By Arkadiusz Sieron. Originally published at ValueWalk.

What outcome or outlook for crude oil should we expect when looking at the current (macro-)economic environment?

Recession Fears

Oil prices were up slightly during the European session on Friday as fears of insufficient crude oil supply to meet demand during the summer took precedence over those of a recession amid runaway inflation. Markets fear that the slowdown in economic activity will lead to lower global demand. In addition, growth in economic activity in the Eurozone slowed sharply in June – notably in the private sector – to its lowest level in 16 months due to inflation, according to the composite PMI index published on Thursday by S&P Global. It must also be said that comments by Federal Reserve Chairman Jerome Powell have fueled fears of a global slowdown since J. Powell has not ruled out the risk of recession in the United States.

Q1 2022 hedge fund letters, conferences and more

Indeed, the head of the US Federal Reserve, who was heard Thursday by the Finance Committee of the House of Representatives, repeated that his priority remained the fight against inflation. “We’re going to want to see evidence that it really is coming down before we declare ‘mission accomplished,” said Jerome Powell. Finally, whilst addressing an audience’s question as to whether war was responsible for inflation, Powell answered: “No, inflation was high before – certainly before the war in Ukraine broke out.”

Here is an interesting article just published on FXStreet that summarizes some of Powell’s remarks in Congressional testimony.

In addition, according to several media, Joe Biden’s proposal to temporarily lift the federal tax on gasoline and diesel did not have sufficient support to be adopted in Congress (a mandatory step).

Fundamental Analysis

In a rare occurrence, plagued by technical issues, the US Energy Information Agency (EIA) has announced that it will not release weekly US oil inventory and oil inventory figures this week. So, let’s look at the figures from the American Petroleum Institute.

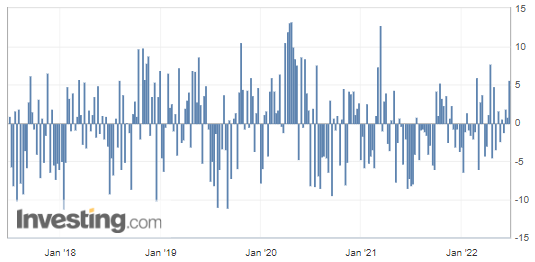

U.S. API Weekly Crude Oil Stock

The weekly commercial crude oil reserves in the United States increased by over 5.607M barrels while the forecasted figure was expected to be in negative territory (-1.433M), according to figures released on Wednesday by the US American Petroleum Institute (API).

US crude inventories have increased by over 5.607 million barrels, which firmly confirms slowing demand and could be considered a strong bearish factor for crude oil prices. This figure would indeed signal a drop in Americans’ appetite – at least at the current fuel prices – for petroleum products.

(Source: Investing.com)

WTI Crude Oil (CLQ22) Futures (August contract, daily chart)

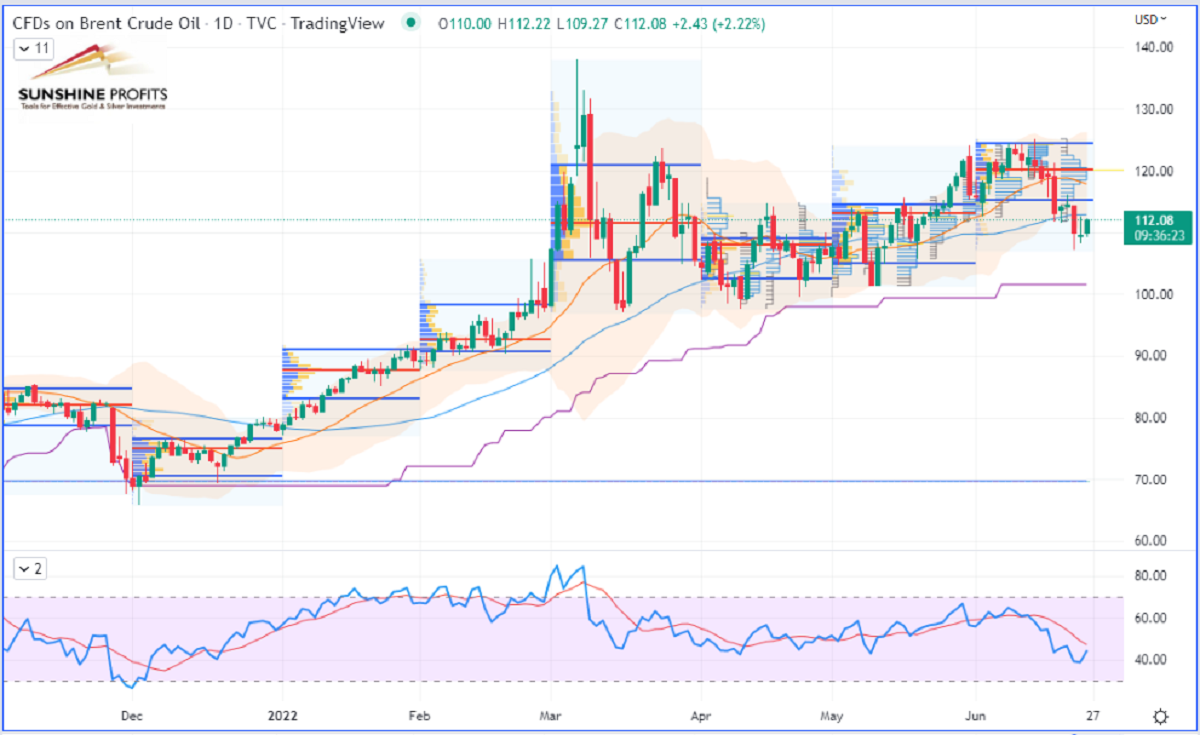

Brent Crude Oil (BRNQ22) Futures (August contract, daily chart) – Here it is represented by its Contract for Difference (CFD) UKOIL

To conclude, is it even worth pointing out that in the event of a recession, the demand for petroleum products would fall, the current astronomical refinery margins would collapse, and therefore, a key bullish factor for crude oil would certainly vanish?

Have a nice weekend!

Like what you’ve read? Subscribe for our daily newsletter today, and you’ll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits’ associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data’s accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits’ employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Updated on

Sign up for ValueWalk’s free newsletter here.