Here we go again:

Here we go again:

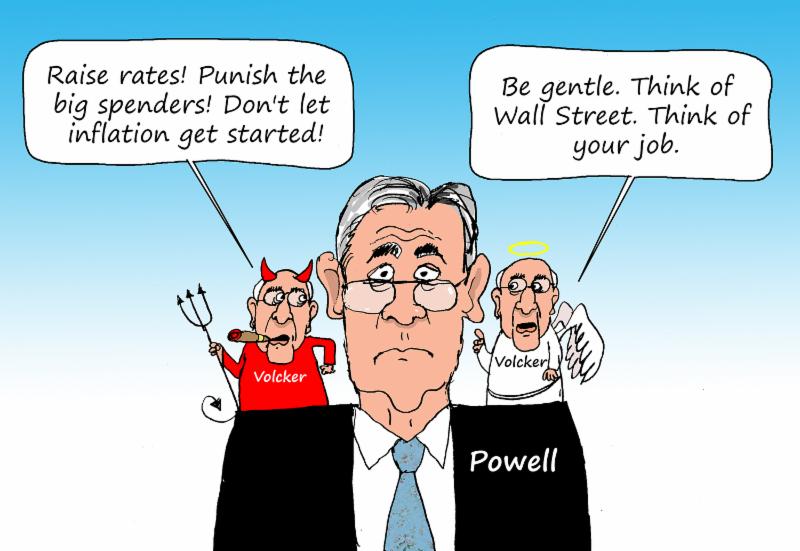

Federal Reserve Chairman Jerome Powell said he was more concerned about the risk of failing to stamp out high inflation than about the possibility of raising interest rates too high and pushing the economy into a recession.

“Is there a risk we would go too far? Certainly there’s a risk,” Mr. Powell said Wednesday. “The bigger mistake to make—let’s put it that way—would be to fail to restore price stability.”

That has cost the S&P 500 60 points (1.5%) since yesterday afternoon and we’re now 3% away from those June 16th lows, which marked essentially no gain at all since Dec 31st, 2020 – when the S&P 500 finished at 3,756 – up from 3,733 that morning. That’s 18 months of market progress erased and, if you listen to the AWFUL Consumer and Investor Sentiment readings – we may only be just getting started.

Powell is making it very clear that he does not work for Wall Street and that, of course, is scaring the crap out of Wall Street and the investing class – who love a nice round of inflation as long as they can profit from it. The fear now is that the Fed is overdoing it and rising rates will kill the consumers but that’s BS as the consumers are concerned about rising PRICES, not the rates. So Powell’s tact is correct if you want to actually fix the economy but investors could care less about the economy – they just want more free money – and that is something the consumers were never given access to.

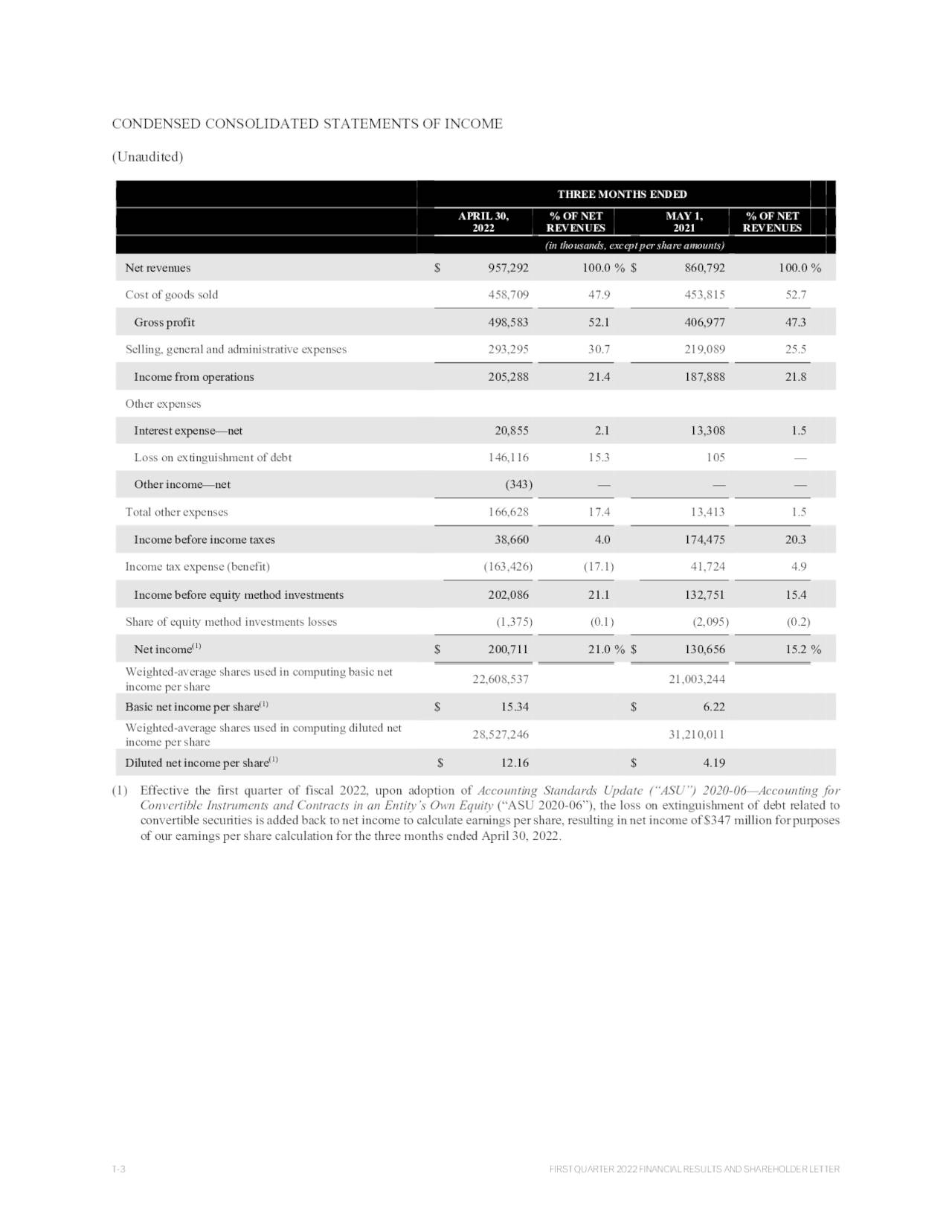

RH spooked the market last night by cutting their sales guidance down 2-5% vs up 0-2% prior. Shares of RH (we are long) fell 8% after hours, down to $216 from $271 on Friday and is down from $700 in 2021, which we consider an excellent value.

“With mortgage rates double last year’s levels, luxury home sales down 18% in the first quarter, and the Federal Reserve’s forecast for another 175 basis point increase to the Fed Funds Rate by year end, our expectation is that demand will continue to slow throughout the year,” CEO Gary Friedman said in a statement.

The position we have in our Long-Term Portfolio is as follows:

| RH Short Put | 2024 19-JAN 150.00 PUT [RH @ $236.44 $-7.35] | -5 | 5/23/2022 | (569) | $-10,750 | $21.50 | $3.65 | $-21.50 | $25.15 | – | $-1,825 | -17.0% | $-12,575 | ||

| RH Short Put | 2024 19-JAN 250.00 PUT [RH @ $236.44 $-7.35] | -5 | 6/21/2022 | (569) | $-32,000 | $64.00 | $4.35 | $68.35 | – | $-2,175 | -6.8% | $-34,175 | |||

| RH Long Call | 2024 19-JAN 250.00 CALL [RH @ $236.44 $-7.35] | 15 | 6/21/2022 | (569) | $114,075 | $76.05 | $-7.80 | $68.25 | $-7.25 | $-11,700 | -10.3% | $102,375 | |||

| RH Short Call | 2024 19-JAN 320.00 CALL [RH @ $236.44 $-7.35] | -10 | 6/24/2022 | (569) | $-54,800 | $54.80 | $-7.10 | $47.70 | – | $7,100 | 13.0% | $-47,700 |

Fortunately, we only just added the position but, unfortunately, we were aggresssive so this drop will sting but, mechanically, we will take advantage of the dip and roll our 15 Jan $250 calls down to the $200 calls, at $90 or less and that will cost roughly $36,000, which we can make up by selling another 2024 $250 put, which is in the money but still in our target range for 2024.

RH’s market cap is $5.5Bn and they were expecting $750M in profit on $3.8Bn in revenues so even if they only make $600M on $3.4Bn in revenues (much worse than guidance), they are still trading at less than 10x current earnings. It is entirely possible that RH timed this “adjustment” to tank their own stock as they are sitting on an unused buy-back authorization of $300M – or over 5% of the outstnading stock at this level.

Looks pretty good to me so we’re going to take full advantage of the move down in RH and other stocks as the rest of the market panics because Jay Powell is finally doing his job. And, of course, Powell promising to do his job causes the Dollar to rise (105.5 this morning) and that is putting downward pressure on all the things that are priced in Dollars – like Stocks and Commodities. As I’ve been saying all week – that is certainly no reason to let yourself get forced out of a perfectly good asset…

As you can see, the Dollar is up 16.66% in the past 12 months so imagine how horrible inflation looks to people in other countries. Those guys will break long before we do so stop letting the media panic you with anecdotes and focus on what’s really happening. Yesterday we got a revised Q1 GDP Report that was down 1.6% from Q1 of last year – that is really not that bad – a mild Recession at best. The Atlanta Fed is forecasting a 0% gain for Q2 – that is better than a 1.6% drop and, though it may go negative and put us in a technical Recession – it’s still just a report of old news.

When we run out of jobs and people stop getting raises and prices are still rising – THAT is when we panic. We’re not there yet.

As we discussed in yesterday’s Live Trading Webinar, we had already bumped up our hedges and now it is time to follow through and buy more longs – as well as making bullish adjustments to the longs we already have – like RH above. We’re also buying Silver (/SI) when it crosses back over $20.50 (with tight stops below) and Gold (/GC) at $1,810 is very attractive and that one I’ve got conviction on to add more if it gets lower. Just like last time – 105 on the Dollar is too close to parity 1.00 on the Euro and the ECB has to step in and do something about that.