By Smead Capital Management. Originally published at ValueWalk.

Dear fellow investors,

Someone once said, “Better than being smart is knowing who is!” Over the last few weeks, three of the richest and most successful businessmen in the U.S. have let us know what they think about being in the oil and gas business. Warren Buffett, Jerry Jones and Harold Hamm are instructing us in a special way and we at Smead Capital Management are happy to be instructed. It is a trifecta that any good handicapper couldn’t pass up.

Q1 2022 hedge fund letters, conferences and more

An Oil Wisdom Trifecta

Warren Buffett bought over nine million shares of Occidental Petroleum (NYSE:OXY) for around $56 per share between June 17th and June 22nd. Counting his warrants and shares purchased earlier this year, he controls 25% of the company. His prior purchases were also in the $50-58 per share range. Additionally, Buffett has invested heavily ($20 billion) in Chevron (NYSE:CVX). For a guy who was gun shy in the aftermath of the COVID-19 outbreak, this aggressive deployment of cash spells long-term bullishness to us.

Jerry Jones was featured in a story by The Wall Street Journal about his $1.1 billion investment in Comstock Resources (NYSE:CRK), a major natural gas producer. After an extensive rundown on how his investment had grown to $2.7 billion, Jones is quoted as saying about energy prices, “We’re still in the first quarter!” Jones believes we are in the early stages of a favorable long-term bull market for energy.

Harold Hamm is the showstopper in this triumvirate. Hamm explained that since the stock market isn’t properly valuing his and other oil and gas producers, he was going to put us minority shareholders out of our misery. He is offering $70 per share and the offer is being turned over to his independent board members to see if that is a fair price.

The Price Of Oil

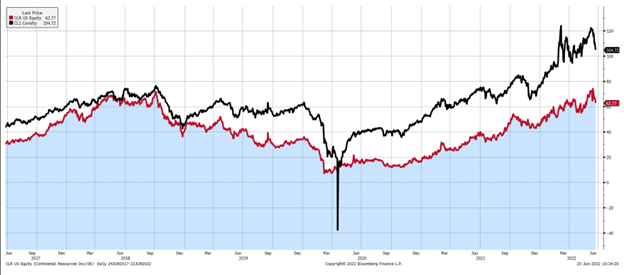

Our argument on that subject is very simple. Below is the stock chart of Continental Resources (NYSE:CLR) with the price of oil over the last five years. Continental traded at $70 per share when oil was much lower than the $100 per barrel current prices. In effect, he is using Wall Street’s mispricing to steal the shares from the investors who invested the last two years when they had no fans.

As you can see, CLR used to track very closely with the price of crude, peaking at $71.79 with crude oil at $79.76. Today, the spread between crude and the share price of CLR has massively widened at a time when investors would normally be falling all over each other to buy these stocks. Hence, Hamm’s willingness to borrow against the copious free cash flow of CLR to buy out minority shareholders for what historically looks like a song.

Let’s put this in a real-world setting. Hypothetically, we will assume that Jerry Jones, Warren Buffett and Harold Hamm are at the Dallas Cowboys game as Jerry Jones’s guest in the owner’s suite. You are also a guest and hear them talking about what each other is doing in the oil patch. What would you do the following Monday after hearing this chitchat as a guest in that owner’s suite? What are investors doing the week after? They are selling oil stocks down to the lowest prices in weeks.

We are bullish on oil and gas and own CLR, OXY, COP and CVX in our U.S. portfolio. We know that investors are worried about what a recession would do to gasoline consumption. However, a number of recessions happened in the 1970s and those economic slowdowns didn’t stop oil and gas stocks from being the best performing stocks of that decade. Fear stock market failure.

Warm regards,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2022 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.

Updated on

Sign up for ValueWalk’s free newsletter here.