By Insightia. Originally published at ValueWalk.

What’s New In Activism – Trian Investors 1 Gets A Taste Of Its Own Medicine

A group of investors in Nelson Peltz’s U.K.-listed vehicle Trian Investors 1 called a special meeting to replace a majority of the board, arguing the fund’s corporate governance must be improved.

Global Value Fund, Invesco, Janus Henderson, and Pelham Capital said 43.6% of the fund’s voting capital supported its resolutions to remove three directors and replace them with two new ones. The investors said in a June 20 notice they were dissatisfied with the fund’s investment mandate change, which allows the fund to vote in a basket of stocks, rather than a single investment idea.

Q1 2022 hedge fund letters, conferences and more

Changes to Trian Investors 1’s bylaws were approved by 52% of the shares cast at the June 14 annual meeting, but the dissidents said the resolution would have been rejected by 70% of the shareholders if Trian and affiliated parties were blocked from voting their shares.

The dissidents also criticized the fund’s fee structure, noting that “for every pound of value seen by shareholders, Trian has already accrued 99 pence in its capacity as the manager.”

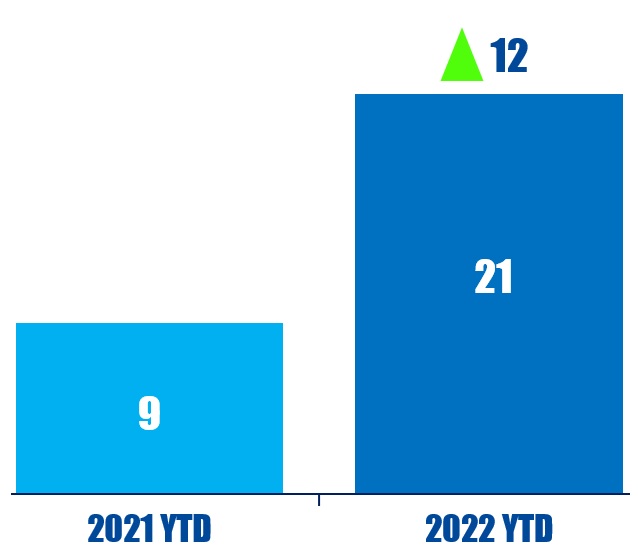

Activism chart of the week

So far this year (as of June 23, 2022), 21 Japan-based companies have been publicly subjected to appoint personnel demands. That is compared to nine companies in the same period last year.

Source: Insightia | Activism

What’s New In Proxy Voting – A Boost For Retail Activism

As You Sow and U.K.-based fintech Tulipshare announced a strategic partnership aimed at empowering global retail investors to engage in shareholder advocacy.

On June 22, they revealed the partnership will enable retail investors to vote for As You Sow shareholder resolutions, which call on leading U.S. companies such as Amazon, McDonald’s, and Twitter to strengthen their ESG commitments and reporting.

This development may bolster support for ESG shareholder proposals and strengthen shareholder advocacy, which As You Sow noted has “largely been in the domain of large institutions.”

Antoine Argouges, CEO and founder of Tulipshare, said this partnership will mean that “ordinary investors will finally have access to a platform that enables them to demand companies take responsibility for their impact on the people and planet.”

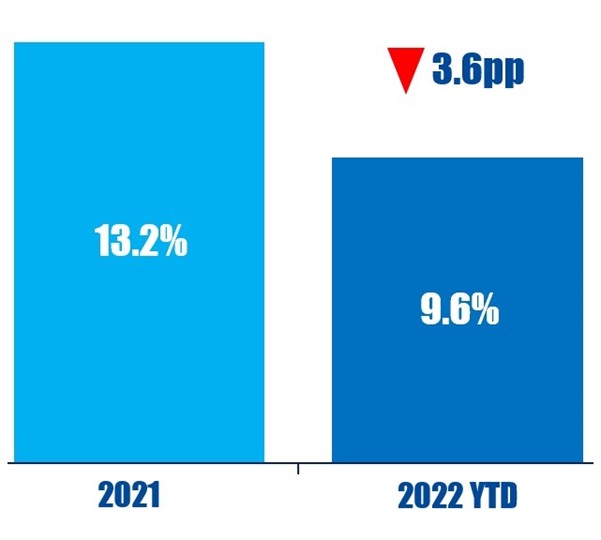

Voting chart of the week

So far this year (as of 24th June, 2022), 9.6% of binding remuneration policy votes at U.K. companies have received upwards of 20% opposition. This is down from 13.2% of remuneration policies across the whole of 2021.

Source: Insightia | Voting

What’s New In Activist Shorts – Spruce Point v Generac Holdings

Spruce Point Capital targeted generator company Generac Holdings Inc. (NYSE:GNRC), labelling the company’s shares as materially overvalued.In a June 22 short report, Spruce Point said Generac’s core portable generator business is under “extreme pressure” from having to cut prices by nearly 20% to compete against new foreign competition. Spruce Point estimated this could lead to a roughly $100-million cash flow headwind.The short seller also pointed to Generac’s recent product recalls due to safety issues and believes that, in an effort to deflect from these core challenges, the company is attempting to position itself as a clean energy company to improve its ESG and transparency image. However, Spruce Point’s report details a host of serious concerns including “irrational” and “shady” acquisitions as well as “ballooning receivables” and “channel stuffing.”

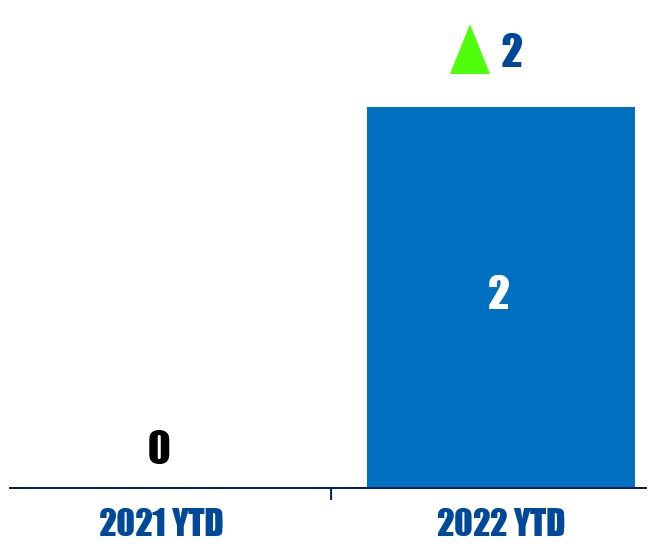

Shorts chart of the week

So far this year (as of June 24, 2022), two public activist short campaigns have alleged that target companies are overleveraged. That is up from zero in the same period last year.

Source: Insightia | Shorts

Updated on

Sign up for ValueWalk’s free newsletter here.