By Monica Kingsley. Originally published at ValueWalk.

S&P 500 bull couldn‘t extend gains on Monday, and credit markets don‘t look too optimistic. One more hooray before the bears take over? That‘s my working hypothesis. Whatever gains right after the open the bulls manage to achieve, would likely be reversed relatively fast – perhaps even later this session. I don‘t think the consumer confidence data would paint an optimistic picture – a picture that the market would react optimistically to, said precisely. “Bad is the new good”- no, this mantra hasn‘t yet kicked in, and the dive to the yesterday discussed target, would take over. If you had been with me for quite a while already, you know that I was talking early July as my leading scenario for a stock market bottom. So far so good.

Q1 2022 hedge fund letters, conferences and more

Precious metals keep unsurprisingly going sideways, and commodities are having a good day today – the open oil positions are solidly in the black. Even copper is resilient on a daily basis, but I am not yet sounding the all clear – more economic slowdown and disinflationary currents are under way, no matter how much bringing the inflation down sounds are overhyped. Cryptos lackluster performance goes on, without much of a short-term chance of a turnaround on the horizon.

As stated yesterday:

(…) The big picture hasn‘t changed, and it‘s one of decreasing liquidity and the Fed being bound to surprise on the hawkish side down the road. That helps explain precious metals resilience (as always stating lately, that‘s gold and miners) while silver and especially copper bear the brunt of economic challenges. The red metals doesn‘t look to be done on the downside – contrasted with crude oil set to continue rising without much looking back, and natural gas having a very shallow, high priced and interesting summer „off season“ – wonder what‘s in store for the winter prices (up, up). Agrifoods are setting up a nice entry point with corn having turned already, and wheat about to do the same. Cryptos would continue struggling, of course – it‘s quite impossible to be bullish there.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

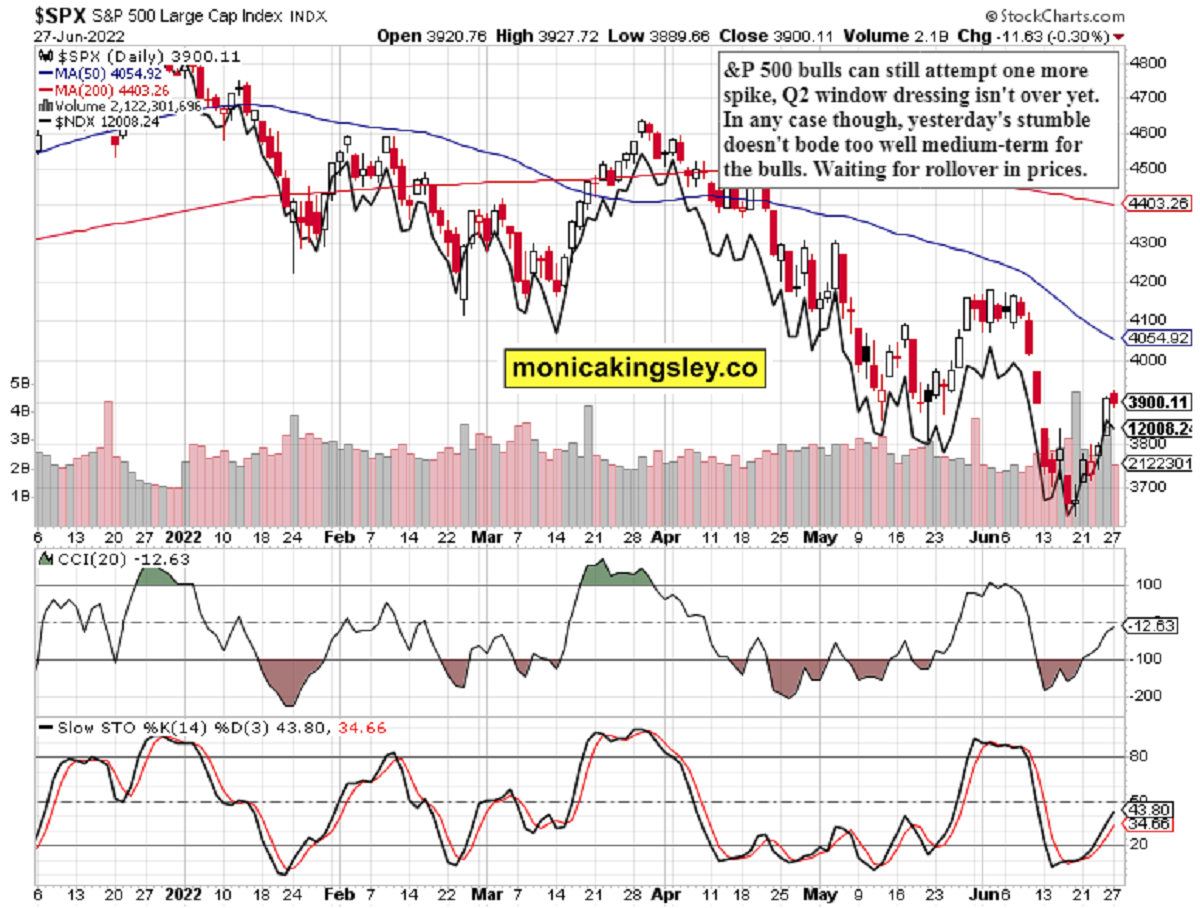

S&P 500 and Nasdaq Outlook

Troubled spot for the S&P 500 bulls – time is running out, and the credit market support is weakening. Time for some quick window dressing.

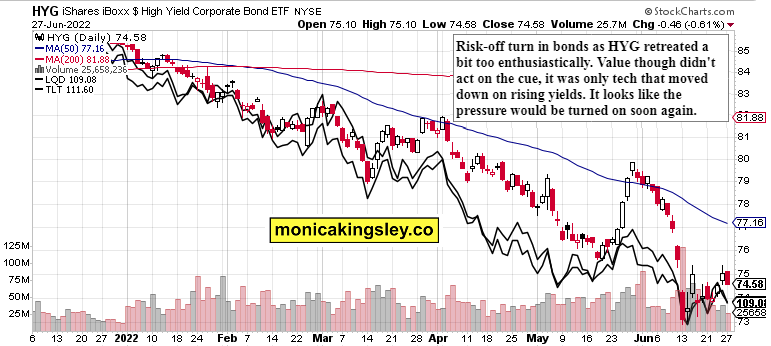

Credit Markets

The low volume behind HYG downswing is the only thing to be „cheerful“ about. The bulls will be lucky if they don‘t get summarily rejected $75, which probably translates into the stock rally not having all that much time left.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Updated on

Sign up for ValueWalk’s free newsletter here.