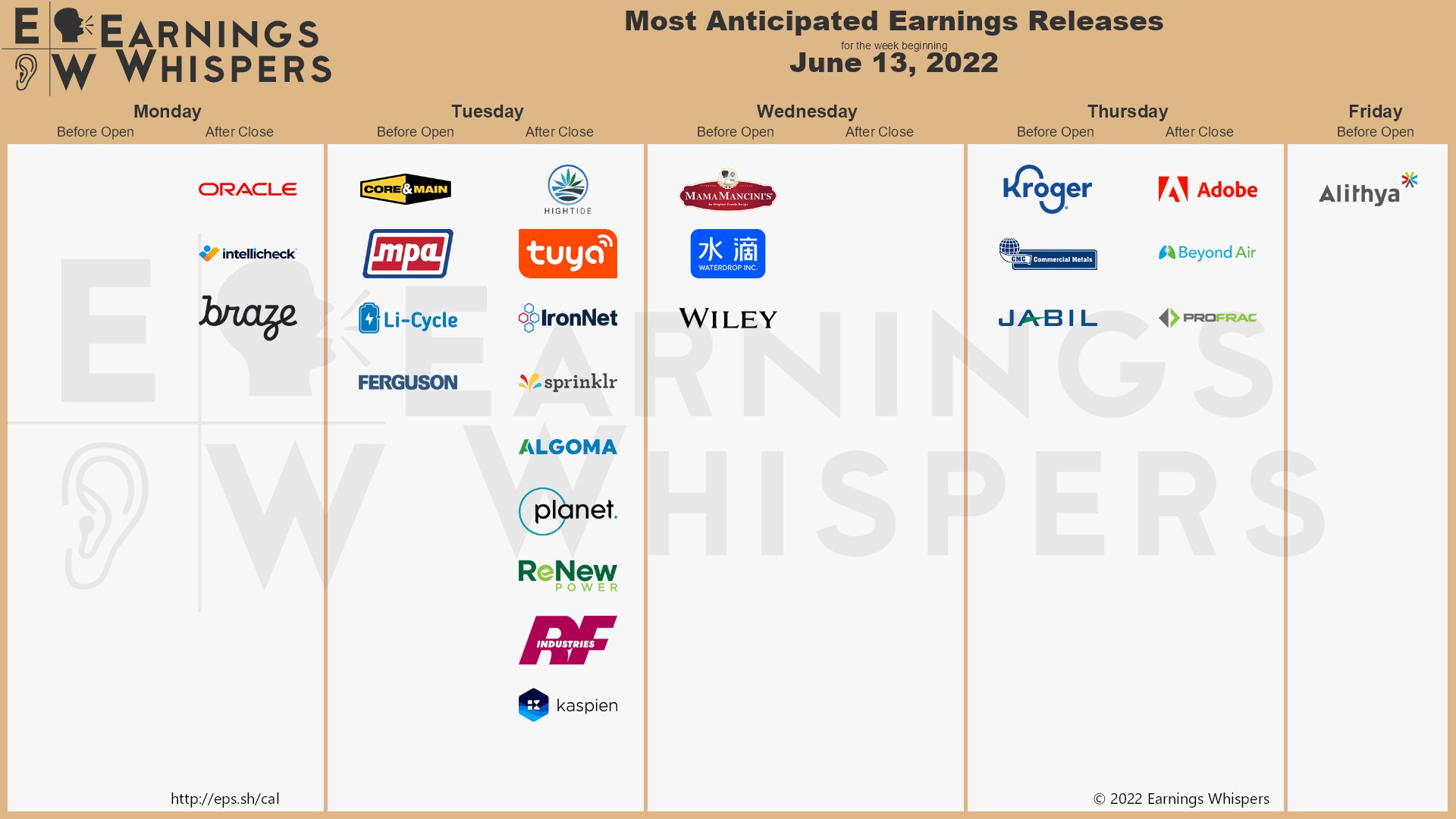

Not exciting is good, it should give things a chance to calm down a bit and we'll have a chance to see what holds – on the Dollar and the Indexes. We get Oracle (ORCL) today and Adobe (ADBE) on Thursday but Q1 earnings have run their course and now we get a rest period there as well:

Mama Mancini (MMMB) just appointed an M&A guy to their board and the stock is tanking pre-market to $1.16 but I think it's more likely a buy-out as $1.53 was only $54.7M and there are lots of bigger companies who would like an extra $100M in sales that they could easily double or triple at 15% margins – far more than justifying a $75M buyout at $2 or more – so I like the stock down here for sure (they have no options).

We are going to have a very busy week reviewing our Member Portfolios – join us inside!