What a time to have to review our Member Portfolios!

Indexes are back at the lows – it's like taking a picture when nobody's ready – you KNOW it's going to come out terrible and everyone will want a do-over. Nonetheless, it is options expiraiton week so we're going to plow ahead and see what we can do with this mess. Remember, the only reason we didn't cash out is BECAUSE we wanted to practice what to do in a market correction – so here it is...

The first thing we do, of course, is adjust our hedges. In this case, we took a chance and cashed in over $500,000 worth of long hedges (TZA and SQQQ) and then added back more TZA protection in yesterday's Live Member Chat Room. It's a messy transitional period and raising cash cost us in the portfolio's net value but, if we are right and this is a short-term bottom – we'll be hitting new highs in our Long and Short-Term Portfolios next week.

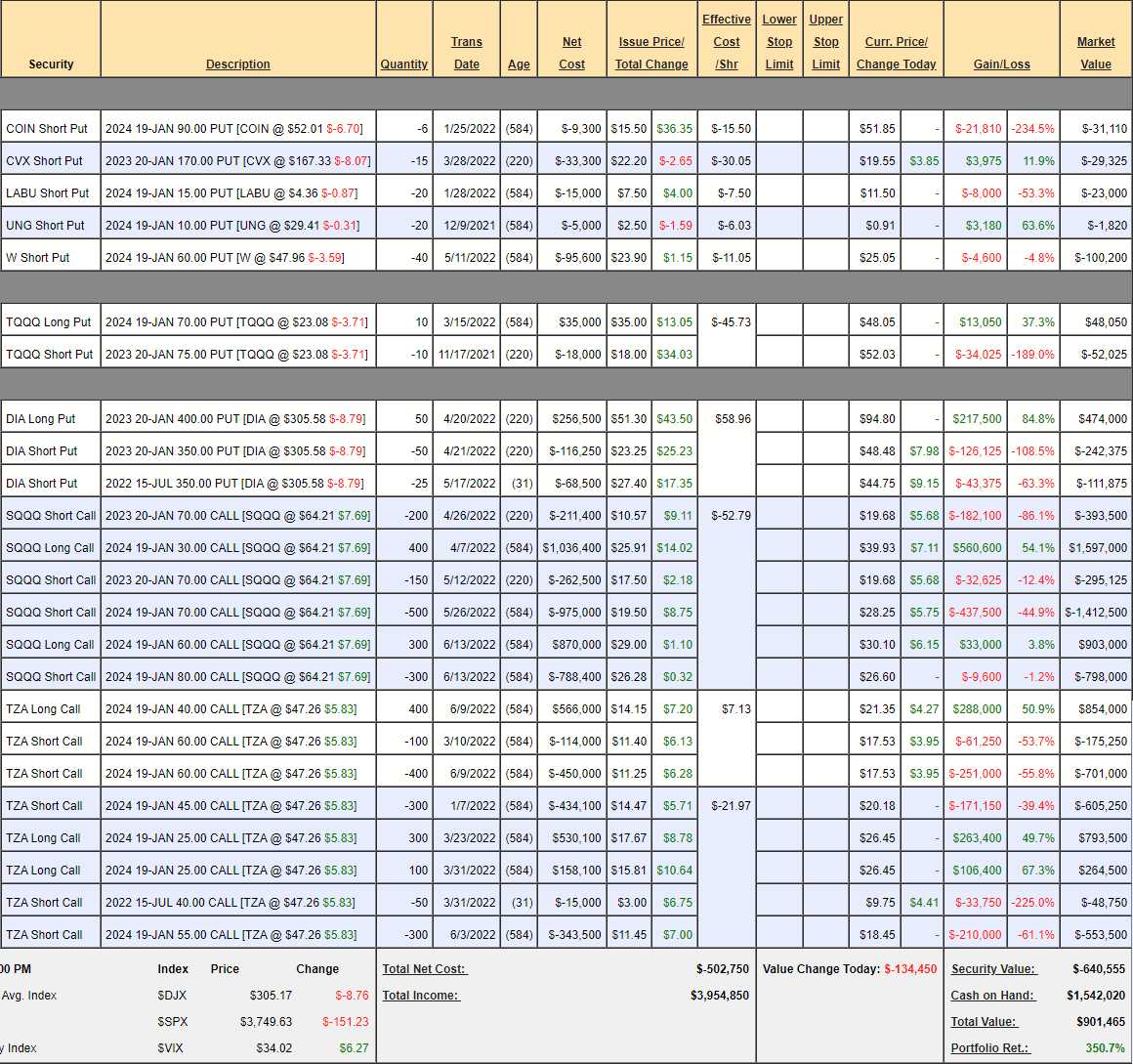

Short-Term Portfolio Review (STP): At the moment though, the STP is at $901,465 and that's DOWN $100,999 from our 5/24 review but we have $530,849 more CASH!!! which we can use to adjust our long positions in our other Member Portfolios AND we moved $100,000 to the Future is Now Portfolio – so closer to even overall.. That's the point of the STP – it's our hedging portfolio to balance out the rest and, when you consider that we started with $200,000 back on Oct 28th, 2020, $901,465 is a pretty nice gain (350%).

- COIN – I was going to wait for 2025 puts to come out but now that they are down to $50, I think we have to take advantage and sell 10 of the 2024 $50 puts for $22.50 ($22,500). It's the first leg of a roll and, ideally, COIN pops back up and we can buy back the short $90 puts for $22,500 and then we've completed our roll. We should also put a stop on 3 (1/2) the current $90 puts at $60 ($18,000) and the other 3 at $70 ($21,000) because we sold them for $9,300 so that would be a $29,700 loss and then, if the new puts work out, it will be a net $7,200 loss – which we can live with. Hopefully that doesn't happen and we cash out the old puts for $22,500 or less and then we're still in for net $9,300 if all goes well.

- Other short puts – Nothing to worry about.

- TQQQ – When the 2025s come out, we'll do a roll but the Jan $75 puts at $52.03 can be rolled even to the 2024 $75 puts, which would limit our loss to $5,000 though it's currently showing a net $21,000 loss – so lots of room for improvement. These are left over from a successful short, so just cleaning up the mess.

Are things really as bad as when the whole planet shut down with a virus raging in almost every country? I don't see that out there and that means these prices are getting a bit silly, right?

- DIA – The July $350 put might burn us but we'll roll it. It's a $250,000 spread that's currently showing net $119,750 sp we have $130,250 left to gain.

- SQQQ – The overriding premise here is that we don't think SQQQ will hit $70, which is only 10% away now. The Nasdaq 100 is at 11,370 and we think 11,000 will hold – and that's 3.25% down from here, which would be right about 10% on SQQQ. Unfortunately, our conviction is being tested here and the 350 short Jan $70 calls are now almost $20 ($700,000) but, if it works out in the end – it's a 70% bump to our portfolio's value. If not – RAWHIDE!

- Just to be safe(r), we added 300 of the 2024 $60/80 spreads to cover the additional short $70s and that gives us $500,000 of additional headroom – enough to cover us past $80 and we can always add 300 more for another $105,000 if we get nervous. After all, the cash we're using to buy the $60/80s came from the sale of just 100 of the 2024 $30s (now $40 or $400,000 per 100).

- So, if we assume the short calls are not going to be a problem, then our 400 remaining 2024 $30 calls are covered by $70 calls and that would be $1.6M and, currently, the net of this spread is -$379,000 so, if all goes perfectly (when does it?), we have $1.979M worth of hedges in SQQQ.

- TZA – Even messier than SQQQ now. Same thing, we cashed out some winners and re-hedged. The primary hedge is 400 2024 $25 calls covered by 300 2024 $45 calls and 300 2024 $55 calls. TZA is already over $45 so we have $600,000 in the money at $45, whcih leves us with just 100 2024 $25s against 300 short 2024 $55s (that's because we cashed out half our longs yesterday). The $25s would be worth $300,000 at $55 and we bought 400 of the 2024 $40/60 spreads and those are net $153,000 on the $800,000 spread so we have another $647,000 of protection there against the open short calls.

- I'm way more comfortable with the SQQQ than I am with TZA so what's the cheapest fix? The $40/60 spreads are only net $4 for the $20 spreads but rolling the 2024 $45 calls at $20.18 to the 2024 $55 calls at $18.45 would only cost us $1.73 x 300 contracts ($51,900) and that will buy us $300,000 of additional headroom – so let's do that!

- That will give us 400 of the 2024 $25/55 bull call spreads so $1.2M before they go in the money and then we have 200 uncovered short 2024 $55s and, of course, we'll eventually buy 2025 spreads to back them up and we also have 400 of the 2024 $40/60 spreads for another $800,000 that have their own uncovered $60 calls and those spreads can be added at about $40,000 per 100 with $160,000 more protection – if we need it.

Overall then, we have about $4M worth of protection plus $1.5M in CASH!!! to cover our longs. We'll be taking a chance this week and improving our longs (using our beloved CASH!!!) in the hopes that we have valued the Recession and the Fed actions correctly in our model. Of course, it's difficult to model panic so we're not going to go crazy but there's a lot of good stocks out there being sold at very low prices – so it's time to do a little shopping!

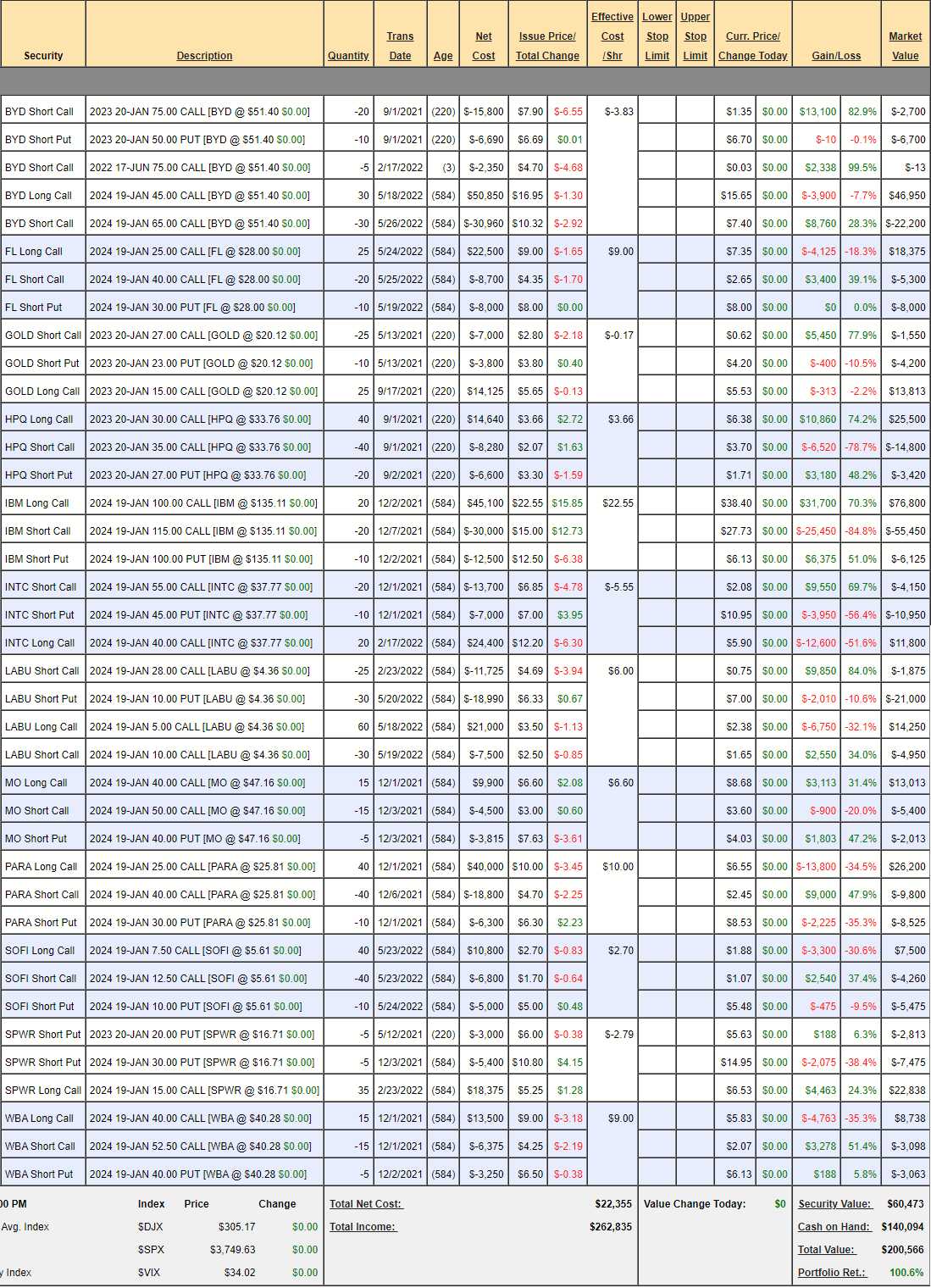

Money Talk Portfolio Review: Well, we can't go shopping in this one as I'm not on the show and we only adjust this portfolio when I'm live on Money Talk. I was last on on May 18th and the portfolio stood at $223,779, up 123.8% from our 11/13/2019 start at $100,000. The challenge of the Money Talk Portfolio is to make trades only once per quarter so we look for the most bullet-proof trades we can find – as there are no in-between adjustments.

The positions are holding up pretty well as we're still at $200,566, which is down $23,213 from our last review but still a double from where we started. We can't make changes so I'll just put out some notes:

- BYD – The short June $75 calls will expire worthless and we're in generally good shape on the trade because we sold the extra calls. Just because we like a stock, doesn't mean we don't think it can get toppy and we just didn't see a way to justify $75. Now we'll see if we're right about the short puts at $50 but we do like these guys long-term. If we can get back to $65 in 2024, it will be a $60,000 spread but, currently, it's net $15,337 so there's $44,663 (291%) left to gain if we recover.

- FL – One of our new trade ideas. We were a bit aggressive, not fully covering the longs and we're suffering for it – but not too much. It's a $37,500 spread at net $5,075 so $32,425 (638%) upside potential at $40 in 18 months.

- GOLD – One of my favorites. This is a $30,000 spread that's $12,500 in the money that is currently net $8,063 with $21,937 (272%) upside potential.

- HPQ – Holding up well so far but what an ugly drop last week. This spread only goes to Jan so we'll have to roll the longs to 2024 at some point. At the moment though, we're still about $16,000 in the money on the $20,000 spread yet you can buy it for net $7,280 with $12,720 upside potential – aren't options fun?

- IBM – Our Stock of the Year refuses to go down! It's a $30,000 spread that's entirely in the money at net $15,225 so still good for another $14,775 (97%) even if you missed the early gains.

- INTC – Well we knew it would be a bumpy road but ouch! This is just silly and we'll be rolling the 2024 $40s to a lower strike next time. At the moment, it's a $30,000 spread at a net $3,300 credit so $33,300 upside potential at $55 but is $55 still realistic? Let's count on $50 and that would be $20,000 so $23,300 of upside potential is still 706% more than the current credit.

- LABU – You would think Biotech is Bitcoin the way its sold off. I only HOPE (not a valid trading strategy) this recovers so I'm not even going to count the upside potential – we'll just be thrilled if it works out.

- MO – Biden wants to limit nicotine in cigarettes but I think people will just smoke more of them. Was outperforming and now just performing but I have faith. It's a $15,000 spread at net $5,600 so $9,400 (167%) left to gain if MO can claw back over $50.

- PARA – Used to be VIAC and it was getting better but now selling off with everything else. $40 is far away but we'll move to 2025 etc. as this is a great long-term hold. Even if we just get back to $30, it's a $20,000 spread currently priced at $7,875 so I'm going to call this $12,125 (153%) of upside potential at $30 and there's another +$40,000 (507%) bonus if we get to $40.

- SOFI – No one believes in these guys but I do. The CEO does too – he's bought stock 15 times this year so far. We need to roll the spread so I'm not going to count the upside but, as it stands, it's a $20,000 spread with a net credit of $2,235.

- SPWR – Wow, I thought they were getting back on track but right back off it. We're super-bullish here and why shouldn't we be with Biden pushing solar so hard? Our calls are still in the money and let's say we get to just $25, that would be $35,000 and the spread is currently net $12,550 so I will hang my hat on $22,450 (178%) of upside potential.

- WBA – Took an ugly hit back to $40 and that's where our calls are. $50 is easily within reach and that would be $15,000 and the net is currently $2,577 so $12,423 (482%) in upside potential is still pretty damned good.

That's $206,218 of upside potential in 12 (10 really) trades so we can double the portfolio in 18 months. Not bad for a portfolio we only touch one day each quarter, right?

IN PROGRESS